Moncler Deep Dive Part 2: The Moncler Brand

Business Model, Moat and Opportunities

Welcome to part 2 of this deep dive into the Moncler group. In this deep dive, I will analyse the most important aspect of the Moncler brand. I will cover: Business model, industry landscape, moat, and opportunities.

If you missed part 1: History, check it out using the link below.

In Part 3, I will cover Stone Island, management, and valuation. Stay tuned!

Subscribe below to not miss my future deep dives.

Business Overview

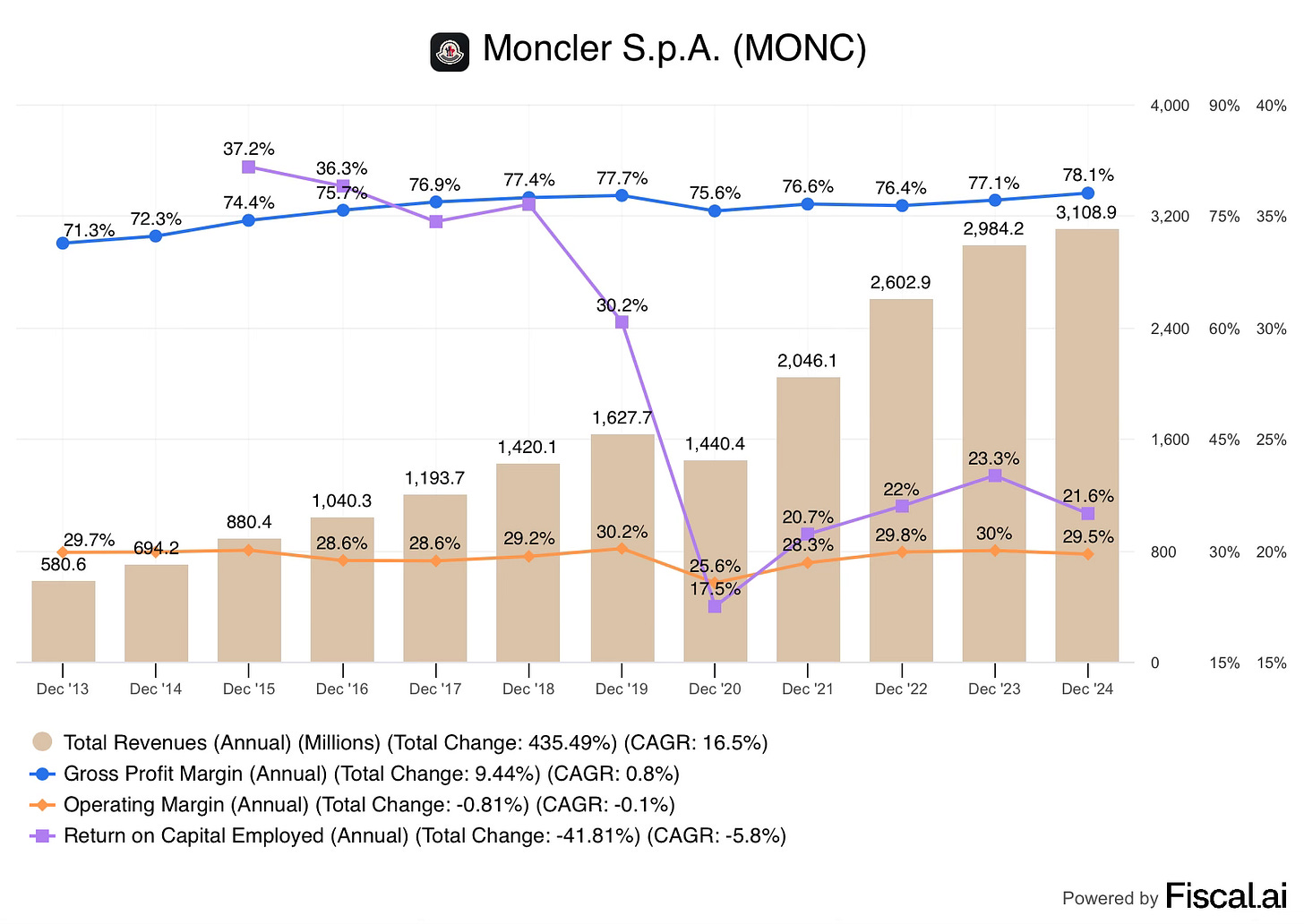

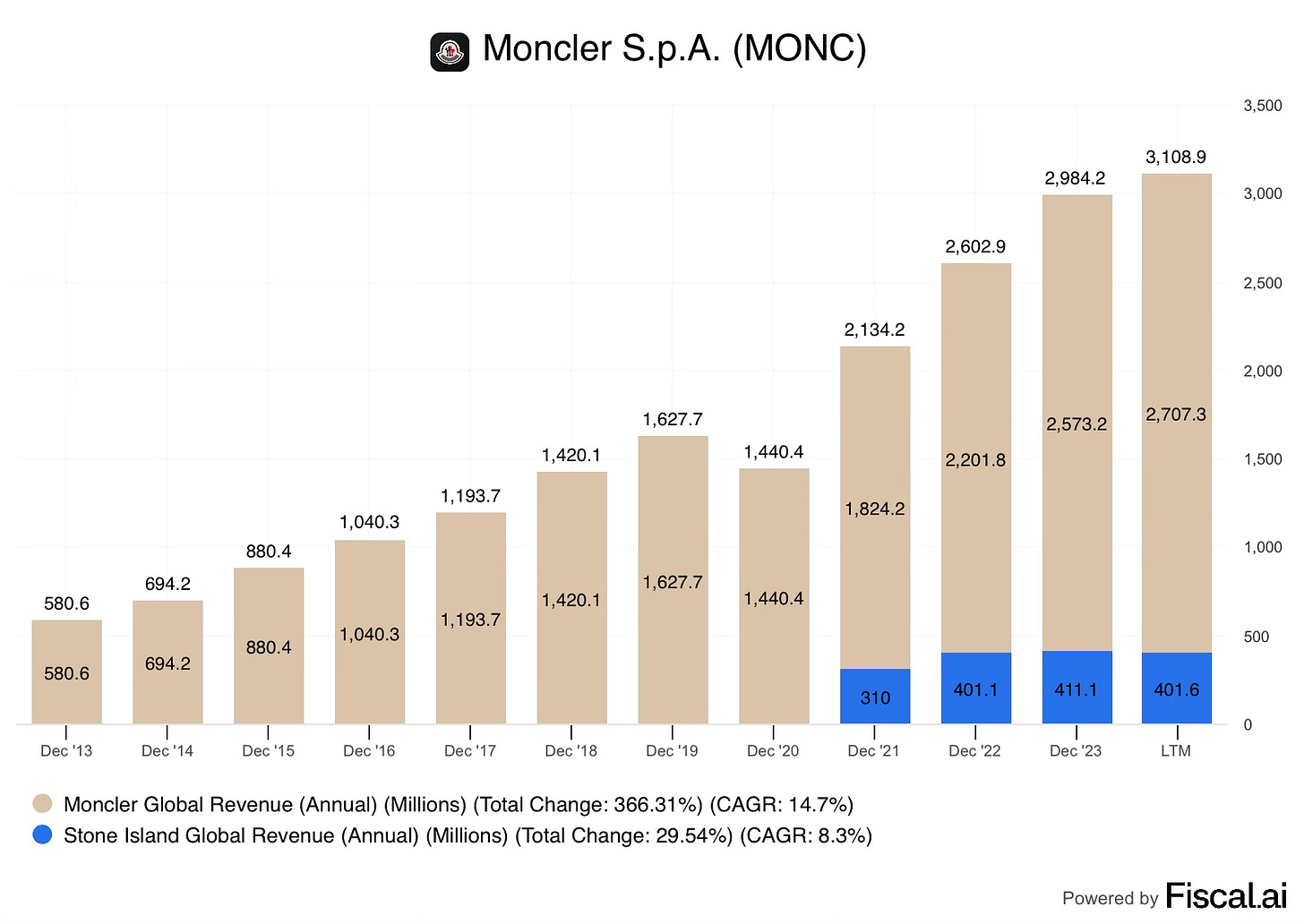

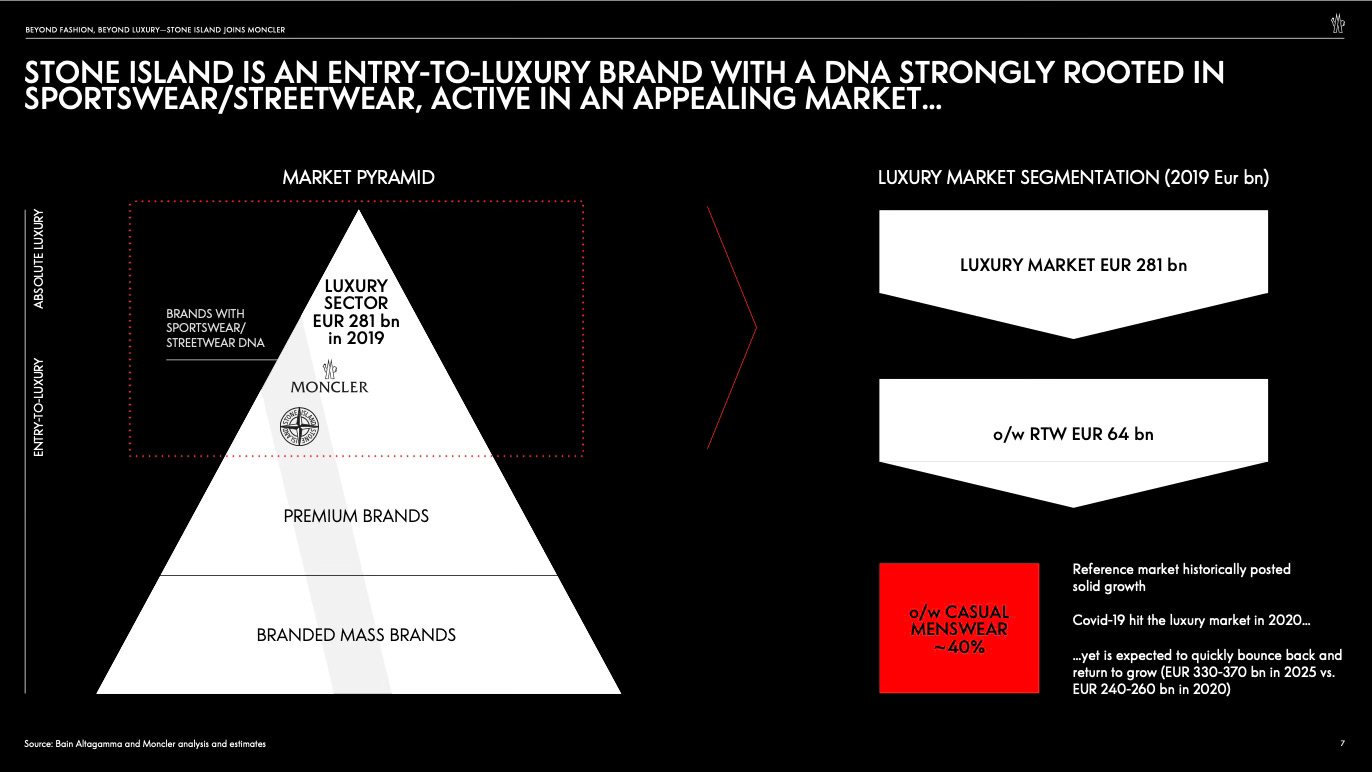

