October portfolio

Welcome to the October portfolio update!

Substack Update

In October, I published a two-part deep dive into Charter Communications ($CHTR), which can be viewed using the links below.

Charter Communications: Deep Dive Part 1

Charter Communications, a cable operator, was once a favourite among some of the best investors, with names such as Chris Hohn, Bill Nygren, Bryan Lawrence, and many more all holding sizeable positions throughout the recent past. However, in recent years, the company’s core broadband business has come under pressure, mainly due to intensifying competiti…

Charter Communications: Deep Dive Part 2

Welcome to part 2 of this deep dive into Charter Communications.

To access all previous deep dives, links are available below.

Evolution (1, 2, 3 + update), Airbnb (1, 2), Crocs (1), Paycom (1), Xpel (1, 2), Moncler (1, 2, 3), Charter Communications (1, 2)

I am currently working on three different posts that I hope to release shortly:

Deep Dive into Judges Scientific £JDG

Reflections on Charter Communications CHTR 0.00%↑

An update on Evolution AB EVO 0.00%↑

Cumulative performance

My investment record dates back to November 4, 2020. Since its inception, I am currently ahead of the S&P 500, my benchmark:

My portfolio: +106.55% (15.62% annualised rate of return)

(Note: returns are tracked across 3 brokerage accounts; calculations to combine these into one figure may contain mistakes. Calculation method remains consistent.)

S&P 500: +98.65% (14.75% annualised rate of return)

While I am happy to be ahead so far, a longer period, likely decades, is required to determine whether this is luck or skill.

