Overview

Evolution was founded in 2006 by Jens Von Bahr & Fredrik Österberg in a bid to bring online gambling to the masses. Today, the company is leading the industry with an estimated 60% market share with over 20,000 employees, €2 Billion in revenue and a market capitalization of roughly $16B.

Evolution develops and produces content for online casinos; this content takes multiple forms, including live streaming traditional casino games (think blackjack & roulette), online slot games, and game shows through well-known franchises such as Deal or No Deal or in-house games such as Crazy Time.

Evolution operates through a B2B business model and therefore, does not have any customer acquisition costs or account management that would add complexity, allowing the company to solely focus on providing the best content possible. It’s through this model that Evolution’s mission “to make operators successful and provide an excellent gaming experience for their end users” comes alive.

Contents

In this deep dive, I will be asking myself 5 important questions that will help me assess how investable Evolution Gaming is. These 5 questions are:

Is the business understandable?

Is it a good business?

Are management capable and trustworthy?

Does the business have a long re-investment opportunity, and what are the risks associated.

Is it available at a fair price?

At the end of the analysis, I will share some closing thoughts for portfolio allocation.

1. Is the business understandable?

In this section, I will dive into the business model in more detail along with the critical elements to make Evolution’s business run.

Business Model

Evolution provides online casino games to online casino operators; the company generates revenue through variable commissions based on the earnings those games make. Depending on the complexity of the individual agreement, Evolution could also earn additional revenue for exclusive tables, table branding and other value-added services, enhancing the lock-in.

Evolution’s business model has several key advantages.

Alignment: This business model aligns Evolution well with the key stakeholders. If Evolution creates high-quality, engaging games, it benefits the end users who spend more time and get higher satisfaction than other online casinos. The same high-quality games benefit the gaming operator, who earns more money from engaged end users. Finally, Evolution only wins when both the end user and the gaming operator succeed through a cut of the earnings that the game takes.

Scale: Unlike a Land Casino, Evolution does not experience capacity constraints in the same way, for example, you can only serve a limited number of players around a physical roulette wheel. However, Evolution can serve a theoretically unlimited number of players, while the cost of serving them changes minimally. This means Evolution can achieve far higher margins through this model. This scale is demonstrated above by the revenue per employee chart.

Key Performance Indicators

Games: are the most important ingredient to Evolution’s success, high quality and engaging games, which attract players, and this in turn makes Evolution an increasingly valuable partner to gaming operators. Furthermore, the time spent gaming influences the amount of money spent, driving financial returns to both the operator and Evolution through commission.

Over time, Evolution has focused on pushing the boundaries of creativity and technology to provide the most entertaining experience for operators and the end user while also providing a seamless experience across the platform.

Evolution produces and distributes games through its collection of 6 brands. The primary brand is the namesake Evolution, followed by acquired brands; Ezugi, NetEnt, Red Tiger, Big Time Gaming and Nolimit City.

Historically, the core product has been live casino games (blackjack, roulette, backgammon). These products appeal to the mass audience. Over the past several years, Evolution has been adapting classic games that further add to the end user’s experience. Adaptations include multipliers allowing players to earn more.

Evolution introduced the live game show category to the world in 2017 with the game Dream Catcher Since that time game shows have increased in popularity. Beyond this first release, Evolution has introduced; Crazy Time, Deal or no Deal Live and Crazy coin flip. These games attract a different type of audience and now have overtaken the live casino category to entertain the largest number of players.

Beyond live games, Evolution has acquired its way into RNG (random number generator) and slot games. Over it’s history, the company has acquired 5 brands, 4 of which were RNG. Despite the acquisitions, Evolution has failed to gain the organic traction they were hoping for (double-digit revenue growth), more on this later.

Over the past couple of years, Evolution has been increasing its game release cadence. In 2022, Evolution released 88 games. In 2023, Evolution launched 110 new games with 15 of these being live casino games, this strong cadence has continued in 2024 with 46 games released in the first half and even more to be released in the second half, putting the company on track to exceed 110 games.

Studios: are the core of Evolution operations. They are the location where live casino games are produced and live-streamed, similar to that of a TV studio. As of Q3 2024, Evolution operated 22 studios around the globe. Of these 20, 12 were situated in Europe, 7 in North America and 3 in South America, with 3 studios (Latvia, Malta & Georgia) acting as hubs where the mission control room, gaming innovation and other key operations are situated.

There are several key measures of studios:

First is capacity, which can be measured by the number of live tables. These 22 studios could host 1,600 tables worth of capacity at the end of 2023 (likely more now with 2 studios opening in 2024). This is up from 1,300 in 2022 & 1,000 in 2021.

The second measure is operational reliability. Reliability is essential for operators, when a game is down. No one is earning money, therefore, a strong uptime track record provides customers with the best experiences and the longest time to be earning. In 2023 Evolution was operational 99.93% of the time. Over time, Evolution has earned a reputation for quality & reliability.

Studio & table growth is a good indicator of demand growth. In Q3 24, Evolution opened two studios: Colombia & Czech Republic. Evolution now has 2 studios in Colombia, this second one will support that market as well as the broader LATAM market. The Czech Studio will primarily serve the domestic market but will also provide capacity to the broader European market.

