Judges Scientific Deep Dive

UK small cap serial acquirer

History and Understanding the Business.

David Cicurel created Judges Scientific in 2002 with £2 million in capital, after spending the first part of his career as a “company doctor”, turning around poor-performing businesses, first in France before moving to the UK. Cicurel identified the UK’s scientific sector as ripe for consolidation; the initial plan was for Judges to be an arbitrage vehicle, buying stakes in small public companies, later selling them to private equity at a premium.

This strategy quickly became challenged as valuations rose prior to the financial crisis, eliminating the arbitrage opportunity. Cicurel subsequently pivoted, instead looking to acquire small scientific instrument manufacturers for themselves.

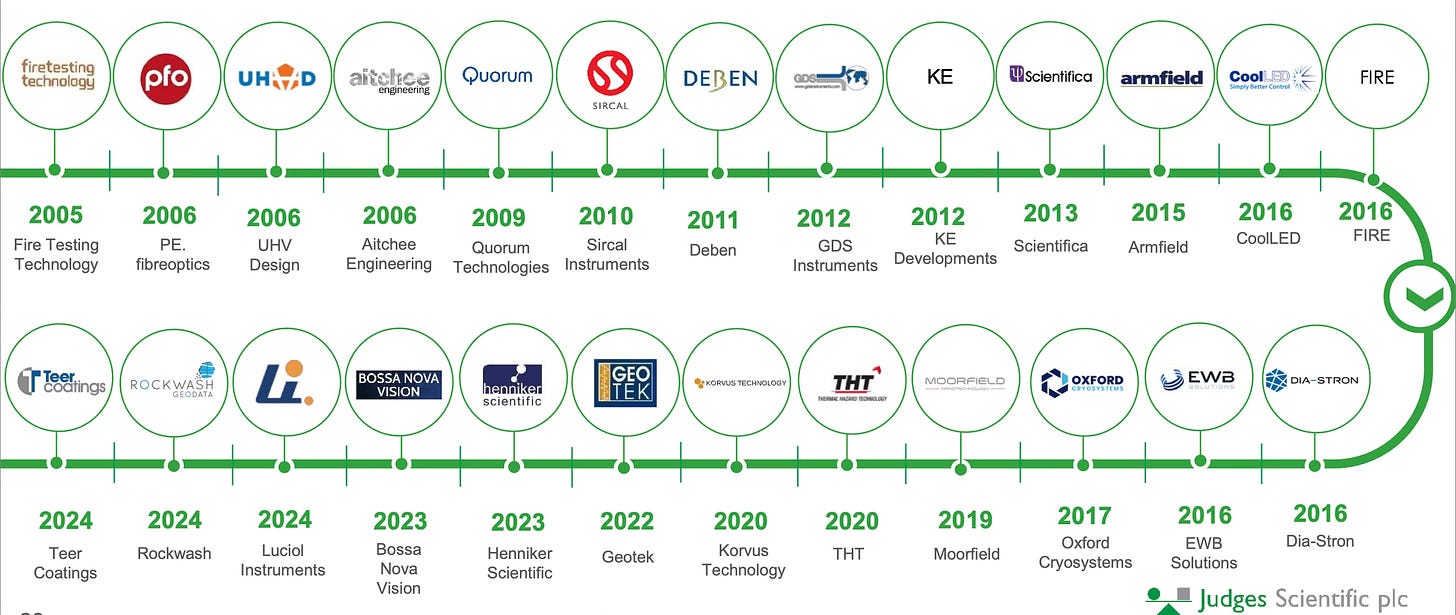

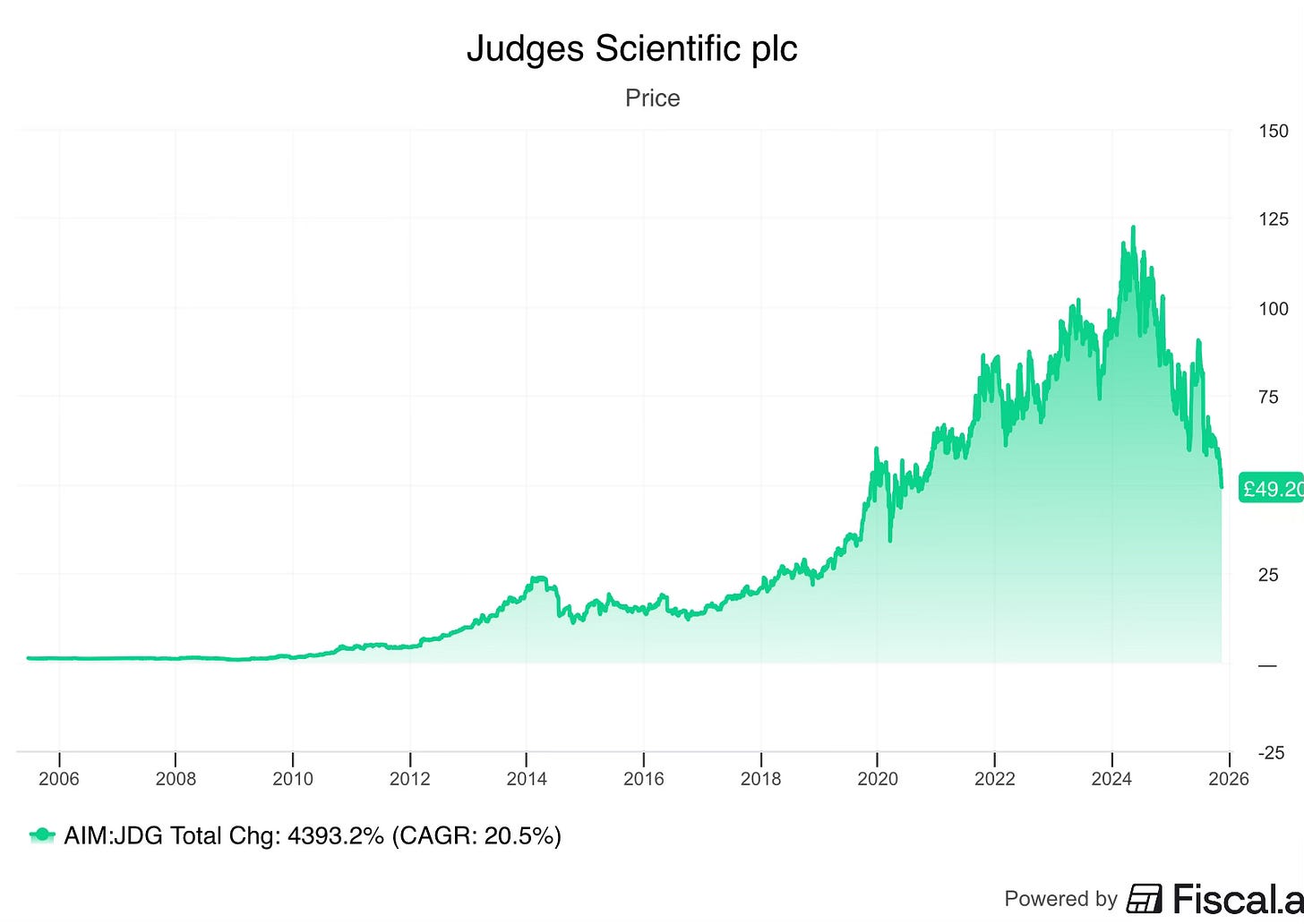

After a year of searching, Judges made its first acquisition, FTT in 2005; in the same year, it IPO’d on the AIM market of the London Stock Exchange at £0.95 per share.

FTT generated £0.75 million EBIT on £3 million of sales, with only 19 employees. The business generated 25% operating margins due to its extremely strong position in its respective niche, “which had no solid competition.” Judges paid just 5X EBIT for FTT. This early success laid the foundations for the buy-and-build strategy that Judges has been executing ever since.

The Buy and Build strategy

There are 2 pillars to the Judges buy & build strategy: Acquisitions and Organic growth.

Buy: Judges look to acquire niche scientific instrument manufacturers, which are typically for sale due to the impending retirement of the founder. The company in question must be a small to medium-sized global leader (Global exporter) in a niche industry that has demonstrated sustainable sales, profits, cash generation, and secular growth that will likely continue. Each acquisition is therefore immediately earnings accretive.

the target business has sound underlying strength with robust and defensible margins and is acquired at a sensible multiple. - Alex Hambro

Deals are financed mainly through debt. Judges can borrow up to 3X EBITDA (of the business being acquired), with the rest coming from cash and stock as an earn out. The company has historically paid between 4-6X EBIT for all but two deals: one of which was 3X EBIT (during the financial crisis), and the second, Geotek, Judges largest acquisition to date (2022), acquired for 7X EBIT. Larger businesses have typically commanded valuations at the higher end of the range. Once acquired, debt is paid down promptly to provide borrowing capacity for future deals. On average, Judges have made just over 1 acquisition per year. Until recently, the acquisition team consisted of only David Cicurel, however, Rik Armitage joined the team as group acquisition executive in the summer of 2025.