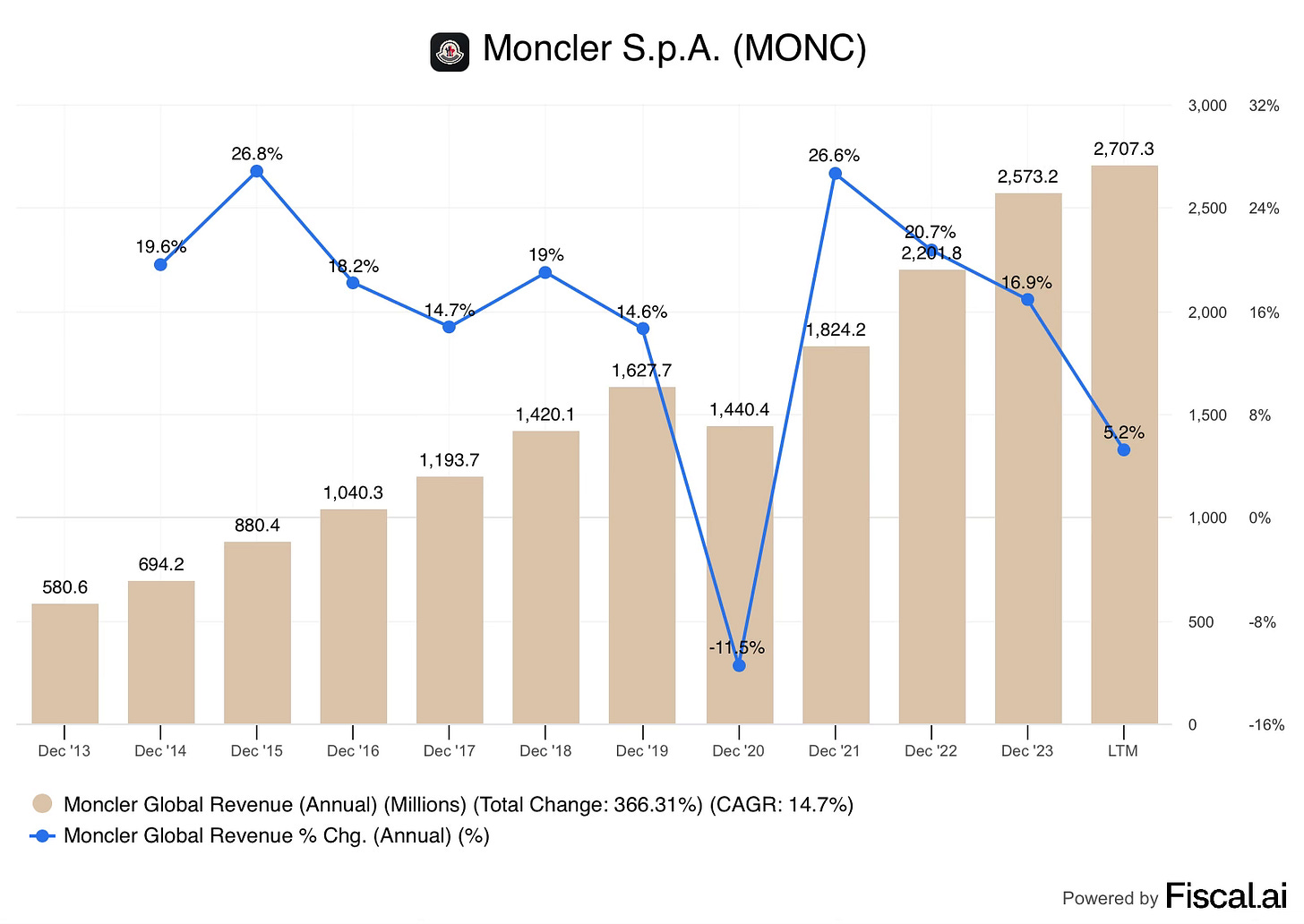

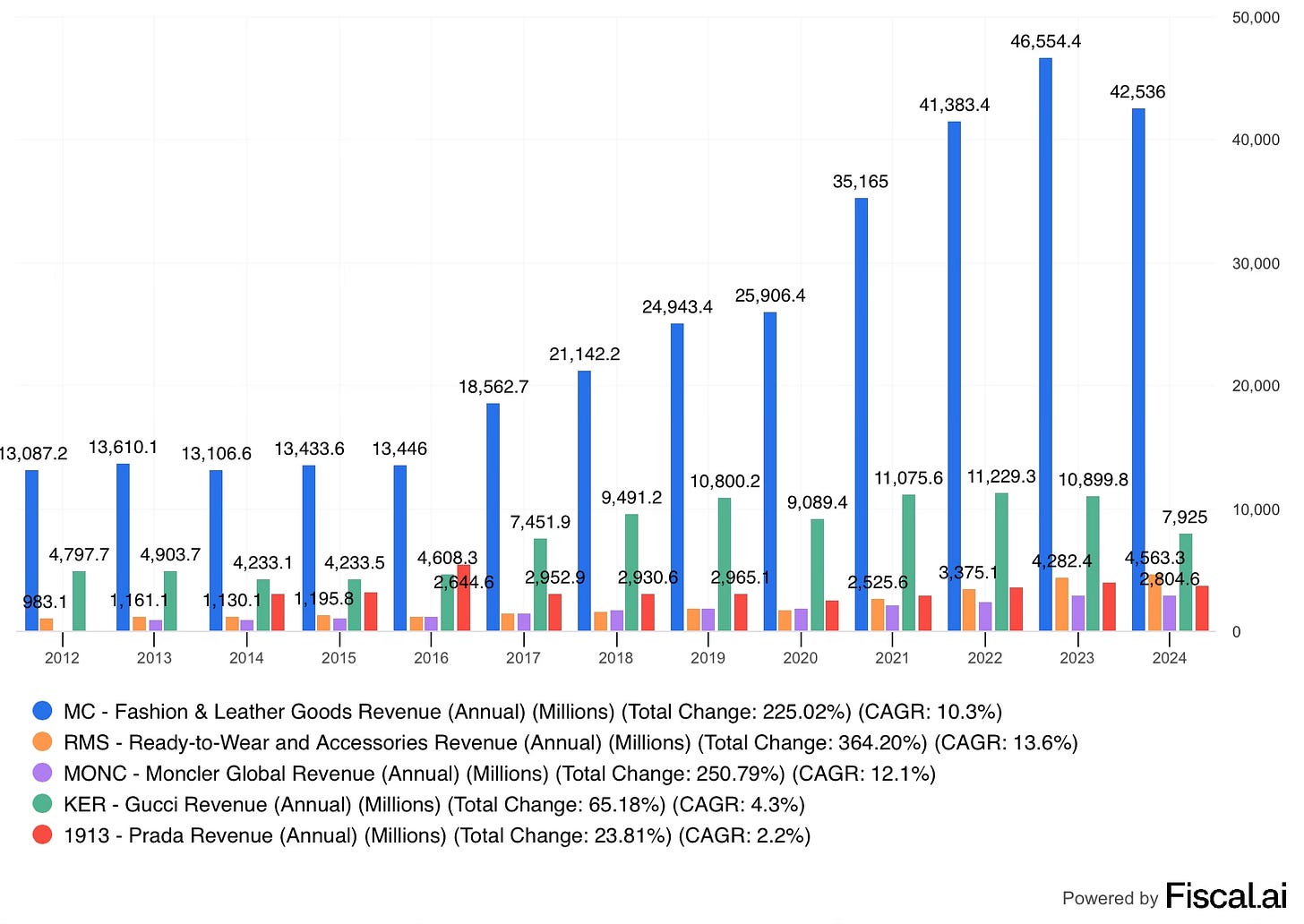

Today, the Moncler Group comprises two brands: Moncler and Stone Island, generating a combined annual revenue of €3 billion. The group is a relatively small player in the broader luxury market, but a leader in the Outerwear subcategory through the Moncler brand.

Looking at the group from a high level, it undeniably demonstrates the characteristics of a great business: strong growth, consistent high margins (both Gross and operating margins), a capital-light nature, strong cash flow generation, and high returns on capital employed.