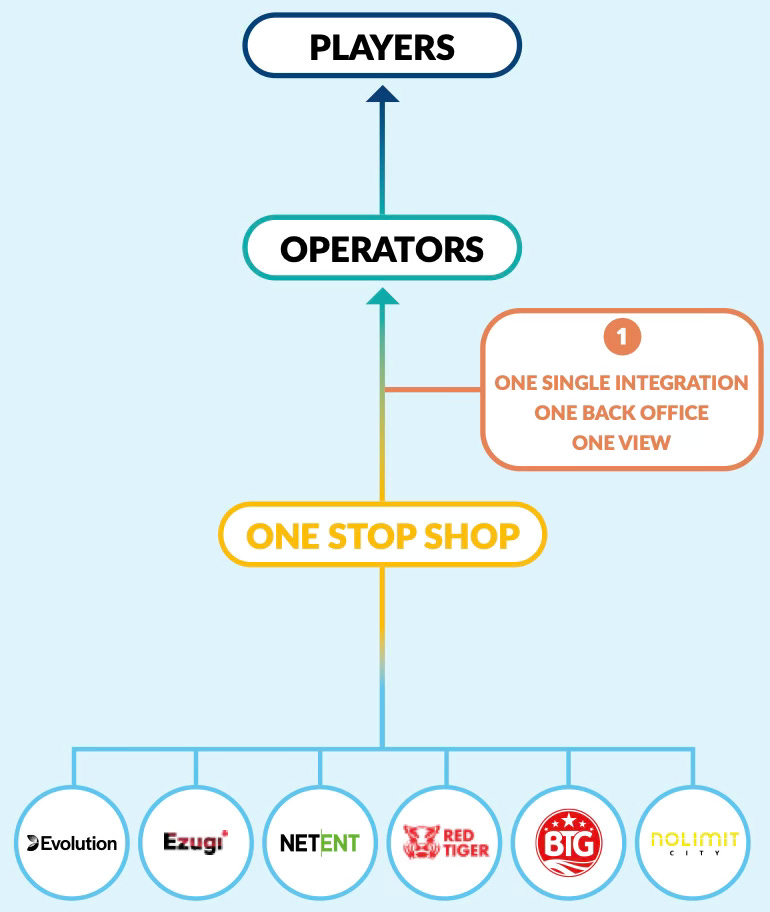

One stop shop (OSS)

From a consumer standpoint, a user sees the game portfolio through a lobby, similar to the home page of Netflix. The company uses AI to tailor & recommend games that are most likely attractive to that specific user.

The back end is significantly more complicated. Historically, Evolution was the sole brand in the group, allowing operators to just connect their infrastructure to this single brand. Now, the company operates through 6 brands they have been working to make these accessible through a single touchpoint.

This touchpoint is the One-stop Shop (OSS), through the OSS an operator gets access to the entire portfolio from all of the companies’ brands through a single point of integration.

This integration has caused significant disruption, with player dashboards losing signal to recently played games and previously favourited, causing a bad customer experience and the potential loss of some players.

Despite the short-term headwinds, longer term, it allows for more features to be brought to the platform, enhancements to the recommendation engine and increased cross-sell opportunities for Evolution.

Customer Base

Evolution has partnered with some of the biggest online operators globally, as demonstrated by the logos above. As of the 2023 annual report, Evolution had 800 customers. For the past 2 years, the company has added roughly 100 new customers per year. As mentioned previously, these customers are Online casino operators, however, land-based casinos have also been getting in on the act.

Operating a B2B model has some advantages. Evolution doesn’t interact with the end user, reducing the complexity of Evolution’s operations. Secondly, Evolution has minimal customer acquisition costs. These costs are being spent by the operators, which allows Evolution to have a higher margin profile. On the other hand, Evolution does have customer concentration risk.

Customer Concentration

Evolution’s largest customer represents 13% of total revenue; this has remained fairly stable over the past couple of years. The concentration of the top 5 customers has been increasing over time, currently representing 41% of revenue, this does represent a risk to the company. However, the likelihood of all of these customers leaving in one go is small, in my opinion.

Regulation

Evolution operates in a heavily regulated industry. These regulations are normally laid out at a national level, with some outliers, such as North America, having state-by-state regulations. Depending on the country, online gambling regulations vary massively, with some countries requiring licences while others do not permit online casinos. These regulations also exist at a game level, with most games needing approval to operate.

Regulation is a big opportunity & risk at the same time, I will cover both of these in part 2.