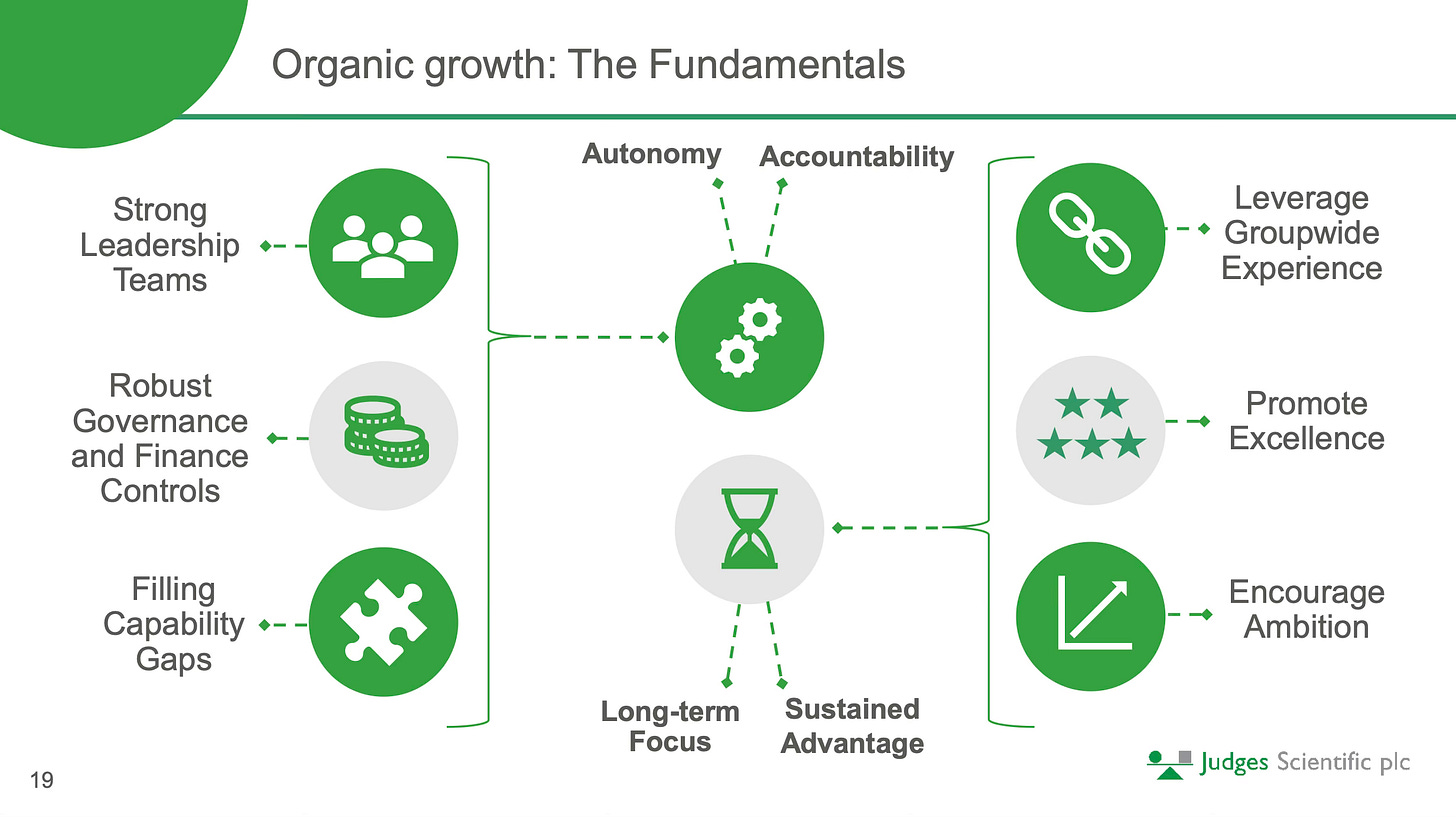

Build: The second pillar of the strategy is organic growth, where Judges aims to create an environment for acquired companies to deliver sustainable organic growth. This pillar first relies on management buying businesses that successfully meet their criteria.

“The quality of the business trumps everything.” - Chris Hohn

Beyond that, the first job is usually to appoint a new managing director due to the owner’s impending retirement. This has typically been an internal hire, most commonly from the sales director position. On a day-to-day basis, the core philosophy is autonomy: management believes that for these highly specialised niche instrument manufacturers, decentralisation trumps integration.

Group-level executives do not run individual companies; instead, they act as coaches to help achieve success at the individual business level. Support includes leadership training, business support, expertise, and capital, where needed to achieve business goals.

Although autonomy is the goal, this must be earned. Judges implement robust financial and governance controls, and managing directors (MDs) are held accountable for their performance against their three-year rolling targets.

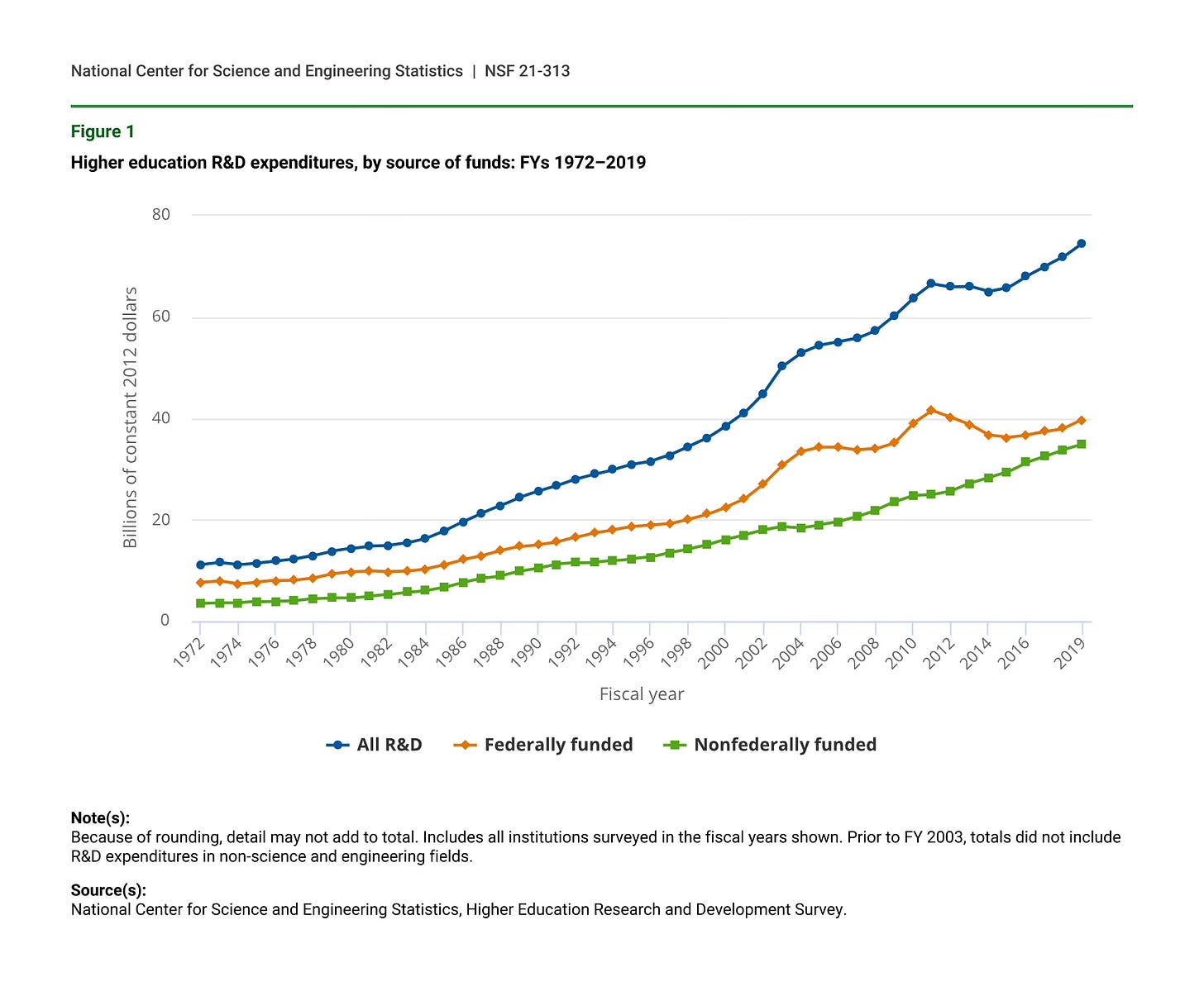

These individual businesses are run fairly conservatively pre-acquisition; however, with financial backing from Judges, businesses are encouraged to do that bit of experimental research, etc, that they may not have done previously. As a result, R&D spending usually increases to 5-6% of revenue per year, this helps sustain their advantage.

Profits from these businesses are returned to the head office, usually to pay down acquisition debt to fund future deals.

Track Record

This flywheel of buying good businesses at low prices, paying down the debt quickly, fostering growth, and reallocating capital for future acquisitions has led to outstanding returns over the past 20+ years.