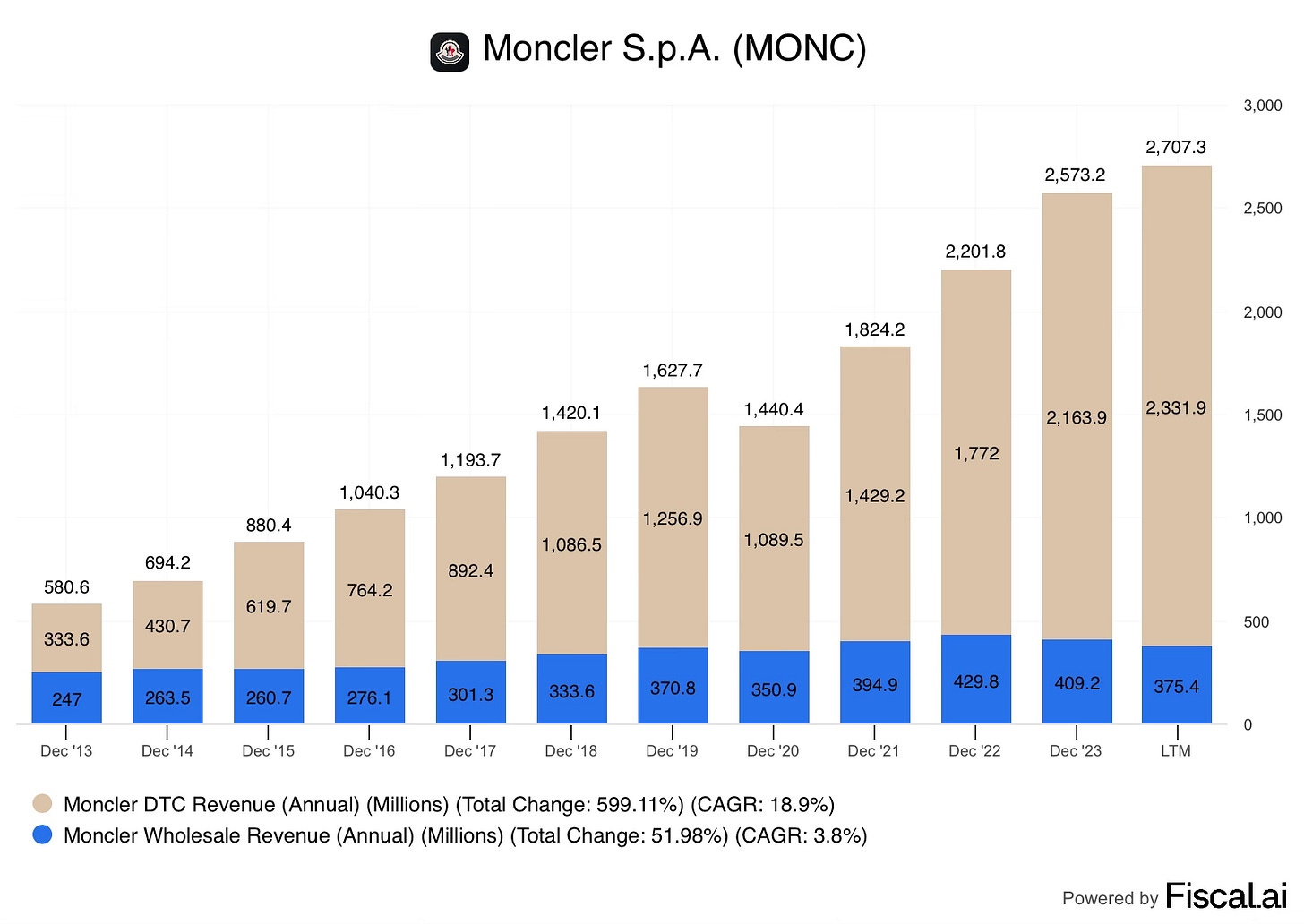

Broken down, Moncler contributes 87% of the group's revenue, while Stone Island contributes the rest. The DTC channel accounts for 82%, while the wholesale channel accounts for 18%. Geographically, Asia accounts for 48%, EMEA 39%, and the Americas for 13%.

Investment Thesis

Since 2015, Moncler has compounded EPS at 15% per year. For Moncler to continue delivering strong shareholder returns that outperform the broader market, three key factors will determine the outcome for the long-term shareholder:

Moncler: Can the company continue to build its brand equity through innovative marketing, selective expansion/remodelling of its directly operated stores, and expansion of its product line beyond outerwear?

Stone Island: Can the company’s luxury playbook, which worked so well for Moncler through the 2000s & 2010s, be replicated with recently acquired Stone Island, elevating the brand towards luxury status over time?

Management: Can Remo Ruffini continue to guide the group through the constantly changing fashion industry, allocating capital wisely and preserving the culture that has been so successful so far?

In this deep dive, I will be solely focused on question 1, likely the most important of the three.

1. Moncler

The Moncler brand generates 87% of the group's revenue and likely an even larger share of the group's profits; therefore, the success of shareholders is heavily reliant on Moncler’s performance, particularly in the near to medium term.

Business Model

Moncler aims to be “the brand of extraordinary”; to achieve this goal, the company operates a vertically integrated business model (for the most part) that keeps direct control of the aspects that drive the greatest value for the Moncler brand. This includes controlling the creative phase, purchasing raw materials, marketing, distribution, as well as strict oversight of production.

This business model aims to make the Moncler brand “the most authentic, the most meaningful and the most distinctive brand on earth”. To maintain and enhance its luxury positioning, every aspect is underpinned by uncompromising quality and craftsmanship that creates long-lasting relationships with its community, driving repeat purchases.

Collections

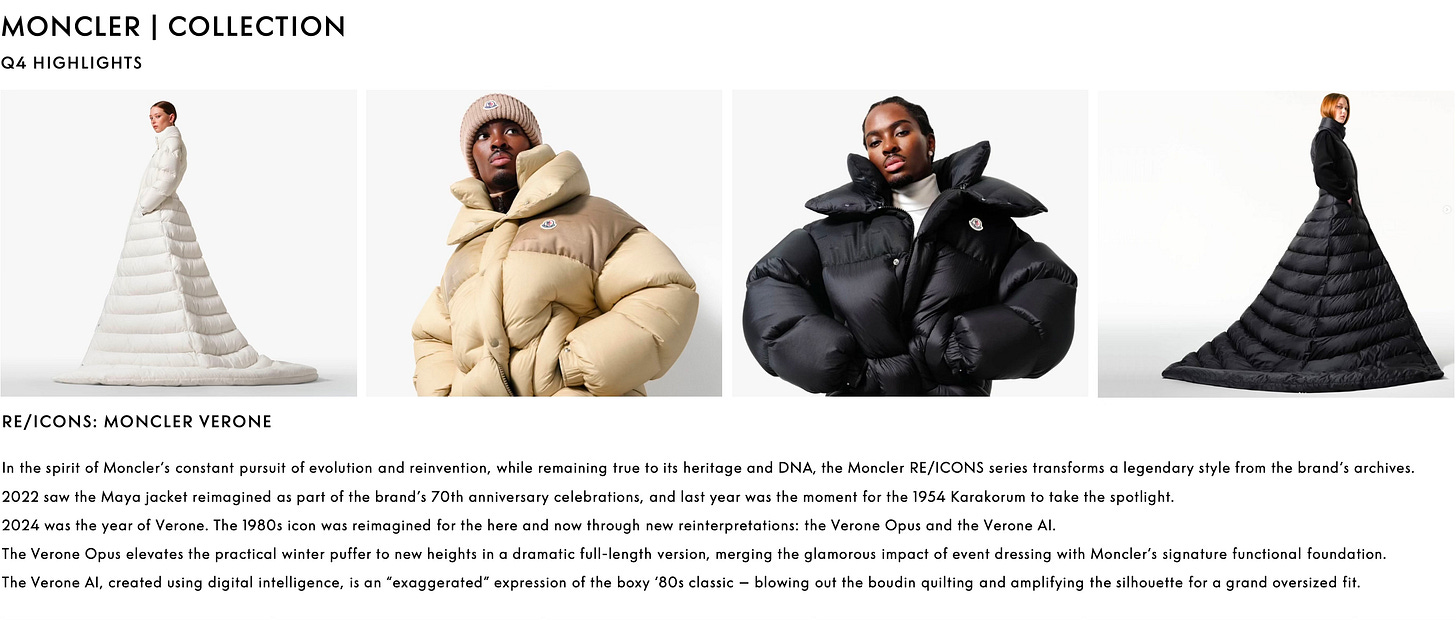

Remo Ruffini is not only the CEO but also the creative director. He oversees a team of fashion designers, setting guidelines to ensure a consistent brand vision. Ruffini’s philosophy is to “survive fashion”, acknowledging the difficulty in staying ahead of trends; instead, they aim to create timeless “products that last over time” and “above trends”.

