Airbnb Deep Dive Part 1

In-depth look at the business model, financials and competitive analysis

Contents

Introduction

Overview

A brief history

Understanding the business

Business Model & Analysis

Flywheel

Hosts

Slowing growth

Benefits of hosting

Growing supply

Guests

User growth

Experiences

Marketing

Key performance indicators

Financial & Competitive Analysis

Financial picture

Industry landscape

Competitive Advantages

Welcome to this deep dive on Airbnb ($ABNB). In this extensive deep dive, I will ask the same five questions I did in my prior deep dive on Evolution Gaming AB. These questions are:

Is the business understandable?

Is it a good business?

Are management capable and trustworthy?

Does the business have a long re-investment opportunity, and what are the risks associated?

Is it available at a fair price?

At the end of the analysis, I will share some closing thoughts for portfolio allocation.

I believe these five questions are crucial to answer before making any kind of long-term investment.

If you enjoy this deep dive or any previous release please subscribe and share this substack, the support goes a long way!

Overview

Everyone knows the company Airbnb. Today, the word is in the dictionary and has become synonymous with travel. The company operates a global platform connecting hosts with travellers looking for short and long-term stays and experiences. It has hosted travellers in almost every country and region, encompassing over 100,000 cities globally.

On the back end, the company provides hosts with tools and resources to help them manage their listings. These tools include scheduling, payments, support, pricing, and host protection. On the front end, consumers can browse a wide variety of unique accommodations and experiences, ranging from private rooms to luxury villas, castles, and even boats.

Since its founding in 2008, the company has grown from a single apartment in San Francisco to having 5 million hosts facilitating 2 billion guest arrivals. This astonishing growth happened in just 17 years, several of which were during a global pandemic.

Today, the company’s mission is “to create a world where anyone can feel at home and belong anywhere,” they do this by providing the largest assortment of unique properties globally, giving travellers unique stays that provide an authentic local experience.

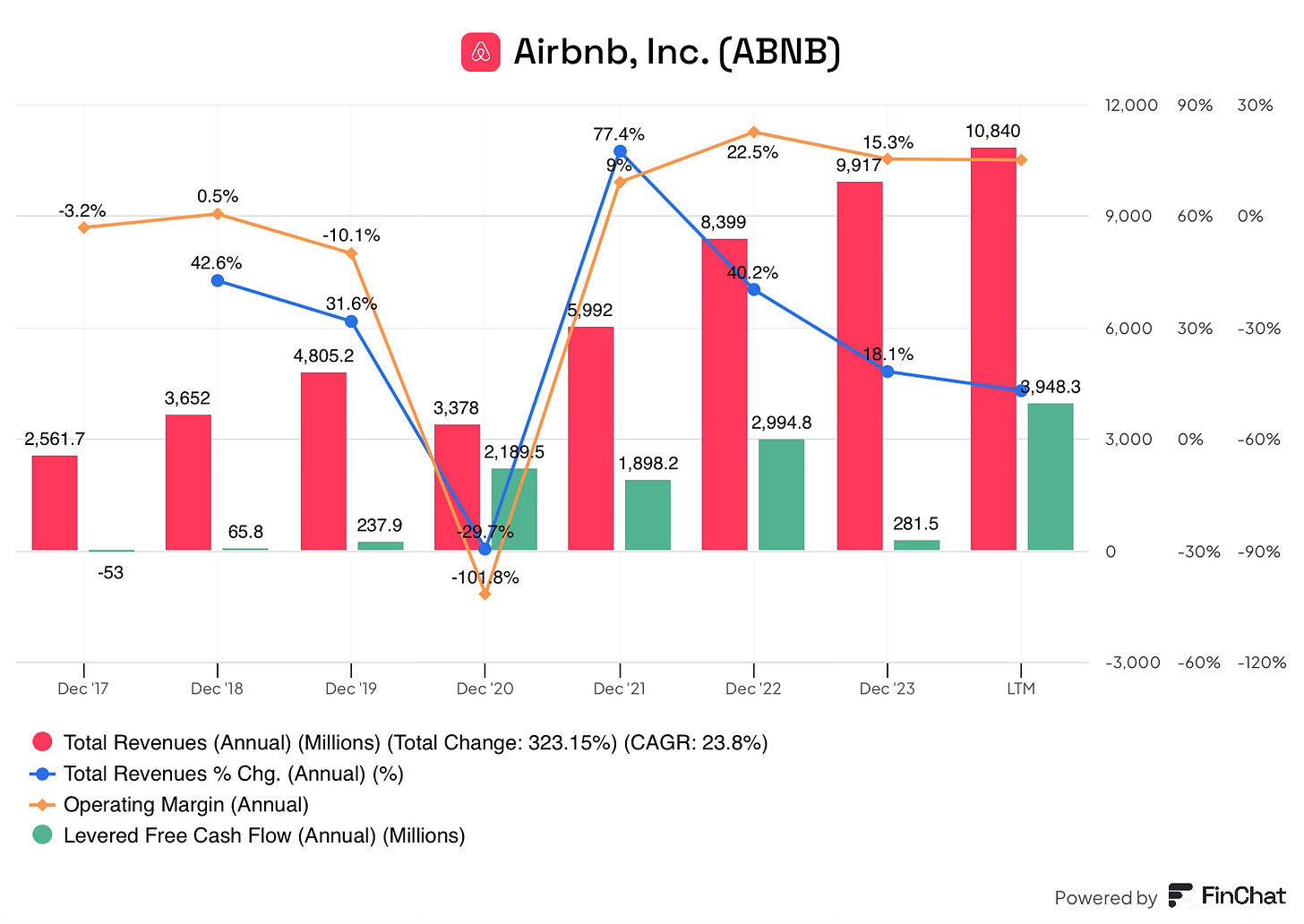

This success has resulted in Airbnb earning $10.8B in revenue over the past 12 months, a market cap of $80B+, and a global employee base of 6,900 staff, an impressive achievement for a company still in its teens!

Airbnb has become an interesting opportunity to examine after the shares have traded sideways / down since its IPO in late 2020. During this time, the S&P 500 is up over 75%, causing Airbnb to underperform by 85%. Additionally, famed investor Chuck Akre has also taken a stake in the company in recent quarters, making me more interested in diving in.

A brief history

While the story of Airbnb has likely been told many times before, I will start with a quick summary of the key points in the company’s history that got the business to where it is today.

The business was born in 2007 when Brian Chesky & Joe Gebbia rented out some air mattresses on the floor of their San Francisco apartment during a local conference as a way to make rent. It wasn’t until 2008 when Nathan Blecharczyk joined, that Airbnb was officially launched. This launch in 2008 coincided with the Democratic National Convention, which resulted in 80 bookings.

In 2008 as a way to raise funds, the group had an unorthodox approach to funding. The company sold special election-themed boxes of cereal called Obama O’s and Cap’n McCain’s for $40 a box, which netted the company roughly $30,000. This type of determination to keep the business alive gives us insight into the character of the founders. The next year, (2009) the company joined the Y Combinator winter class, providing them an additional $20,000 (for 6% of the company), along with valuable training. During this time the company changed its name from Airbed & Breakfast to Airbnb.

In the following years, the company raised several more rounds of cash from Sequoia in April 2009 and November 2010 (Series A) to fund growth. In 2010, the company launched its mobile app, by which point the company had received a cumulative 700,000 bookings on the platform.

In 2011, Airbnb expanded from the US to International countries, with its first office in Germany. This early international expansion has been one of the keys to the company’s success. During this period, the company also introduced several key features such as Instant Book and Host Guarantee, which accelerated growth.

In 2012, the business made several acquisitions, including CrashPadder, NabeWise and Localmind. CrashPadder added 6,000 international listings, while the other two acquisitions were technology-based. Since then, the company has made many more acquisitions such as; Vamo (2015), Lapka (2015), Trip4real (2016), Accomable (2017), AdBasis (2019), Gaest (2019), HotelTonight (2019). These acquisitions potentially leave some clues as to where the business may expand to in the future, more on that in part 3!

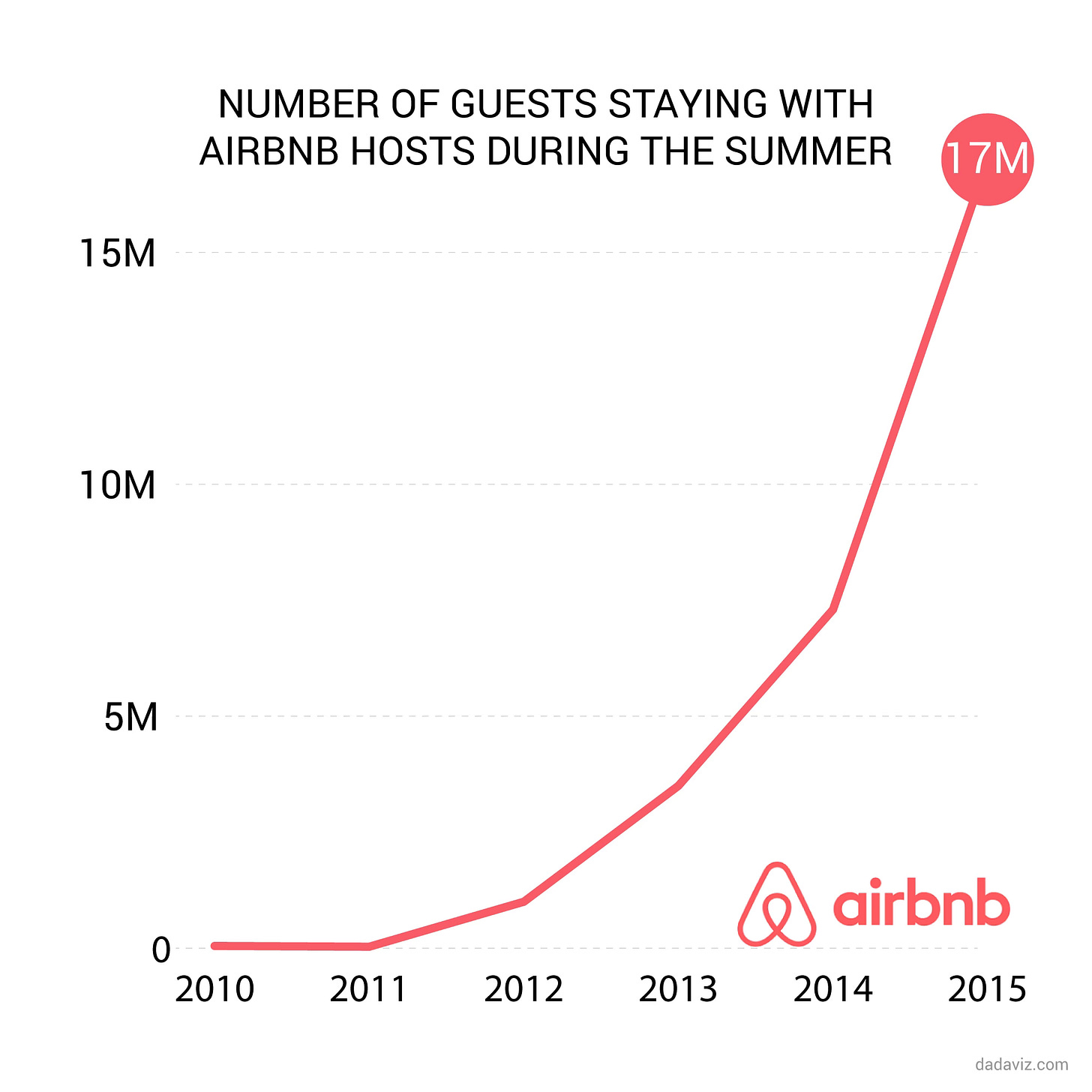

During the mid-2010’s the business was growing all metrics rapidly: revenue, stays, hosts, and guests. This growth was driven by International expansion, performance advertising and brand investments.

By the late 2010’s the business was starting to cool off after multiple years of rapid growth. In 2020, the global pandemic hit, causing demand for travel to plummet.

I will pick up the story of this pivotal period in Airbnb’s history in part 2: Recent developments.

1. Is the business understandable?

In this section, I will analyse Airbnb’s business model, along with the critical elements that are crucial to the success of the business.

Business model

The company has a simple business model with only one reportable business segment, this segment contains two offerings:

Stays

Experiences

The overwhelming majority of revenue comes from stays, while experiences make up the rest.

For stays, the company generates money by charging a service fee to both the customer and the host for booking through Airbnb. The amount Airbnb receives depends on several variables:

Booking value

Duration of booking

Geography

Host type

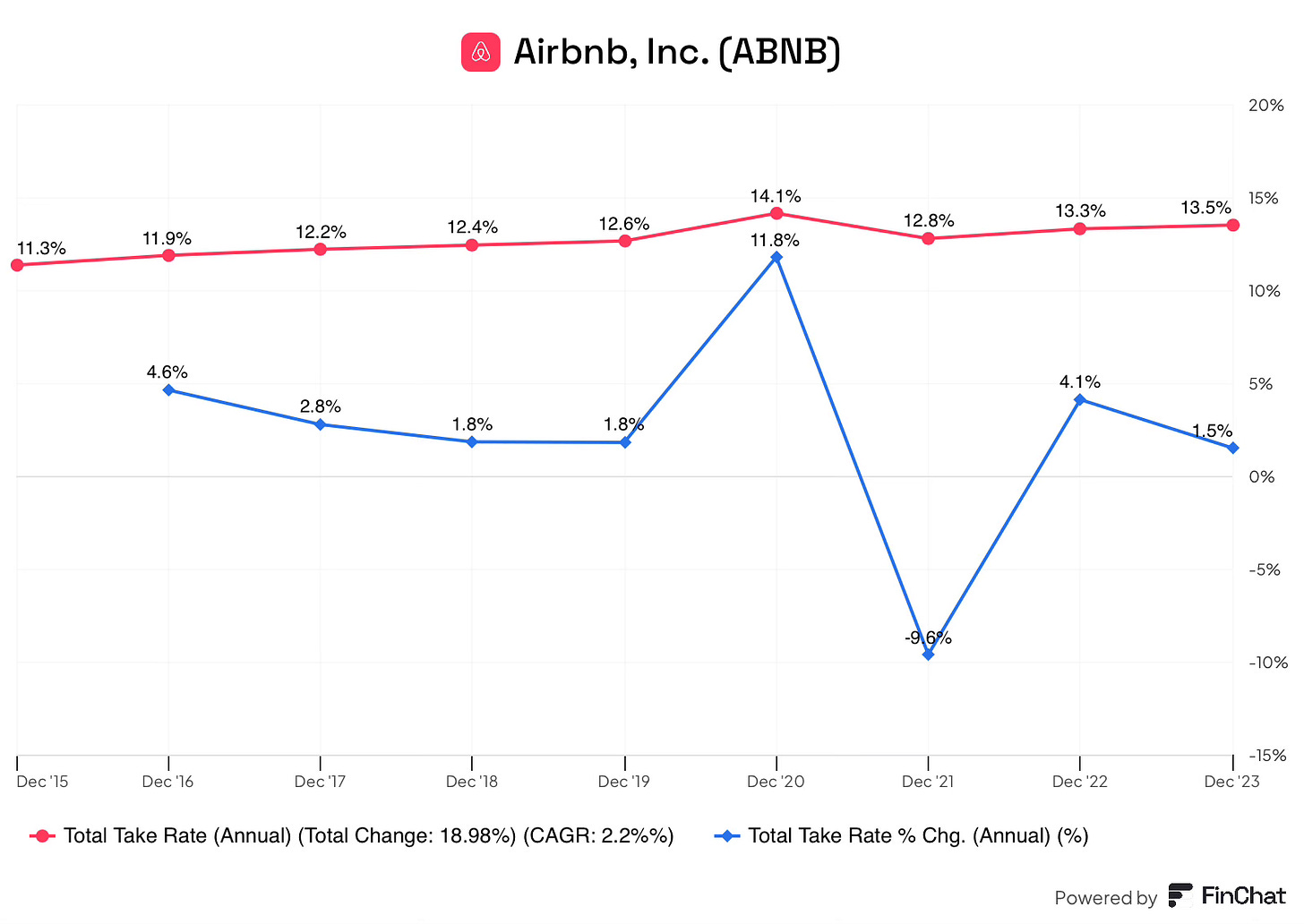

Airbnb typically charges hosts a 3% fee and the traveller 14.2% for standard short-term rentals, for longer-term stays (28 days+) the company reduces this take rate slightly.