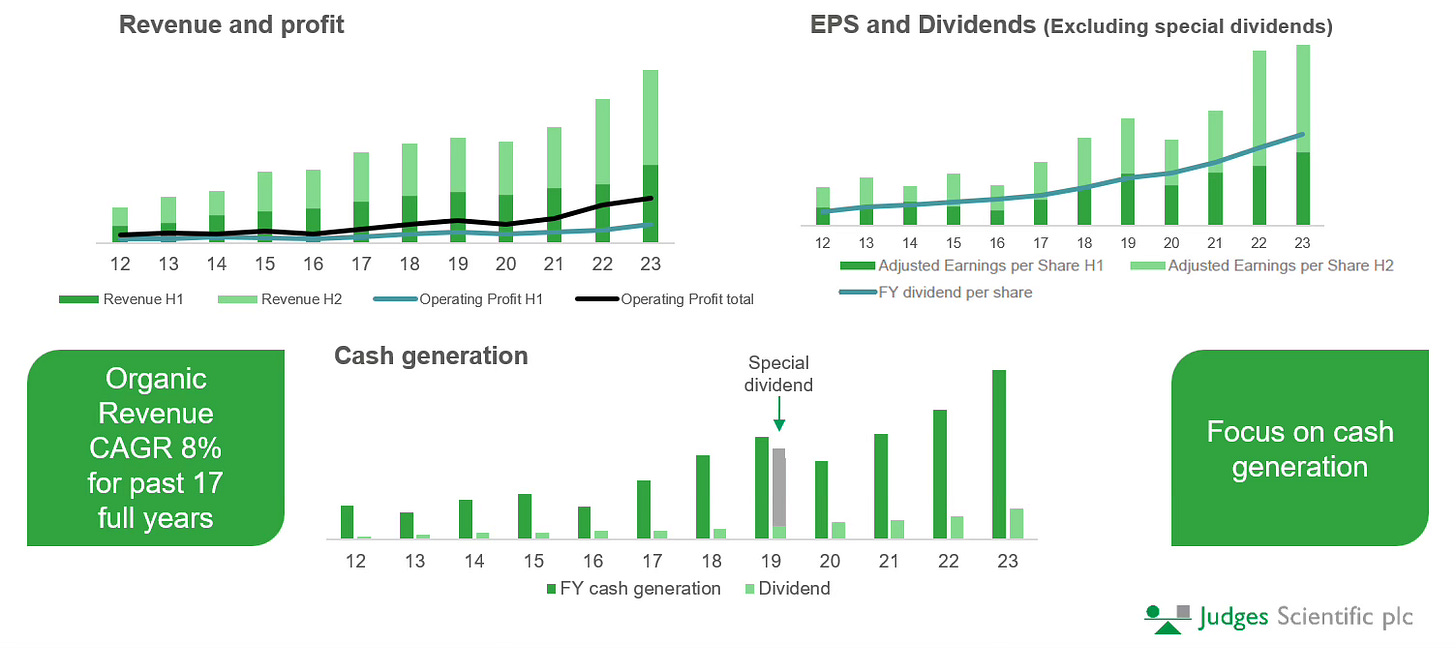

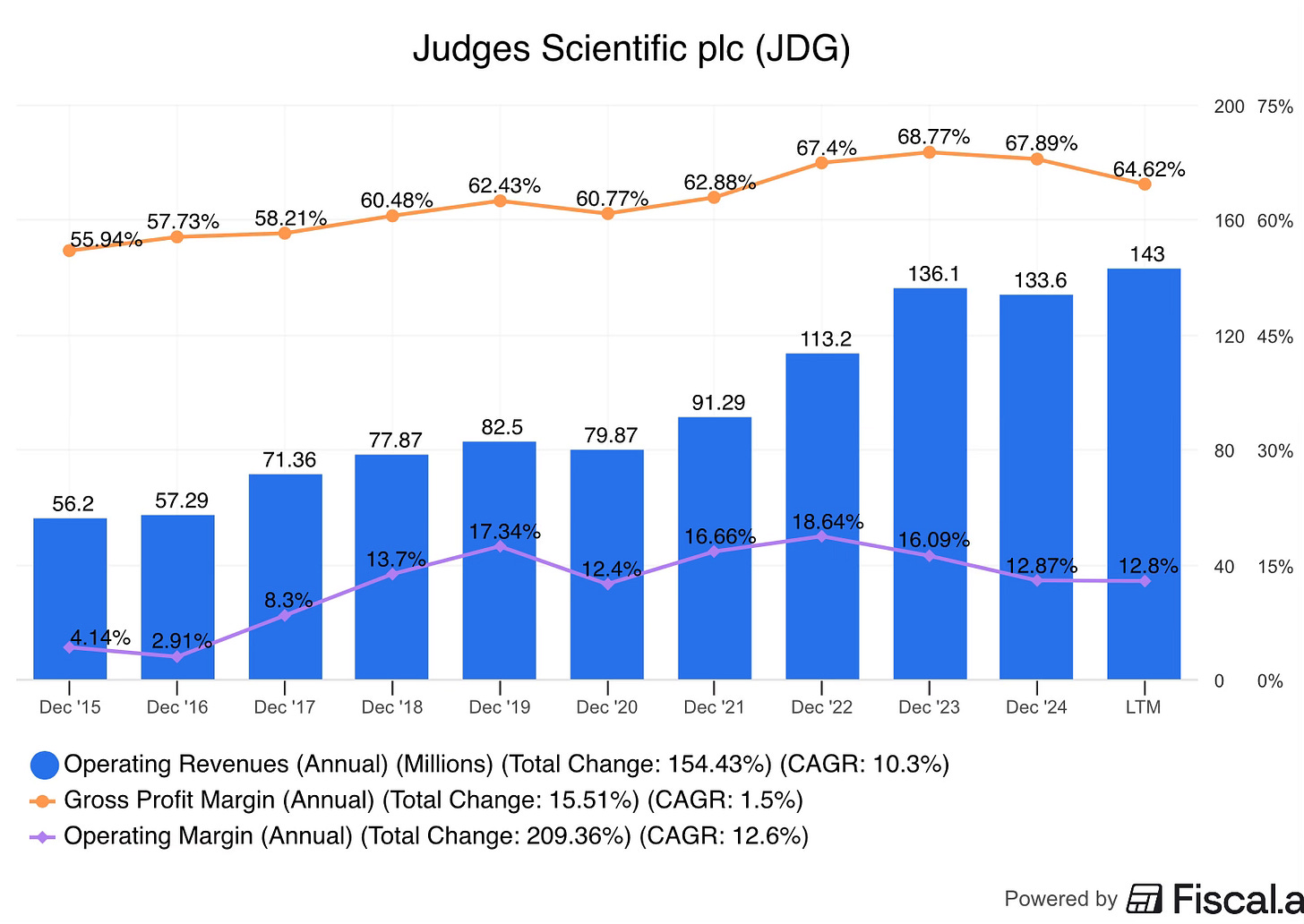

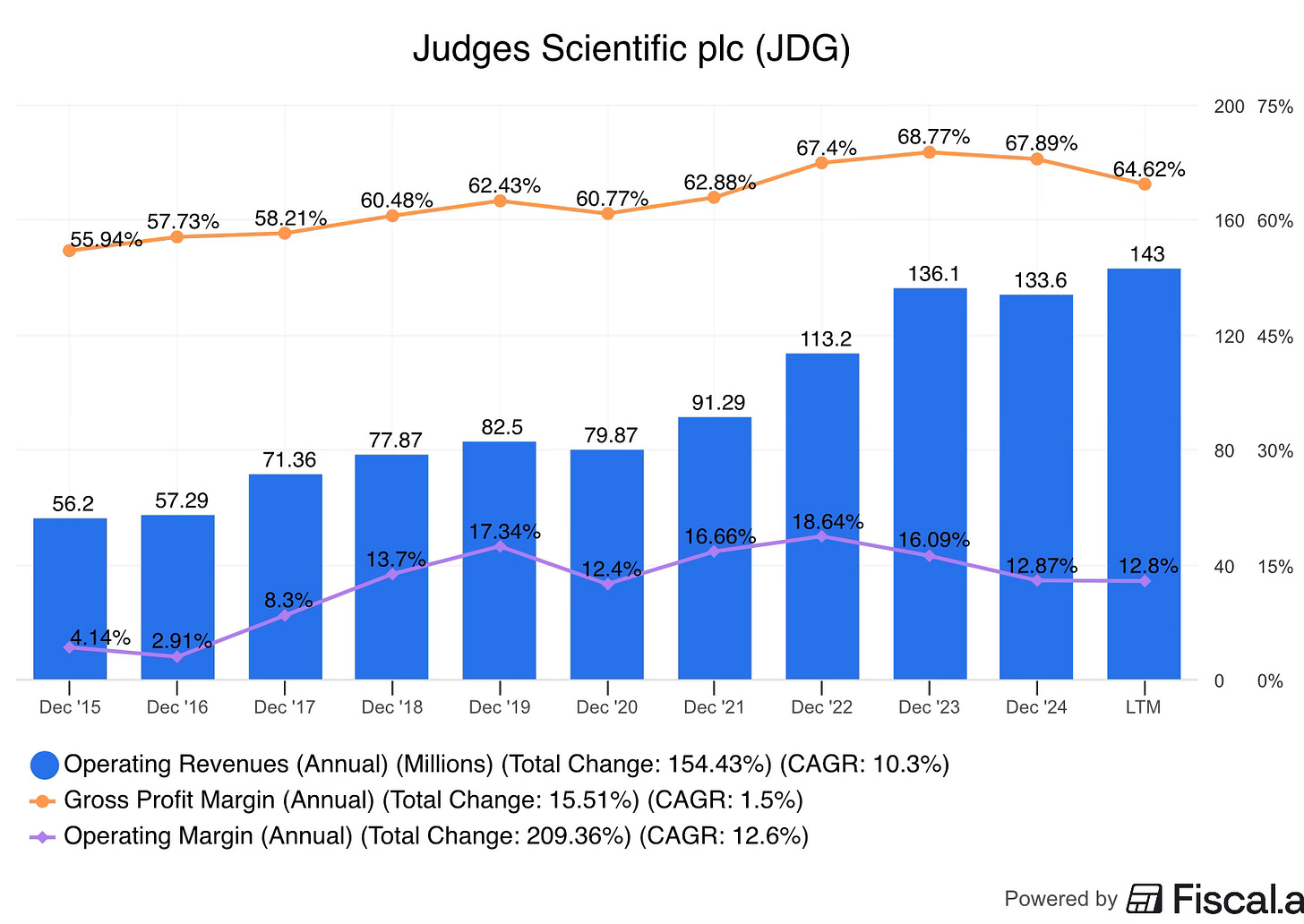

Since inception, revenue has compounded at north of 20%, of which 7-8% has been organic growth. Profits have grown even faster, 26%. The £2 million business has grown into a £389 million enterprise value business today.