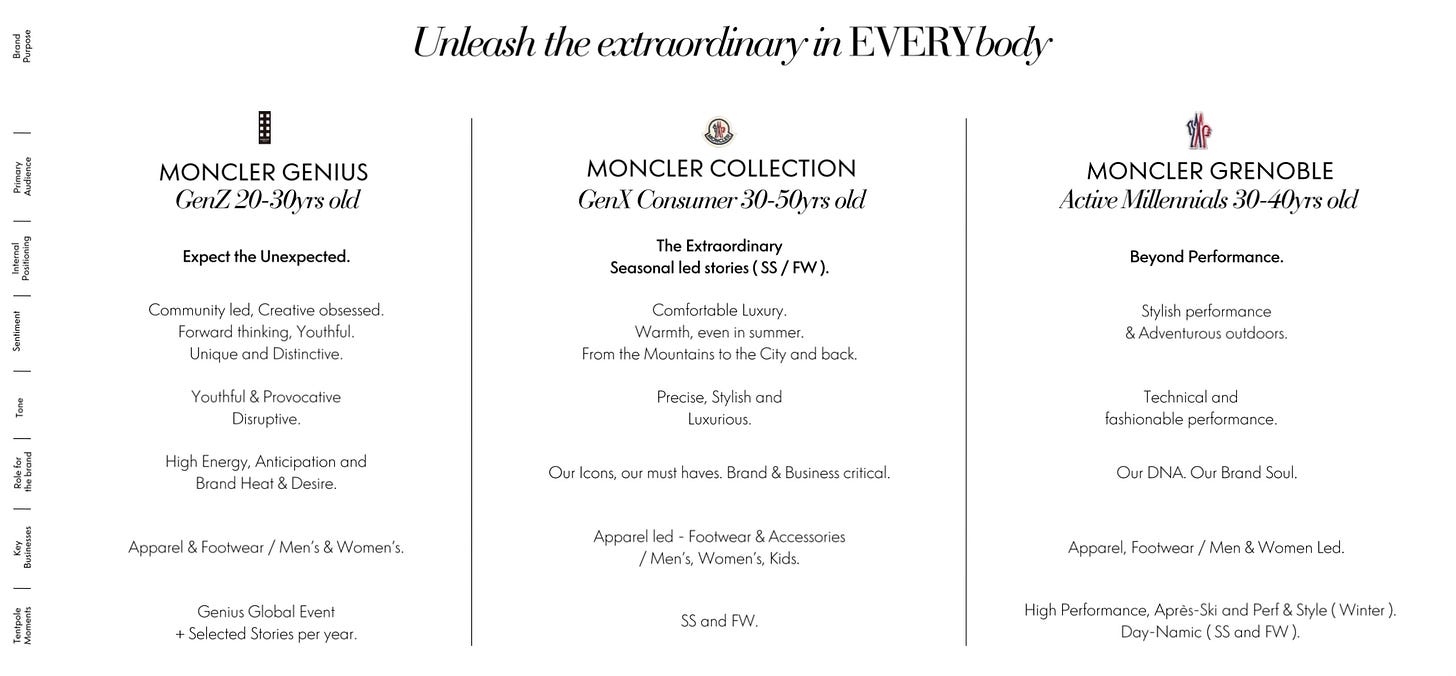

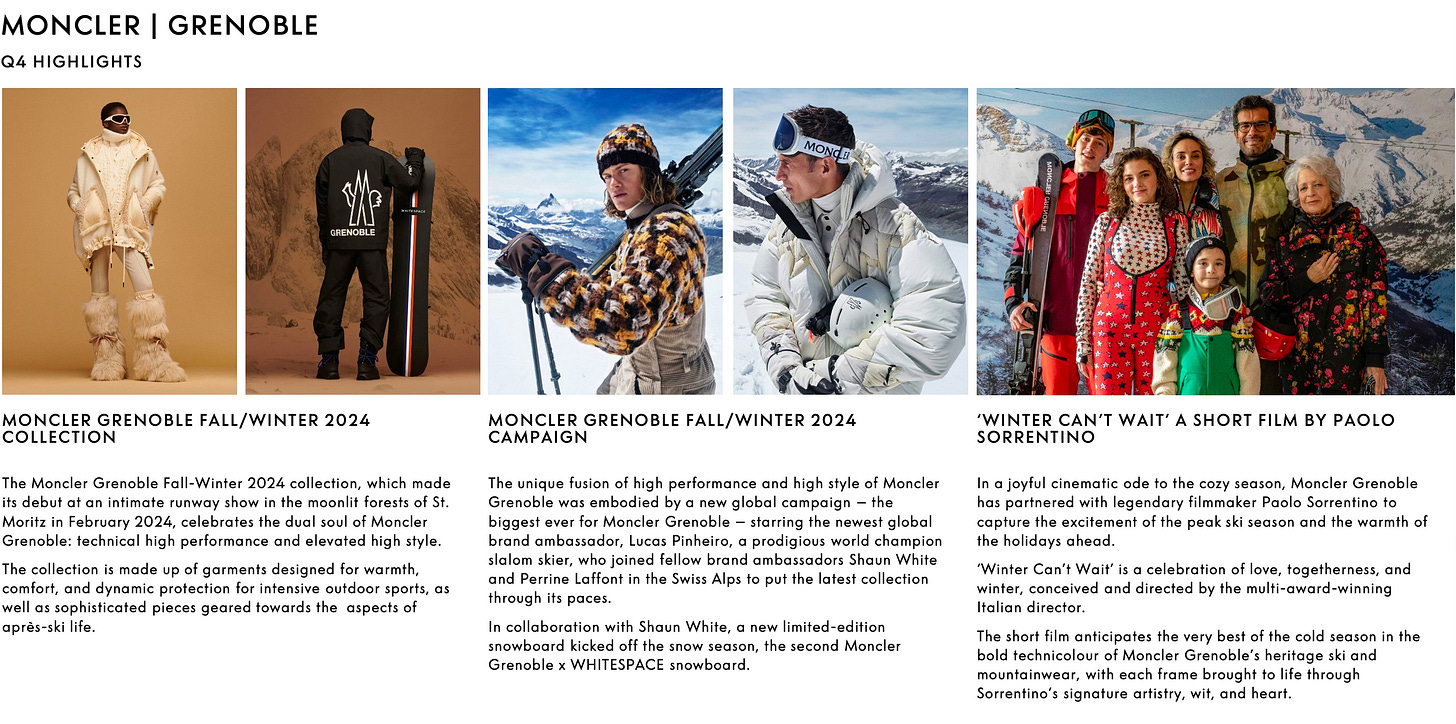

The current evolution of Moncler is a blend of its heritage in high-performance outerwear and luxury fashion. The company describes itself as one brand with three dimensions: Moncler collection, Grenoble and Genius. These three distinct yet complementary dimensions aim to appeal to a broader audience while remaining true to their DNA.

Moncler Collection is the core of the business, representing the classic luxury down jackets, coats and outerwear that are iconic today. Latest estimates suggest that this collection contributes 70-80% of Moncler's revenue. Product releases follow the typical two-season luxury calendar (Autumn/Winter + Spring/Summer). Given its strength in outerwear, the winter collection accounts for the majority of sales; however, Moncler is working to serve its customers all year round by broadening its product offering into knitwear, footwear, accessories and eyewear. Early expansion has been successful, the collection is broken down into: 70% outerwear, 20% Knitwear and 10% other categories (footwear, etc.).

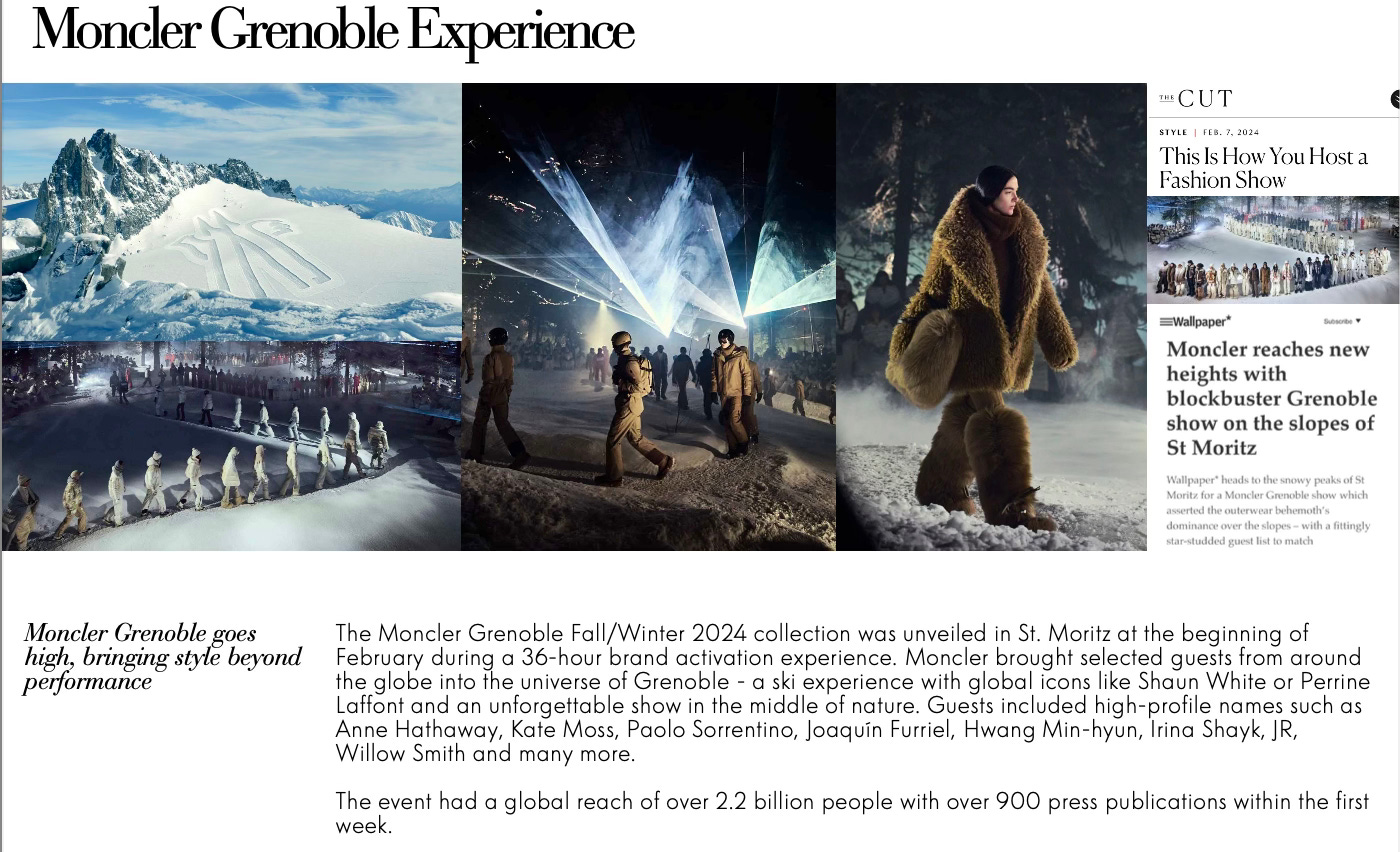

Moncler Grenoble represents the brand’s technical alpine heritage. The winter collection is split between two segments: Performance & Style and Après-Ski. The collection also has a Spring-Summer outdoor collection called Day-namic, focused on technical products. Although the brand’s heritage stems from technical clothing, the brand is in a process of reclaiming “what is ours”, after shifting away from that segment. Today, Grenoble accounts for approximately 10% of brand revenue.