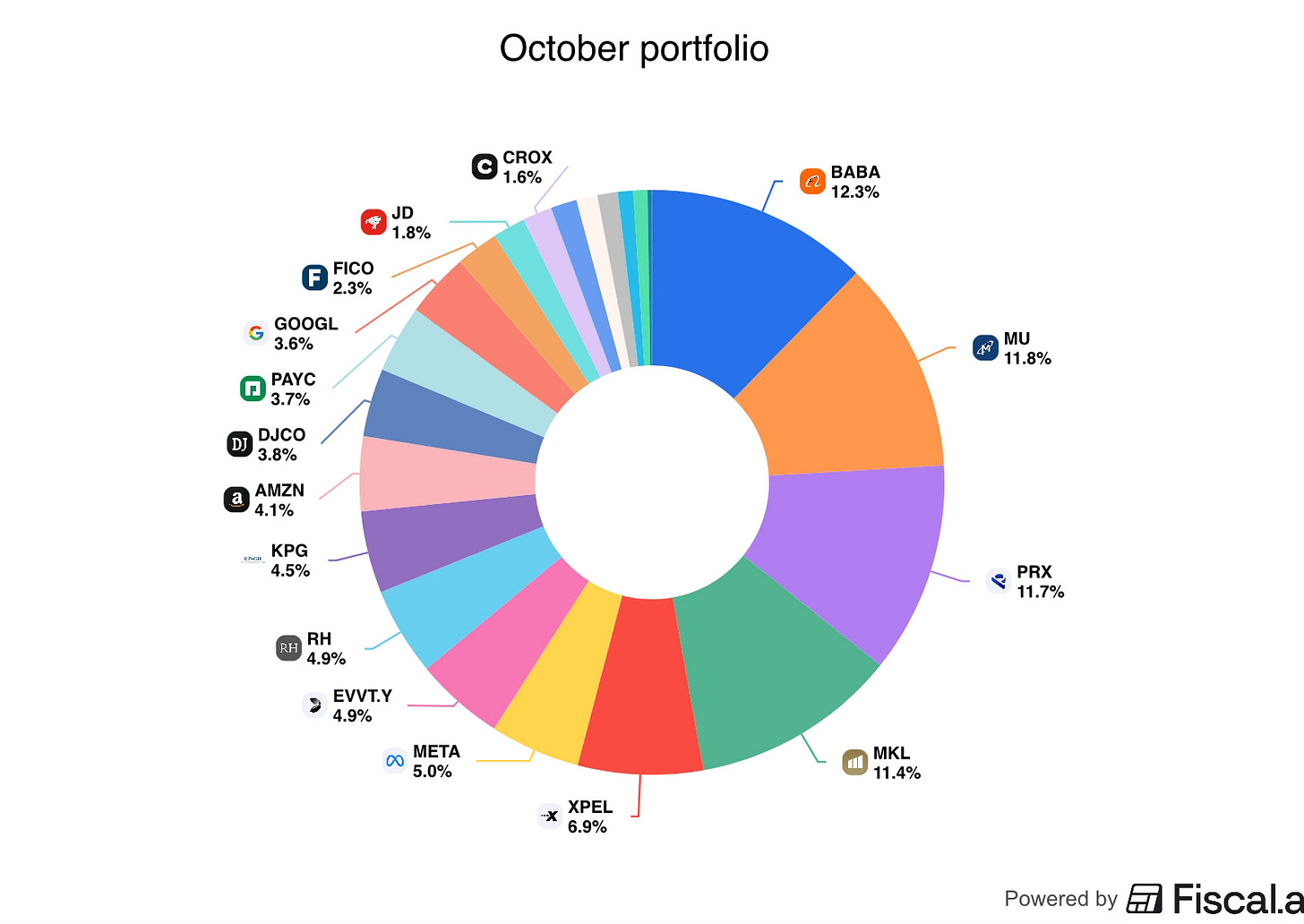

Portfolio

Concentration

“The way to win this game is extreme patience and extreme selectivity.” - William Green.

Top 5 positions: 54.1% of portfolio

Top 10 positions: 77.5% of portfolio

Total positions: 22.

The portfolio continues to have a long tail of portfolio names (12) that contribute very little to the overall performance. While it would be easy to consolidate these names, I would like to do it in a deliberate and methodical manner. Currently, each holding has a reason to be held. Over time, as a reason to sell emerges (broken thesis, overvaluation, better opportunity), I will work down the number of holdings in this long tail to a total of 12-15 names.

Investable Universe (Watchlist)

Airbnb ABNB -1.15%↓

Moncler $MONC

Judges Scientific £JDG

Judges Scientific has joined my investable universe. Although I haven’t finished my deep dive into the company, I feel confident that if the opportunity presented itself, Judges is a company that I would like to own at the right price.

Transactions

During October, I made no purchase or sale decisions.

In my deep dive on Charter Communications, I noted that I will continue to hold the company; however, it will be a source of cash should a more attractive long-term holding arise.

Performance

Top Performers

Micron Technology: +19.1%

Alphabet: +14.6%

Amazon: +11.3%

Top Detractors

Fiserv: -47.7%

Evolution AB: -16.9%

RH: -16.9%

During October, the portfolio and the S&P 500 both increased, continuing to make all-time highs. However, as earnings season started in the final week of the month, significant divergence began to emerge.

Holdings such as Evolution AB, Fiserv, and Charter Communications dropped meaningfully, while big tech names such as Amazon and Alphabet continued to post strong results and subsequent stock gains.

I plan to provide separate posts on both Evolution and Charter that will cover the most recent struggles.

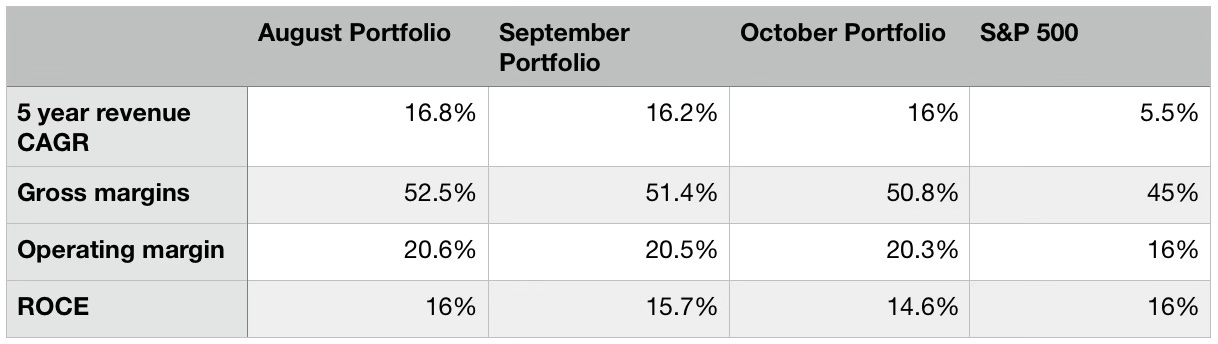

Portfolio characteristics

The portfolio continues to post significantly better results across key metrics, suggesting a higher level of quality versus the average business, but the metrics have declined over the past quarter.

I view this as a combination of portfolio weighting changes and the natural ebbs and flows of quarterly results.

I believe the portfolio continues to be extremely well-positioned; it has consistently better quality metrics while trading at a cheaper valuation.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment

Don’t you think you have to many positions?