Inevitably, growth has slowed as the business has grown larger (revenue growth of 10% over the last 10 years); however, several additional factors have caused growth to slow more than expected: the 2016-2020 period was light on acquisitions, which reduced capital redeployment. Additionally, current macro headwinds are impacting organic growth, both of which have impacted the growth rate.

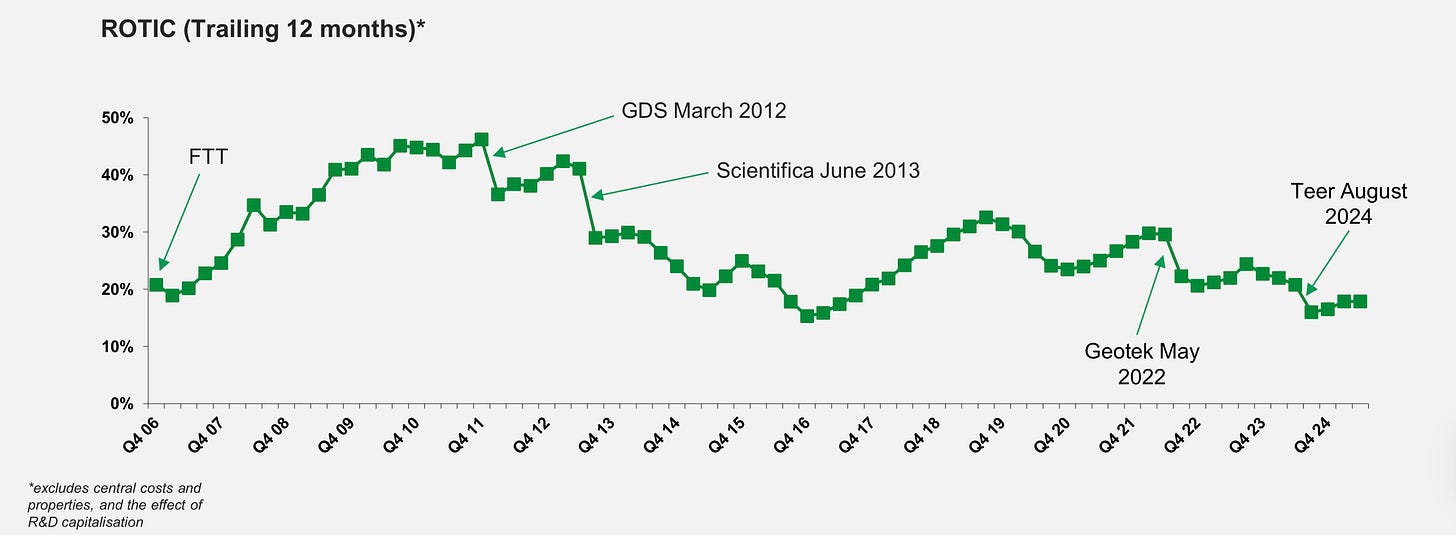

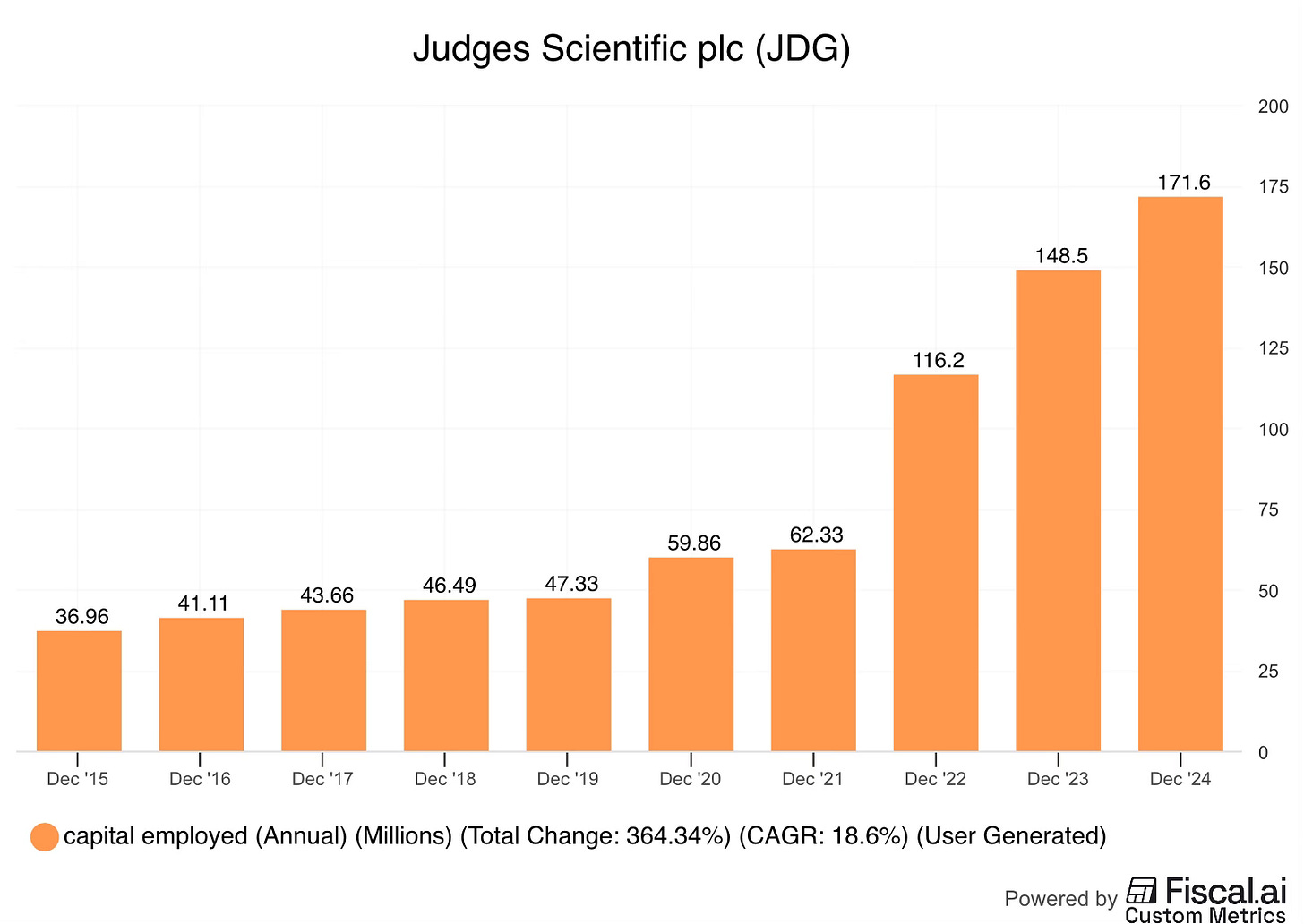

Growth for growth's sake is, however, meaningless; it must generate high returns on invested capital. Return on total invested capital (ROTIC), a metric that management tracks, has consistently ranged between 15-30% while deploying the majority of free cash flow into additional acquisitions. Looking at the ROTIC over time, larger acquisitions have resulted in steep declines due to their immediate impact on invested capital, while the benefits are realised over time. At the individual business level, ROTIC is likely meaningfully higher than the 15-30% range, highlighting the quality of the underlying businesses. ROTIC has declined in recent years due to a slow down in organic growth, however, should organic growth recover, it is likely ROTIC will follow suit.

The combination of strong top-line growth, operating leverage, and high ROTIC has led to market-beating returns for investors. Since inception, the share price has compounded at 20%, despite the current 50% drawdown. Dividends have also grown by 18%.

The business today

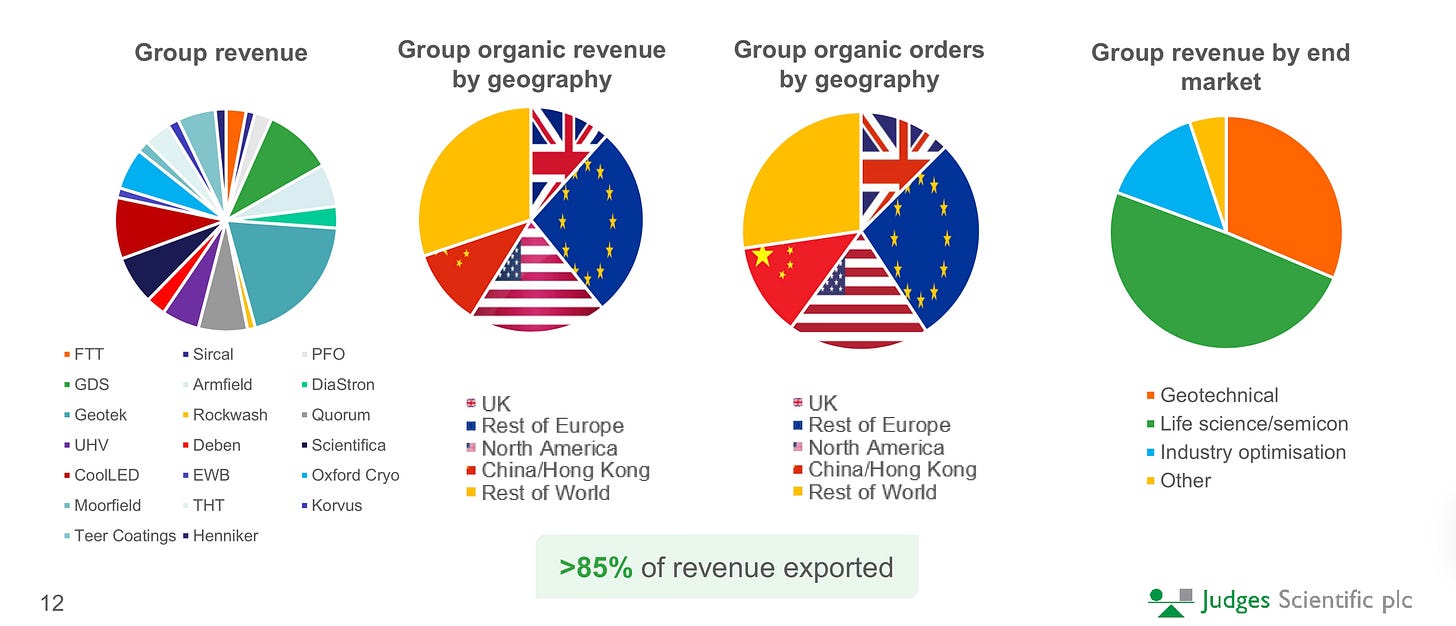

Judges Scientific today is a holding company of 25 businesses within the scientific instrument sector. Combined, these generate attractive financial figures: In 2024, the company delivered £133m of revenue (£5.3m per business on average), 65% gross margins, 12% operating margins, and 17% ROTIC despite experiencing significant macro headwinds that are temporarily impacting revenue growth and profitability.