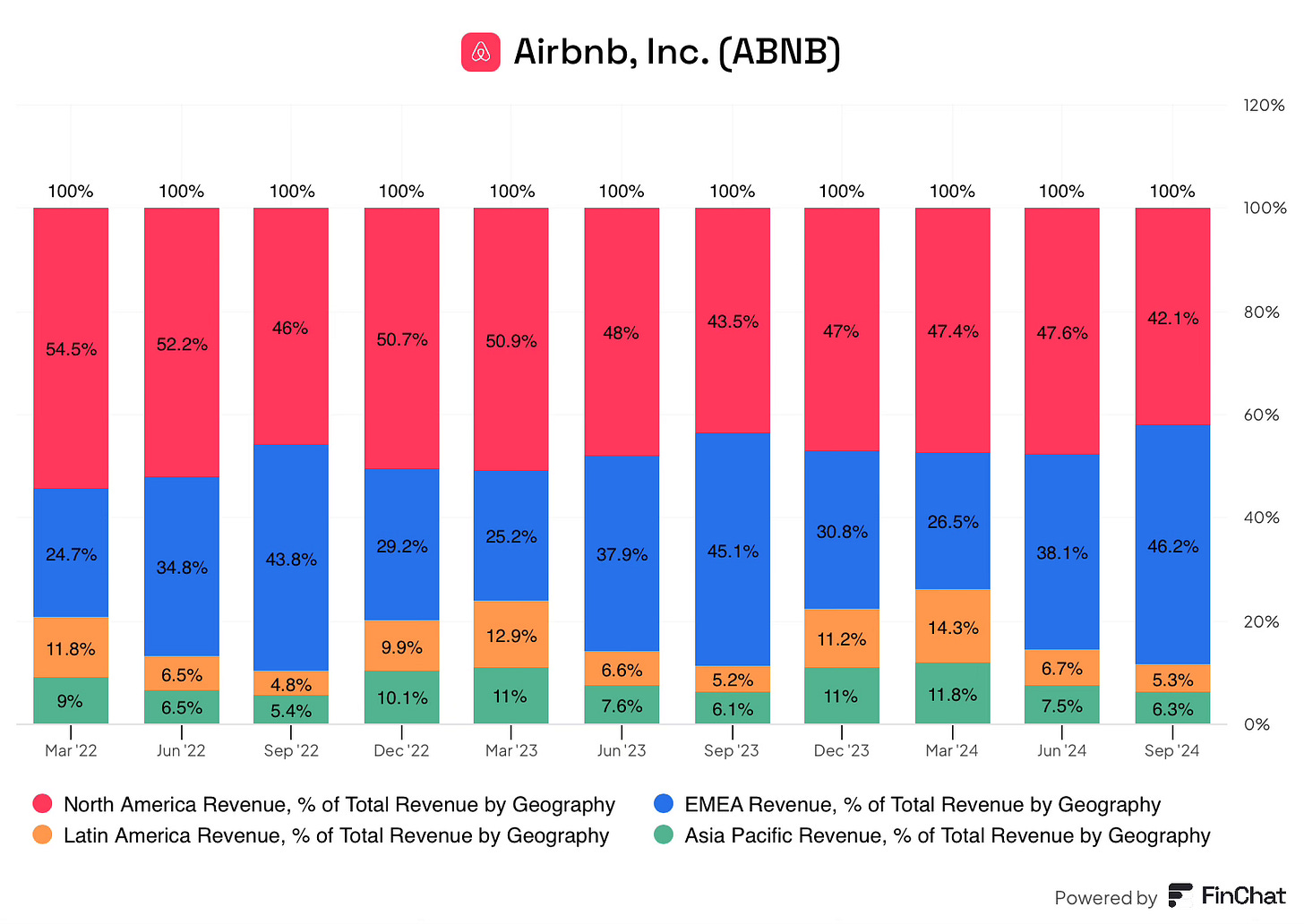

Over time, the company’s take rate has slightly increased, however, they have not made any changes to their pricing, this slight increase is due to a mix shift towards higher daily rate locations such as the US & Europe.

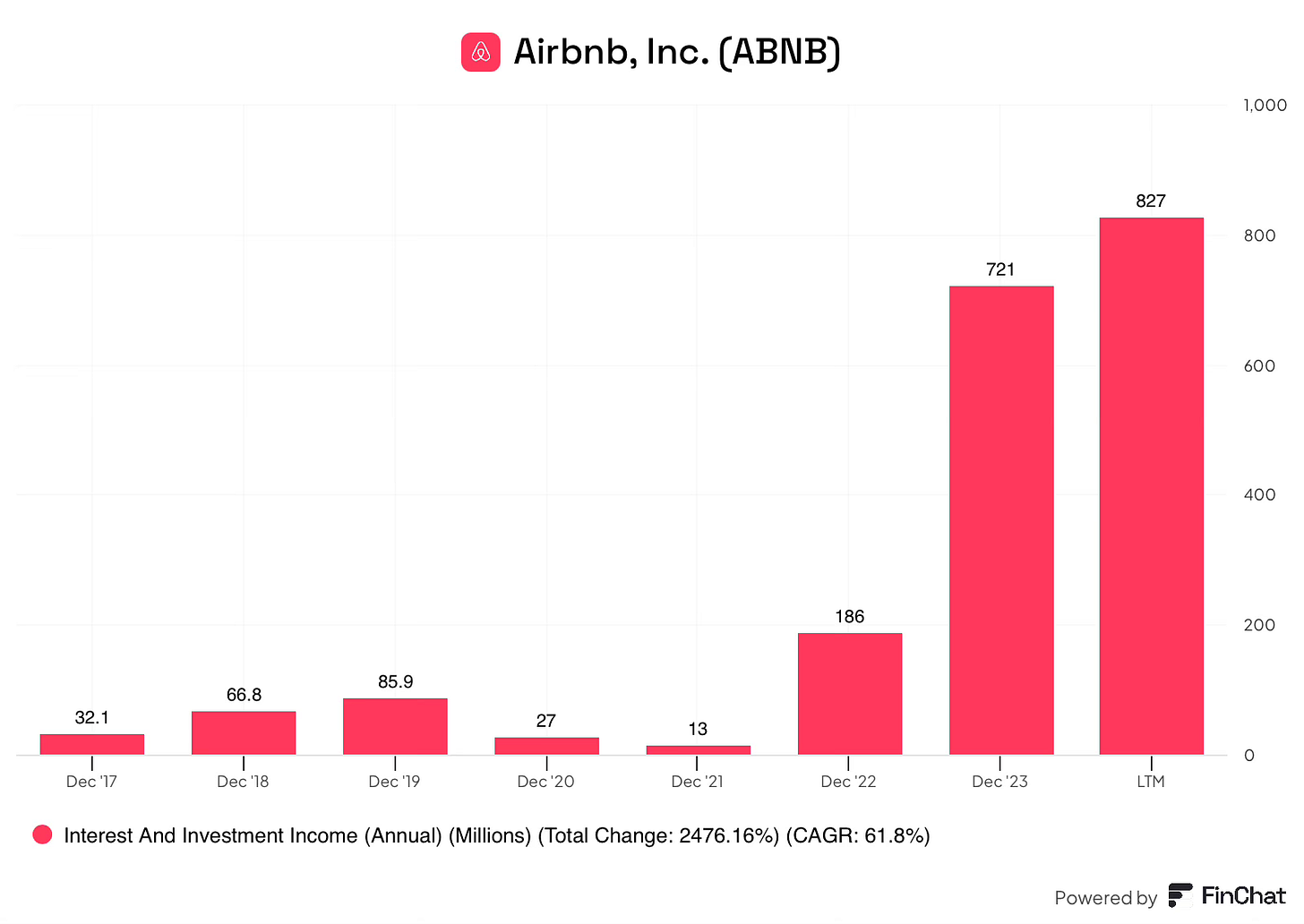

Reported under the operating income line, Airbnb also earns interest income on the money the company holds for the period during which a guest has booked but not yet stayed.

The rest of the revenue generated is from experiences. Airbnb only charges a host fee for this. Please see more on Airbnb experiences later on in this article.

Diversification: While only operating in one business segment may seem highly concentrated, Airbnb’s revenue is highly diversified.

Airbnb operates in 220 countries around the world, with listings in over 100,000 cities, making the company geographically diverse with no city making up more than 2% of revenue or 1% of total listings.

The nature & variety of stays also diversify the company, accommodation varies from private rooms to luxury villas, stay length from 1 night to several months, and travel nature from staycations to cross-border travel.

This diversification resulted in the company faring better than competition during the recent global pandemic.

Analysis

Airbnb’s business model has several advantages over traditional hotel businesses.

Negative working capital: Negative working capital has been a key benefit of Airbnb’s business model, however, due to new payment methods such as Reserve Now, Pay Later, the effectiveness of this has decreased slightly over time.

When a customer books through Airbnb, they pay upfront, while the host doesn’t receive the money until 24 hours after the guest has checked in, this allows for any potential issues to arise. This upfront payment means Airbnb receives payment before they have to pay suppliers (hosts) allowing them to earn interest as described before. This upfront capital also provided the company with a free source of financing to fund its growth during the rapid expansion period.

Some of the best businesses around today have achieved strong growth due to this powerful model, including; Amazon, Walmart & Dell computers.

Capital light: Airbnb operates a capital-light business model, which allows the company to be highly profitable. The company does not own the accommodation listed on its platform, allowing for minimal fixed-cost assets. Between 2011 & 2019, when the company was investing heavily, the company generated a cumulative $1B in operating cash flow. Of this, only $507 million needed to be reinvested back into property & equipment purchases, making Airbnb significantly cash flow generative, even in the early days.