Moncler Genius: Launched in 2018, this innovation platform brings together a rotating collection of designers and creatives to interpret the Moncler puffer jacket and brand into limited-release capsule collections. Genius aims to create a new “story” every month, only available at select flagship and pop-up stores. Despite only contributing 10% of revenue, Genius acts as a significant brand builder, attracting the best designers, media attention and younger demographics to the brand, meaning Genius’s impact goes far beyond the income statement.

A significant risk for luxury companies is the reliance on a sole creative director for brand direction. On the upside, the right director can drive substantial growth; alternatively, the wrong director can result in a brand’s relevance dwindling as collections fail to capture consumers’ imagination. Genius insulates Moncler from this risk by utilising a revolving collection of designers. Moncler no longer relies on a sole creative, instead appealing to a broader range of consumers through individual designers, driving substantially higher traffic to the brand.

Seasonality risk and opportunity

The brand remains heavily reliant on the outerwear category (down jackets), which makes the business highly seasonal, peaking in the winter months (although outerwear is sold throughout the year). Latest reports suggest 75% of revenue is tied to the winter collection.

Over the past decade, the company has been working to diversify its sales, first with Knitwear, which is the second largest category today. More recent efforts include: leather goods, footwear, eyewear (in partnership with Marcolin) and summerwear. These complementary categories have been growing at more than double the rate of outerwear.

Diversification efforts can result in brand dilution, which may not become evident for many years, until it’s too late. While that may be a long tail risk, Moncler seems to be introducing these new collections in a thoughtful and brand-accretive manner.

Sourcing

Moncler sources all materials in-house, with an equally strict focus on quality and sustainability as the rest of the business. In 2024, 589 suppliers were involved in the process of supply and production.

These suppliers are audited extensively on quality, human rights policies, living wage analysis, environmental impact, sustainability and Animal welfare. Moncler releases transparency reports, underscoring its commitment to responsible sourcing. This dedication to quality sourcing can be traced back to the backlash the brand received in 2014 over down-sourcing practices.

The recent events of Loro Piana highlight the risks to a brand that doesn’t apply the same quality focus to its supply chain.

Goose down is a key material for down jackets. Moncler uses only the “best fine white goose down”; each batch of down must meet 11 stringent quality parameters, including a minimum fill power of 710 cubic inches per 30 grams. Moncler conducts over 1,200 internal tests annually to verify quality and strict adherence.

Manufacturing

The cut-make-trim phase (manufacturing) operates through a hybrid model for its main product lines (Outerwear and Knitwear), manufacturing roughly 30% internally (in Italy and Romania) and the rest through third-party manufacturers (Façon manufacturers), mostly in Eastern Europe. For smaller product lines, such as accessories and shoes, Moncler utilises third-party manufacturers. This is a similar model to that of other luxury apparel brands, such as Prada and Gucci.

Quality Risk

Quality is really the mantra of our group, and I like this very much. This has always been and will continue to be our main focus - Remo Ruffini.

For a luxury brand that prides itself on quality, the lack of internal manufacturing capacity may appear to be a risk, especially in comparison to luxury leather goods houses, such as LVMH and Hermes, which craft everything in-house.

Moncler has long-standing relationships with the best specialised (Façon) manufacturers and applies strict quality control measures. Additionally, Moncler has been internalising increasing amounts of the manufacturing capacity (up from 15% in 2018) with the addition of their Moncler Clinique facility in Romania (2022). This trend of internalisation is likely to continue; the company is actively looking at further expansion of internal capacity through greenfield investments or the takeover of existing facilities.

Increasing internal capacity should further enhance product quality and operational flexibility, allowing Moncler to reduce time to market and react faster to fashion and demand changes. On the downside, it will increase capital intensity of the business (modestly).

Go to market

Distribution is dominated by the DTC channel (86%), comprising 286 directly operated stores (including concessions, travel retail locations and outlets) and internally managed E-commerce operations (as of 2021). The remainder is through wholesale channels, with approximately 1,000 wholesale doors and 55 “shop-in-shops”.

From 0 stores 15 years ago, the expansion of the retail channel has been transformational. Initially, store locations could be found in upscale ski resorts (Verbier and St Moritz). Over time, the company has expanded into the most exclusive luxury streets and malls around the world. As of 2024, the 286 DOS are broken down into the following geographies: 143 in Asia, 96 in EMEA and 47 in the Americas. Over time, selling space has increased by mid-double digits as both the number of stores and the size have increased.

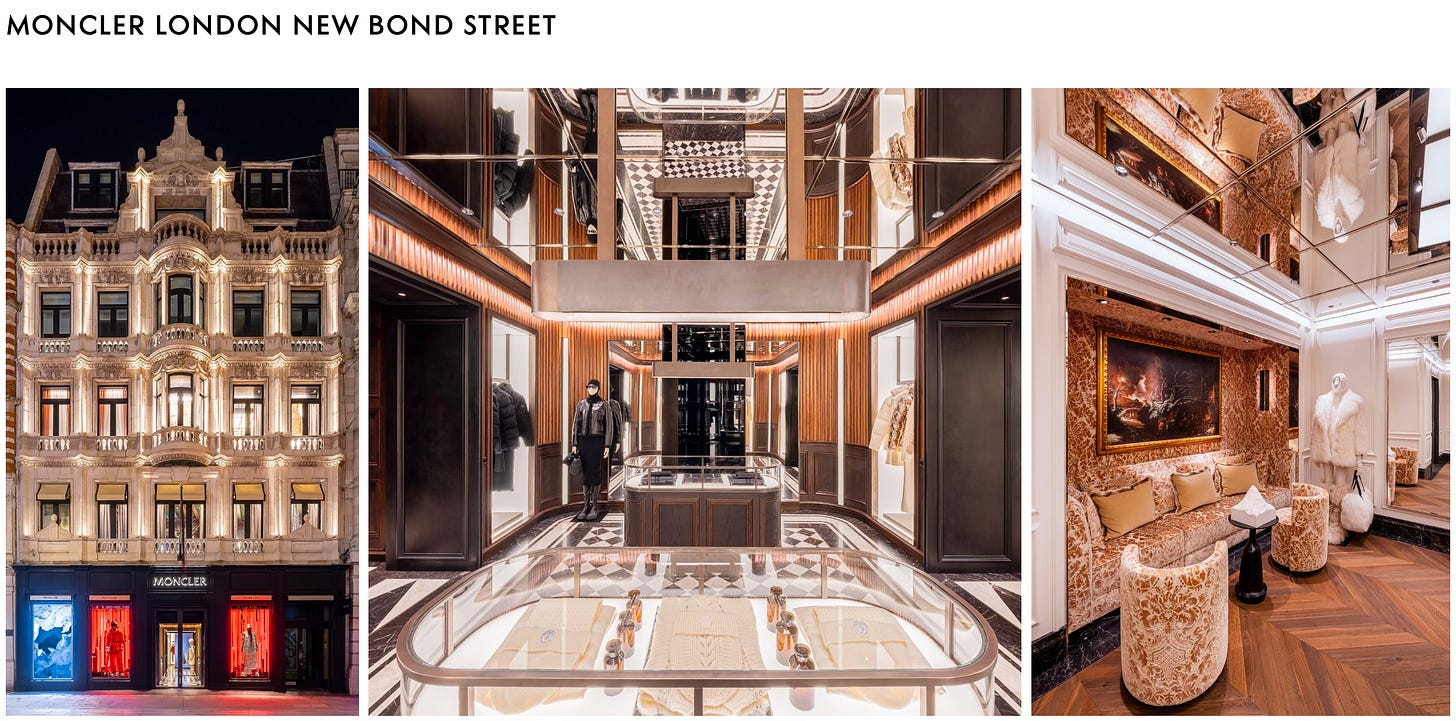

Unlike mass retail stores, which are optimised for volume, Moncler’s stores are designed to feel more like museums, curating a story of the brand rather than a place for commerce. This large direct presence gives the brand full control over its image, product placement and the customer experience.

The wholesale segment has also gone through a massive transformation over the past decade. Today, Moncler operates 56 shop-in-shop locations within luxury department stores, along with a presence in select multi-brand stores and airports. Combined Moncler has approximately 1,000 wholesale locations. However, as late as 2010, Moncler had more than 3,300 locations, demonstrating the increase in quality per location for one third of the footprint to generate the same sales as 3,300 locations. Today, the quality of these wholesale locations is comparable to DOS; the only difference is that third parties handle the sales for wholesale operations.

For both DOS and wholesale locations, Moncler is extremely selective about its physical footprint. Following years of faster-paced retail door openings, today, Moncler continues to expand its footprint but at a slower pace, instead focusing on enhancing quality, upgrading its current footprint through relocation and re-modelling, contributing to increased selling space.

Beyond the physical footprint, Ruffini’s vision is to make Moncler a “digital, omnichannel brand for young people”. After internalising its e-commerce platform in 2020, the company has invested in using its platform as an opportunity to “talk to the market without the need for stores”; today, 25% of revenue comes from E-commerce. Beyond the Moncler-owned digital footprint, the company has also opened flagship digital stores on Tmall (Alibaba) and JD.com in China.

Scarcity

Unlike a mass market brand that is trying to capture all demand for a product, luxury brands must never fully satisfy demand, creating a sense of rarity. The most well-known examples of this include Hermes and Ferrari, both of which typically have waitlists and hurdles to be able to buy their most expensive products.

Although Moncler does not have waitlists, it achieves scarcity in other ways, ensuring demand is never satisfied. Moncler’s go-to-market objective is to increase the desirability of the brand, not to maximise sales.