Looking deeper at the portfolio companies, they design and produce (typically outsourced to reduce capital intensity) a wide range of instruments that diversify the business across end market use cases (Life science (40-50%), Geotechnical (~25%), Industry optimisation (~20%), and compliance and testing).

Most businesses are headquartered in the UK, but 85% of sales are exported globally. Sales typically go through distributors to the end buyer, which are Universities (50-60%), Commercial R&D departments (30%), Government entities, and Compliance testing firms.

Scientific instruments are big-ticket items (ranging from thousands to £1m+) and have long lifecycles (sometimes decades), with very little consumable or service revenue (less than 5%). These factors, along with the highly specialised and technical nature of the businesses, make sales unpredictable from year to year, heavily influenced by the external conditions. Averaged out across the group, sales have much greater stability.

Few have the knowledge or capacity to buy and run such a technical business with lumpy, uncertain cash flows. Yet when rolled up into a holding company with other similar but slightly different instrument manufacturers, the returns are incredible. The sales lumpiness is smoothed out and the aggregate result is stable, growing free cash flow. - In Practice.

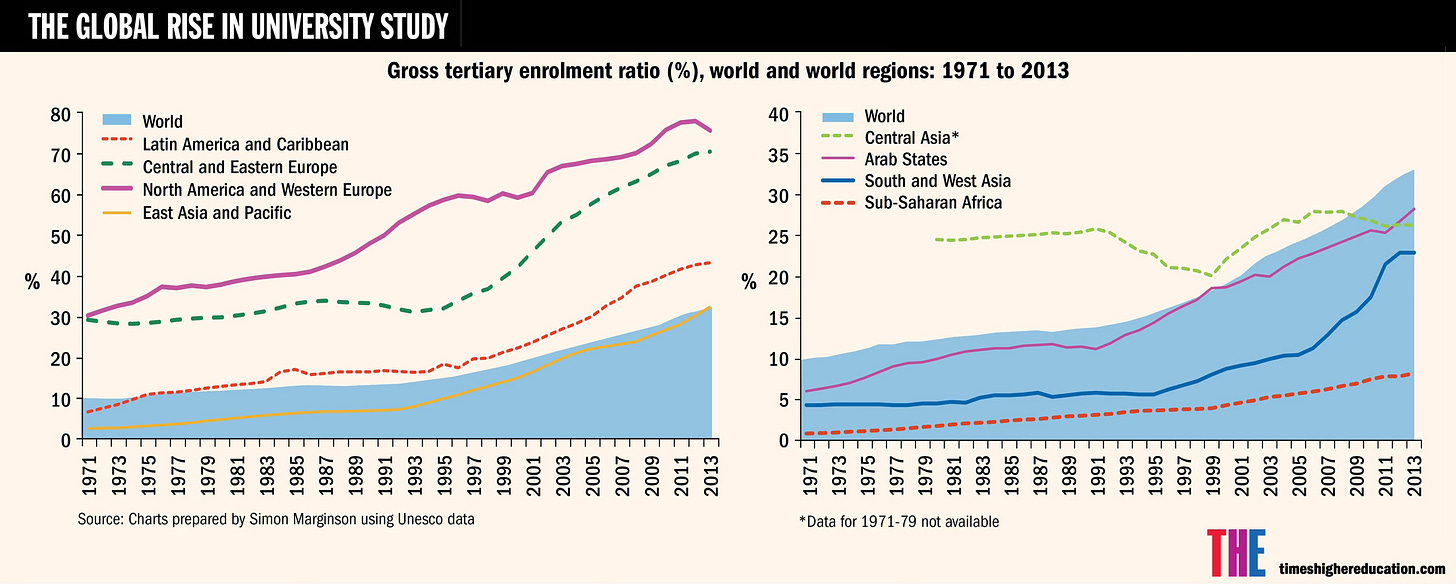

Over time, organic growth of the group has averaged 8% per year (for 17 years), driven by secular growth trends such as worldwide growth of university education and optimisation trends.

What has made Judges a good business?

Multiple factors have allowed judges to deliver outstanding returns:

Scalable and defensible business model

Attractive industry dynamics

Management

Scalable and defensible business model

Serial acquirers have been a common source of outsized shareholder value creation. Judges have historically been one of these. Their decentralised hands-off management approach to subsidiary businesses, coupled with a small head office, has allowed the business to scale from 1 to 25 businesses (and more in the future) with minimal additional cost or complexity at the head office level.

Downside risk is also minimised by owning a diverse portfolio where no single business presents an existential threat to the overall entity should it fail. Similarly, acquisition mistakes may impact near-term results (a period of minimal value creation), but can be outgrown over time. The Scientifica (2013) and Armfield (2015) acquisitions are evidence of mistakes being outgrown over time.

Attractive industry dynamics

The second contributor to Judges’ success is the attractiveness of the businesses and industry they are rolling up:

Niche markets

Secular Tailwinds

Large Deal Pool

Low capital intensity

Niche markets: The scientific industry has hundreds of niche use cases that can each only support a small number of businesses, which reduces competition, especially from well-capitalised competitors. Target companies usually dominate their respective global niche due to some kind of technological advantage.

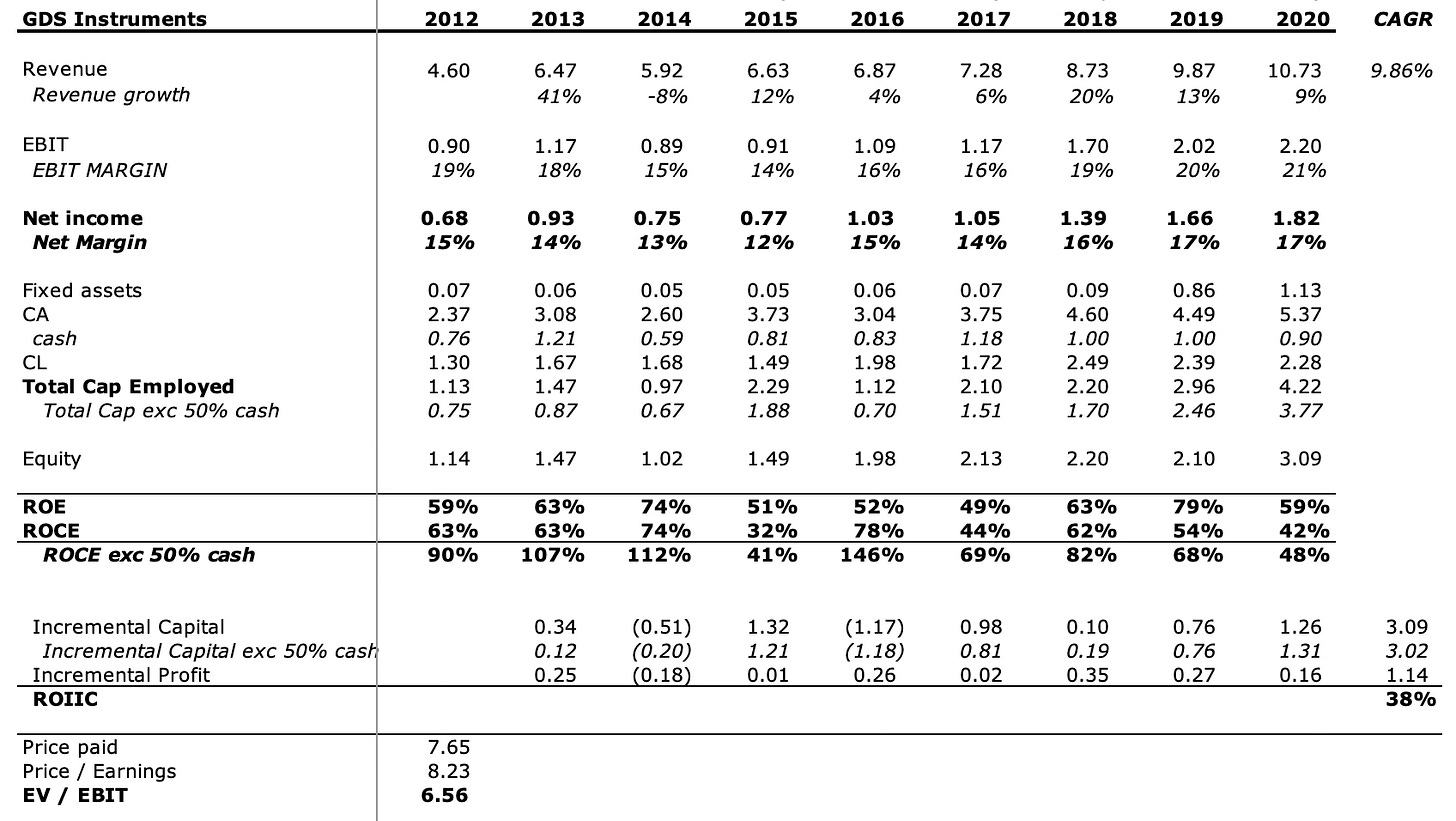

The combination of limited competition, tech advantage, and highly specialised knowledge required allows the individual businesses to earn attractive profits and cash flows (albeit lumpy), typically 25%+ EBIT margins and 30%+ ROTIC, highlighting the underlying quality of each business. Below are the financial statements of subsidiary business GDS Instruments to demonstrate this.