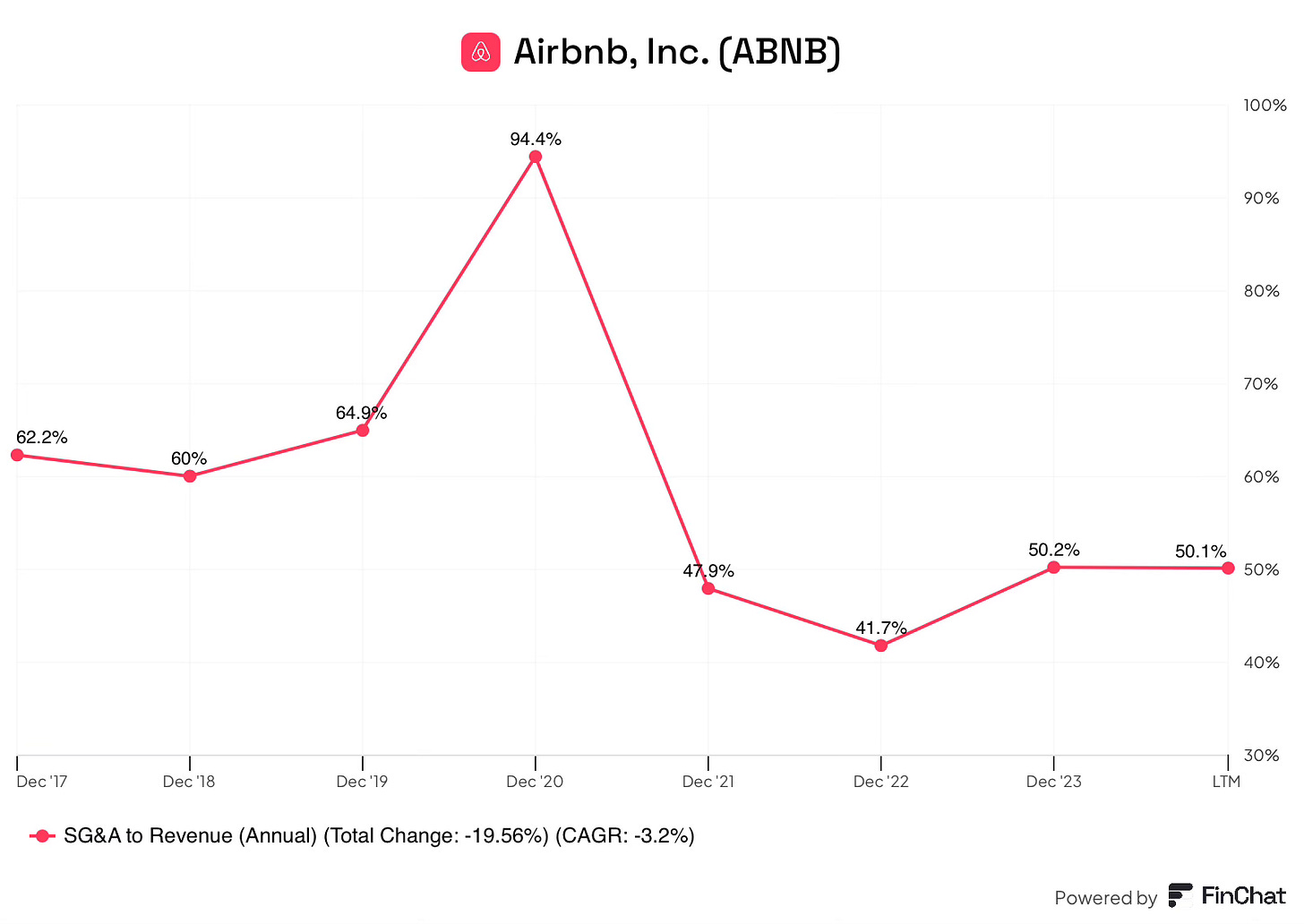

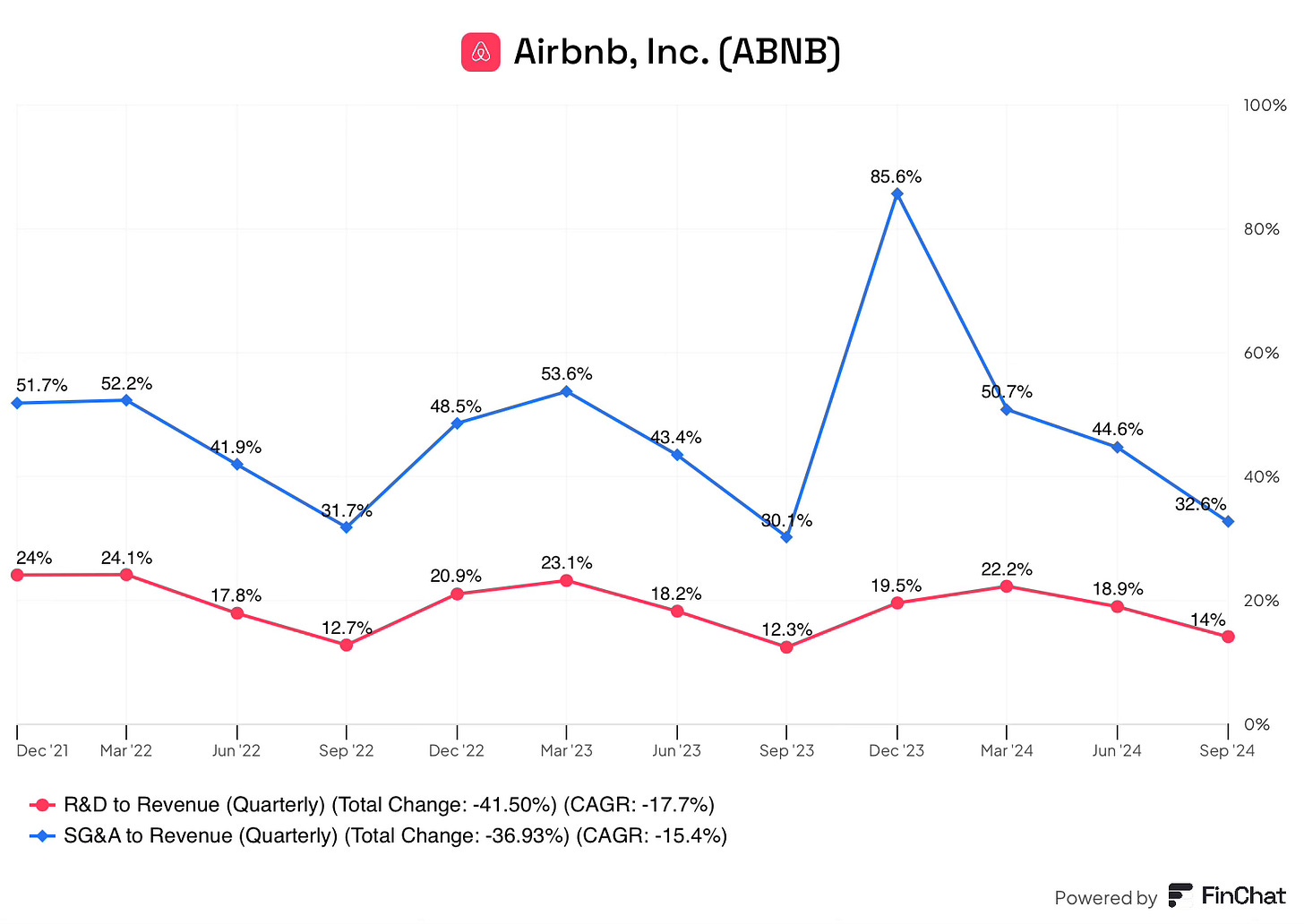

Airbnb is a technology company, which means the main expenses the company incurs are SG&A and R&D costs. SG&A has historically been the primary expense; this has been coming down over time as the business has scaled, excluding the one-time increased costs in 2020 relating to the IPO & pandemic. With the company expected to continue its growth, these costs should continue to come down as a percentage of revenue, allowing for higher profits in the future.

Resilience: Airbnb has a resilient business model, meaning it is insulated from any shifts in travel trends. Not only is Airbnb diversified across countries, cities, customer demographics and stay types (short & long-term), but the business also adapts to changing consumer preferences. Increased guest demand in a certain area attracts more hosts, giving guests what they are looking for, and insulating the business from falling out of fashion.

Alignment: Airbnb’s business model aligns the interests of all stakeholders, the company only earns money when hosts receive bookings and guests find what they are looking for. Assuming Airbnb keeps the take rate the same, any additional revenue Airbnb earns is because the company has been able to provide value for all stakeholders.

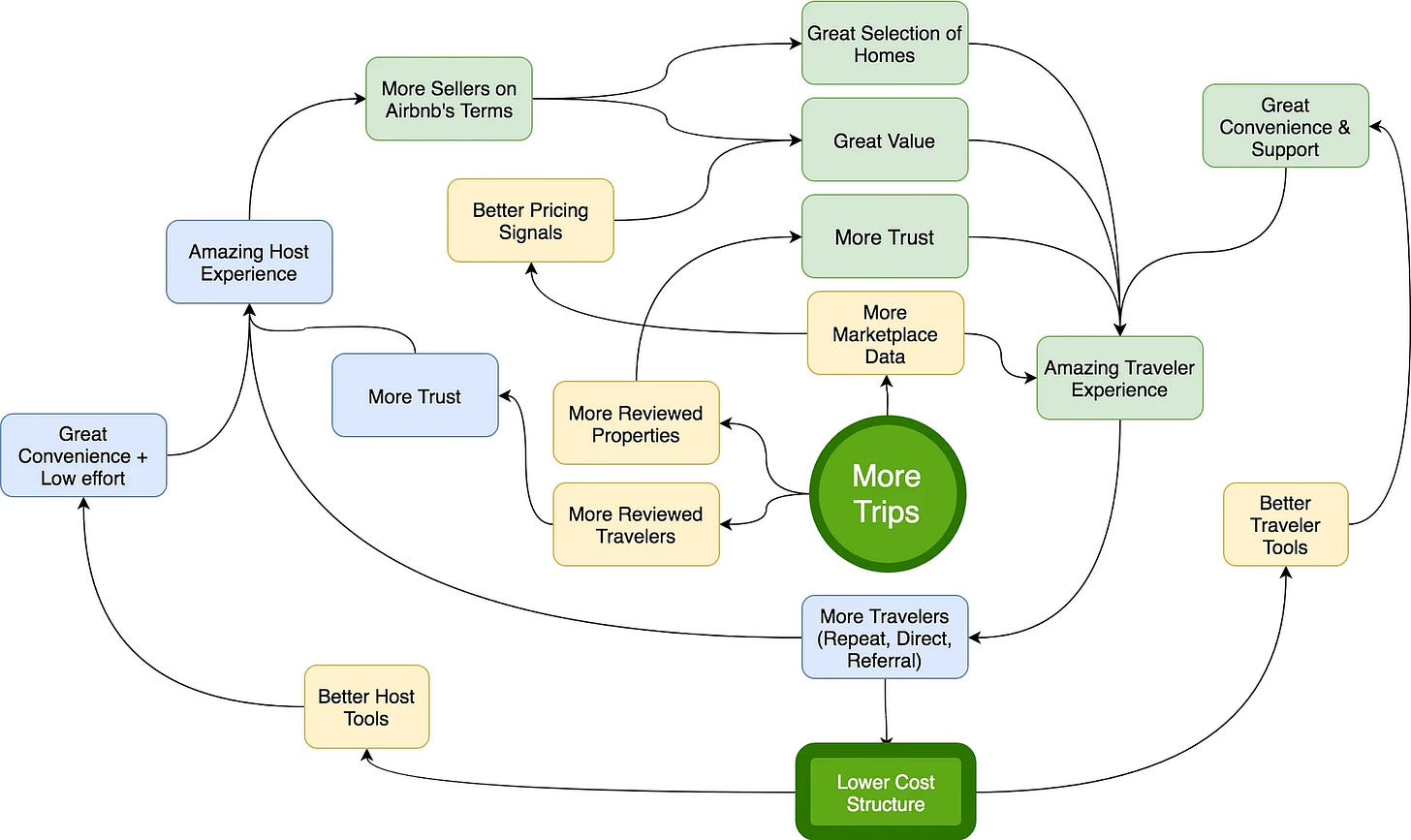

The Flywheel

There are several key aspects of Airbnb’s business that are crucial for the continued success of the company. Together these aspects drive the flywheel.

More hosts on the platform create more supply, bringing more locations, property types, and lower prices. This increased supply attracts more guests, which increases demand, in turn, guests write more reviews, increasing trust in the platform. This increased demand drives earnings for hosts, further increasing supply. The increased trust, supply and lower prices further drive more guests, creating a self-reinforcing loop of more guests and hosts.

Next, I will break down these parts of the business to gain a greater understanding of the drivers within Airbnb.

Hosts

Hosts are the most important stakeholders of the business. Without the supply that hosts provide, Airbnb would not have the supply to sell. Airbnb currently has over 5 million hosts with over 8 million active listings on the platform. These hosts span over 100,000 cities worldwide.

There are two types of hosts: individuals and professionals. Individual hosts make up 90% of the 5 million, or 4.5 million. 75-80% of these hosts only have a single listing on the platform. The remaining 10% are professionals; these tend to be property management companies, serviced apartment providers, and boutique hotel providers, of which there are roughly 500,000. Professional hosts tend to have more than one listing. I expect this cohort to make up roughly 3 million of the total listings.

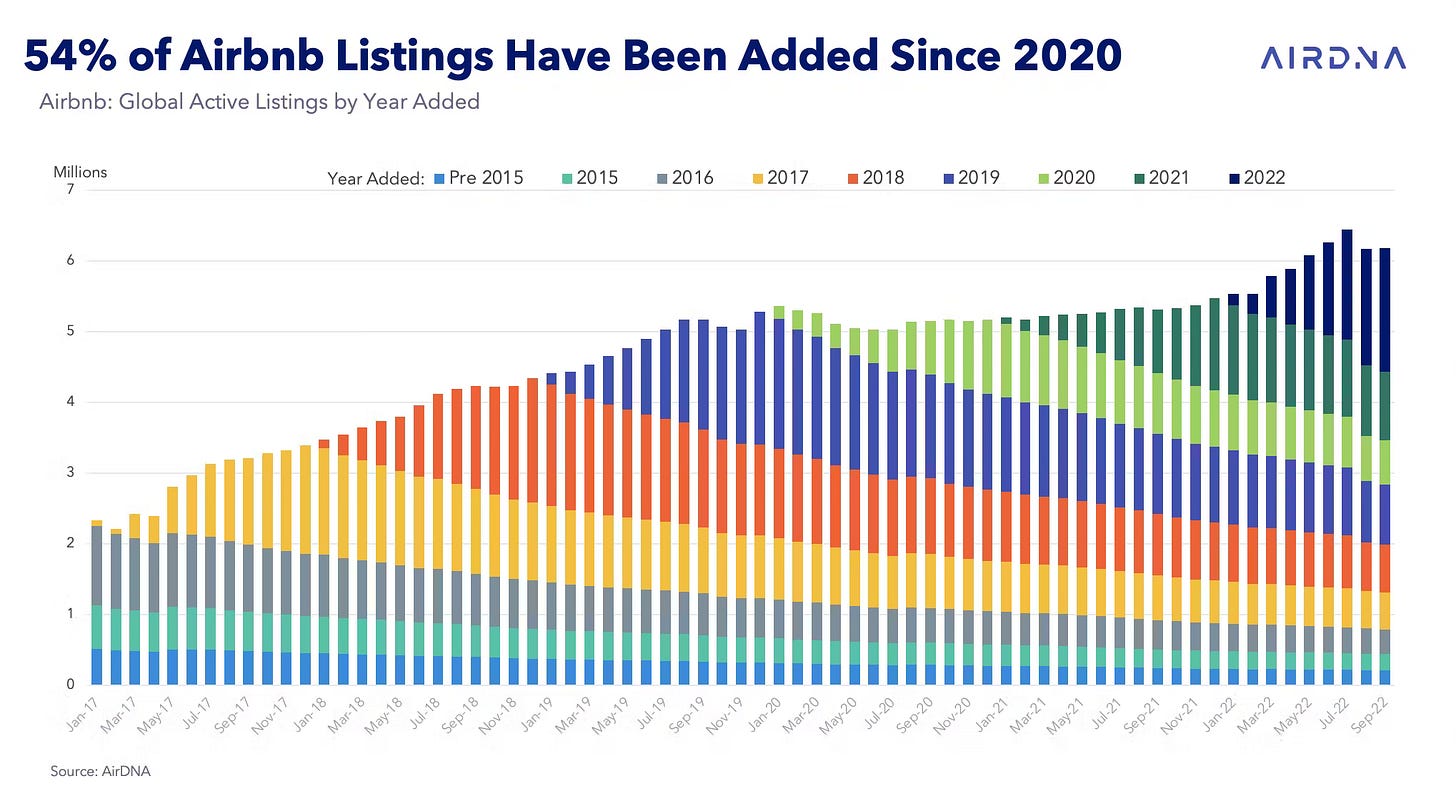

Slowing growth

The above chart demonstrates the growth of active listings since 2017. Active listing growth has moderated in recent years to a mid-teen percentage growth rate. This supply growth has likely slowed down due to a combination of factors.

Pandemic: Firstly, the pandemic caused significant disruption to the travel industry, resulting in a temporary drop in listings. This reduction was likely due to hosts needing the space due to stay-at-home mandates, along with an unwillingness to have strangers stay during a global pandemic. Hosts therefore temporarily deactivated listings.

Competition: Airbnb pioneered the peer-to-peer accommodation market. Over time, competition has woken up to this threat. Today, many sites offer similar home rental offerings to Airbnb, with hosts likely cross-listing properties on many sites. This transition from a sole player to meaningful competition has likely caused listing growth to slow.

Regulatory issues: Cities, states and countries have imposed restrictions on short-term and long-term rentals, creating headwinds to the number of listings on the platform. Many of these bodies believe the rise of these rental markets has caused house prices to be unaffordable for residents, this concern has resulted in restrictions or even bans in some areas of the world.

Benefits of hosting

Despite the slowdown in active listing growth, there are some great benefits to becoming a host, these benefits should incentivise more people to become hosts over time allowing the company to reach its goal of mainstreaming hosting.

Supplemental income: The financial benefits are a huge driver for people to host. The vast array of unique offerings on Airbnb makes it easy for a host with any additional space ranging from a spare bedroom, annexe, shepherd hut, or holiday home to earn additional money on an otherwise unused asset. Airbnb has allowed hosts to earn over $250 Billion collectively since its founding in 2008.

The average annual income from hosting on the platform is $14,000 in the US, this figure differs by country. In the UK, this figure is £5,500. It is important to note that this is an average. Hosts with luxury villas, listed permanently in a highly desirable destination, will earn significantly more than this.

Community benefits: Not only does hosting benefit the individual, but it also helps the surrounding community. In a study conducted by Airbnb, 87% of hosts recommended local restaurants, cafes & bars. These local businesses therefore benefit from the recommendation to guests who would likely not have come to the area if it wasn’t for the local Airbnb. Furthermore, the chance to book local experiences further benefits the local economy surrounding the accommodation.

Growing supply

Airbnb is making considerable efforts to grow the number of hosts on the platform. Airbnb has found that supply growth directly influences future revenue growth, making it a crucial driver of the business. Airbnb has, therefore, made several investments & initiatives:

Support: the company continuously invests in improving the support tools to hosts so they can manage their listings with greater ease, these tools include;

Seamless onboarding experience: Airbnb’s platform is designed to onboard guests quickly with a simple sign-up process. Beyond that, the company offers tools that allow users to create an attractive listing.

Pricing & scheduling tools: once the listing is active, Airbnb has tools that allow a host to easily manage their property from calendar tools to smart pricing options.

Payments: Airbnb’s payment capabilities, provide a layer of trust by providing a secure method of collecting payments from guests in more than 220 countries and over 40 currencies. This service means hosts don’t have to worry about whether a customer is likely to pay.

Host protection: Airbnb provides host damage protection for up to $3 million for damage caused by guests, along with insurance for both hosts & experiences.

Again, all of these services give hosts a level of trust to list on Airbnb.

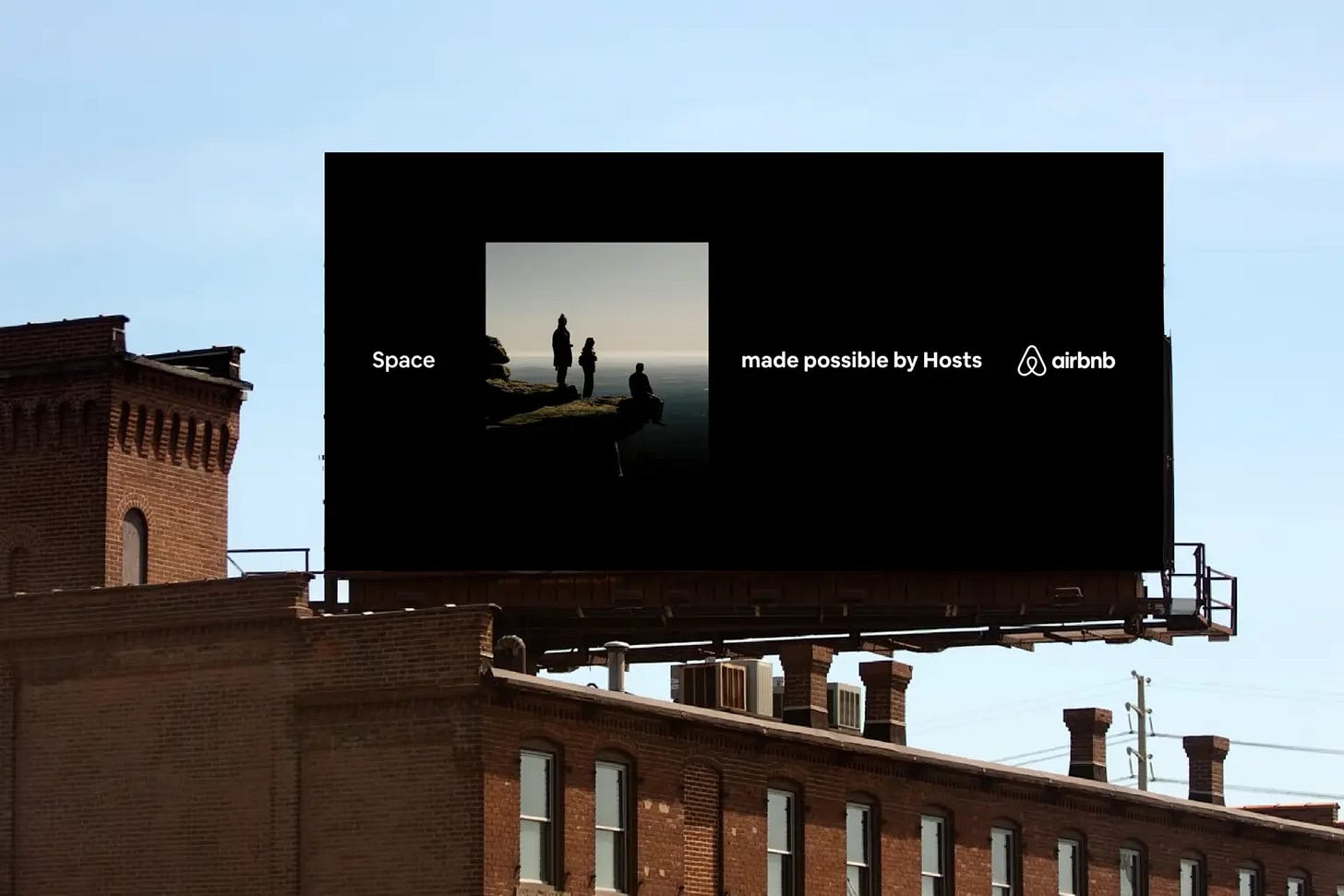

Raising awareness: Airbnb is investing in marketing campaigns to highlight the benefits mentioned above to prospective new hosts. These marketing campaigns, like “made possible by hosts”, use real photos from trips to make the marketing authentic yet aspirational.

Growing demand: Airbnb has found that the areas with the highest guest demand are also the areas with the highest host growth. This growth is likely through word of mouth, as hosts tell family and friends how busy they are, they are inclined to sign up and start hosting themselves, capitalising on the strong demand. This means one of the most important ways to grow host supply, is to attract guests to the platform.

Targeting specific demographics: Airbnb is targeting specific demographics that they view as likely to become hosts, these include;

Prior guests: A significant portion of new hosts have been prior guests, 36% of new hosts in 2022 had been guests prior to signing up.

Life transitions: Airbnb raises awareness among people who have gone through potentially large life changes such as renovating a home, buying a new house, retiring and kids moving out. It is believed that these individuals may have available space or be looking for supplemental income.

Geography: Airbnb is focused on attracting new hosts in underpenetrated markets such as Brazil & Germany to fill in any geographic gaps.

Partnerships: Airbnb is partnering with real-estate developers to make buildings more “Airbnb-friendly”, so far the company has partnered with more than 10 major developers to create a network of properties where tenants are allowed to sublet their apartment for a certain number of days per year, typically 180.

Co-hosts: Cohosting is a new initiative from Airbnb designed to unlock spaces from hosts who lack the time or interest in managing the listing themselves. Airbnb is essentially creating a marketplace on a marketplace to match hosts who already have a track record to new hosts.

To conclude, Airbnb’s continuous focus on providing support & tools to help hosts achieve success and achieve a positive hosting experience should allow Airbnb to attract more hosts over time.

Guests

On the other side of the platform are the customers. Airbnb has created a global network of users that has risen from 6 million in 2012 to over 265 million in 2023, an impressive feat.

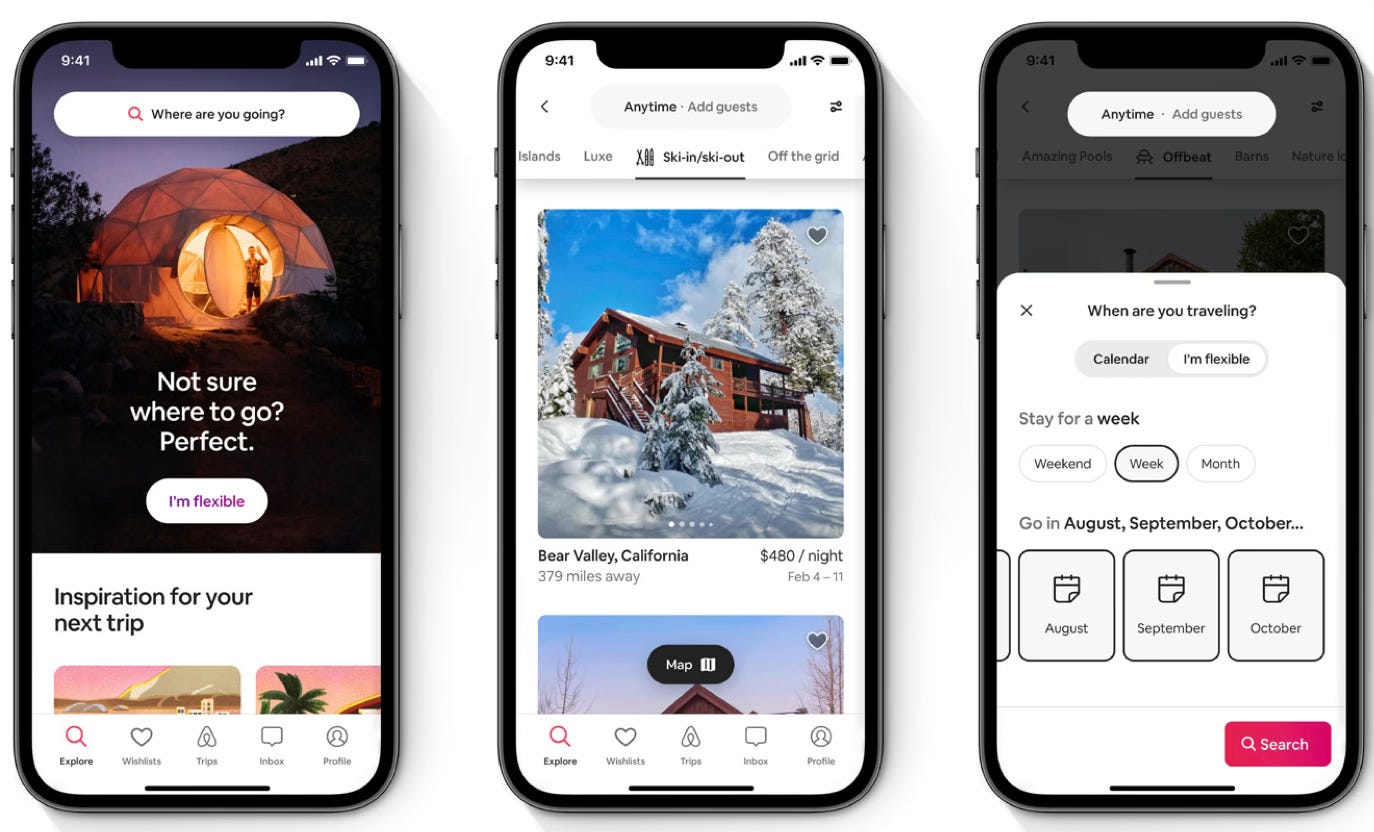

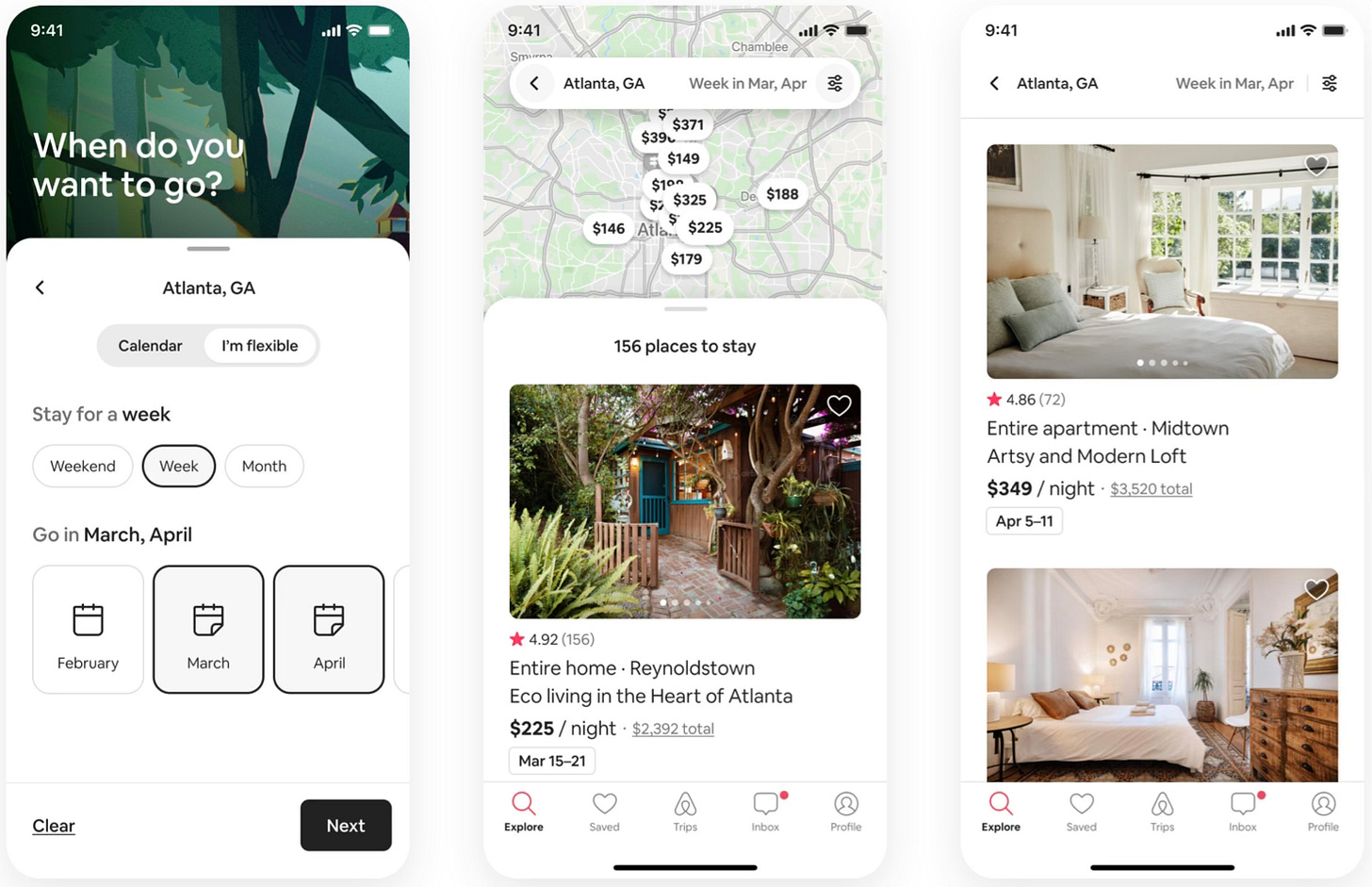

Airbnb’s well-designed website & mobile app allow users to find exactly what they are looking for with key features, such as:

calendar: Guests can book exact dates, flexible dates, short stays, and long-term stays.

Interactive map: Guests can search locations through a scrollable feed or an interactive map, indicating the location and price point of stays in the area.

Categories: For flexible guests, Airbnb offers 60+ categories of home types to search.

Airbnb’s design-first approach has created an intuitive platform that is easy to navigate and aesthetically pleasing, this intentional focus on design inspires guests, increasing the likelihood a guest will book.

Guests are a crucial aspect of the business, as without them, Airbnb wouldn’t have a business. Additionally, increasing the number of guests creates demand for hosts, further attracting hosts to the platforms This flywheel must continue for Airbnb to continue gaining share against other companies.

Historically, this growth has been driven by:

Value: Airbnb’s initial founding story was based on a cheap alternative to a hotel with their initial tagline “an affordable alternative to a hotel”. By offering accommodation types such as a private room or an annexe for an individual or a couple and whole houses for a large group, the company significantly reduced the cost of travelling. Additionally, many of these accommodation types came with cooking & washing facilities which save guests additional money if they were focused on budget. These factors lowered the barrier to travel, allowing people to travel more or for longer.

Over time, Airbnb has drifted away from this value-based approach primarily in the US but likely in other locations also, this shift is due to several reasons: increased demand driving higher prices, a mix shift to more expensive types of property, and a lack of price transparency as hosts added high cleaning fees that have historically not been included in the initial price guests saw when booking.

In response to these concerns, Airbnb has made some changes to address the higher prices, including;

Total price display: this tool allows price-conscious guests to search for accommodation based on total price, including all hidden fees, increasing the transparency of the platform.

Pricing tools for hosts: Airbnb had received feedback from hosts that it was difficult to see what similar accommodation was charging for a stay. The company therefore developed a tool called Similar Listings, which allows hosts to price their accommodation more competitively, lowering the cost for guests.

Discounts: Airbnb has made it easier for hosts to apply discounts to their listings, this can be a discount for longer stays or to drive demand in quieter periods.

Increasing supply: As I mentioned above, the company is extremely focused on increasing the supply of hosts on the platform, as they do this, the issue becomes a simple supply-demand equation, as supply increases, prices decline.

These efforts have resulted in Airbnb’s prices moderating while competitors have seen continued higher pricing, consumers have gravitated towards the total lower-price accommodation options, demonstrating that value is still one of the key considerations guests are looking for when coming to Airbnb.

Unique accommodation: Airbnb offers a huge variety of different styles of accommodation. Initially, travellers came to the platform because it was cheap. However, over time, the significant growth of hosts has brought unique spaces like treehouses, igloos, castles and luxury villas; these unique spaces created a unique and exciting travel experience that was different to the standard hotel offering. Additionally, with the rise of social media, these visually inspiring properties act as the most powerful form of marketing for the platform, differentiating the brand and making it stand out within the travel industry.

Additionally, Airbnb’s expansive range of accommodation types allows Airbnb to easily adapt to changing travel trends. This significantly benefitted Airbnb during the pandemic. During the initial months of reopening, travellers swapped cross-border travel for staycations closer to home, allowing Airbnb to rebound faster than competitors.

Locations: Airbnb’s global presence in 220 countries and over 100,000 cities (not to mention all of the places outside of cities) has allowed guests to stay in locations where hotels have previously not been available, allowing travellers to discover new destinations & stay in different areas of well-known cities, giving travellers a local experience.

Flexibility: Not only does Airbnb offer unique spaces, but the company also offers flexibility on duration and type of stay, In 2024, 17-18% of stays on the platform were for over 28 days, this blurs the lines between travel and living.

This flexibility in stay length expands the number of use cases for which travellers can use the platform. The rise of flexible work has allowed guests to travel on a permanent basis or for longer weekends.

Trust: This is one of the most important aspects of the business. From a standing start Airbnb has built strong trust between hosts and users, this trust gives travellers the confidence to be willing to stay in a stranger’s accommodation, and vice versa hosts have the trust to allow a stranger into their house. This trust is crucial for increasing the popularity of the platform, Airbnb has built trust in multiple ways:

Reviews: Both hosts and guests have the opportunity to write a review after a stay, these reviews are only made public when both parties have submitted. This dual review procedure increases transparency, while also providing trust to travellers who may book in the future. As of 2020, there had been more than 430 million cumulative reviews.

Messaging: After a booking is made, the platform allows guests and hosts to communicate.

Secure payments: Airbnb’s payment capabilities provide security to both hosts and guests. On the host side, confirmation that a payment has been made confirms that the host will receive payment upon arrival. While on the guest side, Airbnb’s systems provide security in case of any fraudulent activity.

Host background checks: Hosts must go through background checks before they are allowed to host, reducing the likelihood of bad actors on the platform.

Community support: Airbnb offers support for both hosts and guests to help with any issues before, during or after a stay to provide a non-biased resolution to any issues.

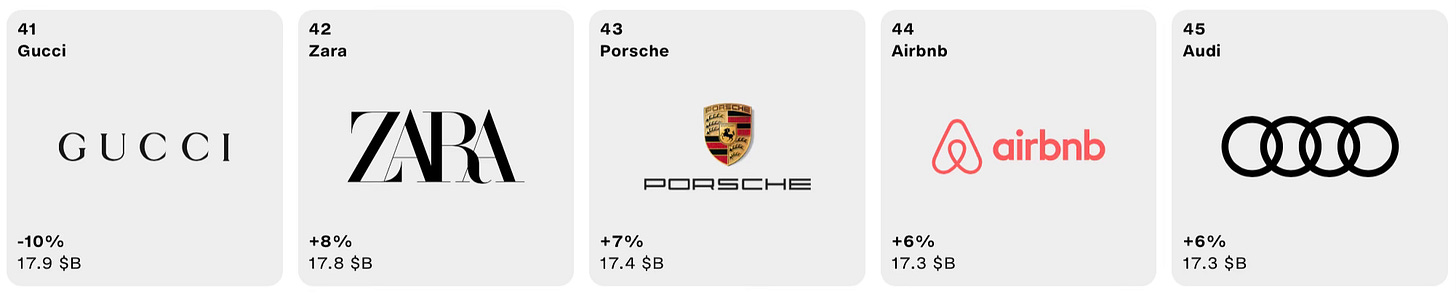

Brand strength: Airbnb’s brand has become globally recognisable. In fact, according to Interbrand, it is the 44th most valuable brand in the world. This strong brand recognition has built trust among users and made it top of mind when considering travel.

Even more impressively, this strong growth has been mostly organic, According to the S-1, Airbnb is the most searched travel brand on Google, and 91% of this traffic is actually from unpaid sources such as word of mouth, demonstrating the brand’s strength. This organic traction is due to the fact that the word Airbnb has become synonymous with travel. In fact, 55% of travel articles have the word Airbnb in them, this top-of-mind association linking Airbnb to travel creates an unconscious affinity towards the company, meaning anytime a guest wants to travel the first place they look & think is Airbnb.

To conclude, consumers have chosen Airbnb due to its strong value proposition of unique accommodation, value offerings, and longer-stay options. This value proposition has been made possible by the trust that Airbnb has fostered & the strong brand of Airbnb.

Experiences

Experiences are an offering on Airbnb that allows guests to book unique & local activities on top of their stay, these can be host-led or from within the local community. The idea behind this initiative is to enhance the overall travel experience and further create a unique value proposition for guests that competitors cannot replicate.

While Airbnb has high hopes for the segment, it remains a very small part of the business today. However, CEO Brian Chesky believes they have only just scratched the surface.

Launched in 2016, experiences have had a rocky start. 2020 was expected to be a breakout year for the segment, however, the pandemic had other ideas. This caused the company to pause product development & reduce investment in the area.

Since then, the company has gained further insight & learnings into the strategic direction they want to take the experiences offering. Investment has resumed in the area and the company is looking to further integrate it into the core offering.

Going forward, the company is looking to make the offering more unique & affordable for guests, while also integrating video into experience listings to make them more attractive.

Despite the rocky start, the offering seems popular among guests, with more 5-star ratings versus accommodation.

Marketing

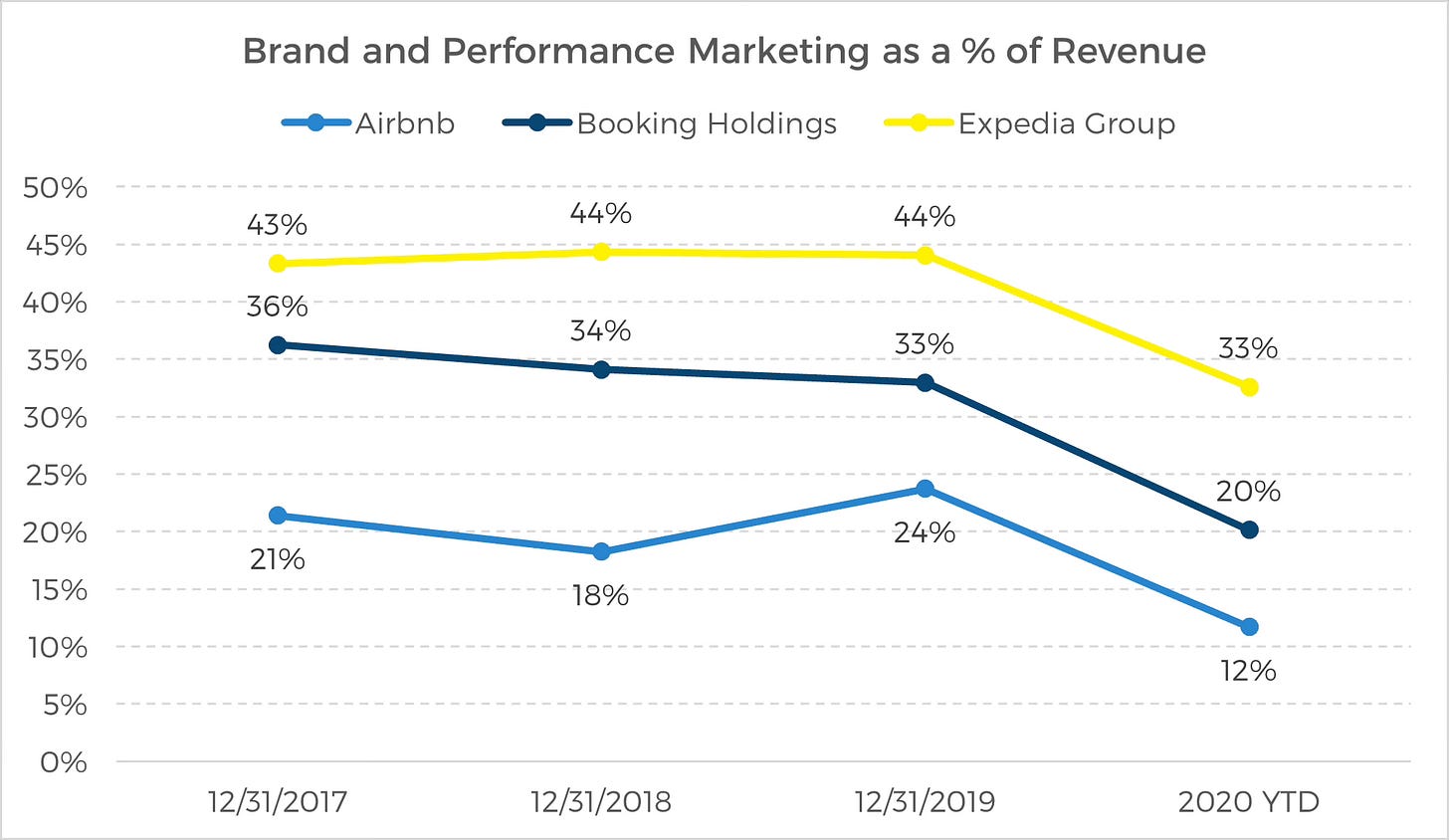

Airbnb’s marketing strategy is another interesting case study. I mentioned above that Airbnb has become the 44th most valuable brand in the world, additionally, most of this traffic is organic. This strong brand position allows Airbnb to have a significantly lower spend on marketing versus main competitors Booking & Expedia. In 2022, Airbnb spent 18% of its revenue on marketing, while Booking.com spent 45.7%.

Airbnb employs a full-funnel marketing strategy that includes: PR, Brand marketing & Performance marketing.

Public relations: PR has been the most effective channel in building the brand. The company’s focus on individual hosts has brought differentiated offerings to the platform, earning the company significant media attention. In 2020, the company received over 500,000 articles written about it, this increased to over 600,000 articles in 2022, and likely even more today in 2025.

Additionally, partnerships have generated significant social media hype, demonstrated by the Malibu Barbie dream house. This significant media attention has resulted in over 90% of traffic being direct and unpaid. This strategy has resulted in Airbnb having more Instagram followers than Booking.com, Expedia & VRBO combined!

Brand Marketing: Airbnb views brand marketing as education rather than an opportunity to buy customers.

Before the pandemic, Airbnb primarily invested in performance marketing, however, the company has since shifted towards brand marketing, due to concerns Airbnb was losing its differentiation. These new campaigns aim to highlight what differentiates Airbnb by mainly focusing on the personalisation and community that give guests a unique experience.

The company leverages user-generated content to create a more authentic brand, that gives greater credibility to the ad versus high-budget productions.

Additionally, the company has leveraged channels such as its own magazine to highlight the unique offering and community feel the company intends to foster.

Performance Advertising: While Airbnb has seen great success through PR & brand advertising to build a strong & valuable brand, the company has seen little success from performance advertising, potentially creating a weakness in the company’s business.

During the company’s early days, Airbnb focused on performance advertising utilising methods such as Search engine optimisation and Paid Search advertising. However, due to poor ROI, the company shifted to brand marketing.

Thanks to the company’s strong consumer mindshare, this lack of performance marketing muscle hasn’t created any issues. But in the future, should the business lose some of its organic traffic, they may not have any safety net to protect them.

To conclude, Airbnb has demonstrated through the years it can create a highly desirable brand image that sets it apart from the competition. However, below the surface, the poor returns from performance ads create a potential risk to future growth if their brand-building efforts hit a wall.

Key performance indicators

I have discussed above that driving the flywheel of increasing guests and hosts is the key to Airbnb’s future, there are several ways investors can track this progress over time.

Along with the typical financial metrics that investors focus on such as revenue, margins & earnings per share, there are several company specific metrics that are important to track.

Hosts, listings & guests

Knowing the growth trends of these three cohorts is important to understand the health of the platform. Unfortunately, the company no longer discloses these numbers unless they have reached a major milestone so the last known metrics for these are:

Hosts: 5+ million

Listings: 8+ million

Guests: Estimated 265 million

These have steadily increased over time, however, the fact these numbers aren’t regularly disclosed suggests growth will be slower in the future.

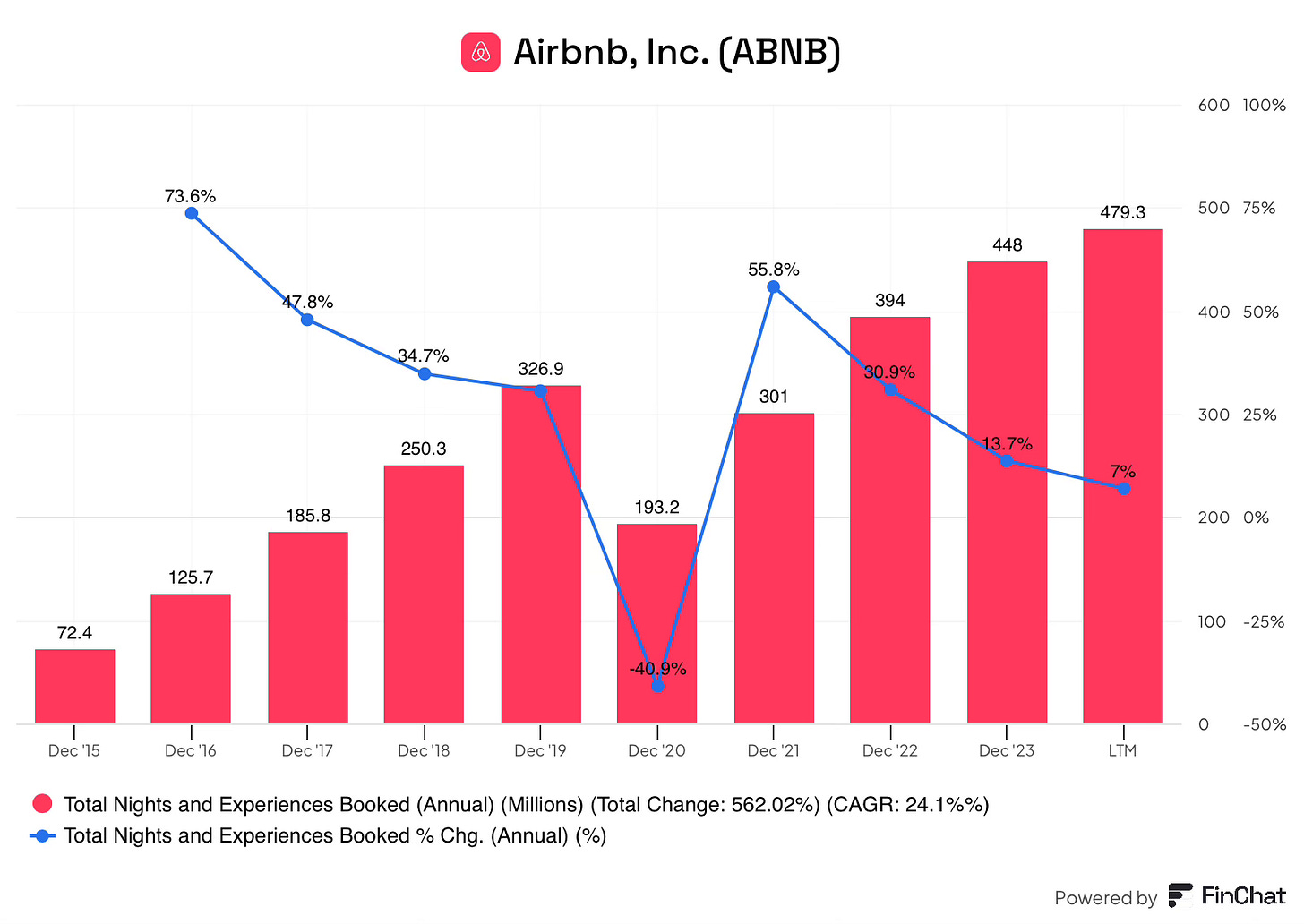

Total nights & experiences booked

This metric highlights the volume of nights & experiences booked through Airbnb. This indicates the underlying demand trends on the platform, over time this metric has increased due to the increased popularity of the platform.

Other factors that would affect this metric are average nights per stay & booking frequency per guest.

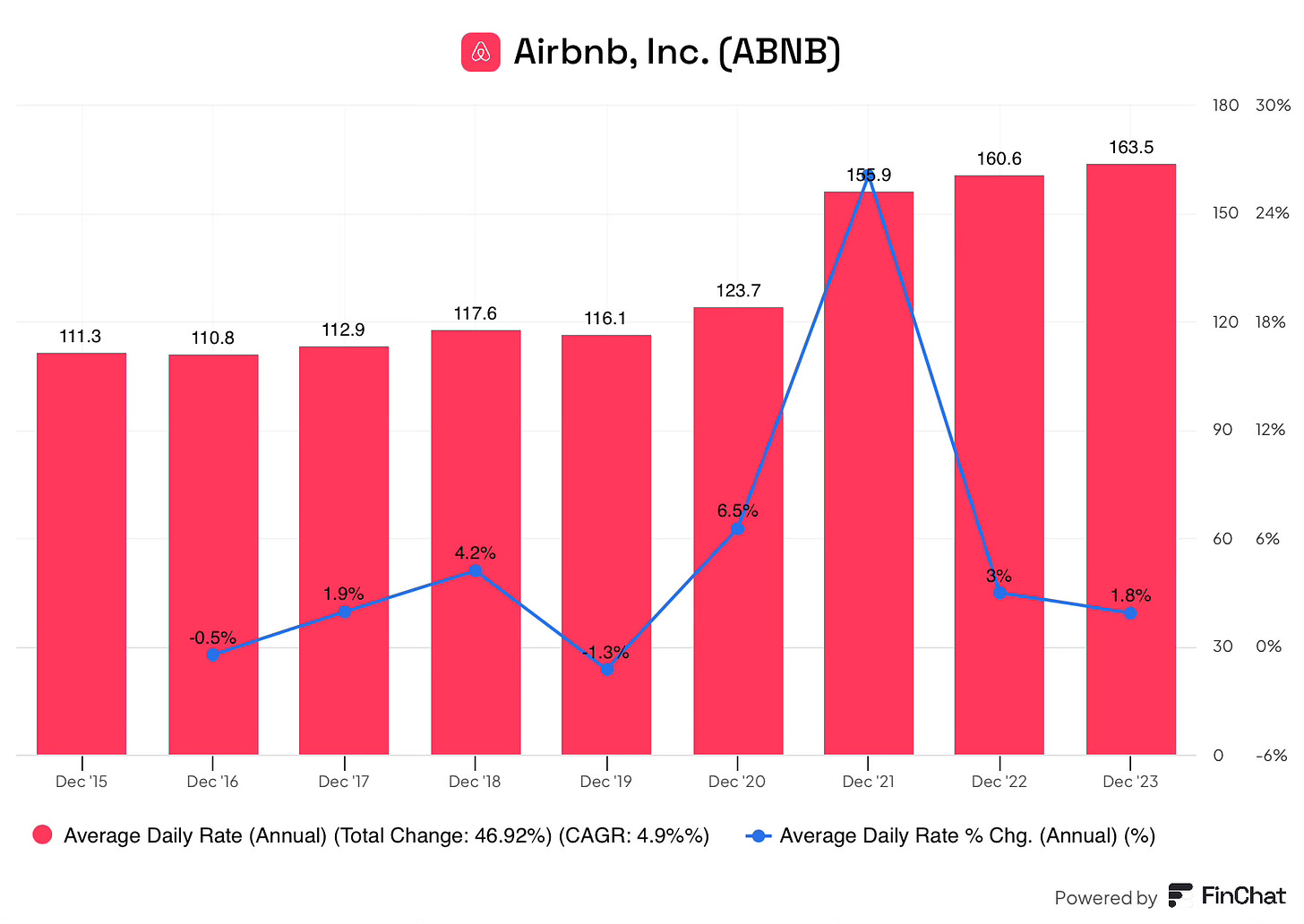

Average Daily rate

This figure reports the average cost per night across the platform from all geographical regions. This figure remained fairly consistent prior to the pandemic. However, during the pandemic, this figure experienced a jump of 6.5% in 2020 & 26% in 2021. Since then, Average Daily rates have stabilised at this new higher rate. This large increase was primarily due to mix shift & price appreciation due to high demand in certain areas.

Mix shift: As restrictions slowly lifted after the pandemic, guests sought to travel once again. There were some changes to the way people travelled, they typically stayed closer to home whether that was a staycation or short-haul travel resulting in a shift in demand to North America & Europe. Guests also sought non-urban locations and entire homes, all of which typically carry higher ADRs. This mix shift resulted in a higher average stay.

Since 2021, the mix towards global travel, urban areas and apartments has rebounded, potentially contributing to the moderation of ADRs.

Demand: Following the pandemic, Airbnb & the wider industry experienced a strong rebound due to the pent-up demand created by the global shutdown. This surge in demand along with a relatively fixed supply allowed hosts to raise prices, contributing to stubbornly high prices.

Similar to the mix shift, as the demand has normalised and the economy has begun to slow, hosts are finding lower prices are driving demand growth, resulting in normalised ADRs.

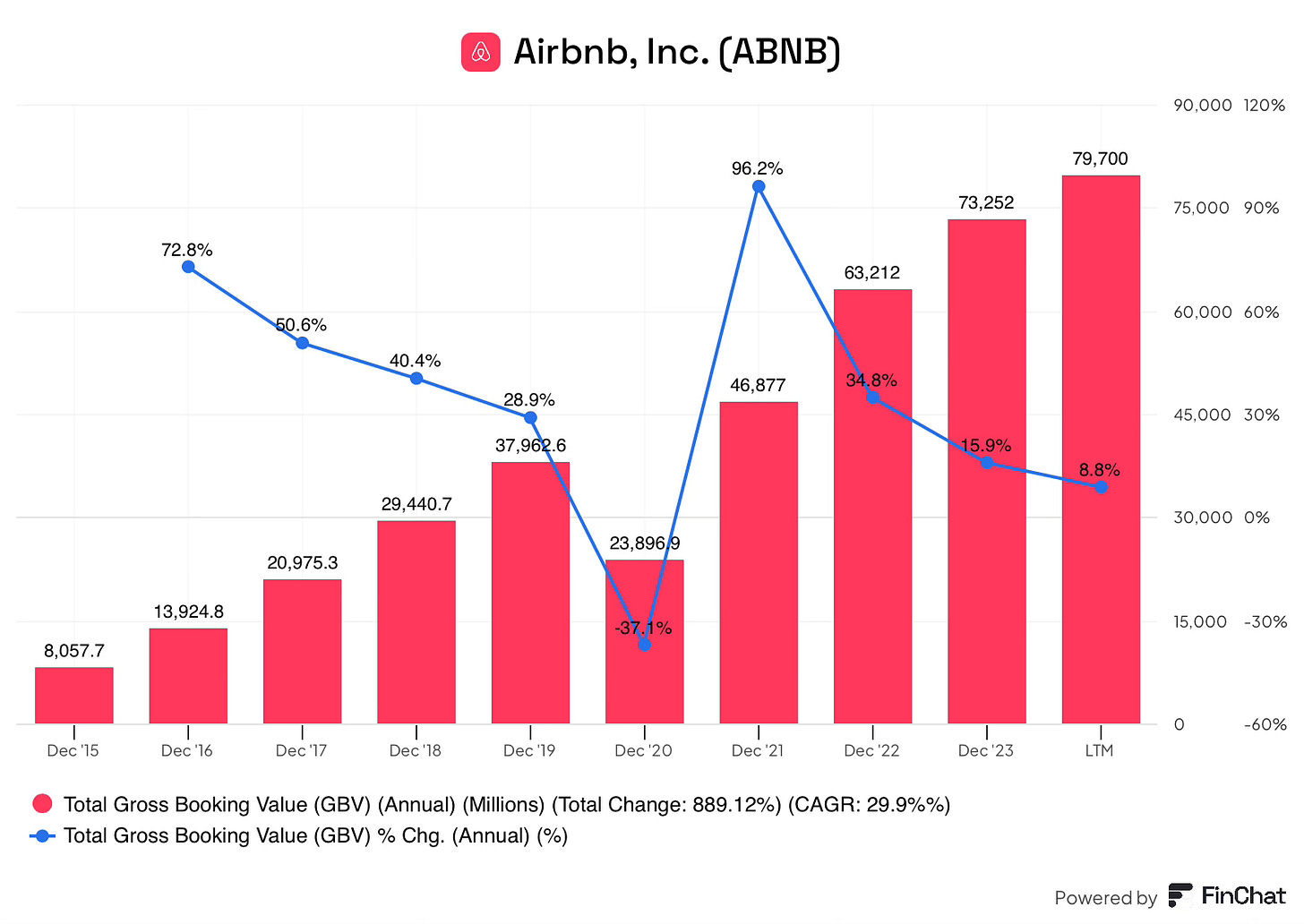

Gross Booking Value

Gross booking value is the monetary value flowing through Airbnb’s marketplace per year. It is calculated by:

Total Nights & Experiences X Average Daily Rate = Gross Booking Value

This is the most important metric on Airbnb because it outlines the total growth of the platform, it is also the most easily comparable metric to other travel companies.

Currently, the growth in GBV is being driven by volume over price, this is the highest quality of growth because it demonstrates Airbnb is further increasing its popularity. While higher ADRs may drive short-term gains in GBV & revenue, the longer-term implications of charging more for the same accommodation make the platform less attractive to potential guests, potentially jeopardising future demand growth.

Is the business simple & understandable?

To round up this section, Airbnb has a simple business model that has multiple competitive advantages over the rest of the industry.

Airbnb’s focus on creating success for hosts has resulted in a strong flywheel to develop that Airbnb has nurtured over time through platform innovations & improvements along with creating a strong brand image.

2. Is it a good business?

Financial Analysis

There are several financial indicators I look for when determining the quality of the business. I am looking for a growing business that is highly profitable, achieves good returns on invested capital, ideally low capital intensity & conservatively financed.

Additionally, the business should have a strong competitive position with a moat that insulates it from competition.

Growth & Profitability

Airbnb has grown revenue by almost 24% annually since 2017, even while grappling with a global pandemic for multiple years. While this growth has slowed down since the initial rebound following the pandemic, the company continues to experience healthy growth with the opportunity to accelerate this in the future.

While Airbnb has been cash flow positive for the majority of its history, the company has significantly increased its margins in recent years. During the pandemic, the company opportunistically re-engineered its cost base, allowing for significant margin expansion during the subsequent travel rebound.

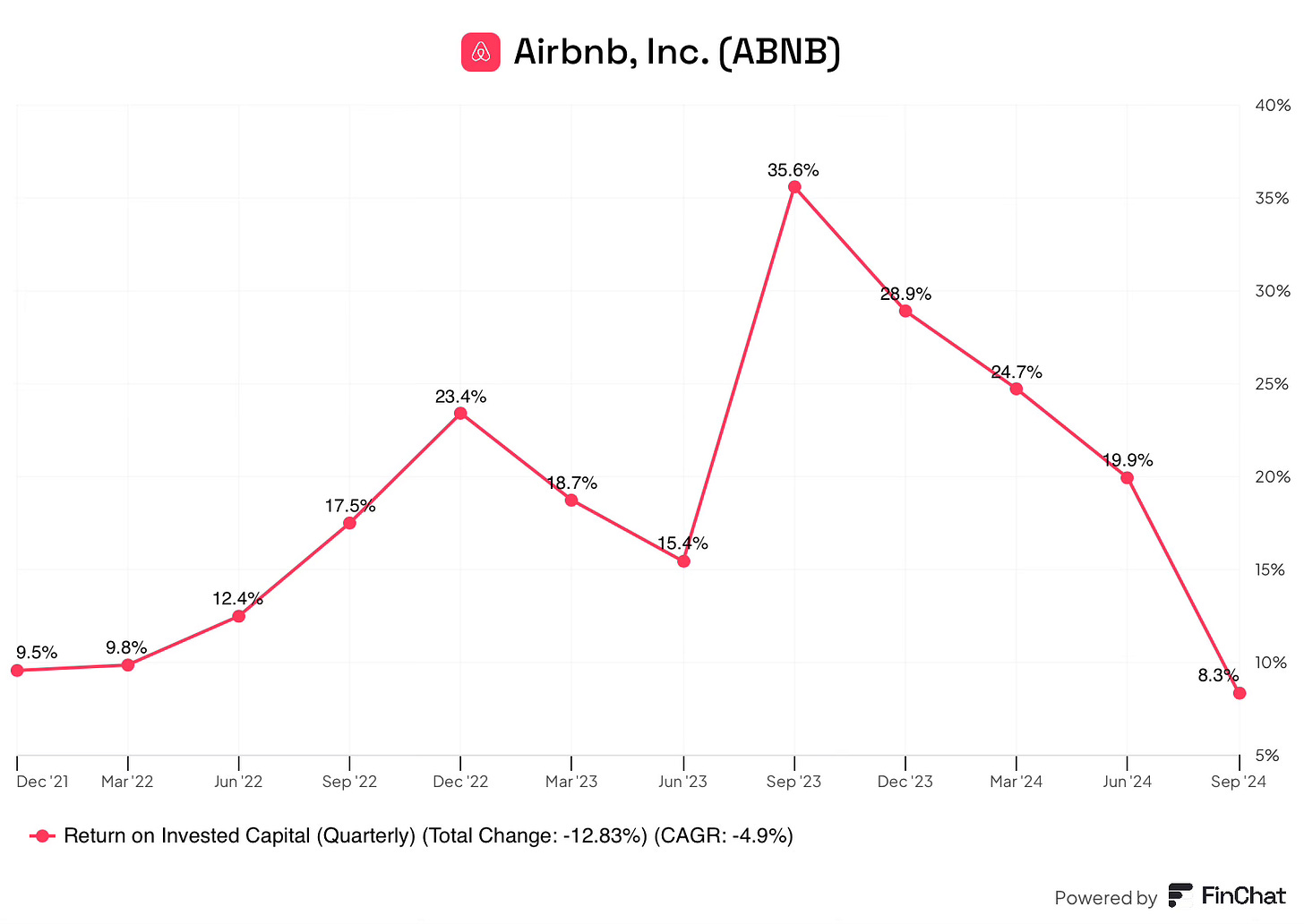

Return On Invested Capital (ROIC)

Since turning profitable on a GAAP basis after the pandemic, Airbnb has demonstrated strong growth in return on investment capital, benefiting from its capital-light business model.