Revenue Composition

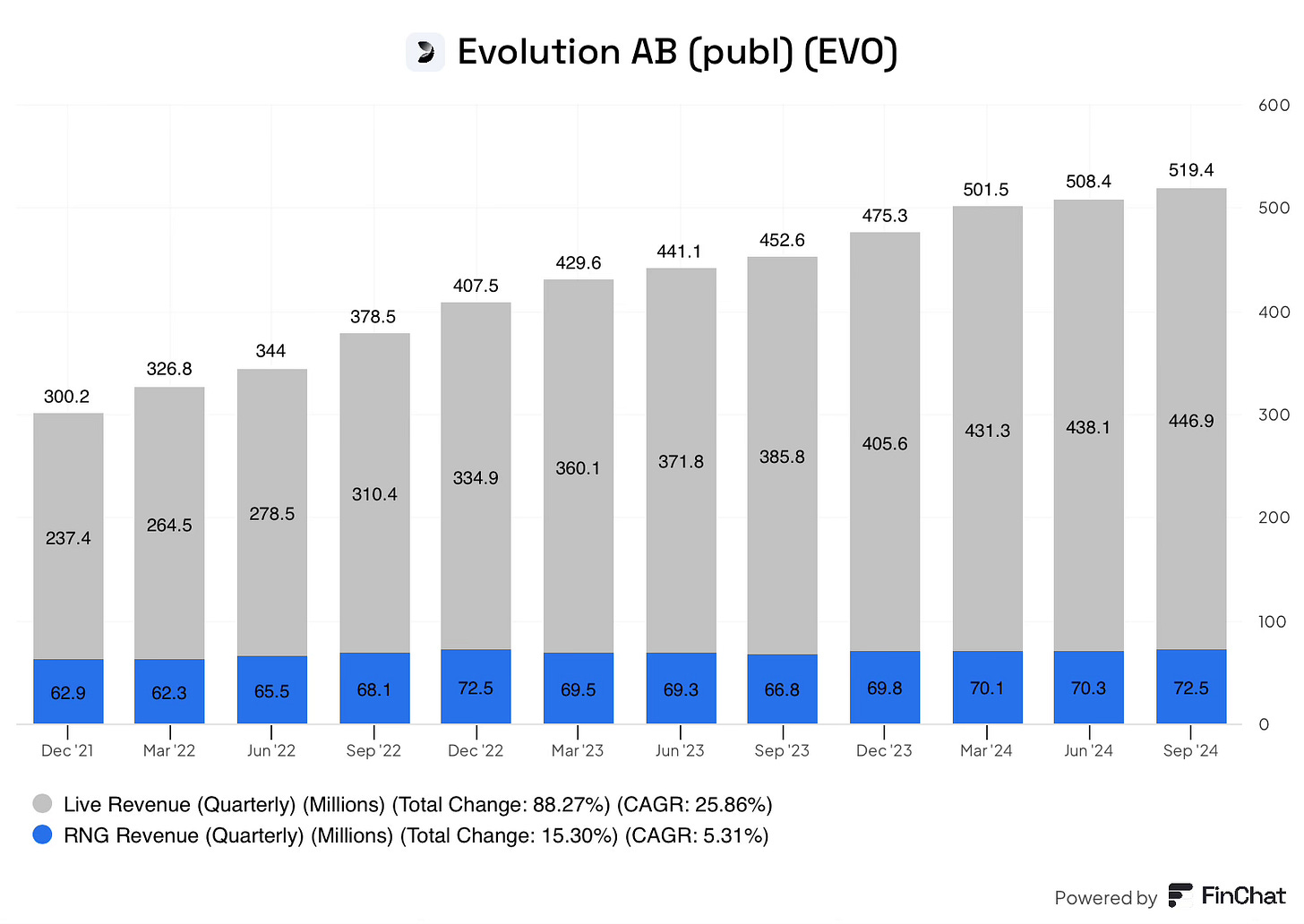

Evolution has 2 reportable business segments; Live and RNG. Evolution achieved €2B in revenue over the last 12 months with Live games contributing 83% of this revenue.

Live revenue has been the core growth driver of the company, compounding growth at 35% annually since december 2019. Recently, revenue has slowed down, with growth of “only” 15.8% in Q3 2024. This slowdown is due to a number of reasons including; Forex headwinds, cyber attacks in Asia, and disruption at the Georgia hub leading to capacity constraints along with a macro slowdown affecting bet size. I will dive into these in more detail later.

RNG revenue has grown through acquisitions. This acquisition spree has meant revenue has grown from €0 in Q3 2020 to €72.5M in Q3 2024, a compound growth of 45%. Despite what looks like a fast growth rate, organic growth has been minimal, this is a dissapointing performance for a business that is in a growing industry. The slow growth is likely due to slow game release cadence, coupled with disruption caused by the OSS integration.