Secular growth tailwinds: Scientific manufacturers have benefited from secular growth trends, such as Worldwide growth in University education and Industrial optimisation, leading to an organic growth rate of 7% annually (8% for Judges). This organic growth reduces the pressure on management to make acquisitions to drive growth, allowing them to be disciplined, increasing the probability of successful deals.

Large deal pool: Judges identified a pool of around 2000 potential acquisition candidates in the UK alone when it launched; today, this number has likely increased due to the expanding size of the market. Globally, the pool is probably multiples larger, which until recently have been untapped. Due to the nature of these acquisitions (founders retiring), only a fraction of this total figure is available for sale at any one time, allowing Judges to act opportunistically over time.

Capital light: Many of the acquired businesses are capital-light; they typically outsource the manufacturing, focusing instead on the intellectual property and design of instruments. This simplifies the business and reduces capital intensity, requiring little capital to grow; instead, increased revenue falls straight to the bottom line (operating leverage). Cash Conversion has historically been over 90%.

Management

Management’s capital allocation, led by David Cicurel, has been the primary contributor to the company’s sustained success. Management understands the drivers of value creation and has demonstrated several qualities over the years that have allowed Judges to outperform peers and the market:

Valuation discipline: David Cicurel has demonstrated extreme discipline and patience on both price and quality of acquired businesses, paying an average of just 5x EBIT, and preferring to stay on the sidelines when their criteria cannot be met. This attribute has been crucial in maintaining the quality of the portfolio, which in turn has led to high ROTIC.

If management had chased growth at higher valuations, future founders looking to sell would be unwilling to sell at a lower price, forming a higher floor for all future acquisitions. While this may have accelerated short-term growth, long-term value creation would be meaningfully less (reversion to the mean). Many of the Judges’ peers have fallen into this trap of chasing growth at the expense of ROIC.

“Every time I sign on the line, I’m scared; I’ve got all my net worth tied up in this. I’ve got friends and family who are shareholders, and I’m scared we are going to do a bad deal” - David Cicurel

This discipline comes from fear of making a bad deal, a stark contrast from most managers who make acquisitions to chase growth or get bigger.

Best in class reputation: Similar to the great acquirers, Berkshire Hathaway and Constellation Software, Judges is rarely the highest bidder (although sometimes the only bidder). However, the company has earned a reputation as an ideal home for the businesses of retiring founders due to management’s honourability and fairness in the acquisition process, a big advantage in deals with long incubation periods and founders who care not only about the size of the cheque but also about the future prosperity of their life’s work.

“Reliability is magnetic because humans are hardwired to avoid risk, so once you prove yourself trustworthy and reliable, you become the default choice for opportunities without ever asking for them.” – Shane Parish

This reputation likely has numerous unquantifiable benefits, such as access to otherwise unavailable deals, lower valuations, and talent acquisition, that all contribute to the financial results over time.

Skin in the game: Judges spend a lot of time aligning the different layers of management to act in the interest of shareholders. At the subsidiary level, MDs are given the autonomy and trust to act like owners, maintaining a lean entrepreneurial culture. However, they are also held accountable for achieving their targets. MDs are incentivised with stock awards for achieving agreed-upon compound growth targets.

Group-level executive compensation is designed to emphasise long-term shareholder value creation through non-dilutive growth. Executives are awarded modest base salaries and generous option grants based on EPS targets over a three-year period. The goal of the compensation structure is for the share price to be the primary determinant of compensation over time.

Never ever, think about something else when you should be thinking about the power of incentives. - Charlie Munger

These incentives have led to meaningful insider ownership, not only from founder David Cicurel, who owns approximately 9% of shares outstanding, but retiring COO Mark Lavelle owns stock worth 20X his base salary.

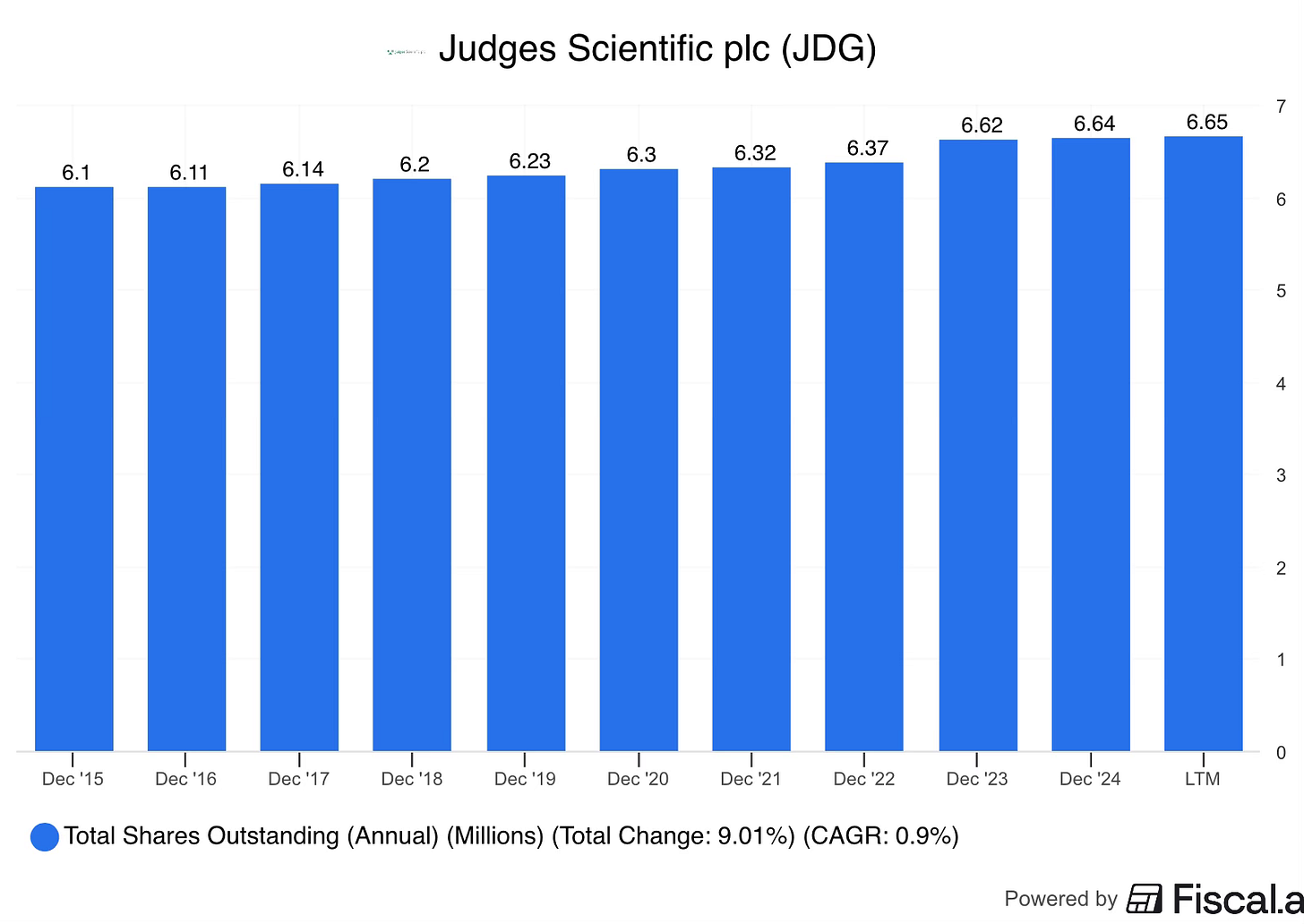

Dilution minimisation: Share issuance has been a key fixture of their acquisition model as part of the earn-out incentive. Management has focused on minimising this dilution, recognising its importance in creating per-share value, another sign of their shareholder orientation. Since its inception, the share count has doubled; most of this dilution occurred during the early years. Since 2015, the share count has grown by less than 1% per year; in comparison, shareholders of peers have experienced significantly more dilution.

Small advantages

“Small advantages compound over time like interest in a bank account, so being 10% more committed doesn’t give you 10% better results; it gives you 10x better results. Think of it like studying: the genuinely curious person will remember and connect ideas in ways that the person just trying to pass will never.” - Shane Pairsh

Individually, these attributes are not unique to Judge’s, nor is the business model or management characteristics difficult to replicate. However, combining all of these, and having the discipline to maintain these through business cycles, has led to long-term shareholder returns far in excess of the market and peers.