Recently, the company has seen a decrease in ROIC, dropping from 19.9% in Q2 2024 to only 8.3% in Q3 2024. This significant drop is due to a decrease of 68.7% in net income during Q3 for two reasons:

A higher-than-normal tax expense of $367M

The company ramping up investments for future growth.

It is also important to note that the company’s relatively large cash pile has also diluted ROIC somewhat, meaning the underlying assets are generating higher than demonstrated.

On a normalised basis, Airbnb has demonstrated that it can achieve an ROIC around the 20% mark, which has also been increasing over time!

Capital Intensity

Airbnb’s business model is inherently capital-light. The company operates a platform that is hosted by Amazon Web Services (AWS). This means Airbnb does not need any of its own technical infrastructure to run the business.

The only physical expenditure the company needs is office space & the respective furniture to fill them, along with technology to run the business. Even this physical line item has been reduced as the company has reduced the number of properties it owns.

The main costs for Airbnb are R&D expenses & marketing spending.

R&D: Airbnb is primarily a technology business, therefore the company needs to continue to invest & innovate to remain competitive. While seasonal, R&D spending has come down as a percentage of revenue over the past few years due to scale benefits.

Recently, R&D spending has accelerated slightly as the company invests in AI use cases & hiring to support future growth. Over the long term, the company intends for R&D as a percentage of revenue to continue decreasing.

Marketing: I have already covered Airbnb’s marketing strategy in this deep dive, so I will not cover that in detail here. Marketing spending is not broken out specifically, however, it is estimated that marketing spend is roughly 15% of revenue. While this spending may shift between marketing strategies, the company expects it will remain consistent over time as a percentage of revenue.

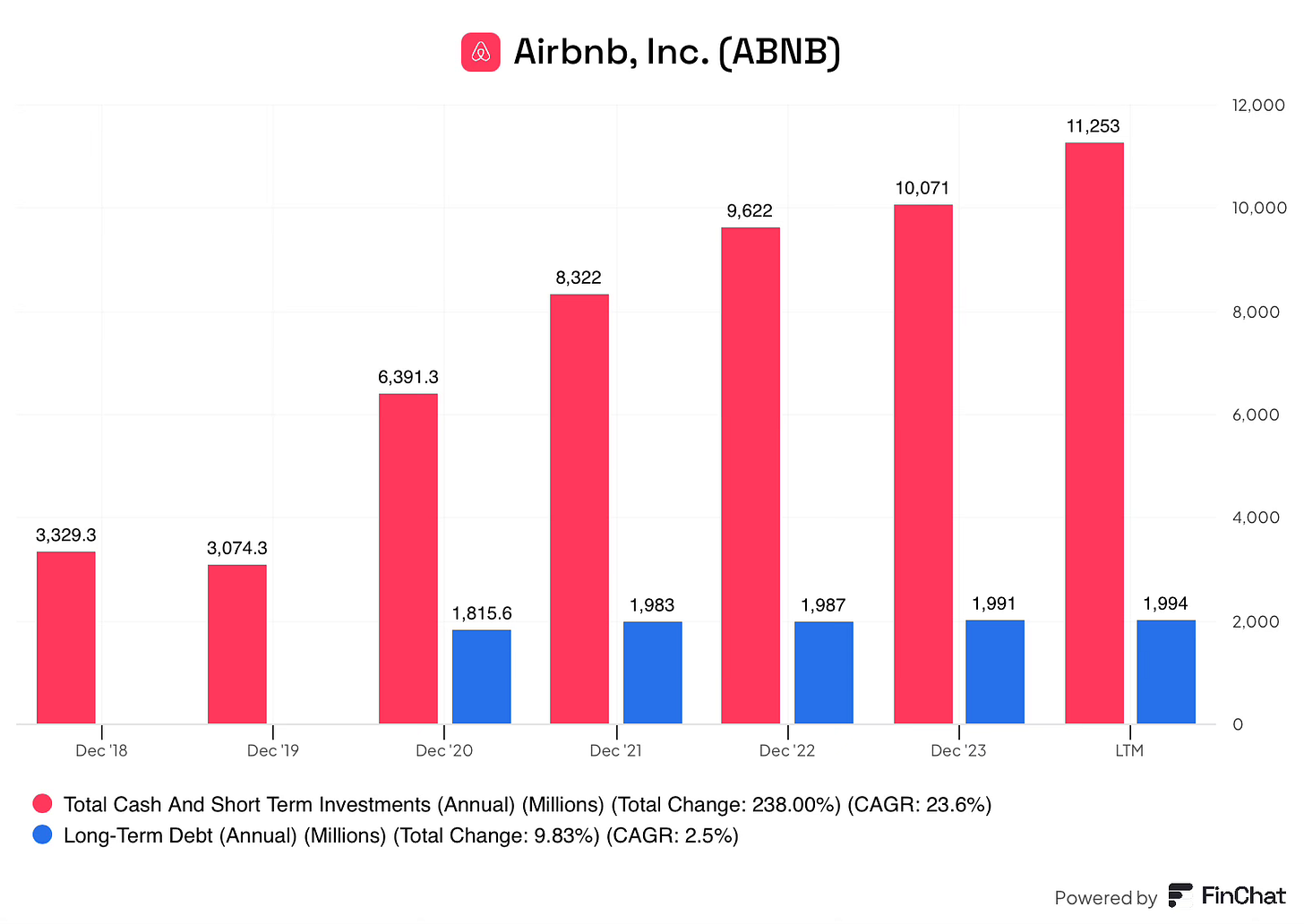

Balance Sheet

Airbnb is very conservatively financed, the company has $11+ billion in cash and short-term investments and only $2 billion in debt. Additionally, the interest expense of this debt can be more than covered by the interest earned on this large cash pile.

This conservative financing allows the business to invest freely without concern for the financial health of the business, allowing the business to think & act truly long-term, a great position to be in.

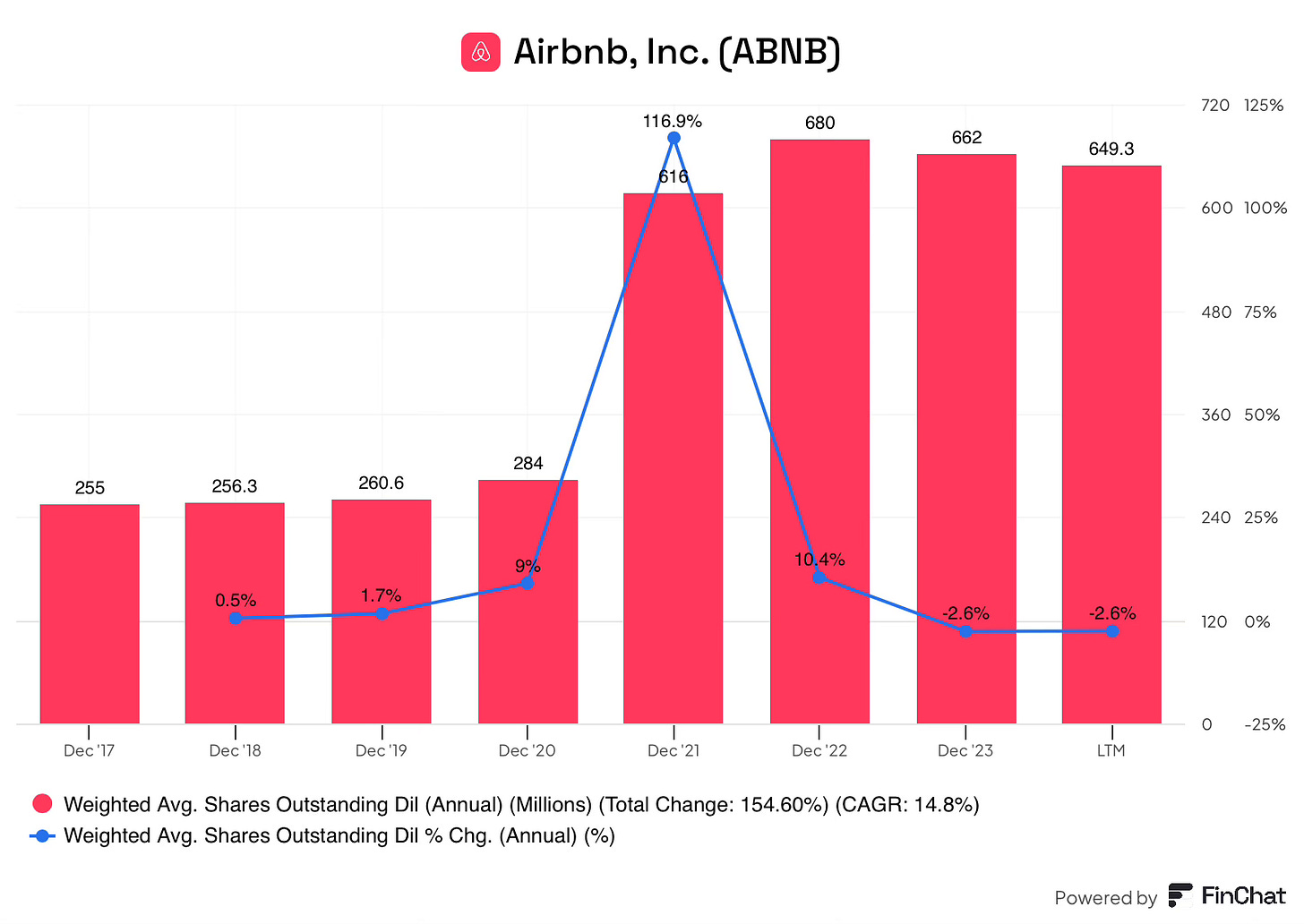

Shares Outstanding

In the above section, I have established that Airbnb has the financial characteristics of a great business. Next, I will take a look at shares outstanding, this helps us understand how much of this great business investors get to keep or whether share dilution from stock-based compensation is resulting in poor per-share performance fundamentals.

While stock-based compensation at 12% of revenue is higher than I would like to see, share buybacks have been reducing shares outstanding over the past couple of years. This offset has resulted in a small increase in shares outstanding since the IPO in 2020. While not ideal, this is also not the end of the world if the business continues to perform well and buys back shares over time.

To conclude this section, while Airbnb has historically been cash flow positive, the pandemic proved to be a blessing in disguise for the company as it emerged as a significantly more profitable company.

Today, Airbnb has all the characteristics of a great business!

Industry Landscape

While the travel industry has always been highly competitive, Airbnb has managed to carve out a niche. Over time, the industry has responded to the rise of this new form of travel by providing new accommodation types and expanded offerings, while new companies have entered the space.

In the early days of the company, travellers primarily had no choice but to stay in a hotel or a dedicated holiday home. Airbnb carved out a niche of people who were looking for “convenient, cost-friendly and unique experiences.” Additionally, it created a market for hosts who wanted to rent out their property on a short-term/flexible basis. This offering was significantly different from anything else in the market.

Over time, as Airbnb grew from a tiny player to a legitimate threat, the company developed a brand presence that was known for unique accommodation & trust. However, there was little initial reaction from hotels; the industry believed that the respective companies catered for different types of guests, “Airbnb, after all, was catering to a niche market: people who were willing to sleep on an air mattress on the floor of someone’s living room.” This differed from the amenities of a gym & swimming pool that hotel guests desired.

With Airbnb’s continued market share gains during the 2010s, competitors finally woke up to the threat that Airbnb may not be just a niche player. This perception likely changed due to the growth in Airbnb’s supply which allowed the company to expand its offering from solely value-based to one that included a unique supply of listings across the globe that could not be replicated by traditional accommodation types.

Participants in the industry started to take aim at the company, claiming that they had an unfair advantage due to individual hosts not being subjected to the same regulations as hotels. Groups argued that because Airbnb did not have to comply with these regulations, hosts could charge less than established players. This viewpoint likely missed the forest from the trees.

Finally, after a period of denial, competitors began to adapt to the threat of Airbnb, which meant Airbnb went from an industry of 1 to competing with multiple players. Today, Airbnb competes with multiple forms of competition, some of which have been established players that have adapted their business model to fend off a rising threat, others are new upstarts that have seen opportunities to grow. Below I will dive into the different kinds of competition Airbnb deals with today.

Online travel agencies (OTA’s): Online travel agencies such as Booking.com & Expedia Group (including all of the brands within) have historically focused on Hotel supply. However, with the rise of Airbnb, these competitors expanded their product offerings to include peer-to-peer options by acquiring small players to establish a presence. This move blurred the lines between traditional hotel offerings and peer-to-peer accommodation.

Companies such as Booking.com have benefitted greatly from this expansion. The company already had an established position in the market with a well-known brand that allowed it to gain traction very quickly. The expansion of supply therefore drove greater traffic & increased bookings.

Furthermore, Booking.com has a distinct advantage over Airbnb, by having hotels and other forms of accommodation all on one site, allowing consumers to compare the options between hotels and hosted accommodation with minimal friction, providing greater choice. Additionally, these travel sites include the option to purchase flights, car rentals and other activities, allowing guests to book the entire holiday through one platform, something Airbnb hasn’t managed to provide as of yet.

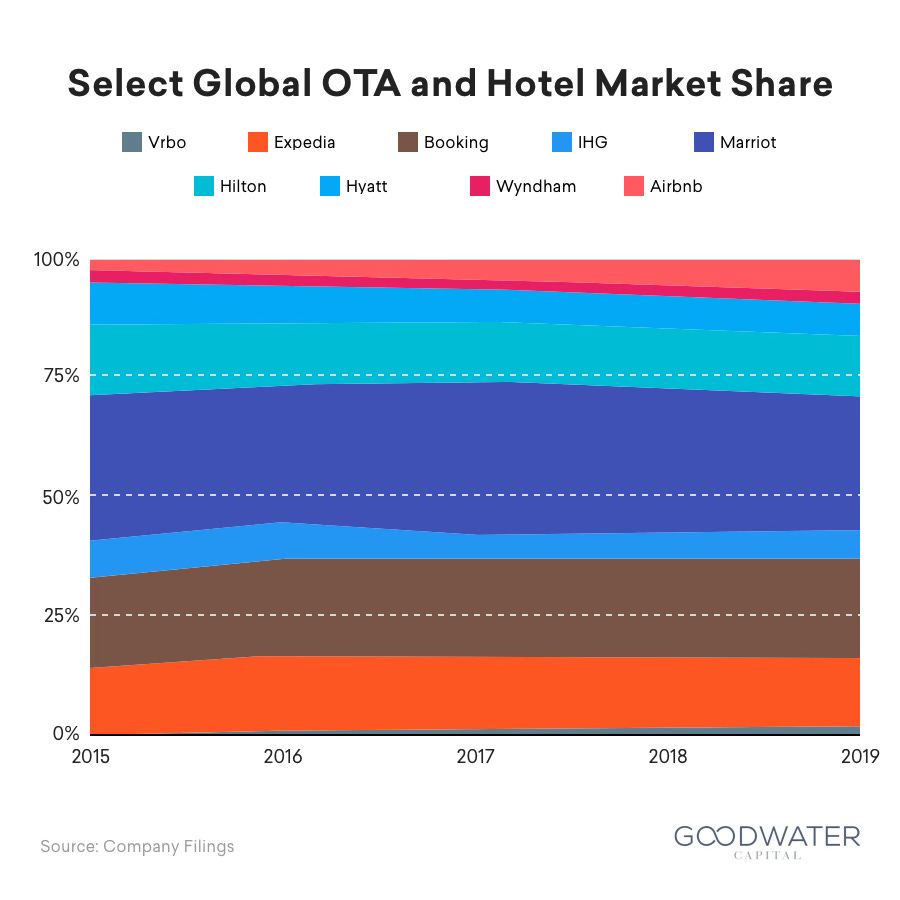

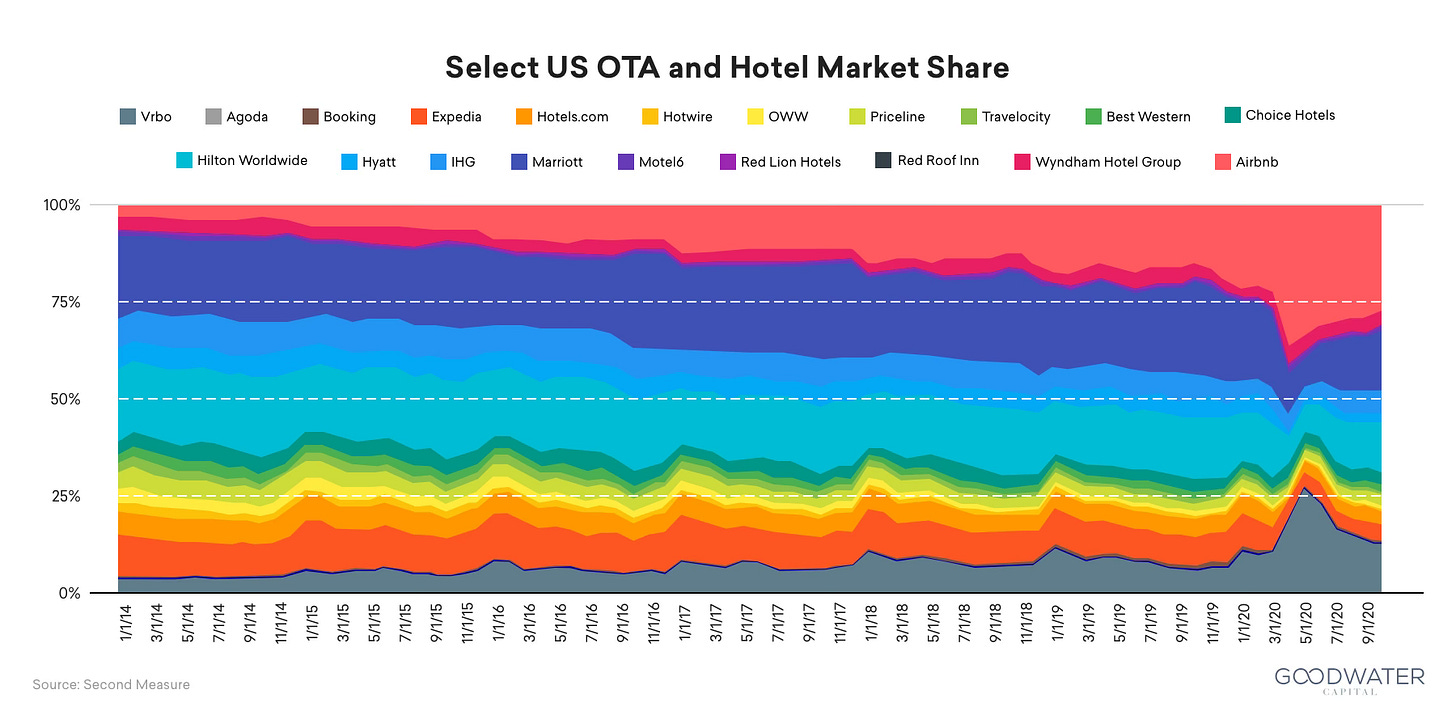

Peer-to-peer competition: Following the huge success of Airbnb, there have been many start-ups formed that are now competing against Airbnb for both hosts and guests. These competitors have taken two approaches: mass market & niche carveouts. The biggest competitor in the mass market space is VRBO (owned by Expedia Group), which has grown in popularity, especially in the US, as demonstrated by the market share chart below.

While not competing as significantly with Airbnb, niche carveouts appeal to a certain demographic, geography or hobby which likely takes incremental hosts & guests away from Airbnb.

The market share graph above demonstrates that both Airbnb & VRBO have managed to gain significant market share from traditional travel companies. It appears that the smaller OTA’s and low to mid-market hotel providers have been the source of most of this market share.

While both companies have managed to grow in tandem historically, this may not be the case going forward as the market reaches saturation. Airbnb is currently in pole position to win here thanks to the strong network effects these businesses create. VRBO currently has 2 million hosts, less than half that of Airbnb, furthermore, VRBO may be competitive in the US but they have significantly less brand awareness in the rest of the world.

Hotels: While the delayed response likely meant it was too late for some lower-end hotels to compete, many of the large hotel chains such as Marriott & Hilton have adapted to the threat of peer-provided accommodation. The best way for these companies to compete was to focus on their strengths, these strengths include:

Facilities: Gyms, Swimming pools & restaurants

Location: positioning themselves near high-demand areas.

Service standards: improving the quality of a customer’s experience increases the chances of a repeat customer.

Loyalty programs: Improving the customer lock-in.

Furthermore, companies such as Marriott have expanded into different forms of accommodation like luxury villas, likely to cater for an Airbnb-like experience for their most loyal customers.

While there are many more forms of competition, at the end of the day all of these companies are competing for a prospective traveller accommodation budget (& to a lesser extent experience budget).

However, because Airbnb is a two-sided network, this also means they are competing for hosts.

Airbnb’s Competitive Advantages

Competition for guests

In some aspects, the travel industry is a poor business, with very little customer conversion and retention. This means it is a constant battle between companies to attract prospective guests again and again!

Companies, therefore, have to spend significant amounts of money on advertising & promotions while also keeping prices extremely low to compete. However, due to the capital-light nature of the businesses, the large players still manage to earn strong returns on invested capital.

Airbnb has several competitive advantages on the customer-facing side:

Brand: As I have described above, Airbnb has created a brand image that differentiates itself from other competitors in the industry.

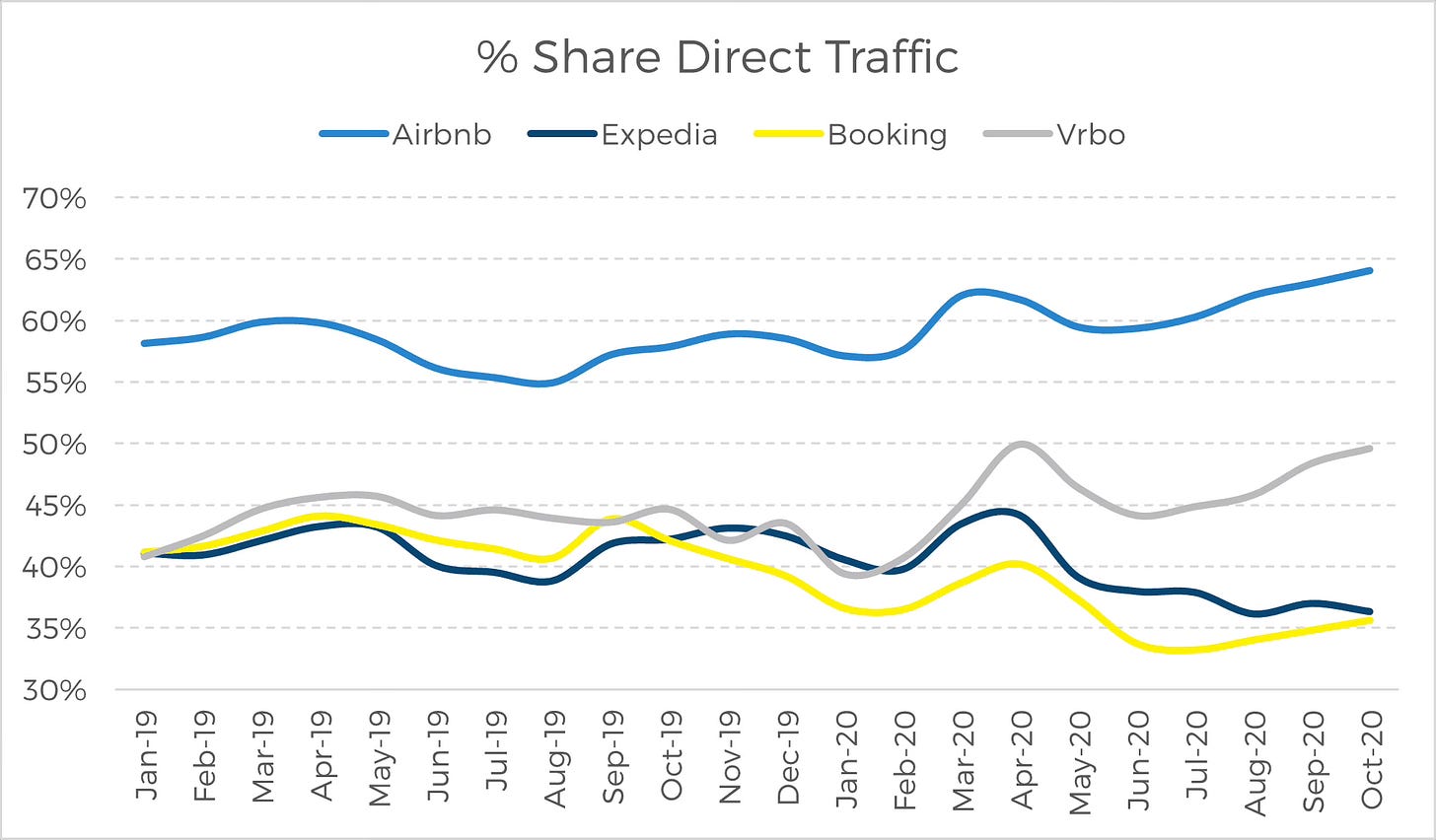

Through PR and brand marketing, the company has associated itself with travel; this means more than 90% of traffic to Airbnb is direct (up from 65% in the graph). This top-of-mind position means Airbnb can spend significantly less money as a percentage of revenue to acquire guests. Instead, they can invest in strengthening their brand image and educating hosts & guests around the world.

This strong brand recognition is a significant competitive advantage, it allows the business to be able to focus on the long-term and provide value to consumers by increasing choice, lowering prices and providing unique experiences. In contrast, other businesses remain on a constant treadmill of acquiring new customers to sustain their business.

Unique Supply: Airbnb’s large supply of individual hosts provides the platform with a wide variety of unique accommodation types. The majority of these hosts are exclusive to Airbnb, allowing the company to have a differentiated offering. Furthermore, this supply is truly global, with listings in 220 countries and over 100,000 cities. This unique global supply allows guests to find the right accommodation to suit their specific needs, whether that is on price, location or amenities, Airbnb has options for everybody.

Booking.com has reached the same number of alternative listings as Airbnb, currently 7.9 million in total. Along with that, Booking.com has been touting that they have been growing faster than Airbnb in 13 of the last 14 quarters. However, this growth is due to the onboarding of professional property managers and the many accommodation listings they run. These property managers list across multiple property sites to increase the chances of a booking. This equivalent amount of listings is therefore, of significantly lower quality than those of Airbnb’s, highlighting the competitive advantage that Airbnb has.

Design: Airbnb’s design-first approach is a significant advantage over its competitors. Studies have shown that a website’s design positively affects the intent to purchase. Airbnb’s sleek, minimalistic user interface and quality listings are an under-appreciated aspect of why the business has performed so well. For established competitors, this is a difficult component of the business to change with consumers becoming accustomed to where to find website features.

Network effect: Airbnb’s two-sided network that I touched on before has built up significant network effects, the accumulation of guests, hosts and respective reviews, further enhances the trust in the platform over other peer-to-peer accommodation providers.

Competition for Hosts

Airbnb also has to compete with the likes of Booking.com and VRBO to attract and retain hosts to the platform. The company has several advantages that make Airbnb the most attractive option to list.

Brand: Like above, Airbnb’s strong brand image and organic traffic means hosts have the most chance of receiving bookings through Airbnb, in fact, hosts typically receive their first booking within 3 days of listing.

Furthermore, this strong traffic also allows hosts to have a higher occupancy rate versus booking.com. While not an exact science, Booking.com’s 7.9 million listings account for 390 million of the 1,114 million nights booked. This means the average occupancy rate is 49.9 nights per year for Booking.com

Airbnb hosts 479.3 million nights per year and has approximately 8 million listings, this gives an occupancy rate of 59.9 nights per year.

It is important to note that this figure likely underestimates Airbnb’s occupancy advantage over Booking.com. Individuals make up 90% of hosts on Airbnb, which means they have a far higher number of listings that are seasonal. Full-time listings, therefore, will have a higher occupancy rate versus the stated 59.9. This higher figure would be a more representative comparison against Booking.com given the professional nature of their hosts. This further advantage extends Airbnb’s lead.

While 10 nights per year doesn’t seem like a massive advantage, it provides hosts with at least 20% more income per year (& likely higher), this is a significant difference!

Tools: Airbnb’s heavy focus on providing tools that allow hosts to run their business on Airbnb more easily is a competitive advantage.

Onboarding tools: Airbnb has spent significant time making it as easy as possible to list a property on the platform. The process now involves 10 simple steps and can be completed in under 10 minutes.

Co-host network: with this feature, Airbnb is reducing the barriers to hosting by connecting a potential host with an experienced host who can help manage a listing.

Aircover: Airbnb provides hosts with free protection for damage protection and liability coverage, giving hosts peace of mind about hosting.

These tools (and many more) are all designed for the individual host, something OTA’s aren’t particularly focused on given the professional nature, allowing the company to provide significantly better service than competitors, and allowing the business to have a higher retention rate of hosts.

To conclude, Airbnb’s advantages on both sides of the network allow Airbnb to be well-positioned to compete and grow its network, further enhancing the flywheel & network effect I detailed earlier.

Is it a good business?

To conclude, Airbnb demonstrates all of the financial characteristics of a great business. While the company is likely to experience increased competition in the future, the business has developed a strong network effect and other competitive advantages that they continue to invest in. This should allow Airbnb to continue competing effectively in the future.

I hope you have enjoyed this first part of my 3 part deep dive series into Airbnb, now we have covered the basics of the business model, key aspects, financial characteristics and in competitive landscape, I will be going into even more detail during parts 2 & 3.

Join me for part 2, where I discuss management and recent developments, before finishing this 3-part series with opportunities, risks and valuation.

Sources: Company filings & transcripts unless otherwise linked.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Really strong deep dive! Keep up the good work!