The Maya Jacket, Moncler’s iconic jacket, is a prime example of scarcity. Although synonymous with the brand, the Maya jacket is never on display in a Moncler store. By not having it readily available, consumers typically have to ask for it, adding to the product’s desirability.

Moncler Genius Program (10% of sales) is another example of product scarcity on a smaller scale, releasing only capsule collections in select locations geographically. Consumers have to expend significant effort to get these items new, or pay up for second-hand.

Moncler’s inventory, location and wholesale strategies further add to the scarcity. Moncler deliberately limits inventory with the goal to sell out, making items harder to buy. Additionally, Moncler’s extremely selective location strategy means consumers typically have to go out of their way to find a product, especially in wholesale locations, where Moncler heavily limits volumes.

Story Telling

Marketing is paramount for a luxury brand. Through storytelling, a brand creates loyal consumers who buy into the brand narrative. Unlike a mass market brand, luxury isn’t advertising a product. Instead, they evoke an emotion by weaving their heritage, craftsmanship and timelessness into a cinematic story, focusing on the brand rather than a particular product.

Marketing has been an area where Moncler has excelled, attracting new and loyal consumers to the brand. Since 2014, the number of people in Moncler’s database has increased from 300,000 to 3 million, a 10X increase. Repeat purchases have also increased from the mid 20% range to over 40% of revenue.

To achieve this success, Moncler has gone beyond the traditional 2 annual fashion shows and accompanying ad campaign schedule. Moncler believes the consumer demands “Monthly, weekly, daily interaction”, disrupting industry norms.

Today, Moncler spends 7% of revenue on marketing, split between digital channels, extravagant events and Moncler Genius. These three pillars build on each other. Regular Genius launches and extravagant events, such as the recent Moncler Genius event in Shanghai, the Grenoble event in St. Moritz, and the 70th anniversary event in Milan, can all be leveraged digitally to reach a much wider audience. For example, Genius Shanghai reached 15 billion views in 70 days, the 70th anniversary reached 2 billion views in 40 hours, and a live stream on Weibo of the Fragment Genius collection garnered over 32 million viewers live.

Brand

Moncler’s brand is the company’s key competitive advantage, allowing it to consistently grow faster than the broader luxury market and achieve high margins (gross & operating) through pricing power. This luxury brand positioning has been cultivated over many years, prioritising quality at every turn (discussed above) over short-term financial returns.

“Moncler has delivered a masterclass in staying power, versatility, and collective cultural conscience, from the summit to the city. Existing as a hyper-real microcosm of the world around us, Moncler consistently pre-empts the competition and pioneers innovative new ways to remain on the very tip of the global zeitgeist. A future-facing ideology and an unwavering commitment to developing the ultimate technical down jacket and positioning it as an interminable symbol of status and style underpins every decision at the Franco-Italian powerhouse.”

Recall, roughly 20 years ago, the business was struggling and the brand lacked direction. Fast forward to today, Moncler’s brand stands for a blend of luxury, technical performance, and innovation, underpinned by its rich Alpine heritage and a forward-thinking approach to fashion.

According to Fashion United, Moncler’s brand has a value of $5.9 billion (one-third of the market cap), making it the 16th most valuable luxury brand in the world, 1 place behind Tiffany & Co. and ahead of luxury watch maker Patek Philippe. This brand strength allows Moncler to achieve luxury prices. Today, Moncler’s core down (puffer) jackets often fetch $1,500 to $2,700, with limited capsule jackets fetching multiples of this. For example, the Moncler Maya 70 by Palm Angles Jacket fetched $13,500, and the lacquered down-filled gown from Craig Green fetched $22,000. Even entry-level products, such as a baseball cap, achieve $300+.

Another indicator of brand strength is the secondary market. While core Moncler jackets can be found for less than MSRP, sought-after Moncler Genius pieces can often fetch multiples of their original price, demonstrating its brand's strength.

The luxury fashion market is large, estimated to be worth in the region of $250 billion (varies depending on source). Within this, Moncler is positioned between entry-level luxury brands and traditional luxury houses.

While the luxury market comes with its own set of risks: Fashion risk, key-man risk (creative director & CEO (on occasion)), inventory risk, and short-termism (sacrificing brand image for short-term financial performance). On the whole, industry participants generate highly attractive financial characteristics as a result of the psychological response that luxury products evoke (discussed in part 1), allowing the industry to price products well in excess of the functional value of the goods sold (pricing power), translating into high margins and attractive ROIC.

Despite the luxury market as a whole being well represented, the outerwear segment is uncrowded, allowing Moncler to achieve superior economics.

A consumer looking for a quality down jacket will not be lacking choice; these offerings will typically come from 2 distinct groups:

Premium brands specialising in outerwear (Canada Goose, Patagonia, Arc’teryx, etc.)

Luxury fashion houses (Louis Vuitton, Burberry, Prada)

However, as I will argue, there are no true competitors to the Moncler Brand.

Premium Brands

Within this premium category, Canada Goose, which similarly utilises the highest quality down and materials and has an instantly recognisable logo, is arguably the brand that gets compared to Moncler the most by investors. Prices of Canada Goose jackets typically range from $700-$2,000, on average several hundred dollars cheaper than Moncler ($1,500-$2,700+). While the core products are somewhat similar in price, the most significant difference is how the two brands present themselves. Canada Goose is all about functional quality, from the presentation of the website to product descriptions, the brand justifies higher prices with promises of functionality: temperature ratings (warmth), number of pockets, adjustability and waterproofing. The company also maintains a significant wholesale presence, prioritising shelf space over brand control.

Everybody say that the Parca guys came from Canada is our major competitor. I feel they are very good company, but I don't think they compete with us. They are very functional. They are very not designing, very, what I say, premium on North Face.

Although both brands sell puffer jackets at their core, Moncler emphasises a blend of function, beauty, quality, and innovation. This meticulous focus on brand image can be seen in every aspect of the business, from the product to Boutique stores, highly selective wholesale locations, marketing, and the website.

Although each difference is only minor in itself, the combined difference is profound. Canada Goose is selling a promise of protection and performance, while Moncler is selling fashion, prestige and exclusivity, evoking a different emotional response. This positioning has allowed Moncler to be twice as large as Canada Goose, yet 10 times more profitable!

Luxury

The other type of competition is from traditional luxury houses, selling complementary products to their core collections, similar to Moncler expanding beyond Outerwear.

Although Moncler is the leader in the category, Louis Vuitton, Prada, Gucci, Dior, Balenciaga and more all offer puffer jackets within a similar price range to Moncler. Similar to Moncler, these items will only be found within their highly controlled distribution networks of directly operated boutiques and select wholesale channels, delivering consumers a luxury experience.

So how does Moncler differentiate itself?

The luxury houses (mentioned above) traditionally emerged from bespoke craftsmanship for elite clientele, building their reputation in a certain discipline. Moncler, on the other hand, as outlined in part 1, has a utilitarian founding, supplying the necessary survival equipment to the elite mountaineering community of the 1950s. Today, this and the achievements of the subsequent expeditions provide the narrative of “born to keep people warm”, a story that no other brand can replicate.

Moncler can anchor itself to this alpine heritage while also embracing a forward-thinking luxury strategy, which they define as “new luxury”. This strategy embraces immersive retail experiences, digital-first communication, and community obsession that allows Moncler to disrupt the status quo of traditional luxury houses (as discussed in Storytelling above).

Moncler Genius and its digital transformation have been a significant driver of this disruption, creating a platform of extraordinary creativity and collaboration, elevating the brand and attracting consumers of all demographics. Moncler’s ability to disrupt the traditional conventions of a luxury brand allows it to generate significant brand buzz, maintaining its position as a leader in outerwear, while continually elevating its brand.

From the point of view of a luxury brand, the prospect of competing at the edge/outside of their core competency against a brand that has 70 years of heritage and a strong culture of reinvention, pushing boundaries and agility in a product category that is likely not a meaningful driver of financial returns is an uphill battle.

In the eyes of Moncler (and to some extent, it may be true), their only true competitor is themselves (within outerwear). The brand’s strength continues to increase, as highlighted in storytelling. The number of consumers in Moncler’s database has increased ten-fold; despite this, repeat purchases have almost doubled, highlighting Moncler’s growing customer loyalty.

The combination of a highly attractive industry, unique positioning and a strong brand allows Moncler to generate high and consistent margins, surpassed only by Hermès.