Recent developments

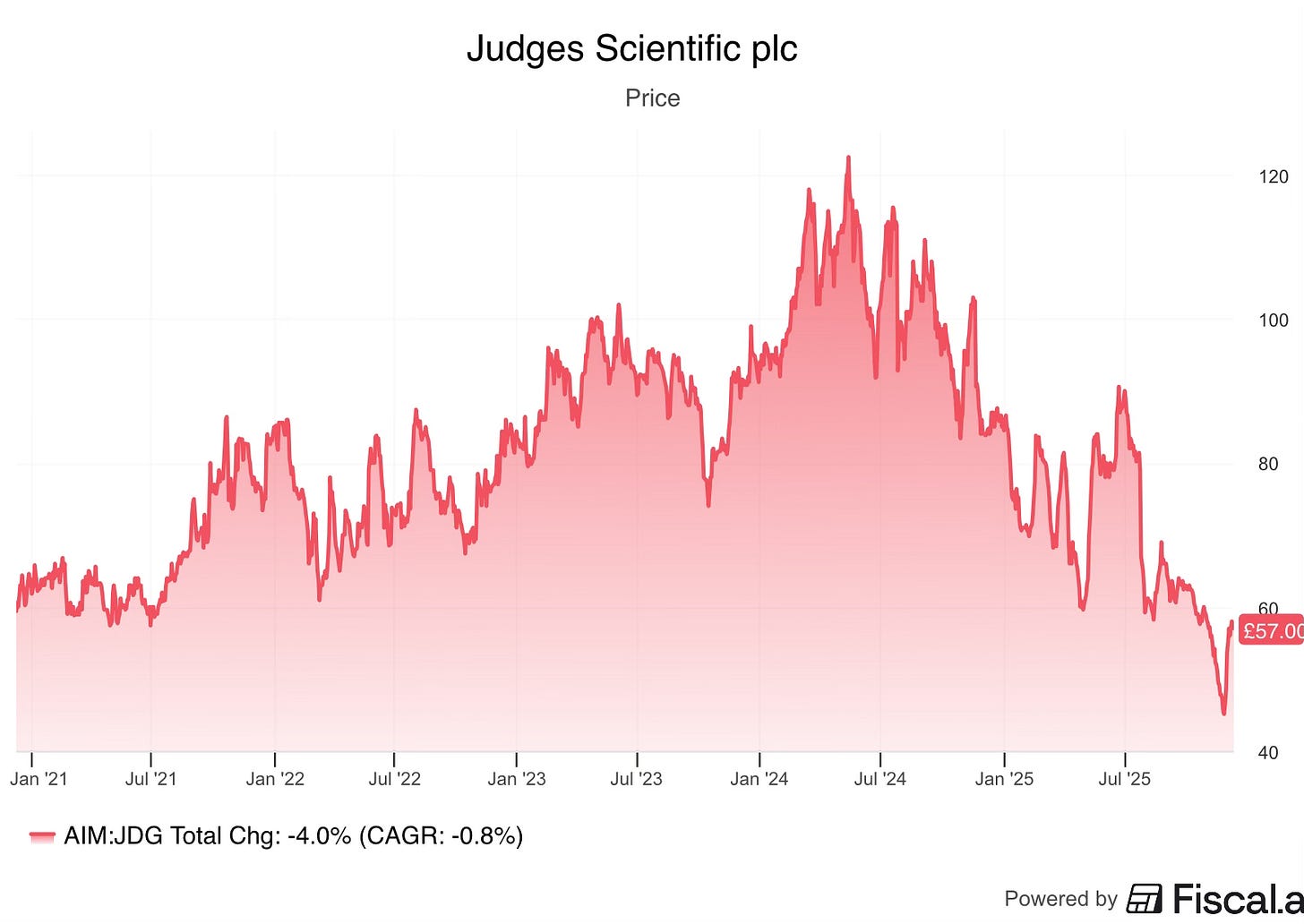

Recently, the share price has experienced significant weakness, down over 50% to levels last seen 5 years ago.

Looking at the financial picture, revenue has slowed but continued to grow, benefiting from several strong years of acquisitions. On the other hand, organic growth has struggled, declining by 8% in 2024 and an additional 7% so far this year. While some of this is a timing issue from the Geotek business, the trend is directionally correct. As a result, profit margins (operating leverage in reverse) and ROTIC have come under pressure.

Macro: The primary headwind has been the proposed federal funding cuts to research grants that, in some cases, have cut research institutions’ R&D budgets by 20-50%. While some cuts have taken effect and others have been blocked or delayed, the threat has caused college spending for new equipment to come to a halt (fear). These cuts are particularly impactful to Judges, as around two-thirds of revenue comes from government-supported institutions. As a result, US revenue (Judges largest market) declined by 17% in 2024 and a further 20% so far in 2025.

Management remains confident that the long-term secular growth drivers: global growth in university education and the increasing need for optimisation and measurement, remain unchanged. While the timing is unclear, I share this view.

Specific company issues: Beyond the macro headwinds, several individual businesses simultaneously have faced issues that are unrelated to the broader market. While it is inevitable that there will always be issues below the surface, especially as the portfolio grows, management has reported that there are currently more issues than normal. These appear to be centered around product quality: management has cited recurring quality issues (manufacturing level), and design philosophies focused on academic interest over commercial viability, leading to product capabilities below market requirements as causes. It is unclear how much these issues have contributed to the overall decline.

Outlook

Going forward, Judges’ strategy remains unchanged: they will continue to execute their buy and build strategy, aiming to deploy the majority of free cash flow while maintaining/improving ROTIC. In recent years, management has emphasised the growing importance of the organic growth aspect of the business, suggesting it may contribute an increasing amount to overall growth.

Beyond the current macro headwinds particularly affecting US organic growth, which I view as temporary, what factors could derail the long-term trajectory of the business?

Persistent Product Quality Issues

Many of the Judges’ businesses have a reputation for being global leaders of their respective niche technology, catering to a specific customer base. If product quality issues persist, Judges risks losing this reputation and their competitive edge to other niche providers.

Management has implemented several changes that should improve the quality of products. Actions include instilling a culture of quality, improving quality control at the manufacturing level, and placing a greater focus on designing quality in from the start.

These actions appear sensible, but will likely take time to take effect. While it is natural that a business will be experiencing challenges, these actions should prevent a widespread recurrence. If unsuccessful, Judge’s diversity prevents it from going to 0, however, there will be portions of the portfolio growing and declining, impacting the total growth rate, leading to lower future returns.

Competition

The greatest risk to the long-term prosperity of any individual business is increased competition. Judges have made a few notable acquisition mistakes: Scientifica and Armfield. Both of these mistakes were due to the businesses not being as niche as expected through either misjudgement or increased competition. As a result, both businesses have seen their top line shrink and profit margins evaporate.

There is currently no indication that competition is intensifying; however, if it did, the downside is clear. David Cicurel has noted that the most likely source of future competition would be low-cost producers in China. If this materialises, it would first impact Judges’ China revenue.

Finally, organic growth is a double-edged sword; the greater the growth of any end market, the greater the possibility that the market would be able to support another provider. To best defend against this risk, Judges must continue to encourage and monitor effective R&D spending to protect any technological advantages.

Acquisitions unable to move the needle

As the overall size of the business grows, the company either needs to increase the cadence of smaller acquisitions or increase the size of deals, or a combination of the two, if they are to continue deploying the same percentage of FCF that they have in the past. If unable, future growth will inevitably be slower.

This will become increasingly difficult to sustain as the size of the company continues to increase.

There are a few reasons why Judges could continue to maintain a high re-investment rate.

Large deal pool: As I previously mentioned, Judges still has a large deal pool of potential acquisition candidates that has recently been expanded beyond the UK. Due to the nature of these acquisitions (founders retiring), this will likely lead to periods of high activity and inactivity, but should present plenty of opportunities for Judges to act overtime.

Increasing capacity: As previously mentioned, Rik Armitage has been appointed group acquisition executive to increase the capacity for potential deals, indicating an accelerated cadence of future deals.

No signs of slowing: In recent years, Judges has actually accelerated capital deployment, beginning with the Geotek acquisition in 2022. Since then, Judges have continued to deploy the majority of FCF in the years following.

The combination of an already large deal pool being expanded internationally, expansion of the acquisition team, and a sustained high re-investment rate all indicate that the company still has plenty of opportunities to continue moving the needle.

Unsuccessful Succession

On November 26th, 2025, David Cicurel announced that he would be stepping down as CEO on the 9th of February 2026, transitioning into the non-executive chairman role, while also playing an active role in the acquisition process.

Dr Tim Prestige, current group business development director, will assume the CEO role. In the days following the announcement, shares rose almost 20%, which may or may not be linked to this news. The news, however, does provide clarity to a question that has been on investors’ minds for many years.

Tim and the rest of the management team have proven capable of fostering organic growth amongst subsidiary businesses. The key question will be, can management maintain the same acquisition track record and discipline that has created so much shareholder value in the past? Management will have to demonstrate the following traits:

Discipline on both value and business quality: Willing to walk away if the criteria are not met, not chasing growth.

Shareholder orientation: Minimising dilution

Cicurel has previously spoken about finding someone who is equally scared when making acquisitions as the ideal candidate to take over this role; this level of care is not easy to find. On the 1st July 2025, Rik Armitage was appointed group acquisition executive, a first step towards transition. However, with Cicurel expected to maintain an active role with no specified end date, this transition will likely be slow and methodical to ensure it is done right, a key indicator of just how important this transition is to the future of the business.

Beyond David Cicurel, Chairman Alex Hambro, and COO Mark Lavelle have both announced their retirement, it will be crucial that the new management team maintains the same culture that has allowed Judges to thrive.

Outlook Conclusion

While there are plenty of potential risks associated with the business, I view the greatest threats to be value-destructive acquisitions after David Cicurel retires and increased future competition. Despite this, I view the probability of a satisfactory long-term business outcome (not stock) as relatively high.

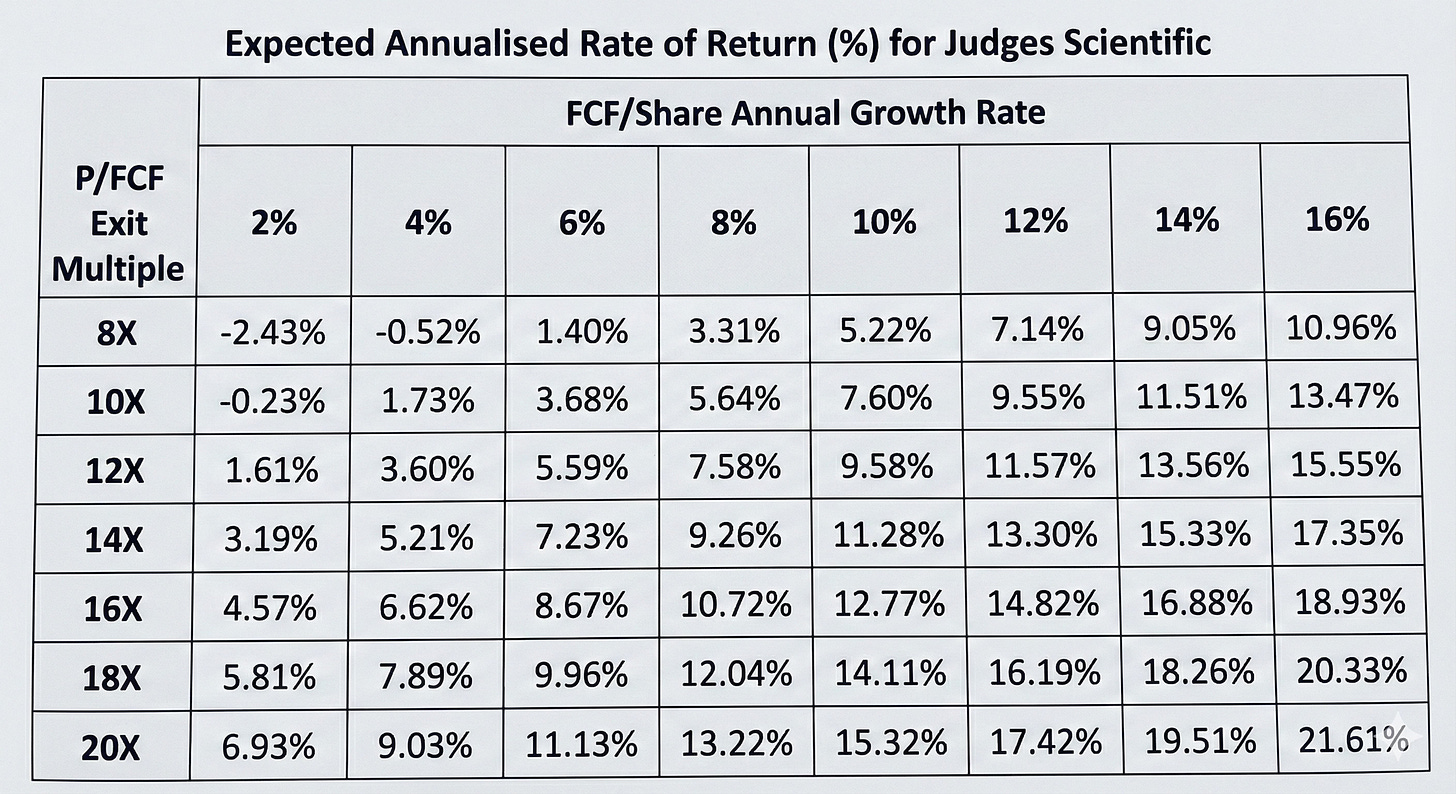

The theoretical upside for Judges could be significant, providing they can continue to re-invest the majority of their FCF into further acquisitions at a similarly high rate of return.

Assuming Judges reinvests 80% of FCF, which they have historically done through a combination of retained earnings and debt (- dividends), and returns ROTIC to its historical 20-30% range, the company could sustain a mid-teens growth rate. This would be a slight acceleration from pre-COVID levels, where the company made very few acquisitions.

Valuation

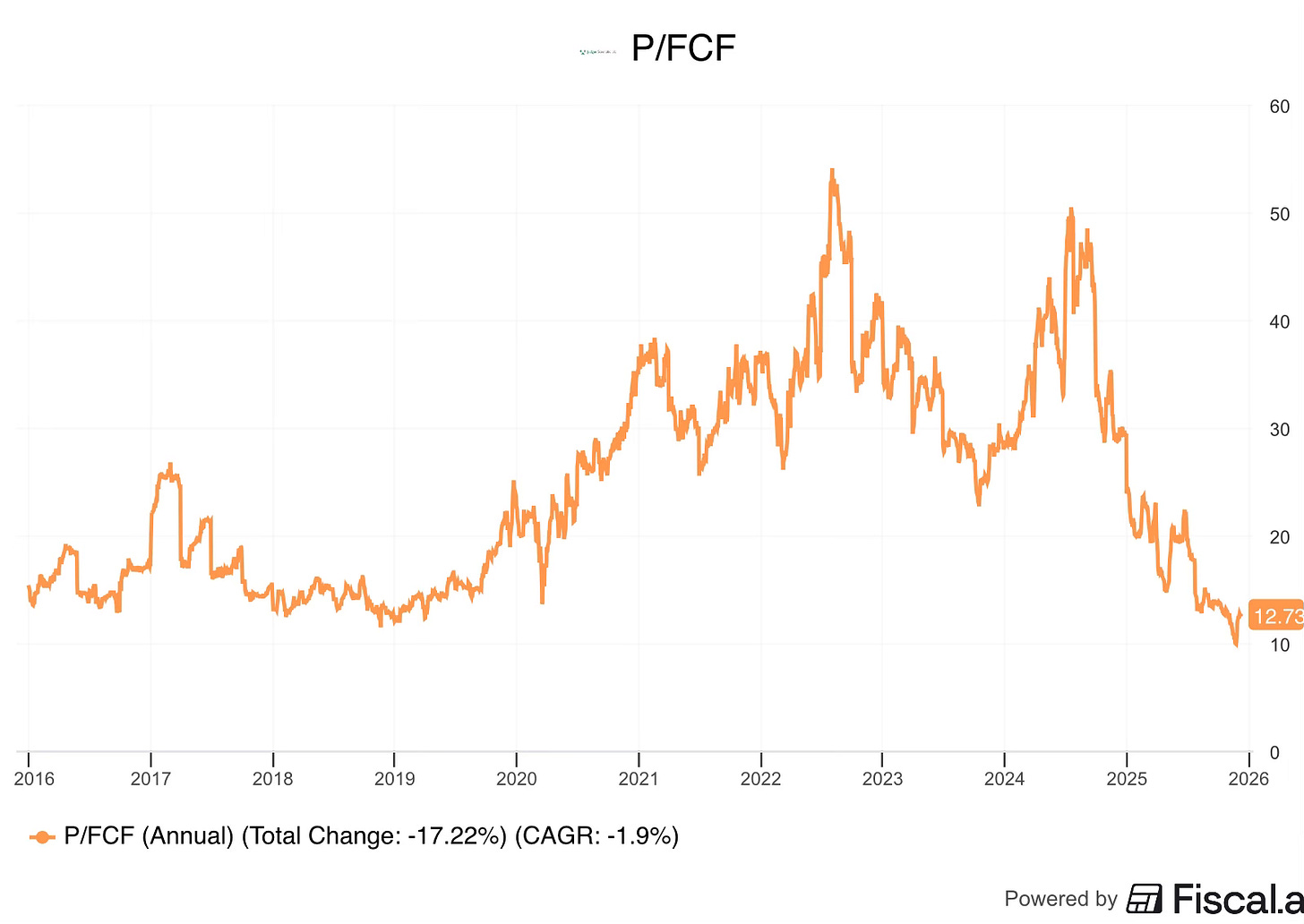

Following the share price sell-off over the past 2 years, the business now trades at 12.5X FCF, a relatively undemanding multiple versus other serial acquirers that typically trade at a premium to the market.

Using a reverse DCF, we can estimate that the market is expecting a 4% growth rate over the next 10 years, followed by a 2% terminal growth rate. Extending the time period, further lowers the expected growth rates.

Applying a range of growth rates and exit multiples over a 10-year period, it becomes apparent that it does not take aggressive assumptions to achieve market-beating returns from these valuations. Furthermore, the diverse portfolio of mostly high-quality businesses and a valuation towards the lower end of its historical range provides some downside protection.

Conclusion

Judges has been a great compounder over the last 20 years, which has been enabled by a highly scalable business model, attractive industry dynamics and a skillful capital allocator at the helm. Current macro headwinds have potentially created an attractive entry point to this great business if you believe the risks mentioned including; product quality issues, competition and leadership transition don’t materially alter the long term prospects of the business.

Thank you for reading!

Sources: Company material, InPractice, YouTube, InPractice, Redeye

Disclaimer: Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment

Brilliant teardown of the whole Judges model. The part about Cicurel being scared every time he signs feels spot-on because that's exactly the opposite mindset from most acquirers who chase growth metrics. Interessting how the 5x EBIT floor discipline becomes self-reinforcing since future sellers wont accept lower, which basically makes valuation control teh entire moat here. If new management loses that fear and pays up even once or twice, the whole flywheel unravels fast.

It is a wonderful company which is priced appropriately right now