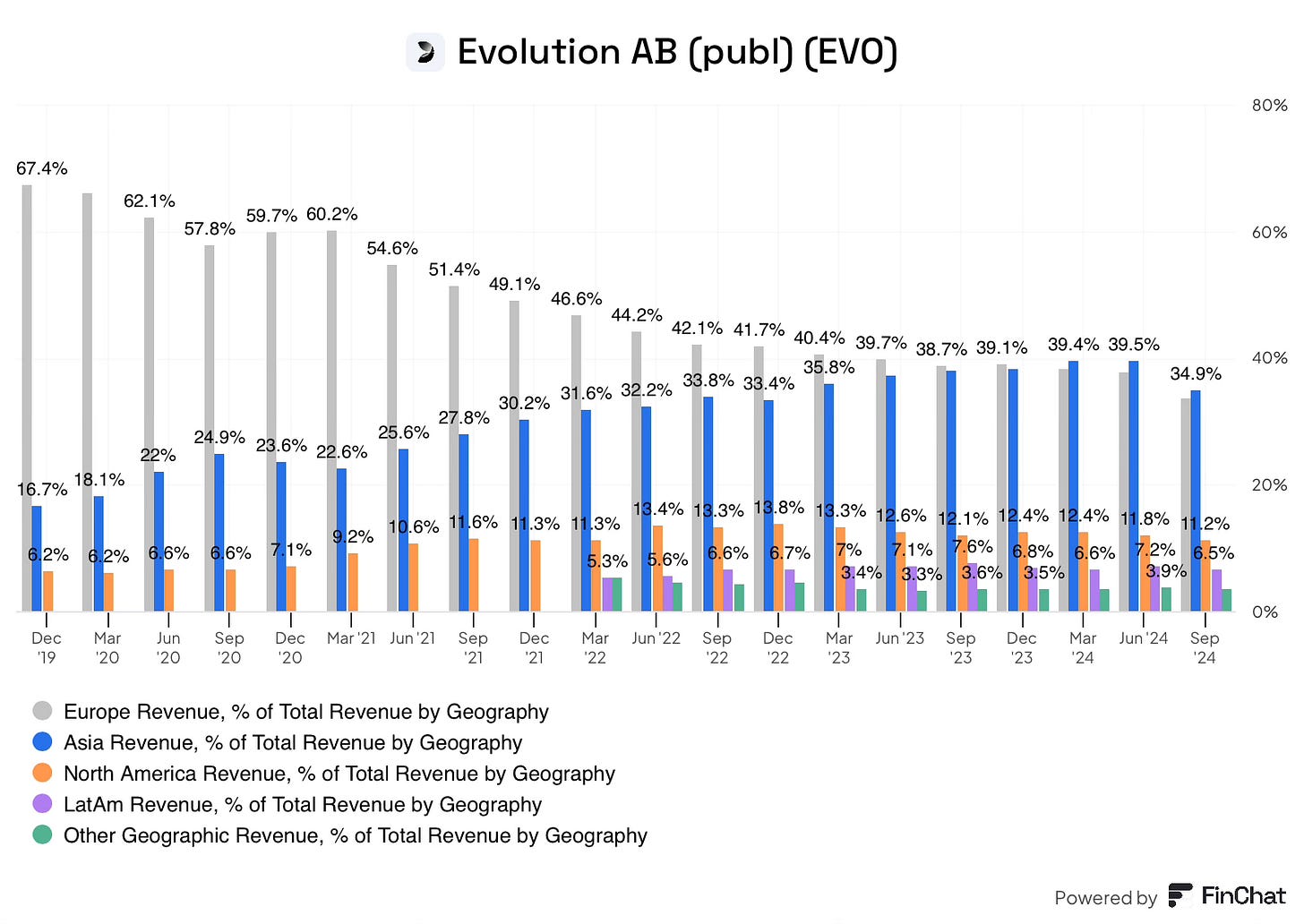

Geography

(note: Sep 24 revenue by geography is distorted by a one time revenue earn out, causing the illusion Europe & Asia revenue has dropped drastically, this is not the case)

Europe has historically been the largest segment for the company, this is unsurprising given the company was founded in Sweden. In Q1 24, Asia overtook Europe as the largest segment due to the population advantage the region has vs Europe.

North & South America make up just under 20% of revenue. The company expects these regions to be growth drivers over time as the regions legalise the online gambling market over time.

Given Evolution is a global company, currency fluctuation has played a big role in changing growth rates. Evolution reports it’s financials in Euros, however the company charges clients in local currency. In Q3 24, currency headwinds resulted in a 4 percentage point impact to revenue growth (14.7% vs 19% CC). The companies lack of hedging means that these fluctuations will continue into the future.

While currency is currently a headwind, I do not consider this a risk to the company. I expect it will continue to swing between headwind and tailwind over time, likely evening the effect out.

Game Rounds index

The Game Rounds Index is an important metric, ultimatley representing the output of the above factors, the index indicates the amount of activity on the Evolution network. This has several caveats;

First, this is different to time spent. A spin of roulette and one round of Bacarrat both count as one game despite the differening game length.

Secondly, this is not money weighted, a game with €1 bet is represented as the same value as a game with €100 bet, despite the higher value game being far more lucrative to Evolution.

This difference between game growth and value is playing out currently. In Q3 24, the game round index grew by 29% while revenue “only” grew 14.7%. The significant difference is due to the large volume of new players Evolution is gaining. These new players tend to spend less initially, creating a headwind to revenue vs the index.

While a headwind to revenue, it is undeniable that new players to the platform is a huge positive to the business over the long term.

To conclude, Is the business understandable?

Yes! The business has a simple business model that alligns it with key stakeholders and is highly scalable. The game portfolio and ongoing studio execution and expansion are the key to Evolution’s continued success. The output of these factors can be measure through the game rounds index, which is a strong indicator into the popularity of the companies products.

2. Is it a good business?

While a lot of section 1 is transferrable into this section, I will not repeat it here. In this section I will analyse the financial picture of the business and the competitve advantages it may or may not possess.

Financial Analysis

Growth & Profitability

Evolution has demonstrated strong growth over the past decade, growing over 46% annually! If this strong growth wasn’t impressive enough, the company has also acheived significant margin expansion. In 2014, the company had operating margins of roughly 25%. This has expanded to the 63% range today, thanks to it’s scalable business model. This has resulted in earnings growing at a mind boggling 59% annaully.

Capital Intensity

To acheieve this oustanding growth, Evolution has had to and should continue to invest in games and studios. On average, Evolution is spending roughly 10% of cash from operations on investments. Over the last twelve months the company has spent roughly €130M of €1.3B. This is evenly split across game development (purchase of intangible assets) and studio growth (capital expenditures).

While there are additional costs such as the Job Shop which run through the Income Statement and acquisitions which the company has made several of over the past several years, the underlying business is extremely capital light.

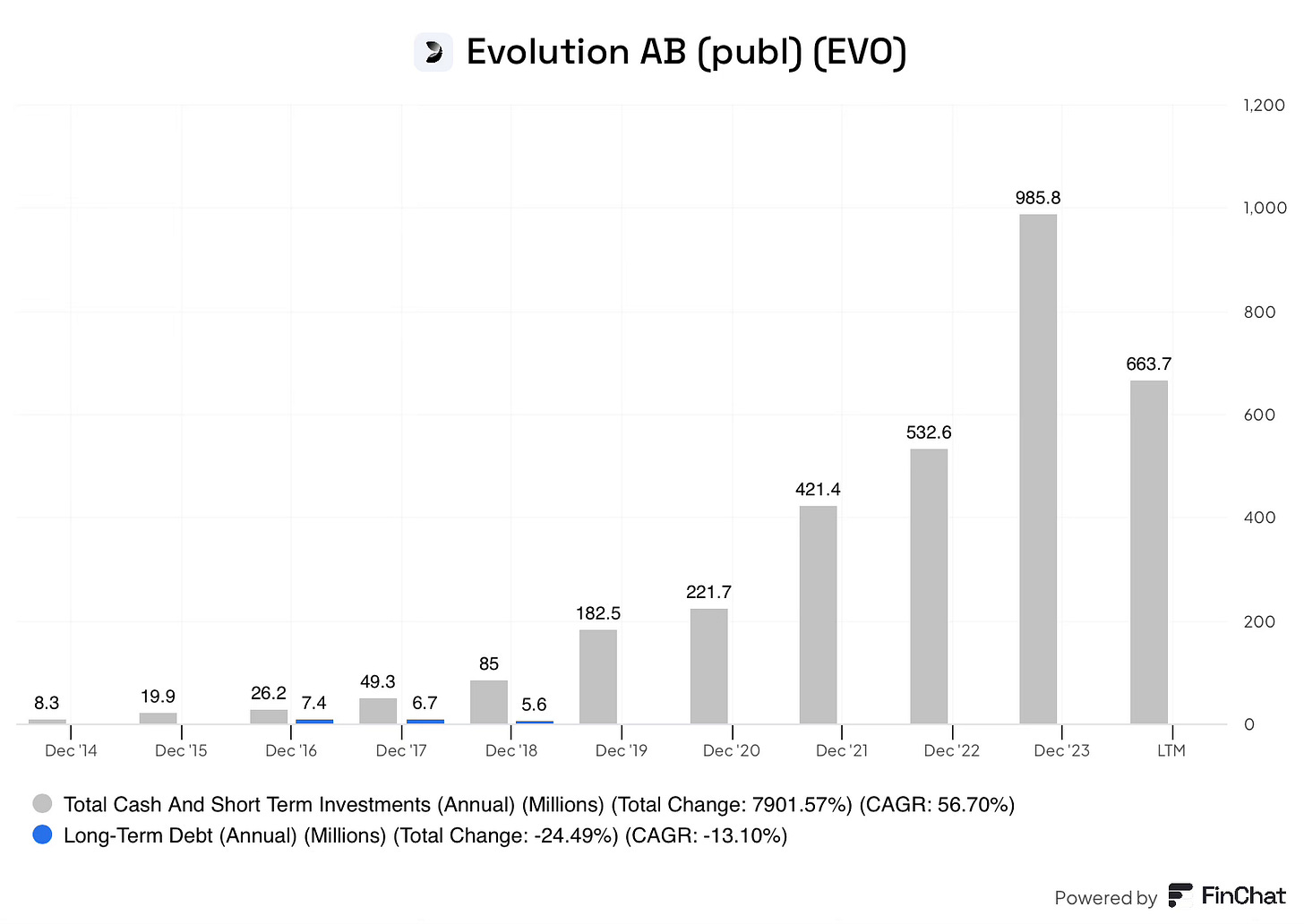

Balance sheet

Evolution is also conservatively financed with no debt held on the balance sheet since 2018 and a healthy cash pile. While running with zero debt is likely not the most capital efficient way from an ROIC perspective, it is likely the right path for Evolution. In an industry full of regulatory risks and a concentrated customer base, a prisitine balance sheet ensures that Evolution can survive through thick and thin.

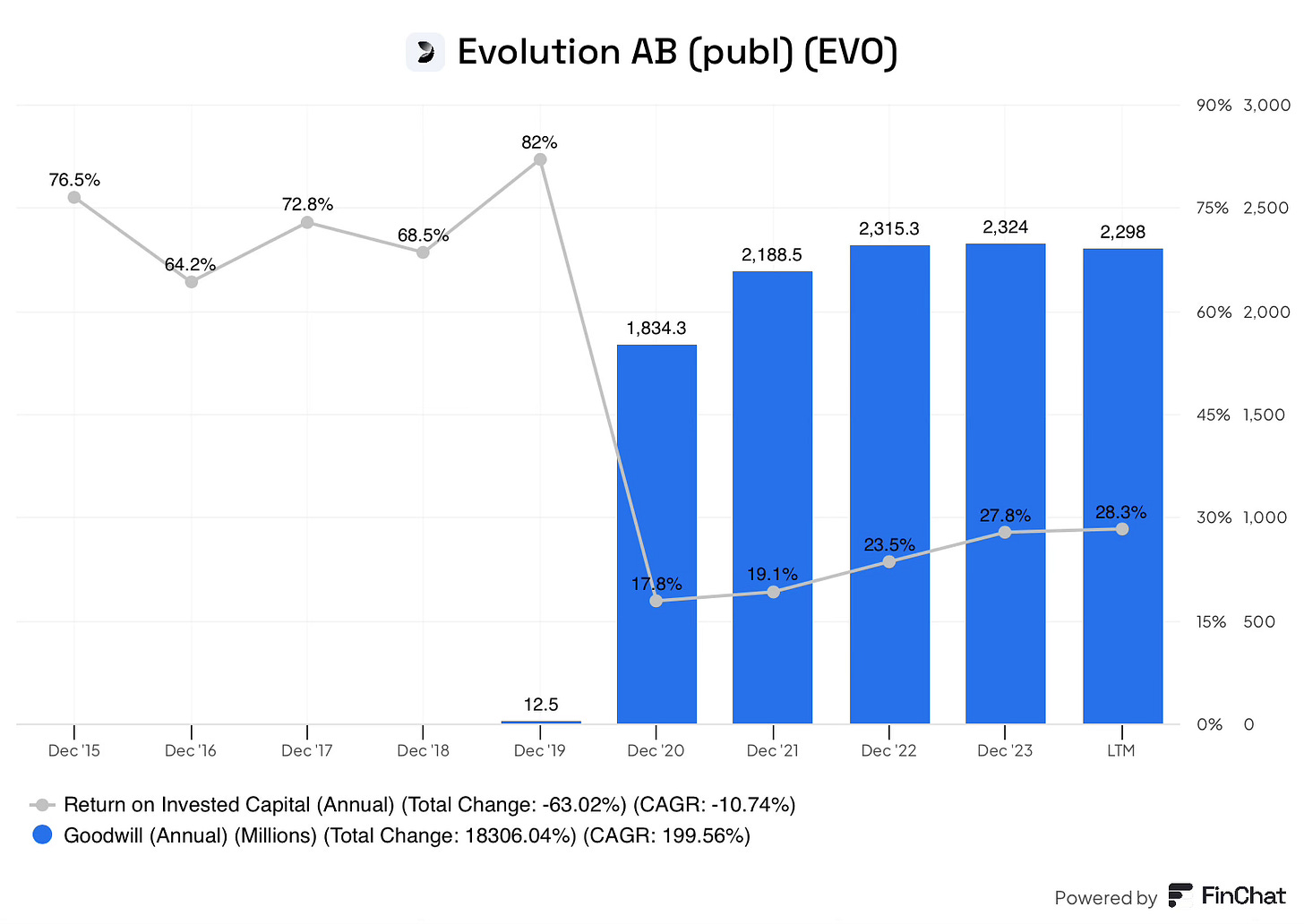

ROIC

The final measure is Return on Invested Capital. ROIC is a great metric to see how efficiently the business generates the profits they do. In the earlier years, Evolution clearly generated significant ROIC, as for every €1 invested, Evolution would earn €0.82 back per year!

In 2020, this metric dropped significantly to a low of 17.8%. This drop coincided with a €1.8B addition to goodwill. This is due to the large NetEnt acquisition. Since the acquisition, Evolution has almost doubled ROIC again.

While this large drop may seem worrying, it’s important to note that NetEnt continues to operate with high profitability and potential for future growth. This could benefit Evolution for many years to come but doesn’t get reflected in the ROIC graph.

Even on an absolute basis, Evolution achieved an ROIC of 28.3% over the LTM, this is a significantly impressive metric. For every €1 invested, Evolution generates €0.28, giving the company a worst case payback period of just over 3 years, and potentially a lot sooner!

Moat Analysis

In this section I will discuss some of the factors that would potentailly insulate Evolution from competition. This involves having a look at the industry to understand the competitve dynamics

Industry Analaysis

Evolution operates in a competitive industry, which is unsurprising given the attractive financial returns the company acheives. The companies main competition is from Playtech & Pragmatic play, while in a youtube interview Todd Haushalter reported there are a total of 41 B2B Casino suppliers, with most of them being small.

Evolution sums up the competitve dynamics in this one quote from the annual report, “While the barrier to entry are relatively low, the barriers to success are considerably higher”. These barriers to success are due to the sheer complexity of providing a flawless experience, which becomes even more difficult at scale across multiple countries, all with different regulations. This is likely the reason why Evolution is the only true global provider.

While competition has remained among a few players, it is reported that Pragmatic may be gaining share on Evolution in the number of players on site. This could be due to a number of factors; Firstly, it could be due to the popularity of a certain operator over others. Second, Evolutions OSS integration could of temporarily caused the shifting of player habits.

Despite this threat, Evolution reported in 2016 that they had a market share of between 50-60%. Since that time, Evolution has continued to grow faster than the market, with reports that it’s market share could be as high as 60-80%. This gain of market share over the same period suggest Evolution is managing just fine. However, it is important to note that Evolution will likely continue to see the competitive intensity increase over time, especially from front runner Pragmatic, so it is worth keeping an eye here.

Evolution believes they not only compete within the industry, but also with anyone who is vying for consumer attention. This is likely a bit of a stretch at the moment. With the company looking to move more into the social aspects of gaming, consumer attention is certaintly something they will be competing for in the future. However, there are 2 forms of competition currently:

In-House solutions: Where gaming operators would bypass the middle man, Evolution, and provide the gaming services themselves.

Alternative gaming providers: These businesses would be vying to take the place where Evolution sits currently.

What is preventing In-House solutions replacing Evolution?

Technical & Operational Expertise: Evolution has been singularly focused on this business for 19 years, devloping the expertise and know how to provide a seamless experience for users. The end result of this is a reputation for being the highest quality provider.

It would therefore be very difficult to get up and running within a year or two and be able to provide a similar level of quality that Evolution is currently providing. Furthermore, the technology being used is always evolving, making it even more difficult.

Complexity: To provide a similar service, a gaming operator would have to develop a game portfolio, which would take significant time and resources to achieve. Currently, Evolution is on track to release roughly 110 games in 2024, with spending on intangibles in the region of €60M. This makes each game cost roughly €1.83M, this doesn’t even account for the wide portfolio of games the company already has.

Beyond games, the company would also need to provide a continuous HD stream quality feed, the background infrastructure, hire & train live dealers along with operating a mission control room to make sure everything runs smoothly and detect any fraud that may be happening. This would add significant complexity to the business, distracting management from the most important thing, providing an exciting experience for users.

Scale: Even if an operator could overcome the above two points, the operation would likely be less profitable due to the lack of scale advantages they would possess. This means at best an operator would save the estimated 10% comission cut Evolution takes, at worst (the more likely option) they would be financially worse off.

This means to take operations in house, an operator must be willing to garner the technical & operational expertise required, which could take many years to provide a seamless experience and develop a comphrehensive game portfolio. They must also be willing to make the organisation significantly more complex, while also likely not recieve any kind of financial gain from it. This combination likely insulates Evolution from this form of competition.

What is preventing competition replacing Evolution?

Evolution is in the enviable position of being the dominant market leader. According to a recent Quatr article, Evolution potentially has 60-80% market share in Europe, and 90%+ in North America. So what is allowing the company to have such a dominant position.

Gaming Innovation: Evolution has the best gaming portfolio. This ultimately stems from managements maniacal focus on always expanding their game advantage over competitors. This focus reinforces the fact that game quality is the singular most important aspect to the business.

Evolution’s first mover advantage and singular focus on the live casino market during the early years, when competitors diversified to RNG gaming, allowed the company to build a lead in providing the best live casino gaming experience out there. This strong core competency allowed Evolution to later innovate to create game shows which are now wildly popular, while also acquiring their way into RNG gaming to provide the full gaming suite.

While, Live Casino gave Evolution the advantage, live game shows has further differentiated the company. In 2017, Evolution launched Dream Catcher as the first live game show. This release was a huge success for Evolution. Since this first release, Evolution has continued to build upon the success with launches such as Lightning Roulette, Crazy Time and branded releases such as Monopoly Live & Deal or No Deal Live.

This different style of game has been significant in attracting new players into the industry who otherwise would not have, expanding the market. This player attraction has made Evolution a crucial partner for gaming operators. In fact today, game shows have a larger audience of players than traditional live casino and they are propriatary to Evolution, meaning to get rid of Evolution would now come at a significnat hit to player numbers.

Furthermore, Evolution isnt’t stopping there. Evolution’s partnership with Hasbro allows it to launch new games like Monopoly Live that already have strong brand recognition. Additionally, the acquisition of Livespins Holdings is allowing the company to push the boundaries further.

Livespins is a B2B social streaming provider. In simple terms, this adds a new social aspect to Evolution games by allowing players to play & bet alongside their favourite streamers, friends and influencers. This could further expand the number of people playing Evolution’s games, making the company even more entrenched.

Scale: Not only does scale mean Evolution commands a dominant position, leading to costs being spread over a wider base of customers leading to higher profitability, scale also protects Evolution from competition.

Firstly, it allows Evolution to reinvest more back into the business by introducing more games and building out a global studio network, further extending the advantage. This global scale better positions the company to capture growth from the regulation of new markets, allowing it to build more partnerships. Additionally, with licences being required for every game and a more complex regulatory framework over time, only the largest companies can afford to be present in every country with a full game line up. This makes it extremely difficult for companies to gain share.

Secondly, Evolution is able to provide better quality service. The Job Shop is a great example of this. The company is able to make it’s own studio props and technology, allowing for a better visual experience. Furthermore, Evolution is able to test on a whole range of consumer technology devices, ironing out any bugs. While this may not be noticeable to most, this creates a better experience for consumers who do not have the latest version of technology. These types of technical investments (and many more!) are not justifiable for smaller industry players, leading to a worse delivery, further extending Evolution’s lead.

Customisation & switching costs: I mentioned at the top that Evolution provides customised solutions such as branded tables, these solutions further lock in operators from moving away. The combination of an irreplaceable game portfolio, global scale, better content delivery and customised tables, creates large switching costs for gaming operators.

To conclude, is it a good business?

Again, Yes! Building on the strong business model from section 1, Evolution has demonstrated strong growth & profitability, coupled with high returns on invested capital, all while maintaining a pristine balance sheet.

These fundamentals are backed up by a strong value proposition to operators, a dominant market position and high switching costs. To me, that is a good business.

3. Is management capable and trustworthy?

To access management, I will first look at their track record, capital allocation, ownership and compensation.

The management team, led by Martin Carlesund have a long tenure, which is a good sign, and gives us the opportunity to look back at what they have achieved. Martin Carlesund joined the company in 2015 and took the CEO role in 2016.

Since then, Evolution has continued its focus on the same key items; gaming innovation & providing a superior service to operators. This has resulted in some key achievements:

Grown market share from an already dominant position as previously mentioned from 50-60% to 60-80%.

Expanded the game portfolio into live game shows & RNG, while positioning the company for more innovation ahead.

Expanded from 5 studios in 2016 to 22 in 2024. This has resulted in live tables increasing from 300 to 1,600+ today.

Grown customer count from just over 100, to 800 partners today, this includes attracting land based casino partners.

Maintained an innovative culture while growing employee count from 3,402 to 20,000.

These achievements have resulted in annualised revenue growing from €115.5M to €2B today. In fact, the only blemish on an otherwise outstanding track record is the acquisition history.

Acquisition History

2019 - Ezugi for $12M

2020 - NetEnt (including Red Tiger for a total consideration of €2.28B

2021 - Big Time Gaming for €227M

2021 - DigiWheel for €1M

2022 - NoLimit City for €200M

2024 - Livespins for €4.3M

2024 - Galaxy Gaming for €85M

The majority of these acquisitions are all related to RNG with the exception of Ezugi, which was/is the leading live casino provider in North America, and DigiWheel & Livespins for their technical capabilities.

So what went wrong?

Firstly, the integration of these brands into one platform (OSS) led to significant struggles. What on the surface seemed like a good long-term decision to make all brands accessible through one touch point, has initially led to the loss of some players. The company experienced disruption as players’ favourite games could no longer be found in their recently played or favourited sections, leading to players leaving. However, these issues seem to be over with RNG revenue growing 8.5% in Q3 2024.

Secondly, the poor performance of the RNG section brings into question whether these companies should have been acquired in the first place. The RNG sector is a worse business with far higher competition, resulting in lower margins. Despite these negatives, the acquisitions did give Evolution a complete game lineup, which has made the company a complete solution This portfolio has likely led to the company winning more live casino wins that are not reflected in the RNG numbers.

Finally, to compound the issue, management used stock to buy the biggest company, NetEnt, resulting in share dilution of over 16%. This use of company currency not only diluted existing shareholders, but also reduced exposure to the superior live segment. This use of shares seems to be a one-time event that I hope will not be repeated in the future.

Capital Allocation

Capital allocation is probably the most important aspect for a business like Evolution. The strong cash generation abilities mean that the company needs to allocate capital in a way that will maintain its strong historical ROIC. Recently, management outlined in a press release their capital allocation philosophy, which I will outline below:

Balance sheet: Evolution will maintain a strong net cash position.

Organic Investments: Evolution will also invest in organic opportunities (games & studios) to capture the long-term secular tailwinds the industry presents.

Dividends: Evolution will also distribute 50%+ of net profits to shareholders via dividends.

M&A: Evolution will opportunistically invest in inorganic investments as they have previously.

Excess cash: If the company still has excess cashflow beyond the above investments, the company will return this to shareholders. The preferred method is via repurchases, and the board will assess this based on the accretion to shareholders.

This is a solid capital allocation strategy which management has followed for many years. The most important thing is that the company continues to invest in the business before anything else. Beyond that, while I would prefer buybacks over dividends, the return of cash is the main factor, rather than keeping it piling up on the balance sheet.

Alignment

Management is compensated in a number of ways:

Fixed salary: Management receives a competitive fixed salary, with CEO Martin Carlesund receiving €2.6M annually.

Variable compensation: Management can receive variable compensation from 0-50% of fixed salary based on long-term share price performance.

Share award incentives: Further to cash compensation, key employees are also eligible to receive share warrants. These warrants have a maximum dilution effect of 0.9% between 2023 & 2026.

Ownership: Insiders also own a decent amount of shares, aligning their interests with shareholders. CEO Martin Carlesund owned 684,710 shares as of the 2023 annual report.

Furthermore, the founders Jens Von Bahr & Frederik Österberg own a combined 10.4% of the business and remain on the board of directors. Ian Livingstone also serves on the board of directors. He and 2 others founded Games Workshop, which in itself is a $5.7B company today.

Is management Capable and trustworthy?

Management has a long tenure and a strong track record to back it up. Furthermore, insiders own a considerable amount of shares making them aligned with shareholders. While the company is in the process of turning around the RNG business, I believe management can be trusted to do so.

Thank you for reading this far, join me in part 2 where I will discuss recent developments, long-term opportunities, risks, valuation and any portfolio changes.

Sources: Company filings & transcripts unless otherwise linked.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Very good writeup, learned something new on EVO!