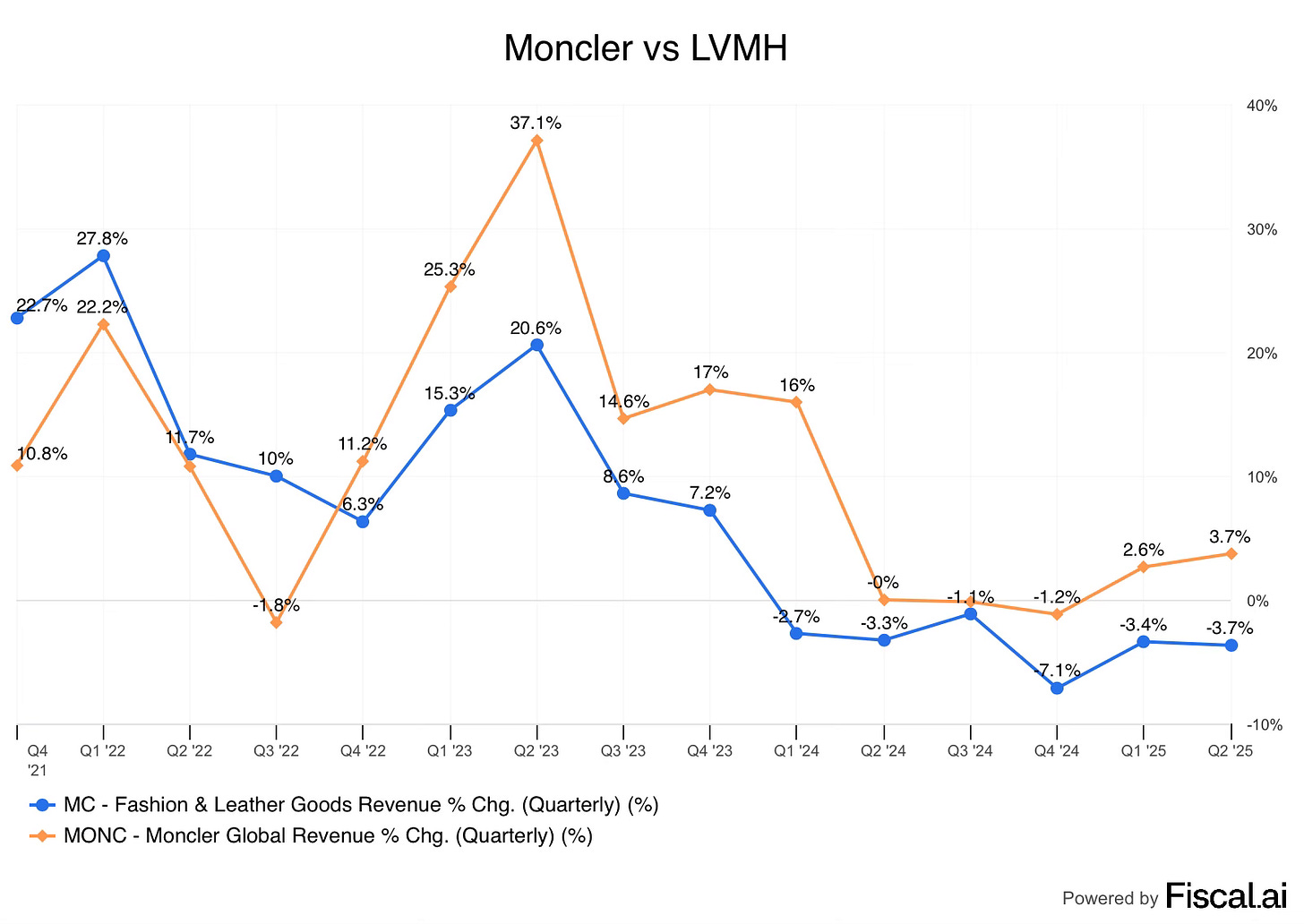

Another sign of Moncler’s brand strength is the resilience demonstrated over the past few years. As luxury brands have dealt with slowing demand from the weakening consumer, growth and margins have declined. Moncler, on the other hand, has seen slower yet positive growth, allowing the company to continue gaining market share.

Moncler has also demonstrated world-class store economics; the company has seen improving store utilisation, achieving sales of €38,000 per square metre ($4,130 per square foot). Despite only opening their first store 15 years ago, these impressive store metrics are ahead of the majority of luxury brands, such as Tiffany & Co., only falling short of brands such as Apple and Hermes (€50,000), which generate some of the highest sales per square foot globally.

Finally, ROCE has consistently been above 30% before the Stone Island acquisition (which impacted ROCE), demonstrating a durable competitive advantage.

Durability

This unique position in the outerwear category is likely sustainable. The company is focused on the brand image above all else, management has the right attitude towards surviving fashion, and the company has the right balance between its alpine heritage (that can’t be replicated) and a forward-thinking digital approach that keeps them relevant.

A new or existing competitor will therefore find it extremely difficult to elevate their brand into a similar category to Moncler, even if a brand could, over time, it would take decades of brand building to earn the same prestige that Moncler has built.

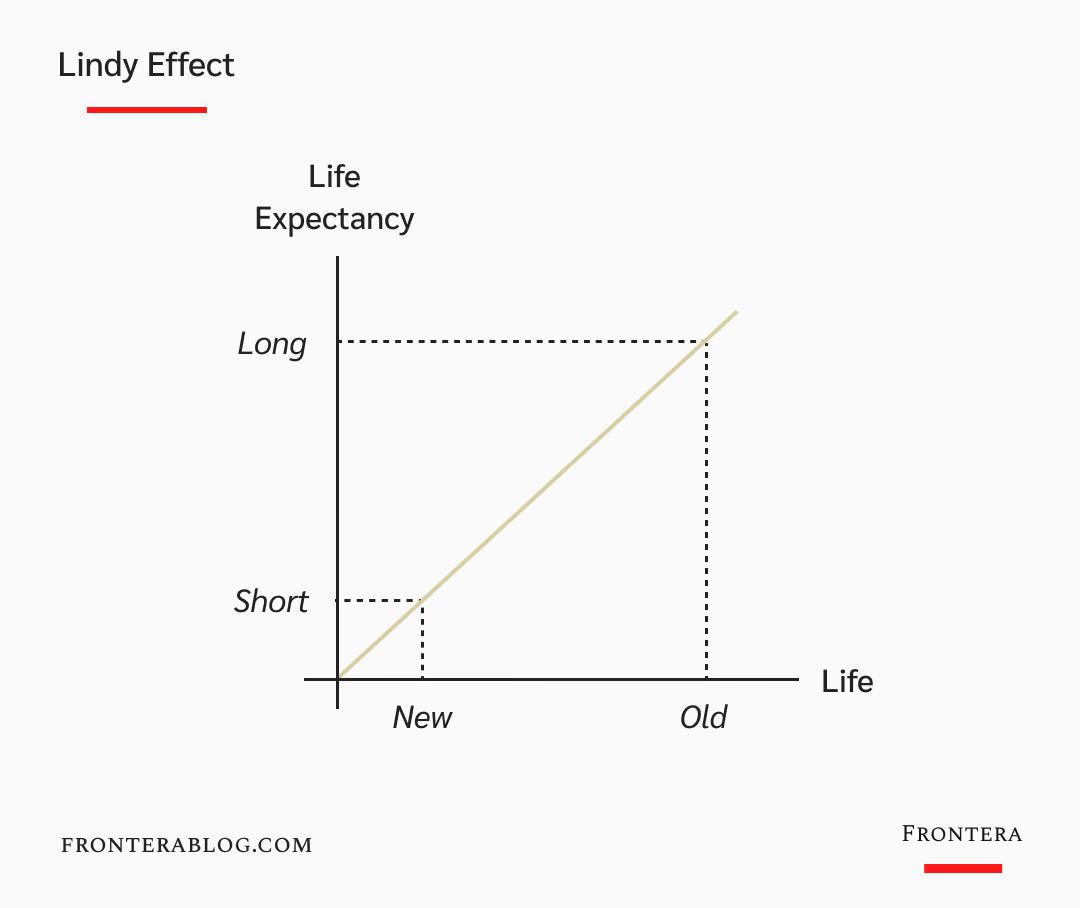

As the brand gets older, this advantage continues to widen, and the Lindy effect comes into play.

The Lindy effect is a useful mental model; it states, the future life expectancy of some non-perishable items, like a technology or idea (or brand), is proportional to their current age. This means the longer something survives (in this case, the Moncler brand), the longer its remaining life expectancy.

Longevity implies a resistance to change, obsolescence, or competition, and greater odds of continued existence into the future.

So, while Moncler will have to continually adapt and innovate, as they have in the past, their brand has already stood the test of time, suggesting a sustainable competitive advantage.

Opportunities

Unlike the average company, Moncler has a great deal of control over how fast it can grow in any one year, thanks to its strict volume controls and pricing power. Historically, Moncler’s growth has been two-thirds volume and one-third pricing power.

Contributing to volume growth over the past decade has been the directly-operated store network expansion, E-commerce investments, geographic expansion (beyond Europe), expansion beyond the outerwear category and initiatives such as Moncer Grenoble and Genius. This growth was offset slightly by the rationalisation of the wholesale network (headwind).

Industry tailwinds

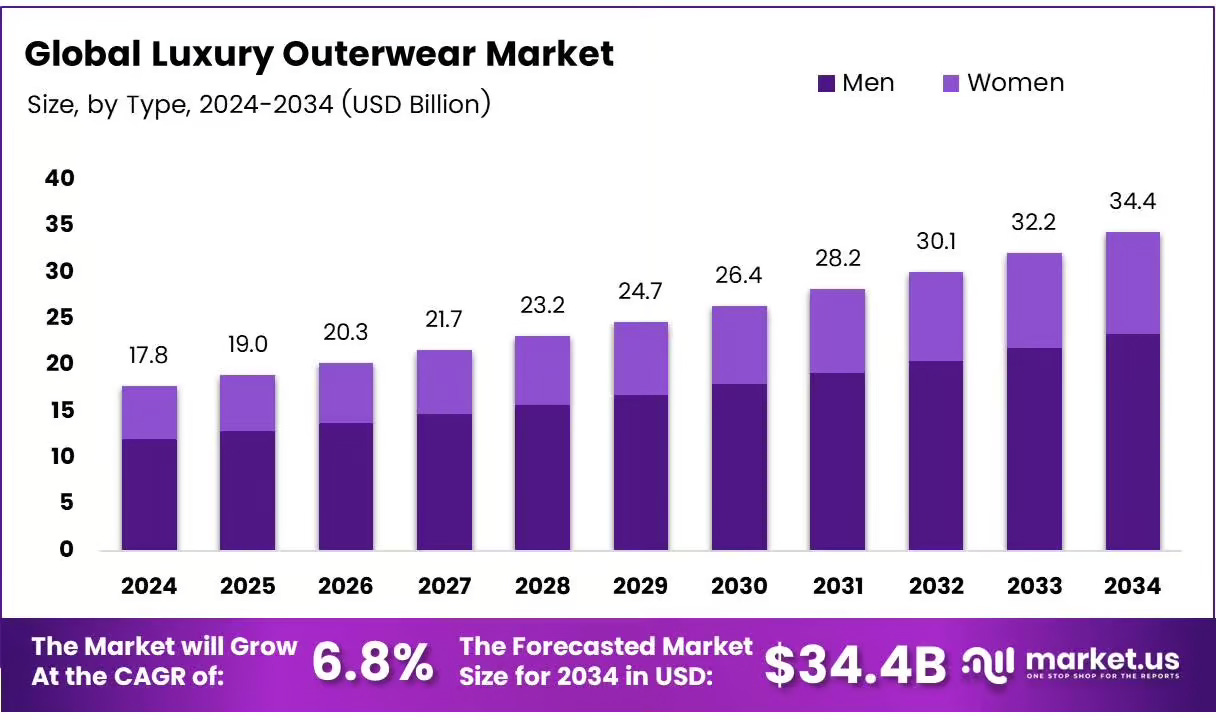

Bolstering the internal efforts, the growth of the luxury outerwear market has been a tailwind, driven by casualisation trends and a higher demand for luxury goods. From a segment created by Moncler in the early 2000s, the outerwear category is reportedly worth just under $20 billion today.

These tailwinds should continue; multiple firms estimate that the outerwear category is expected to grow in the region of 6% annually, driven by a continuation of the trends mentioned above.

The core outerwear category will benefit from this secular tailwind. As the market for these products expands, Moncler will be able to selectively increase annual volumes and price (over time) in a disciplined fashion, once again ensuring that it never fully satisfies demand, in turn driving better store economics.

Beyond the core outerwear category, Moncler should be able to sustain growth rates in excess of industry growth from geographic expansion and by expanding into adjacent categories, such as knitwear, footwear, leather goods, accessories, eyewear, enfant and more.

Geographic expansion

Moncler’s expansion of its directly operated store network has been transformational over the past 15 years. Despite new store openings slowing down, Moncler is underpenetrated in certain geographic regions, such as the Americas and Asia.

The US has consistently been highlighted as an underpenetrated region for the Moncler brand, especially within central states. Currently, Moncler has 26 DOS and 10 shop-in-shops. In comparison, Louis Vuitton has 121 directly operated stores in the US alone.

The same story is true in China, as of 2024, Moncler has 46 stores in China, modestly below the 62 of Louis Vuitton. However, Moncler believes they are under-distributed in terms of size and quality of stores. Beyond the physical network, Moncler is working to enhance its digital presence in the region, strengthening collaborations with Tencent’s WeChat.

Greater exposure in these regions should attract more consumers to the brand, driving increased demand.

Expansion beyond the core

While some investors may argue that expanding beyond the core is risky or brand dilutive, a look back at history would suggest otherwise.

Hermès, originally a saddler and harness maker, later expanded into the iconic Birkin and Kelly bags. Although these are still the core products today, the company has diversified into ready-to-wear clothing, accessories, silk and textiles, perfume and beauty, watches and more. Today, the core Leather goods and Saddlery segment accounts for “only” 42.6% of revenue.

The same diversification can be said for Louis Vuitton (originally a luggage maker), Gucci (leather goods and luggage maker), Prada (Leather Goods), Giorgio Armani (Men’s suits), the list goes on. This product expansion is therefore the norm, and with Outerwear accounting for 80% of brand revenue, Moncler still has a long way to go.

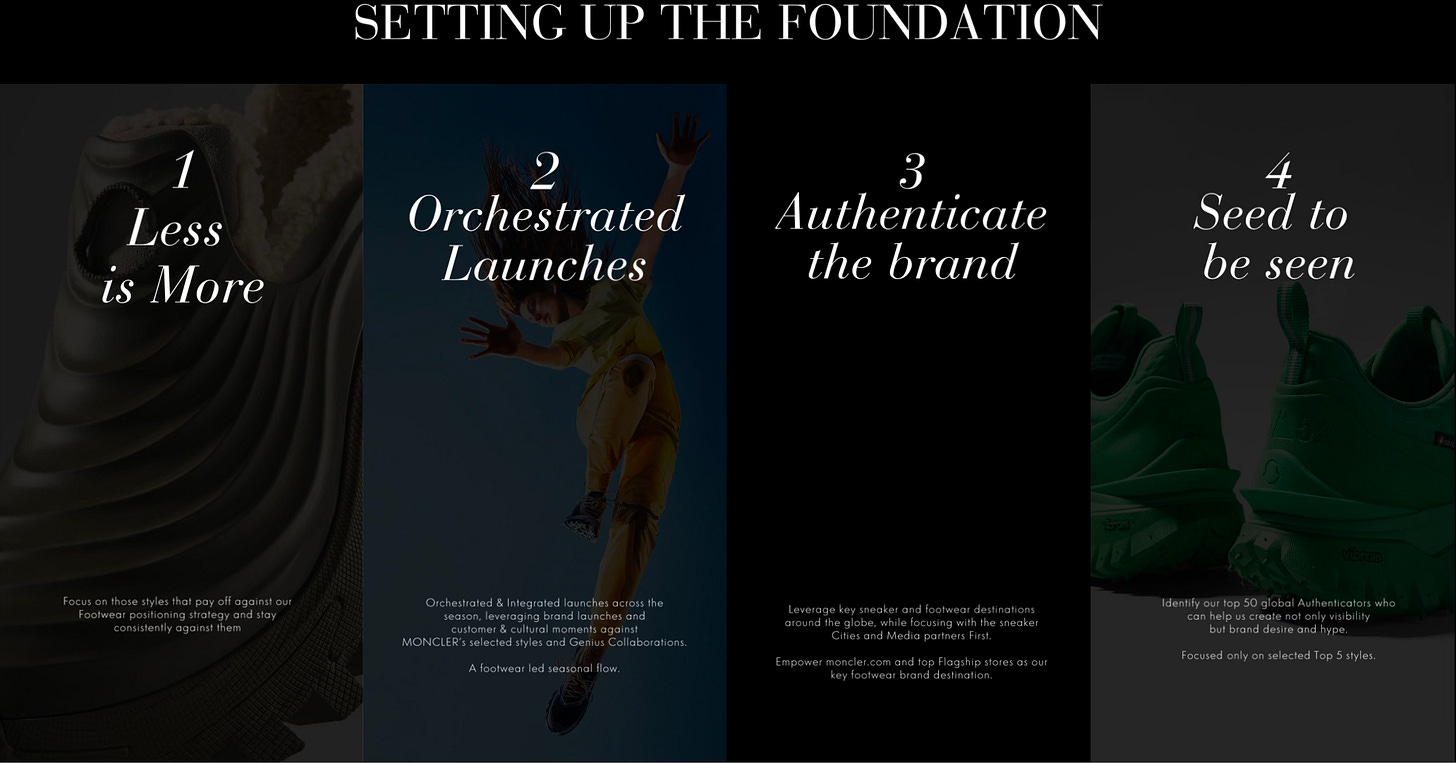

To expand into these categories, Moncler is doing all the right things to build credibility within these adjacent categories. To start with, Moncler is hiring dedicated creatives and experts for the relevant categories, creating a few quality products that enhance the overall brand rather than full collections, earning their right to be in the product category. These introductory collections are targeting locations where Moncler believes they will resonate the most. The company is also providing the tools and training for client advisors to better serve clients.

In connection with this expansion, Moncler is expanding its selling space to increase the visibility of these products. Historically, the company has targeted 10-15 store openings; however, this figure has shifted to predominantly relocation and remodelling, with only a couple of new store openings annually.

The average size of a boutique, as of 2023, was 187 square metres (2000 square feet), an increase from 160 square metres (1700 square feet) in 2019. Moncler believes the ideal format is between 200 & 250 square metres, representing a 33% increase from today’s levels. Since going public, Moncler has increased selling space in the low-mid double-digit range, but with the focus shifting from new store openings to upgrading the current footprint, overall selling space increases will be in the mid single-digit range.

The company has already made strong progress within knitwear, its first adjacency. Knitwear has consistently been the fastest-growing category, thanks to its increasing visibility in stores. Categories such as Footwear and Eyewear, along with the technical category, Grenoble, have shown strong growth as well. Similar to other luxury brands, adjacent categories could end up accounting for more than half of brand revenue.

Pricing Power

Historically, Moncler has been hesitant to raise prices. Throughout the 2010s, they have been focused on narrowing the pricing gap that existed from the high-priced Asia, predominantly Japan (almost double), to the lower-priced Italy. Today, this gap has been reduced to within an acceptable limit.

Beginning in 2022, Moncler began to implement annual price increases (10% in 2022, and mid single digits in 23, 24 and 25) to offset inflation. These increases were “well accepted by consumers”, demonstrating the pricing power the brand possesses.

Despite their ability to raise prices, Moncler is cautious not to exercise this too much. Instead, they would prefer to remain “attractive for younger generations”. This strategy highlights a focus on long-term brand durability, rather than isolating demographics for short-term gain. Although price increases will be kept to a minimum, Moncler will still be able to achieve similar gains through product mix, with adjacent categories playing a major role in this.

There are probably some limits, but we have not touched them now

Moncler believes the brand still has plenty of untapped pricing power ahead. Going forward, volume and price will likely contribute equally (50/50) to the growth rate. But, the overall growth rate will likely be lower than the historic 14.6% CAGR.

Long runway for Sustainable growth

Today, Moncler has annual revenues of €2.7B, several multiples below some of the largest European luxury brands: Louis Vuitton estimated €20B, Chanel €16.2B, Hermès €15B and Gucci €7.7B. While I am not predicting Moncler will reach those lofty levels, it demonstrates that if Moncler can execute on its core outerwear segment and diversification efforts, there is plenty of headroom for growth in the large luxury market, which should drive sustainable growth over many years/ decades.

Closing Thoughts

If you have made it this far, thank you!

Moncler is a fascinating company. The company has demonstrated outstanding economics, backed by a strong brand and unique positioning. The brand still has plenty of untapped growth ahead, which should drive sustainable growth for the overall business for many years to come.

In part 3, I will discuss Stone Island, a currently small part of the business, that could grow in size dramatically over time if Moncler can execute a similar playbook that revived Moncler, providing upside optionality.

Your support is greatly appreciated. A like, comment, and subscription go a long way!

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment