Welcome to this deep dive on Paycom PAYC 0.00%↑…..

Introduction

Paycom is a leading provider of cloud-based Human Capital Management (HCM) software focusing on midsize to large organisations; the company aims to simplify HR and Payroll through technological innovations.

The business was founded in 1998 by founder and current CEO Chad Richison and is headquartered in Oklahoma. The company currently serves over 37,500 clients and stores data on over 7 million employees.

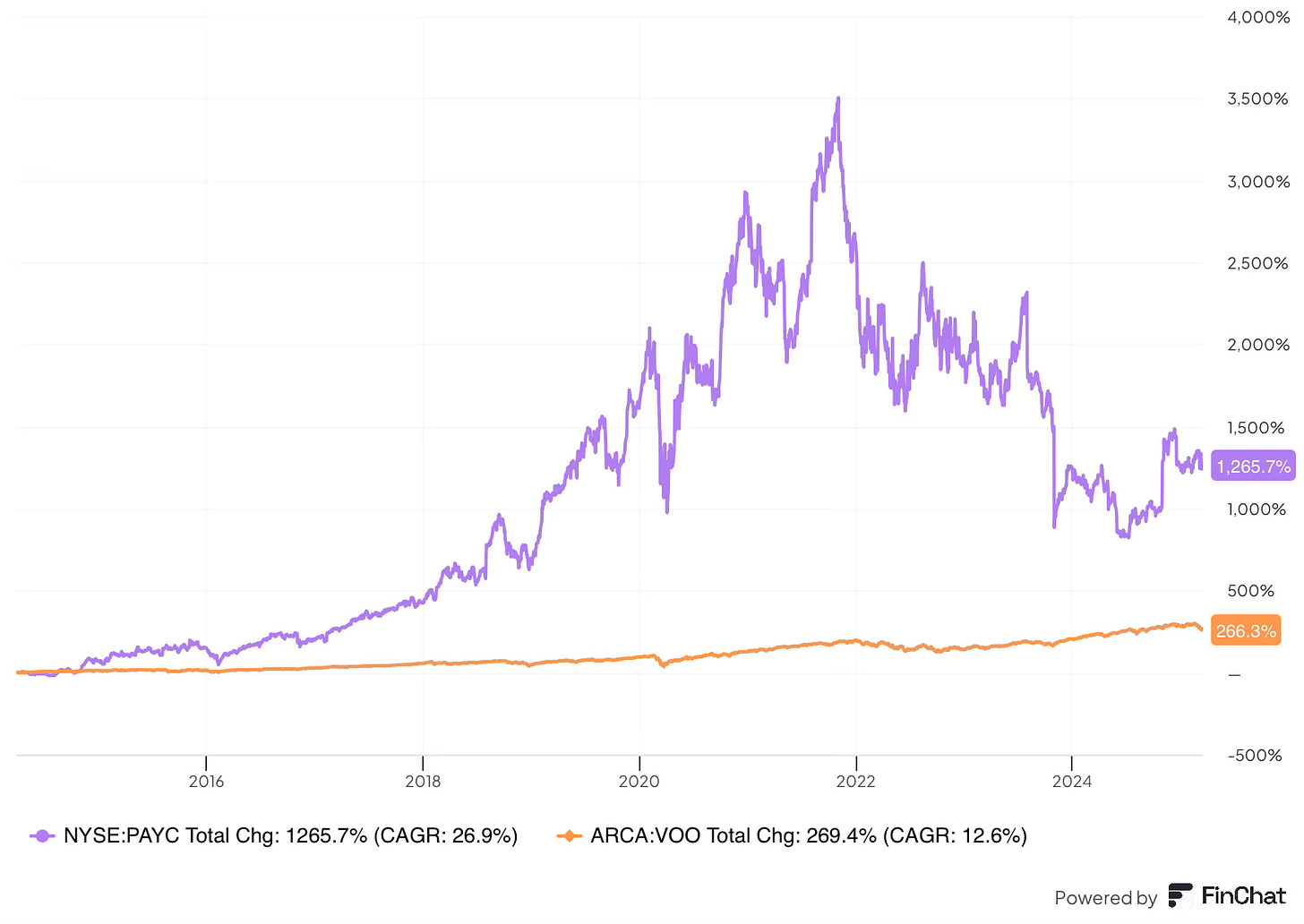

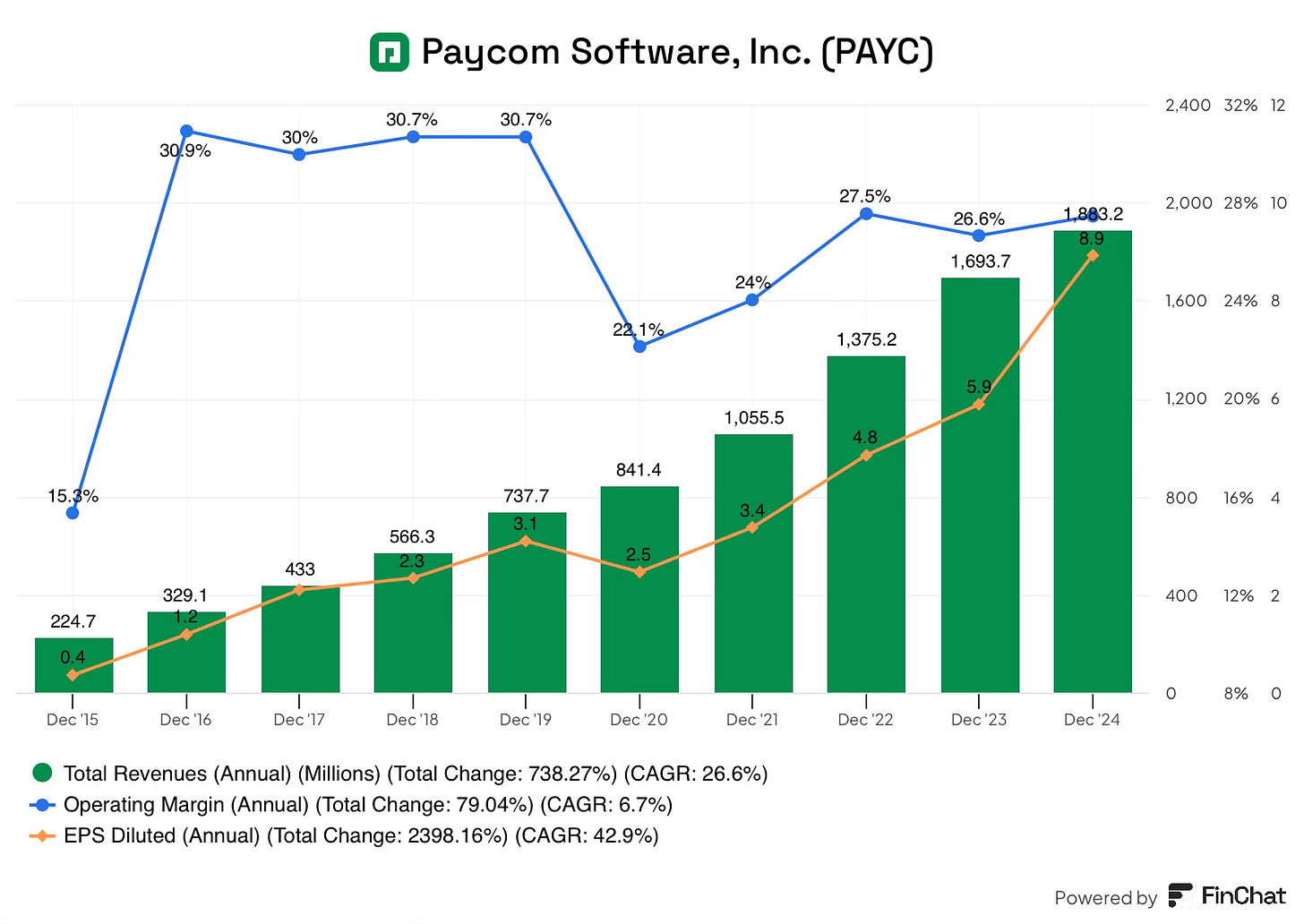

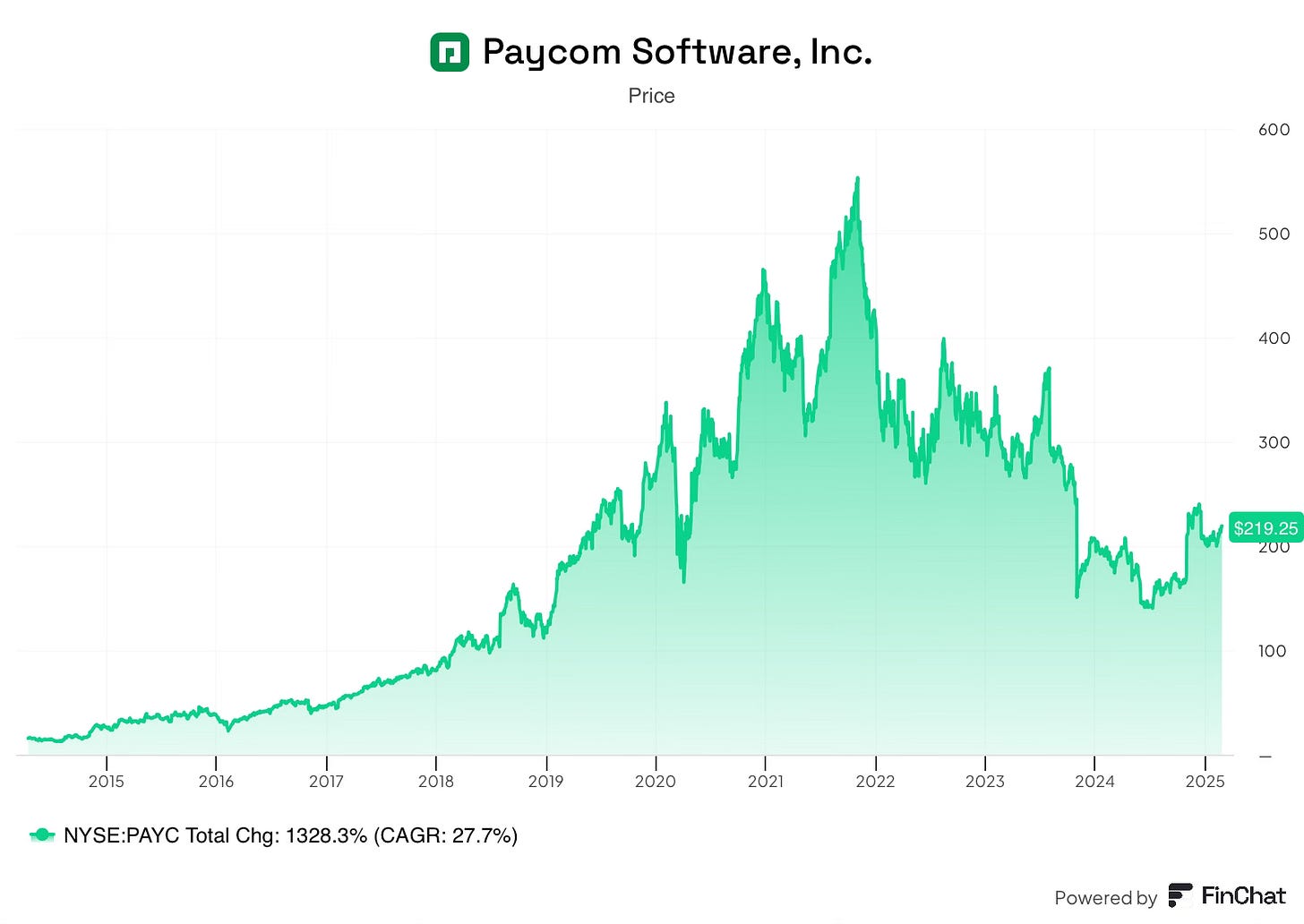

Paycom went public in 2014, and since then, the stock has rewarded shareholders handsomely. A $10,000 investment at IPO would be worth $145,000, compounding shareholder capital at 27% annually!

Despite the strong stock performance, shares peaked in 2021, briefly touching $550. For the following 4 years, shareholders have been on a wild ride, with shares crashing 75%; the stock remains down 60% today.

This drawdown is due to a revenue slowdown, caused by the rollout of Paycom’s new flagship payroll product, Beti. This product, despite being a superior way to do payroll, has cannibalised low-quality revenue while shifting focus away from cross-selling opportunities to client utilisation.

Paycom is an interesting opportunity, it has the potential to be a “long-term compounder”. The business has a strong track record of superior financials driven by market share gains, an attractive business model and a superior product from years of innovation, which has led to high switching costs.

The management team is founder-led and has demonstrated a strong track record of execution driven by organic innovation. Additionally, the company has demonstrated that they are capable of disciplined growth, leading to industry-leading gross margins. In 2023, the company initiated a dividend, which will likely grow in the future.

Providing the assessment that the slowdown is, in fact, temporary, the business has a long runway for re-investment. The business currently has less than 5% market share, which will likely increase in the future, driven by its innovation-led strategy. In 2023, the business also expanded internationally, expanding its addressable TAM, which should sustain growth over the coming decades.

In this deep dive, I will cover the most important aspect of the business to help long-term investors get up to speed with the investment case for Paycom.

Contents

In this in-depth deep dive, I will cover:

Business Overview

Understanding Paycom

The Product

Business model

Vertical integration

Clients

Competitive advantage

Industry Dynamics

Quality Financials

Revenue slowdown

Management

Re-investment opportunities

Valuation

Risks

If you enjoy this deep dive or any of my research, please subscribe and share; your support helps the channel reach new people and grow!

Understanding Paycom

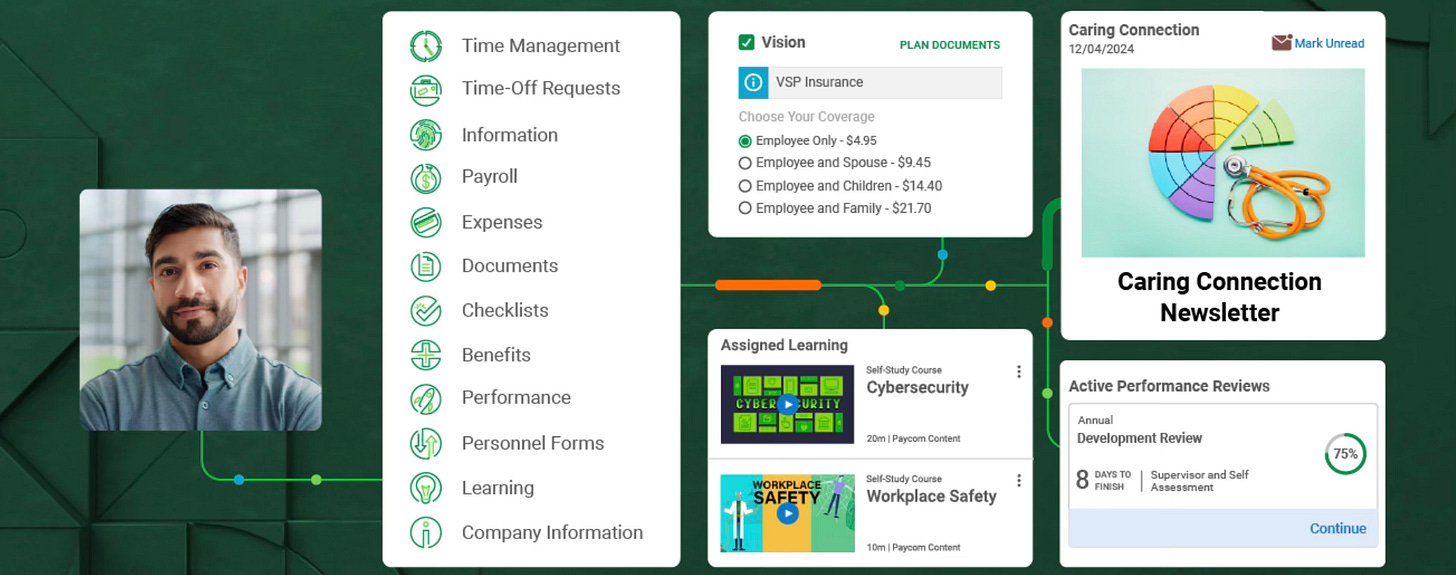

Paycom is recognised as a leader in the Human capital management (HCM) industry because of its track record of innovation. The company provides cloud-based payroll and Human Capital Management (HCM) software that allows a business to manage its entire employee lifecycle from recruitment to retirement with ease through a single database. The company differentiates itself by leaning into employee engagement and automation features.

To HR departments, Paycom provides a suite of applications and analytics through a single database, covering tasks such as Payroll, Talent Acquisition, Talent management, HR management, and Time & Labour management.

To employees, Paycom’s user-friendly software allows users to self-manage their HCM activities, reducing the administrative burden on employers while simultaneously engaging employees, leading to higher employee retention.

Currently, most organisations are served by multiple providers in an attempt to replicate a full-suite HCM solution. The result of this approach, is poor system integration, weak data integrity, low scalability, high costs and extended delivery times for new features. Paycom’s full suite of solutions removes these friction points, saving organisations time and money, and driving industry-leading ROI for clients.

The Product: A story of innovation

Paycom’s story began in 1998, when following a stint at ADP and a local payroll company in Oklahoma, Chad Richision saw inefficiencies within traditional payroll providers. In response, he founded Paycom. At the time, Paycom was one of, if not the first fully online payroll providers.

Initially focusing on payroll, Paycom soon built out capabilities to provide a full suite of HCM solutions (2001). Throughout the company’s history, they have built out functionality and innovated, changing the way payroll is done, this is marked by 3 key product innovations; the move online (Paycom founding 1998), the introduction of the single-database architecture (pre-2011) and employee driven payroll (a gradual process over the late 2010’s period).

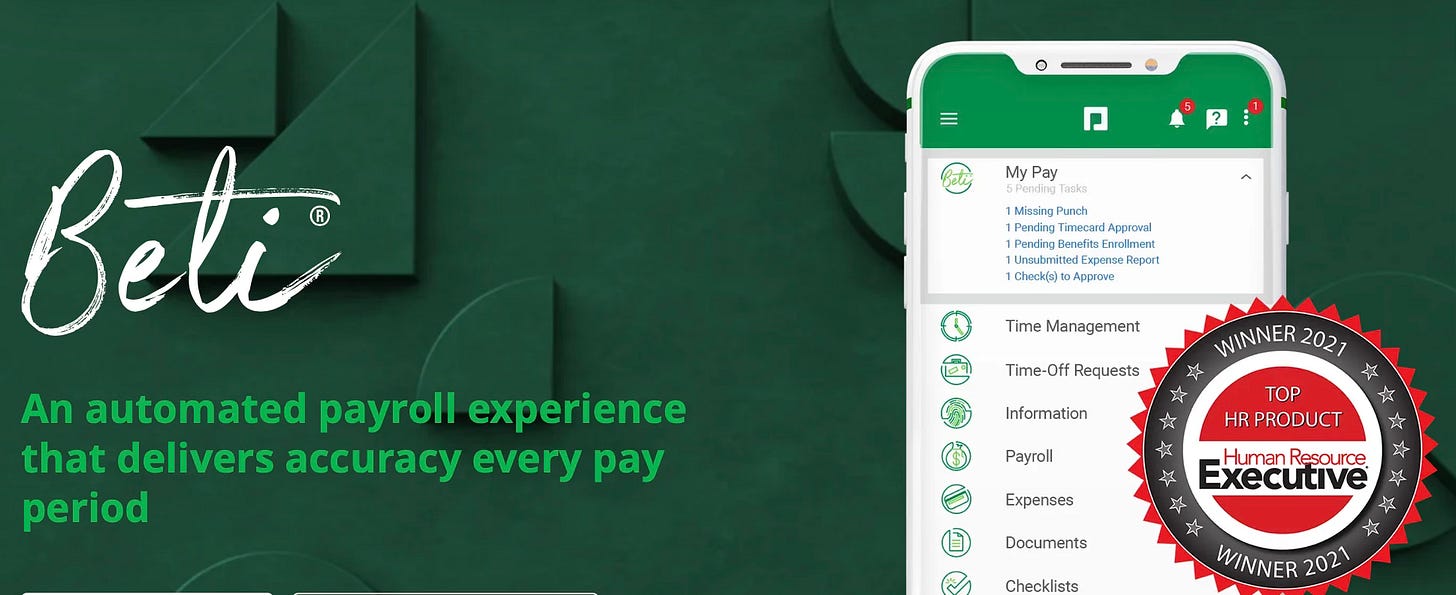

Currently, the business is in the fourth wave of change, automation, marked by the introduction of Beti in 2021 and GONE shortly after.

The success of these innovations can be seen in Paycom’s history of consistent market share gains from industry leaders ADP and Paychex.

Product offering

Paycom offers 34 modules with Payroll being the core offering. All new clients are required to adopt Paycom’s payroll solution, Beti. Beyond this, clients can pick and choose any additional modules for their specific business needs.

Payroll - Beti (Better Employee Transaction Interface)

Beti is an employee-driven payroll solution that delivers the most accurate payroll in the industry, saving HR departments significant time and money. Additionally, Beti offers employees complete transparency, allowing them to proactively review and resolve any issues before payday, increasing employee retention.

I will discuss Beti’s specific advantages in greater detail later on.

HCM solutions

Paycom offers a comprehensive suite of HCM solutions, which can be configured for a client’s requirements with options that include:

Payroll services: Payroll and tax management, Paycom Pay, Expense Management, Vault, Everyday.

Talent acquisition: Application Tracking, Onboarding, E-Verify, Background checks, Tax Credit Services.

Talent management: Employee Self-service, Paycom Learning, Position Management, Compensation budgeting.

HR management: Government and Compliance, Benefits Administration, Enhanced ACA, COBRA Administration, Direct Data Exchange.

Time and Labour Management: Scheduling/Schedule Exchange, Time and Attendance, Time-off requests, and Labor allocation.

Global HCM

Historically, Paycom solely focused on the US market. However, due to popular demand from clients, the company introduced Global HCM and Native Payroll, these solutions are currently targetted to US-based employers with International operations, rather than specifically targetting foreign clients.

Global HCM: Global HCM encompasses all of Paycom’s domestic functionalities but is now available in 180 countries.

Native payroll: Native Payroll complies with all local laws and regulations for the specific jurisdiction and is currently available in Canada, Mexico, the UK and Ireland.

Business model

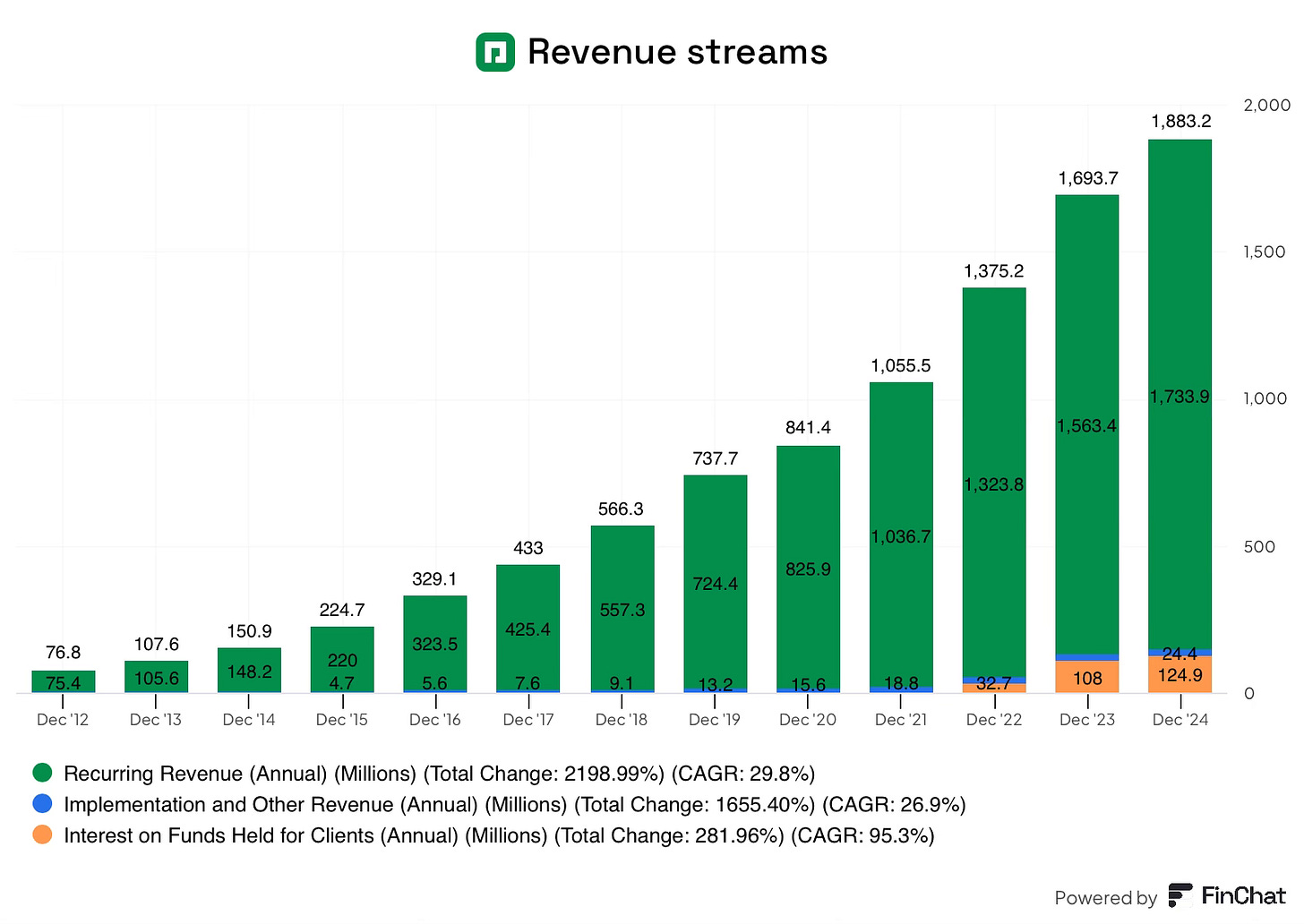

Paycom delivers its solution through a Software-as-a-Service (SaaS) business model, this recurring revenue stream makes up 92% of total revenue. The company charges a fixed fee per billing period (typically monthly), additionally, clients will be charged a variable fee based on the following factors:

Number of employees

Number of transactions

Number of modules a client utilises

Additional services, such as unscheduled payroll runs, background checks and verification services

This revenue model makes larger clients more lucrative.

Additional services have historically been a meaningful part of Paycom’s revenue (roughly 5% of the total). This revenue is mainly generated through unscheduled payroll runs, these occur when an employee’s payroll is incorrect and needs to be rectified. As I will explain later, the launch of Beti has eliminated most of this low quality revenue source.

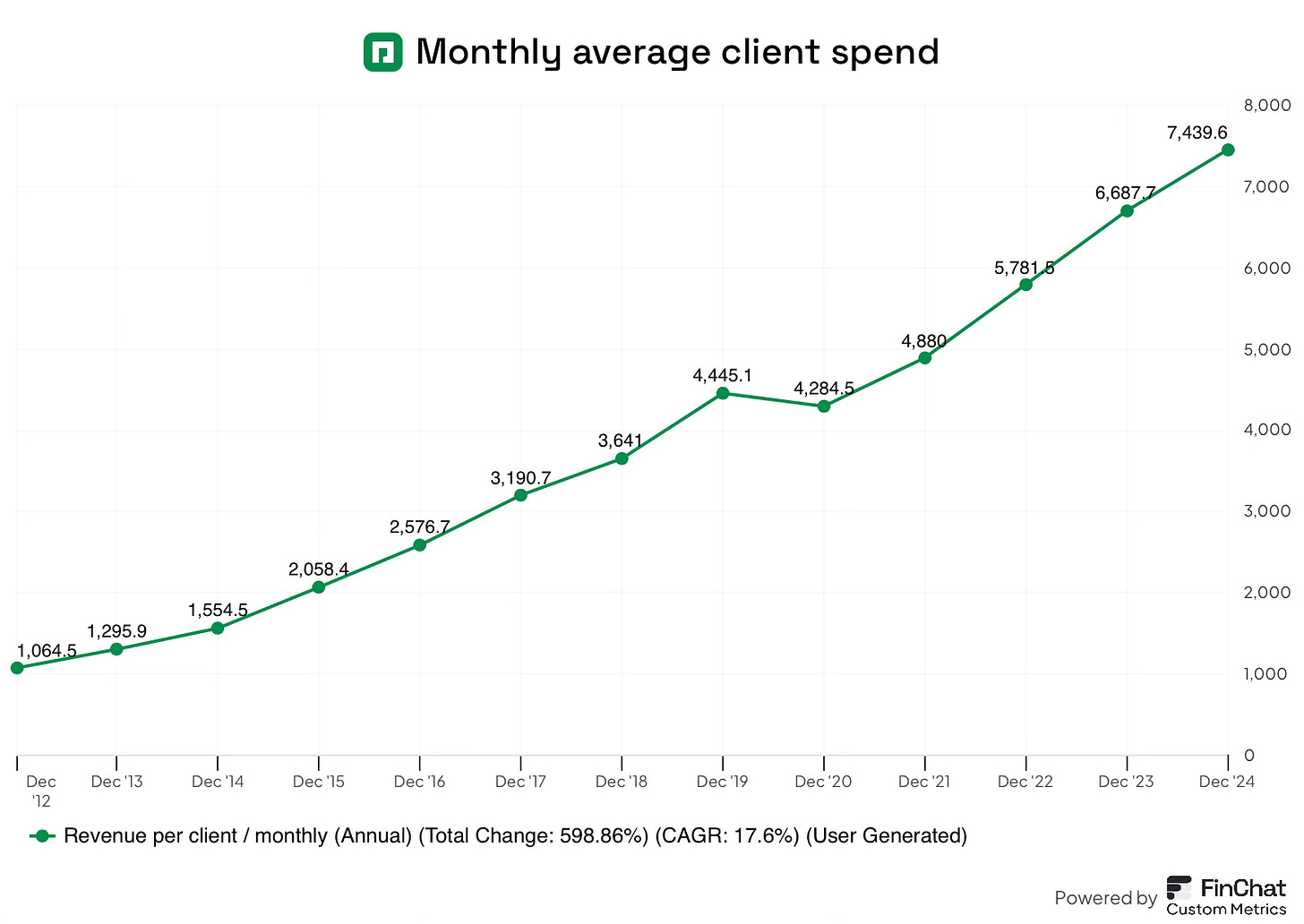

While pricing is discrete, the average Paycom client spends $7,400/month, with 7 million employees on record, this works out to be $20.9 per employee/month. As previously mentioned, this figure will vary between clients based on the above factors.

Client spend has been growing at 17% per year due to a combination of moving upmarket (more employees) and increased attach rate of applications (cross selling modules).

Interest on Funds held for Clients: To facilitate payroll and tax payments, Paycom collects funds from clients in advance of the payment date. During the period between receiving funds and distribution, Paycom invests this cash, typically into money market funds, US treasuries and commercial paper, generating revenue which accounts for 6.6% of the total. This revenue line is highly dependent on interest rates.

Implementation Fee: The remaining revenue (less than 2%) is from implementation fees, Paycom typically charges 10-30% of annual ARR as a one-time non-refundable charge, which is then amortised over 10 years.

From this point forward, I will solely discuss the recurring revenue segment in which the core product resides because the success of that product is what will determine the outcome for Paycom.

Vertical integration

Paycom has taken a deliberate approach to control every aspect of their business from product development, hosting data centres, dedicated customer support and selling through internal sales offices and teams.

Technical infrastructure: Paycom owns and operates three (soon to be 4 in mid-25) data centres in Oklahoma and Texas. While this approach increases organisational complexity, the strategic decision to control the tech stack has several key advantages that allow Paycom to achieve product superiority, these advantages include:

Higher margins, through scale economies

Enhanced security, reliability and redundancy of critical systems.

Superior performance of the product, through faster innovation and product updates.

Research & development: Unlike most software companies which reside in Silicon Valley, Paycom has located its R&D facilities in Oklahoma where the company can access high-quality talent at a lower cost. Despite this, the company spends significantly more than competitors on R&D, highlighting its extreme focus on product innovation. The company spends this budget on:

Developing new applications and enhancing existing features

Adapting to technological advancements

Responding to client and regulatory requirements

Paycom’s philosophy centres around solving current and future problems for clients. By interacting with clients proactively, the company delivers enhancements and new products that have been consistently early to market, making Paycom an innovator. The company has a strong track record of innovation with notable recent releases including; Beti, GONE, Global HCM and Native Payroll.

Additionally, the company released 5,400 product enhancements in 2023 alone.

The company has historically developed every solution in-house, while many competitors have grown inorganically. This in-house development is a significant advantage which allows the business to move faster and produce better products that can integrate seamlessly into their single database.

Go to market: HCM providers typically employ a mix of direct and indirect sales channels, such as partner networks and consultants. Paycom is different, relying solely on its own salesforce, which increases operating expenses but provides better messaging (enhancing conversion rates of new clients) and customer service through dedicated support.

There are several key components to these sales teams.

Field Sales teams: These are responsible for acquiring new clients. A team consists of a sales manager and 6-8 sales professionals. These sales personnel are incentivised through a one-time commission based on estimated future annual revenue after clients have been onboarded for a month.

Client Relations Representative (CRR): CRRs focus on managing client relationships, utilisation and selling additional applications to existing clients. They receive a one-time commission based on estimated future annual revenue from any new applications purchased.

Emerging Markets Representative: These representatives focus on businesses with less than 65 employees.

Sales Offices: Paycom strategically places sales offices in metropolitan areas. Paycom has sales offices in 41 out of the top 50 metropolitan areas. At the moment, these offices are typically only served by one sales team. Paycom currently has 58 sales teams.

Paycom typically hires candidates who have previous sales experience in non-HCM industries or those directly from college and university who have demonstrated an aptitude for sales; the majority of the salesforce has a four-year college degree.

The recruits are put through an intensive training course that includes instruction in accounting, business metrics, application features, and tax matters relevant to the target market. Continuous training is also provided through weekly strategy sessions and leadership development.

Paycom utilises several marketing programs that target senior finance and HR executives, technology professionals and senior business leaders.

Marketing programs include podcasts, webinars, blogs, and White papers, along with national and local television advertising campaigns.

Advantages to controlling operations

This approach likely leads to higher costs and complexity than competitors, which have typically acquired technologies, utilised third-party cloud providers and sold through partner networks and consultants.

However, in an industry that is typically characterised as “high risk low reward” controlling the entire process allows Paycom to;

Provide a higher level of security and control over client data.

Deliver a superior client experience from sales to onboarding to customer support.

Deliver a better product through seamless integration, reduced complexity, innovative products and client-led enhancements.

Additionally, over time Paycom can achieve operating leverage through scale benefits on its technical infrastructure and data centers, likely leading to higher margin potential.

Clients: moving upmarket

Paycom categorises clients in two ways:

Clients (37,543): This figures treats accounts with different taxpayer identification numbers as seperate entities, even if part of the same organisation, think subsidiaries.

Clients Parent company grouping (19,422): This method treats different accounts with the same decision maker as one, combining subsidiaries into one large group.

Over time, Paycom has been pulled upmarket towards larger clients. In 2018, the company targeted organisations with 50 to 2,000 employees; today, Paycom targets clients with between 50 and 10,000 employees, with a team also focusing on clients with over 10,000 employees. Paycom’s largest client has over 25,000 employees.

A third way of looking at client numbers is employee count, Paycom currently serves 7 million employees, and this number has been increasing at a faster rate than client growth due to the shift towards larger clients. The company only began disclosing this figure in 2021.

2024: 7 million

2023: 6.8 million

2022: 6.5 million

2021: 5.7 million

Given that revenue is highly dependent on the number of employees served, this figure is arguably more important than client numbers in the future. The continual shift upmarket has been a growth driver for the business in the long term.

Competitive advantage

Paycom’s primary competitive advantage is derived from its product which delivers industry leading ROI for clients. This product advantage is enabled by Paycom’s vertical integration which has allowed the company to gain market share and achieve industry leading revenue retention rates.

While the majority of Paycom’s features are similar in functionality to those of competitors, the company has differentiated its offering in several key ways, with each component only enabled by the previous differentiator, creating a structure that allows for future differentiation.

Single Database

Paycom has designed its product and infrastructure around a single database.

A single software or, more specifically, a single database, allows for a seamless flow of data and communication between tools. This is the only way to achieve true HR and payroll automation. It also eliminates the need for hopping between apps that require different logins, reentering data into each and the security risks that come with multiple entry points. - Paycom Website

This approach differs from competitors who often use multiple systems, linked together to mimic one database. By developing everything in-house and operating their own technical infrastructure, Paycom is able to deliver a superior experience for clients.

Not only does a single database provide a better experience for clients, but it also gives Paycom a key advantage:

Innovation: compared to businesses who rely on integrating disparate systems, having a single database allows Paycom to innovate at a faster pace, rolling out updates and new product features seamlessly.

Additionally, by having an entire company’s data in a single location, Paycom has a significant data accuracy advantage. This enables the company to introduce features such as Employee self-service, automation and AI tools that other providers can’t replicate, laying the foundation for further differentiation.

Be cautious of providers that claim to have a single software or database but are a patchwork of several systems designed to appear as one. - website

It is likely Paycom was built from the ground up with this architecture, however, press releases began mentioning it around 2011, either way, the company is the first mover in the industry. While smaller competitors, Paylocity and Paycor likely have a similar approach, large incumbents such as Paychex and ADP are still behind. As technology continues to evolve, these incumbents could fall further behind as they maintain multiple systems rather than focusing on product innovation.

Employee engagement

As I mentioned above, Paycom’s single database lays the foundation for further innovation such as employee engagement tools. For years, Paycom has been introducing new tools to empower employees to manage their own HR data and Payroll. Not only does this require new tools but also education and adaptation of clients to utilise these features, likely taking years to achieve.

By empowering employees to manage their own HR data, an organisation achieves the following benefits:

Improved accuracy: This may sound obvious but, the employee is the only person that knows their personal information. By extension, it makes sense for the employee to input and verify critical information. However, in most cases this doesn’t happen until after the employee receives incorrect payroll etc, causing frustration for the employee and time & money for the organisation to resolve. Paycom’s employee self-service tools empower the employee to ensure critical information is correct, reducing payroll errors, and saving the organisation time and money.

Cost savings: Employee engagement also reduces administrative costs. In a study by EY in 2018, they found that each HR data input cost an organisation $4.39, likely even higher today. If employees are able to input the majority of data, this saves clients significant amounts of money, increasing client ROI.

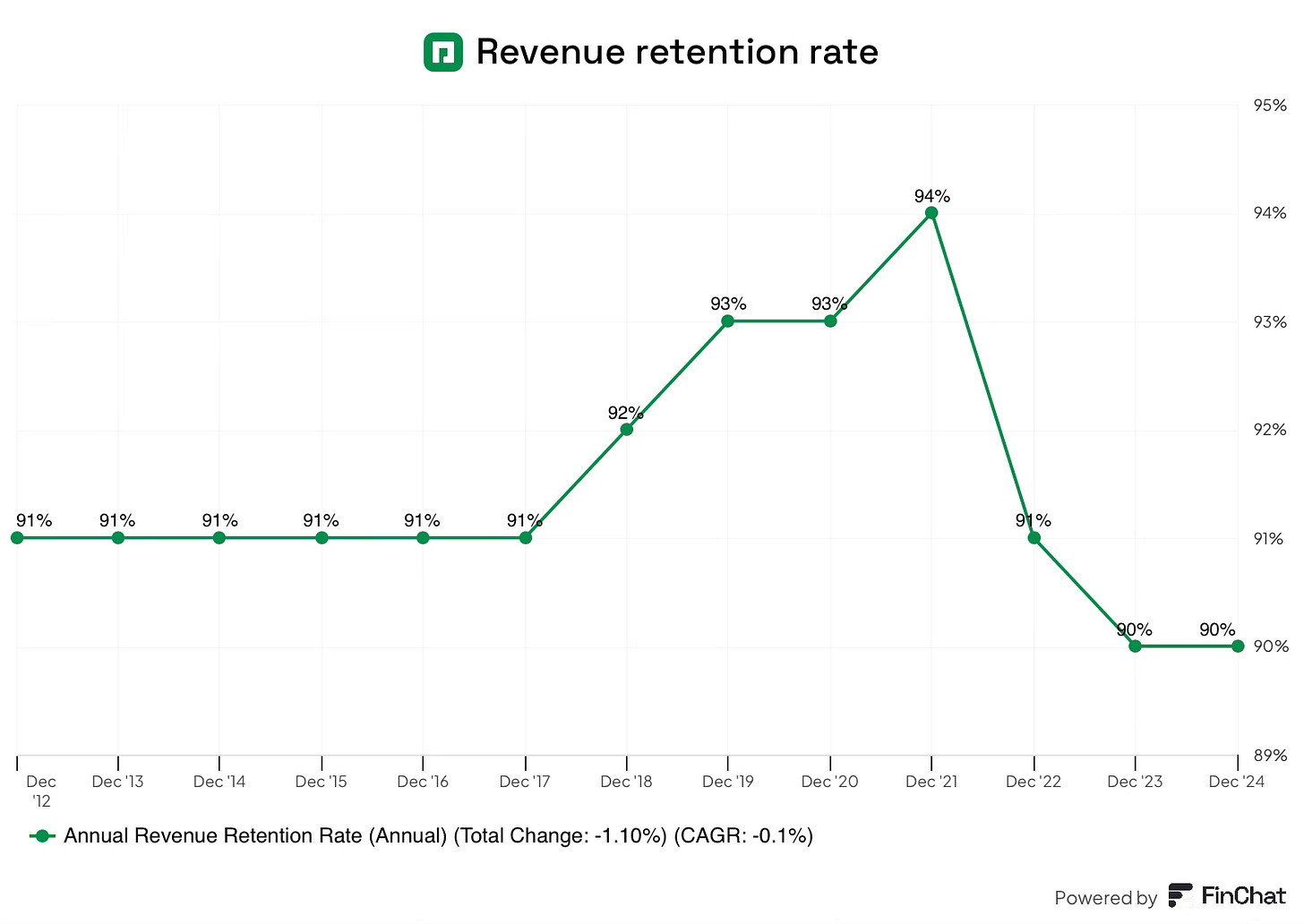

Higher retention rates: Today, nearly 100% of Paycom’s client employees are engaged with their payroll, this engagement increases transparency between an employee and HR, increasing trust, especially among hourly employees. Once an organisation’s employees are all engaged with a particular system, it becomes very difficult to switch to a new provider, increasing Paycom’s client retention rate. Since Paycom began focusing on employee engagement in 2017, client retention rates have improved dramatically, rising from 91% in 2017 to 94% in 2021.

Employee referrals: Beyond the increased switching costs, Paycom also benefits from employee referrals driving new growth. In 2023, the company reported that 5 years prior, they had 0 employee referrals, now they get 1,000 per week, leading to new client logo growth.

Paycom has spent years transforming the industry towards employee self-service. While competitors have introduced some employee features as a response, it would likely take several years for incumbents to transition clients to this way of managing payroll and HR. Furthermore, tools such as Beti (below) would not be possible without significant employee engagement.

Automation

Automation is a key trend in the HCM industry, and Paycom is the clear leader here. Historically, clients would buy an HCM solution so they could do more. Now, clients are looking for solutions that can do more for them.

Automation allows Paycom to increase return on investment for clients by reducing non-productive time of HR and payroll departments, instead allowing a greater proportion of time to be spent on revenue-generating and strategic tasks, a significant shift within the industry.

In 2021, Paycom shook the HCM industry by introducing Beti, an automation tool that enables employees to do their own payroll. Beti has several advantages for clients:

80% Error reduction - The traditional way to do payroll is to wait for the period in question to end, then add up employee hours, before initiating payroll. Beti starts payroll at the beginning of the period and is complete by the end; employees track and verify their hours during the process, providing them with visibility into their paychecks before payroll is run, allowing errors to be caught and resolved before payroll, resulting in fewer re-runs.

On average, 1 in 5 employees experiences wrong pay each period, this is likely significantly higher among hourly employee roles, Beti eliminates these errors. This enhanced accuracy is a huge deal for employees who live paycheck to paycheck that can’t be quantified; it could be the difference between someone not having to borrow money to get through the month or being able to buy their son/daughter a birthday present. While you may think this only benefits the lowest-income employees, 61% of Americans live paycheck to paycheck.

This enhanced accuracy \ can increase employee retention within an organisation, for example, by switching to Paycom, a manufacturing company that increases employee retention from nine to sixteen months, which saves significant amounts of money on recruitment and training.

Time Savings: With Paycom, HR departments spend 90% less time compilling data and 85% less time reviewing & correcting errors. For an organisation with 2,500 employees, this results in a cumulative time saved of 2,600 hours per year. These efficiency gains allow HR departments to shift focus towards more strategic tasks.

Cost savings: For the same 2,500-employee organisation, Paycom could save the company north of $3.5m over three years. These gains are predominantly through the elimination of legacy systems and cost savings from reduced payroll re-runs. According to EY, each payroll error costs an organisation $291, resulting in unnecessary costs, time and effort spent to resolve.

These advantages drive significant ROI gains for clients and increase employee engagement. Clients who adopt Beti have revenue retention rates of 99%.

GONE: is the second automation enhancement, GONE is designed to automate and standardise the time-off request process, reducing the burden on mangers and HR teams to handle these decisions.

Despite Beti & GONE being in the market for almost four years, competitors have not introduced anything similar. Competitors are unable to replicate this solution because they do not have the single database offering and nearly 100% employee engagement that Paycom has spent years developing. This makes Paycom’s automation tools a key competitive advantage, this advantage will likely widen with future product releases.

Emerging moat internationally

Paycom’s global offering is an emerging competitive advantage.

Competitors’ international offerings revolve around using third-party partners to process payroll data, which is then sent back to the original payroll company. This approach is the product of pretty much every company acquiring their international capabilities. This further increases complexity, introducing more databases and reducing client ROI.

Paycom’s product is considerably different from competitors’. By taking the time and considerable effort to build out each market organically, the company is integrating international employees into the same database, while building out native payroll. This allows international clients to benefit from the same product differentiators; Single database, employee engagement and Automation that have differentiated the company in the US, while also providing significant enhancements to data security by keeping everything in-house.

While it will take time to release the Native payroll in all relevant markets, this offering will likely be a key value proposition for larger clients who have employees in multiple countries, pulling Paycom further upmarket.

This solution is creating a competitive advantage that competitors have been unwilling to do in the past.

Conclusion

I hope it is clear to see from the above advantages that Paycom has spent years cultivating products and client behaviours that simply can’t be replicated as a competitive reaction. These differentiators are only possible because Paycom controls every aspect of the business from data center architecture to in-house R&D.

For competitors to catch up, it would likely take several years of product development, to first bring everything onto a single database, before changing client behaviour. Only at this point would they be in a position to introduce a tool like Beti, as I will highlight later, a company not only needs the technical capability but also needs to be in the position to withstand short-term pain when introducing Beti due to the financial impact it will cause, for a professional CEO this is likely not possible.

Industry Dynamics

Paycom operates in a competitive and fragmented market. The company competes with established providers such as ADP, Paychex, Paycor, Paylocity and Workday. I have previously mentioned, Paycom has consistently taken market share from legacy peers, ADP and Paychex. Today, the company’s market share remains under 5%, suggesting there is market share upside left to capture.

Competition varies by client size, for smaller clients, price, ease of use and functionality are typically the primary considerations. On the other hand, larger companies consider scalability, analytics, data security, customisation, return on investment and service support.

Due to Paycom’s comprehensive offering, innovation, service and data security, the company has been pulled upmarket, a trend that is likely to continue in the future with the build-out of automation features and global payroll, allowing the business to benefit from larger, less price-sensitive customers.

Between providers, competitors typically compete by continuously introducing new products and services or via price, with some players undercutting Paycom on price or by offering different billing terms, such as, not charging for unscheduled payroll runs.

Through the years, Paycom has remained extremely disciplined on sales, repeatedly stating that margins are created through sales discipline. Instead, the company focuses on selling their unique value proposition and ROI achievement.

While the market for new business is highly competitive, this likely doesn’t tell the full story with established industry players consistently achieving operating margins above 20%. Additionally, fast-growing companies have demonstrated consistent improvements in profitability.

This better-than-expected industry profitability is likely due to several reasons:

High switching costs: The industry has high revenue retention rates due to the mission critical nature of the service. To change payroll provider a company would need to transfer data, retrain HR employees and potentially endure downtime, which could result in missed or incorrect payroll, impacting company moral and potentially costly to correct. So while the competition for new business is high, a client tends to stay for a long time.

Attractive business models: High levels of recurring revenue and capital light business models allows for all players to achieve attractive margin profiles.

Market segmentation: Competition typically excels in a particular area, which lends itself to a certain portion of the market, such as a certain client size or industry.

Consolidation: Large players have historically acquired smaller providers over time, for example, during the period from 2015 to today ADP made 8 acquisitions while Paychex made 9. Over time, these acquisitions will likely result in less competition overall.

These factors suggest that while some competitors may use aggressive pricing strategies to acquire new business, the high switching costs of existing clients make the industry attractive.

Quality Financials

Paycom’s product advantage and attractive industry dynamics have led to the company achieveing an impressive financial profile which should be attractive to long-term investors. The business has a strong business model with recurring revenue making up 98% of the total, coupled with strong retention rates, makes the business highly predictable.

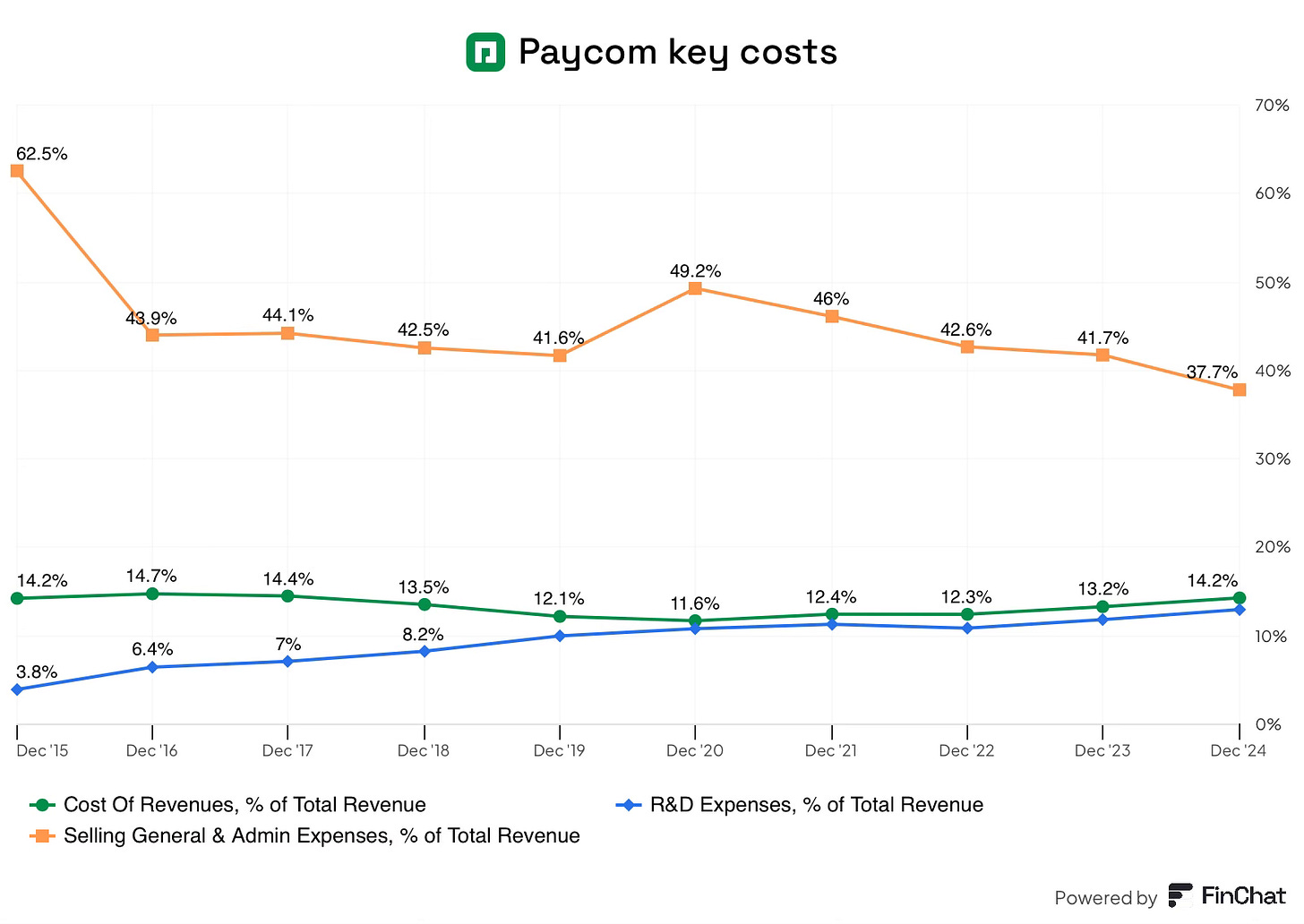

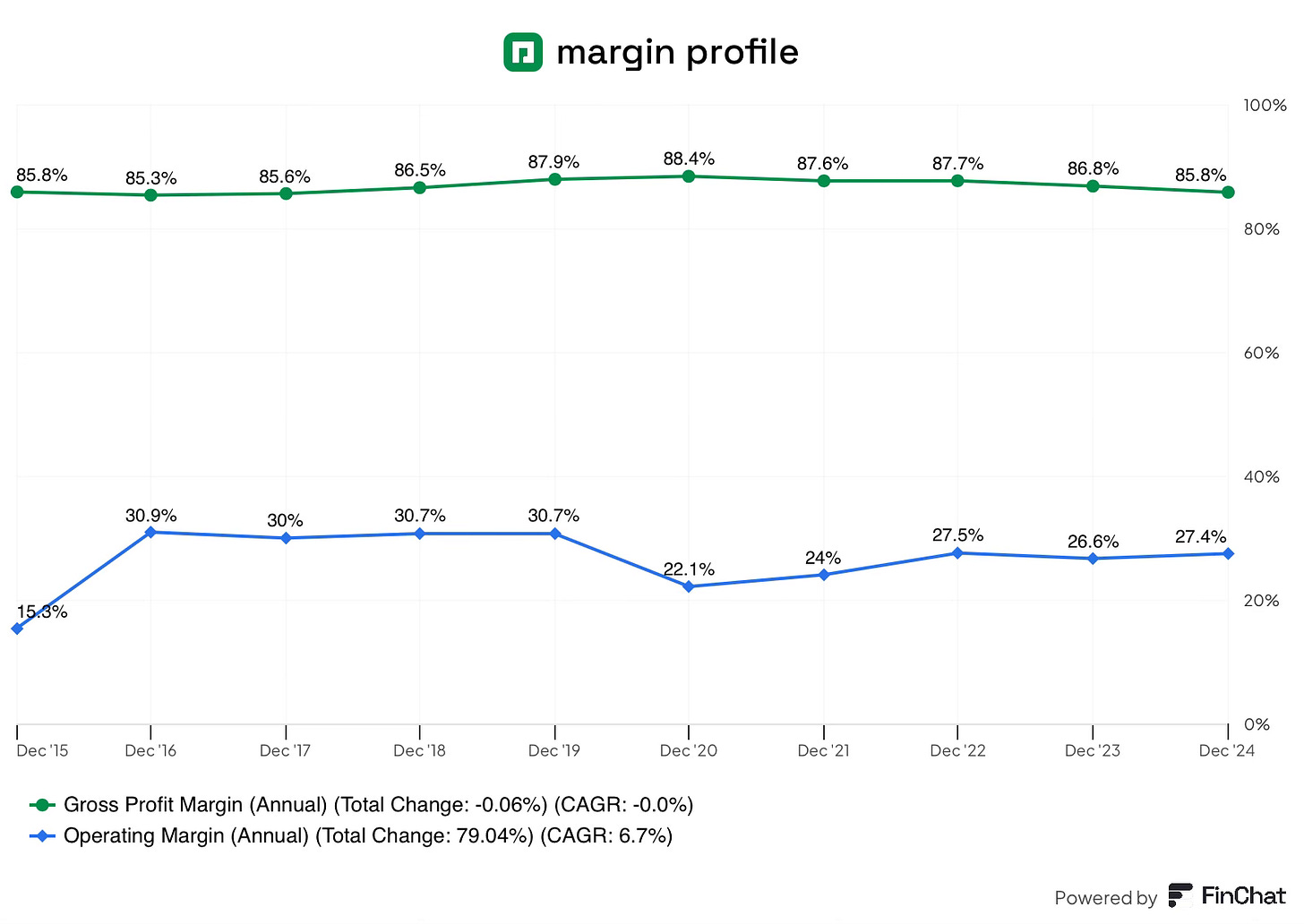

Since going public, Paycom has compounded EPS at almost 43% annually! This means Paycom has not only demonstrated strong growth through consistent market share gains, but they have also achieved high levels of profitability through their capital-light and scalable business model, product superiority and sales discipline. Despite operating its own data centres (which not all competitors do), Paycom has best-in-class gross margins, consistently above 85%, further confirming. That the company has a sustainable competitive advantage.

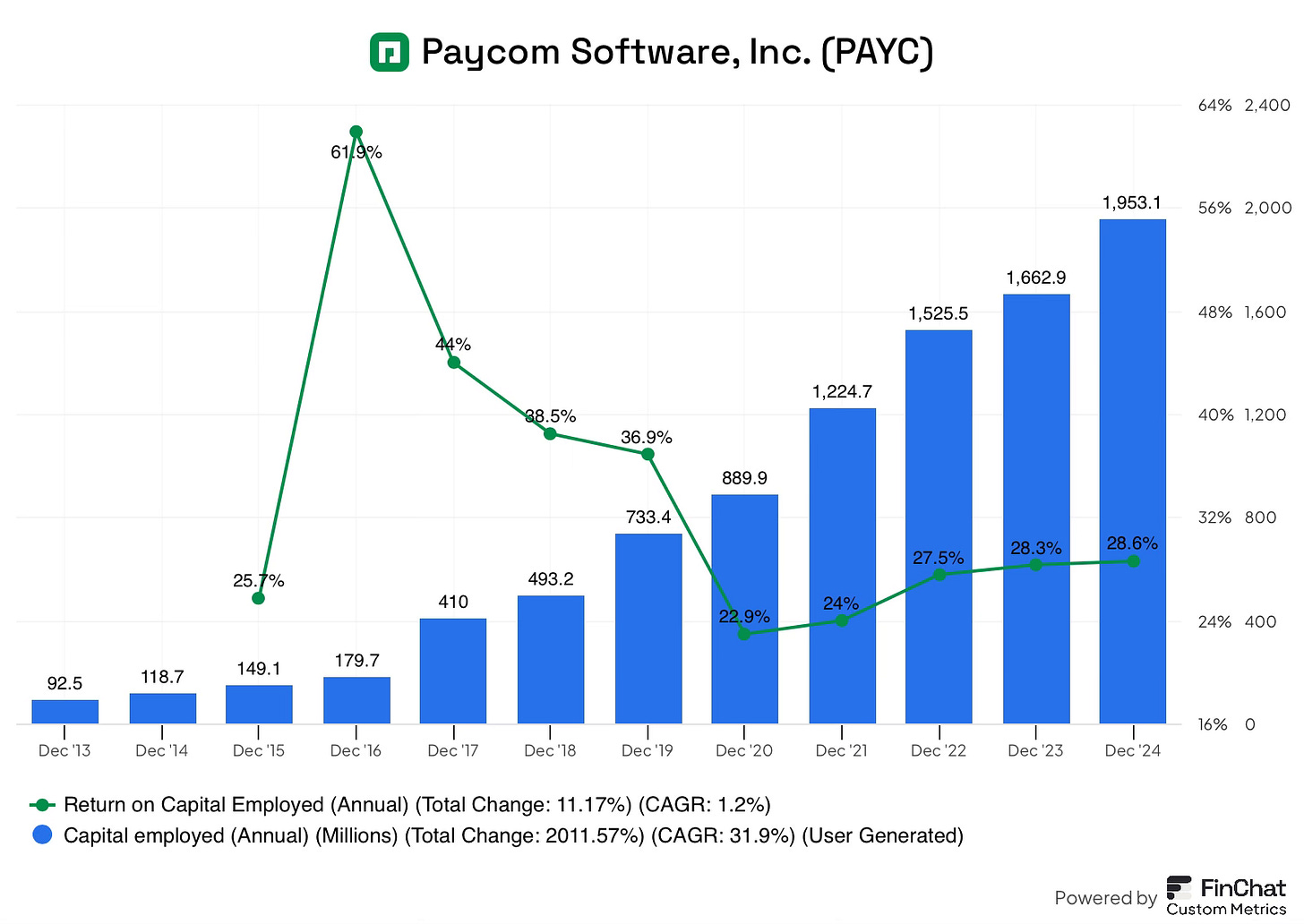

Throughout this rapid growth, Paycom has remained disciplined, consistently achieving returns on capital employed above 28% while increasing capital employed at 31% per year! It is this growing capital employed that will drive the business over the long term.

Additionally, the business possesses industry-leading revenue retention rates, demonstrating high switching costs. While retention rates have been down between 2022 and 2024, this is primarily due to revenue cannibalisation from Beti and some accounting changes rather than an erosion of switching costs. Management has called out that the retention rate among clients utilising Beti is 99%, as penetration of Beti rises and the company laps the cannibalisation headwinds, it is likely retention rate will follow suit.

The business has a pristine balance sheet with zero debt, self-funding its expansion, while likely not the most capital-efficient model, this should give investors comfort that the business will be highly resilient through any scenario.

These metrics clearly demonstrate that the business is extremely high quality and has a competitive advantage. This leads me to two questions:

Is there a long runway for re-investment at similar high rates of return?

What gives me confidence that the company can continue this strong track record?

In the following sections, I will explore these questions in depth before deciding what the business is worth.

However, first I will outline why the business has been seeing slower growth over the past couple of years.

What has been happening?

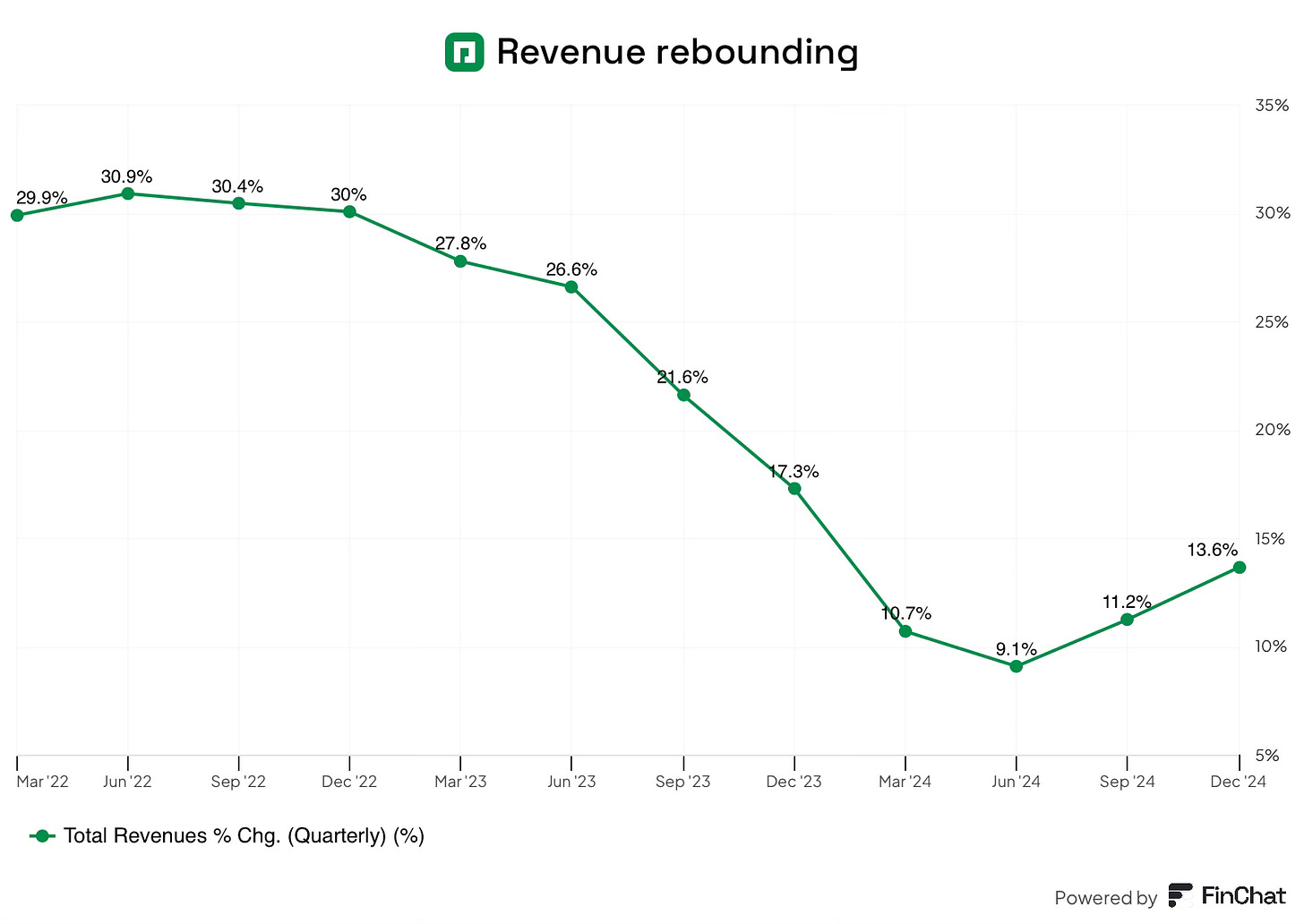

Following the company’s IPO in 2014, the business has grown revenue at over 28% per year. This growth has been driven by:

Client growth

Higher revenue per client through larger business size and cross-selling additional modules.

Despite the strong historic performance, revenue growth has slowed over the course of 2023 & 2024. This slowing growth coupled with a stretched valuation (briefly achieving a P/S of 30X!) have caused shares to crash 75% from their peak, today shares remain down 60%. So what happened?

Macro slowdown

The recent macro environment has been a headwind for the entire industry as demonstrated by the slowing growth in the chart below. Sales teams have had to deal with lengthening sales cycles and additional approval layers to get a deal over the line, additionally, clients have been focused on profitability, which has reduced enterprise spend.

The weak macro environment has also reduced additional service revenue, due to the weakness surrounding pre-employment checks, which have been impacted by weak employment trends.

While everyone has faced difficulty, it is clear from the chart above that Paycom has seen the largest impact, this is due to the rollout of Beti which has slowed growth and optically impacted revenue retention rates. Capacity constraints within the sales organisation have also played a roll.

Beti rollout impact

Paycom released Beti in 2021, initially boosting growth and retention in 2021 and 2022, however, this quickly turned into a headwind.

The release of Beti changed several aspects of the company’s go-to-market.

First, the company mandated that all new clients would have to utilise Beti.

Second, they shifted the focus of the CRR group from cross-selling opportunities within the current client base to focusing on client utilisation and migrating clients to Beti.

As of December 2023, two-thirds of clients had utilised Beti, likely even higher today. With an initial plan to have all clients utilising Beti by the summer of 2022 (1 year after launch), this migration has taken far longer than management had expected.

Despite Beti being a superior product, there has been resistance among the exisiting client base to adopt it. To use Beti, a client must utilise several modules, likely more than some clients had previously been using, requiring time to utilise these systems in the correct way before Beti can be implemented.

Beyond system utilisation, there has been some resistance to change among clients. I previously described how Beti changes the way that payroll is done, to clients not looking for change or to employees who are potentially concerned about job security within the payroll department, there is understandable resistance in adopting Beti. These fears were not helped by some initial missteps in communication that led clients to believe they would be forced to switch regardless.

So why has it impacted revenue?

Beti could have impacted Paycom’s growth rate by as much as 10% (10% growth instead of 20%), evidenced by the impact on its revenue growth rate versus competitors. Beti impacted revenue from several areas:

Reduction in Unscheduled Payroll runs: Beti’s accuracy (described earlier) reduces the need for additional billable services, such as payroll runs and error corrections. These additional services previously made up roughly 5% of total revenue, with the introduction of Beti, this is likely significantly lower today.

Despite the short-term impact on Paycom’s financials, the use of Beti eliminates low-quality revenue and creates more loyal customers.

CRR strategic shift: To help with the adoption of Beti and overall client satisfaction, Paycom implemented some strategic shifts to focus on client utilisation, this client utilisation focused on existing clients achieving the designed ROI from Paycom’s system.

It is extremely common for software providers to sell additional solutions to clients without any kind of focus on whether the client is even utilising the systems they already have correctly. By taking the time to help clients get greater value out of the system, it not only improves client satisfaction and retention rates, but it also helps to migrate clients on to Beti in the future.

To achieve these client utilisation goals, Paycom changed the CRR groups (internal sales) incentives, while also implementing utilisation hurdles that a client must achieve before any new software can be cross sold. This shift inevitably resulted in a significant decrease of cross-selling revenue. Historically the CRR group has increased revenue every year, in 2023 revenue shrunk by $20M for the first time ever.

Despite the short term headwinds, the efforts to increase client utilisation should allow clients to achieve higher ROI, increasing satisfaction and retention in the future.

In 2025, the company continues to focus on client utilisation, suggesting this headwind may persist for longer than initially expected, however as I have argued this is a good thing for clients and retention long term.

Despite the near-term cannibalisation of revenue, I discussed the benefits Beti delivers for clients earlier, including: improved Payroll accuracy, time & cost savings and improved employee retention. These advantages will become evident in the future as the near-term headwinds of converting existing clients onto Beti subside.

Revenue retention rate

Following the rollout of employee engagement tools in 2017, paycom has seen industry-leading revenue retention rates. This changed in 2022 when retention dropped from 94% to 91%, sliding further in the following two years.

As of 2024, Paycom has a revenue retention rate of 90%, still below recent years, but significantly above industry peers. Beti and the associated shift in CRR strategy are once again the primary cause of this decline. Along with this, small business attrition and changes in the way this figure is calculated have also played a factor.

Small business attrition: During the pandemic period, Paycom added a significant number of small businesses after increasing the number of small business sales teams from 1 to 10. Several years down the line, many of these businesses are rolling off due to macro environment forcing them out of business.

Small businesses represent roughly 4% of revenue, down from over 5% a year earlier, suggesting this is only a minor impact.

Calculation changes: Paycom has made two changes in 2023 to the way it calculates revenue retention rate:

Removing interest earned: In 2023, Paycom broke out interest income from client funds as a separate line item, in doing so, they also removed this revenue from retention rate, creating a 2% impact.

Accelerated recognition of client losses: Paycom has tightened its criteria for a client loss, again creating a temporary headwind to the revenue retention rate.

These factors have likely impacted revenue retention rates by 2-4%, while the underlying client trends remain unchanged. These accounting impacts will likely be permanent.

However, as small businesses become a smaller part of the overall mix and the Beti headwinds reduce, revenue retention rates should rise to reflect the impact of Beti’s 99%. It is also important for investors to bear in mind that a 90% revenue retention rate today is likely somewhere in the region of 92-94% prior to any accounting changes.

Sales teams capacity

Because Paycom solely sells its solution through its own direct sales force, the expansion of this sales capacity is a significant factor in driving new client growth. After strong sales team growth between 2012 & 2019, growth slowed meaningfully, with only 8 sales teams being added between 2019 & 2025.

This slow growth is due to internal bottlenecks, there has been limited availability of qualified sales managers ready to relocate and build new teams, along with not enough “depth of backbench” to fill in new and existing offices. The result of this is a reliance on productivity gains to continue to gain new clients.

Sales productivity improvements have allowed the company to continue to sell more than they have historically, for example, a single salesperson sold more last year ($4m) than an entire market did in 2014. Increasing sales capacity is required to capture the full opportunity ahead, this means the lack of new offices has likely hindered the company’s ability to reach new locations and clients.

At the end of 2024, Paycom created three new sales teams, the company also stated that the company is better staffed in sales than it has been over the past 5-6 years after their largest new group of sales reps (67) graduated. These factors suggest that more sales teams could open in the future, releiving some capcity constraints. While this is positive news, it will still take 24 months for these offices to be fully up and running.

Furthermore, productivity continues to improve, in Q2, management reported that they sold 24% more units than a year ago. This improvement is likely due to improved go-to market execution that Amy Walker has implemented since she took over in April 2024.

Temporary

While these headwinds have been meaningful over the past couple of years, I believe they are temporary. The macro environment will normalise over time and the Beti headwinds are likely past there worst with over two thirds of clients now utilising it. These improvements will allow CRR teams to refocus on cross-sell opportunities. All of these factors should lead to a rebound in revenue retention rates.

The last few quarters have shown evidence of this with revenue growth slightly accelerating from the trough in Q2 2024.

Management

Management is aligned, trustworthy and highly capable.

Chad Richison founded the business in 1998 and has been CEO since bar a small period in late 2023 when he was CO-CEO with Chris Thomas. Chad founded the business after a period at ADP and another regional provider. Richison saw the opportunity to take payroll online, with an SBA loan and 13 credit cards, Richison got Pyacom off the ground.

Today, Richison still owns 6.1 million shares, equating to almost 11% of shares.

Track Record

Management has an outstanding track record. Since founding the business in 1998, Chad Richison has grown the business, almost reaching $2 Billion in revenue per year. This strong track record should give investors confidence in managements ability.

Compensation

Chad Richison’s compensation is mixed, the founder recieves a combination of base salary, short term bonus and other forms of compensation. Interestingly, Richision forfeited his large long term equity incentive in 2023 to allow Chris Thomas to become Co-CEO.

Base Salary: Richison’s base salary is $800,000, a rather modest salary versus other CEO’s.

Short-term bonus: Richison can earn up to 100% of his base salary if the company achieves certain revenue targets, with the potential to be downgraded if profitability targets are not achieved.

Other compensation: Among other benefits, Richison also gets 75 hours for non-company use of a corporate aircraft and a $9,000 country club membership. While these benefits aren’t ideal, combining the relatively small base salary and annual bonus makes it more reasonable.

Long-term incentive: Until February 2024, Richison had a long-term incentive plan, implemented in 2020.

The “2020 CEO Performance Award” was very ambitious and very lucrative if achieved. At the time of the award in November 2020, shares traded at $400, to achieve the 1.6 million shares in question, shares needed to:

Exceed $1,000 per share within 6 years, a minimum compound annual growth rate of 16.5%

Exceed $1,750 per share within 10 years, a minimum of 16% compound annual growth rate

These 2 targets were equally weighted at 50% each, and if achieved would have been worth $2.8B! While this amount of compensation seems extreme for a founder who owns over 10% of the company already, it would have only resulted in a 2.7% dilution for shareholders, likely a small price to pay for shares that would have increased by almost 4.5X over the prevailing 10 year period.

In February 2024, Chad Richison forfeit this equity incentive to promote Chris Thomas to Co-CEO. However, after a few months Thomas stepped down for personal reasons, leaving Richison once again the sole CEO and without an equity award.

While a new incentive will likely follow at the next annual shareholder meeting, the structure of this previous award gives investors a glimpse into Richison’s ambitious plans to grow the business over the coming decades, potentially setting his sights on a $100B valuation (only $12B today).

Executive Turnover

The sudden departure of Chris Thomas only a few months after his promotion to co-CEO raised concerns for investors.

To add to this, long time CFO Craig Boelte announced his retirement from Paycom, officially departing on the 21st of February 2025, replacing him is Bob Foster who has been at Paycom for a few years.

While the concerns are understandable, they are likely misguided with both executives departing for entirely different reasons. The reason for Thomas’ departure is unknown, however, it seems like some kind of personal matter rather than Paycom-related. On the other hand, Boelte had recently become a grandfather and wanted to spend more time with family. Both executives have spent many years at the company, with Chris Thomas spending over 6 years and Craig Boelte almost 20 years.

During its history, Paycom has only had 1 CFO, 2 CIOs and 3 sales leaders, suggesting these departures are not a recurring event.

Insider Ownership

Chad Richison owns 6.1M shares, equating to over 10% of the company, aligning the interests of the CEO and shareholders together.

Additionally, Richison has spoken about his family and friends having significant portions of their net worth tied up in Paycom, likely weighing on the CEO to further prioritise shareholder interests.

Founder Mentality

Having a founder CEO at the helm is a significant competitive advantage for long-term shareholders. Since the founding of the business Chad Richison has always chosen to do things the hard way, by building out their own data centres, sales teams, service representatives and developing all software in-house, the company has made a conscious decision to build a business that will stand the test of time, rather than doing what is easy, like many competitors. Each one of these components is crucial to the success of the business, ensuring a better product and service to clients.

Additionally, the last few years have demonstrated that Richison is willing to take short-term pain to ensure long-term success. Very few professional CEOs would have been willing to take the short-term stock and financial impact from the Beti rollout and the subsequent shift in focus to client utilisation. This is demonstrated by the fact that no competitors have even attempted to copy Beti after 4 years, likely making Beti an even harder product to replicate.

Capital Allocation

Management remains fully committed to growth, this means the majority of capital is being reallocated back into R&D, capex and the formation of new sales offices, resulting in Capital employed growing at almost 32% annually with no signs of slowing down. Despite growing capital employed at an extremely rapid pace, ROCE has been sequentially improving demonstrating even higher incremental rates of return. Paycom should continue to allocate as much capital as possible towards organic growth initiatives, provided they can sustain these rates of return.

Beyond the organic growth investments, Paycom has been increasingly returning excess cash to shareholders, initally through share buybacks, now through a combination of buybacks and a dividend.

Share buybacks: Paycom has consistently bought back a small portion of the stock. However, these buybacks were stepped up as shares fell over the past couple of years, demonstrating management understands capital allocation. Due to the company’s focus on growth, these buybacks have been relatively minimal, additionally, SBC expenses have offset a portion of these, resulting in shares outstanding shrinking at just under 1% annually. While I would like to see more buybacks at these levels, the focus on growth will ultimately lead to higher returns.

Dividend: In 2023, Paycom initiated a quarterly dividend of $0.375 per share, resulting in a current dividend yield of 0.69%. As the company grows over time this will likely increase accordingly.

Conclusion

To conclude, having Chad Richison in charge of Paycom is likely a competitive advantage. By controlling every aspect of the business, Richison has built a business that is highly durable. His founder mentallity has meant that Paycom is willing to take short term pain to win over the long term. While the compensation structure isn’t ideal, Richison has significant skin in the game that alligns him with shareholders.

Capital allocation is also a highlight, management has managed to sustain very high levels of ROCE while increasing capital employed at over 31% per year.

Re-investment opportunity

Paycom has a long runway for re-investment, making it an asymmetric opportunity. Historically, the company has grown through both industry growth and market share gains in the form of:

New client growth.

Increase in client size.

Cross-sell opportunities.

These will continue to be the growth drivers going forward.

In this section, I will analyse the growth drivers that should allow the business to compound over time.

Industry tailwinds

The HCM industry should benefit from tailwinds driving industry growth. The global HCM market size is estimated to be worth north of $30B at the end of 2024, with growth expected to continue at a 9% CAGR through 2034.

This industry growth will be driven by:

Increasing complexity of payroll and HR management: Payroll and HR are becoming increasingly complex with local, state and national tax codes and labor laws becoming increasingly complex to comply with. The introduction of legislation like COBRA, the affordable Care Act (ACA) and changes to minimum wage, overtime and PTO are further driving complexity. For businesses, gone are the days of being able to manage this in house.

Attracting and retaining talent: HCM is increasingly being seen as a strategic function to attract and retain talent. Initially, HCM solutions were solely a cost centre for doing payroll, this has evolved as providers have built out more sophisticated functionality. Now HCM is a strategic function to analyse talent management, employee performance and engagement that can lead to better employee morale and retention.

Technological advancements & the shift to the cloud: The introduction of innovative solutions leveraging AI, automation and analytics is allowing the HR departments to do more with less. The increased productivity is allowing businesses to save money and focus on more strategic tasks. This improved technology is forcing companies to shift from on-premise, legacy solutions to cloud-enabled comprehensive single database platforms as companies modernise and improve their technical capabilities.

Given both the evergreen nature of these trends and the mission critical nature of the solution provided, this industry is extremely durable and should continue growing beyond 2034, providing a long runway for growth.

New Clients

Paycom’s two largest competitors, ADP & Paychex, have a combined 1.7 million clients. Paycom has 33,800, less than 2% of legacy peers. While the average size of these clients may be slightly different, Paycom’s market share is less than 5%, suggesting there is plenty of market share left to be gained.

Additionally, with the international product being rolled out over time, this likely increases the number of prospective clients Paycom could win.

How will Paycom win new clients?

To attract these new clients, the company will need to continue to introduce product innovations and expand it’s sales teams further.

Product Innovation.

I have already covered innovation comprehensively during this deep dive, I will therefore refrain from repeating myself here.

Previously I spoke about Paycom’s product having several key differentiators:

Single Database

Employee engagement

Automation

Despite this, the company is not standing still; the business continues to invest in research and development, increasing R&D as a percentage of revenue over the long term. In comparison, peers are reducing R&D as a percentage of revenue, suggesting they are not as focused on product enhancements. Additionally, Chad Richison, CEO, took back control of the product team in September 2023. Since then, the company has doubled the speed of product releases, resulting in a 24-point increase in net promoter scores, suggesting the product continues to improve.

Above, I hinted that competitors may not be as focused on products as Paycom; there are several reasons why this may be true. Firstly, legacy providers such as Paychex and ADP, which currently have the dominant market share in the industry, potentially north of 30%, still do not operate a single-database architecture. Instead, the companies utilise multiple systems, partnerships and third-party providers for the product, slowing innovation and increasing friction for clients. Paycom, launched their single database at the latest in 2011, giving these legacy providers 14 years to adapt.

Secondly, competitors have historically acquired capabilities rather than built them, the latest example is Paychex agreeing to acquire Paycor. During the period from 2015 to today, ADP has made 8 acquisitions while Paychex has made 9. While these may be fine acquisitions, it once again adds additional systems to manage, likely slowing the company down rather than making them more competitive long term.

As Paycom is one of only a few “pure play” competitors left, the company is extremely well positioned to extend its product advantage with further automation tools and global payroll. This should allow the business to continue taking market share from larger competitors in the future.

Go-to-market expansion

As previously mentioned, Paycom solely goes to market through its internal salesforce. Therefore, more capacity (up until a point) will directly affect Paycom’s ability to attract new clients. Paycom likely has a significant opportunity to expand its sales capacity both in the US and internationally.

Currently, Paycom has sales offices in 41 of the 50 largest metropolitan areas, additionally, only 7 of these offices have more than 1 sales team, recall a team has roughly 8 sales personnel. This likely leaves significant room to expand both geographically and expand its presence in existing areas.

Furthermore, Paycom has no international sales presence yet, suggesting this is another untapped area to expand into the long term.

These two factors mean Paycom can continue to grow the number of sales teams for a long time.

The move upmarket (increased employees served)

As Paycom has built out innovative capabilities on its platform, the company has been pulled upmarket by the demand from larger clients. This will likely continue to happen as the company expands its automation and International capabilities that I have covered extensively, making the solution more attractive for larger clients.

The move upmarket will likely result in slower client growth than historical rates, this is due to the longer sales cycles these clients require. A more accurate way to track growth will therefore be through revenue per client or total number of employees served.

Cross Sell Opportunities

Cross sell is another significant opportunity for the company when CRR teams shift focus back to this area. When a new client onboards at Paycom, they typically only take half of the available modules 17/32. Currently Paycom offers 34 modules, this has increased from 18 at IPO (2014), suggesting the company adds 2-3 new modules per year.

As the company continues to add modules and onboard more clients, the opportunity to further cross-sell is enhanced. Additionally, with the current focus on client utilisation increasing usage, clients will be more likely to buy further modules as they realise the true ROI benefits from Paycom’s solution.

Margin Expansion

While gross margins have been extremely high, operating margins could see further improvement. Over time, the company has contiuned to spend significantly on research & development, and sales & marketing, which has meant the company’s inherently scalable business model has not been fully demonstrated.

As the company continues to scale, it will likely reach a point where increased spending in R&D and marketing will not be required, leading to scale benefits being achieved. In comparison, Paychex achieves operating margins north of 40%, while having gross margins of “only” 70%, giving Paycom a good target to reach.

Over time, this should lead to Earnings growing faster than revenue.

Conclusion

The combination of subsiding headwinds, industry tailwinds and market share gains should lead to strong growth that is likely sustainable long term. Potential margin expansion should amplify this!

Investors should have confidence in managements continued execution given their strong track record and recent actions that should only make Paycom stronger.

Valuation

Peer comparison

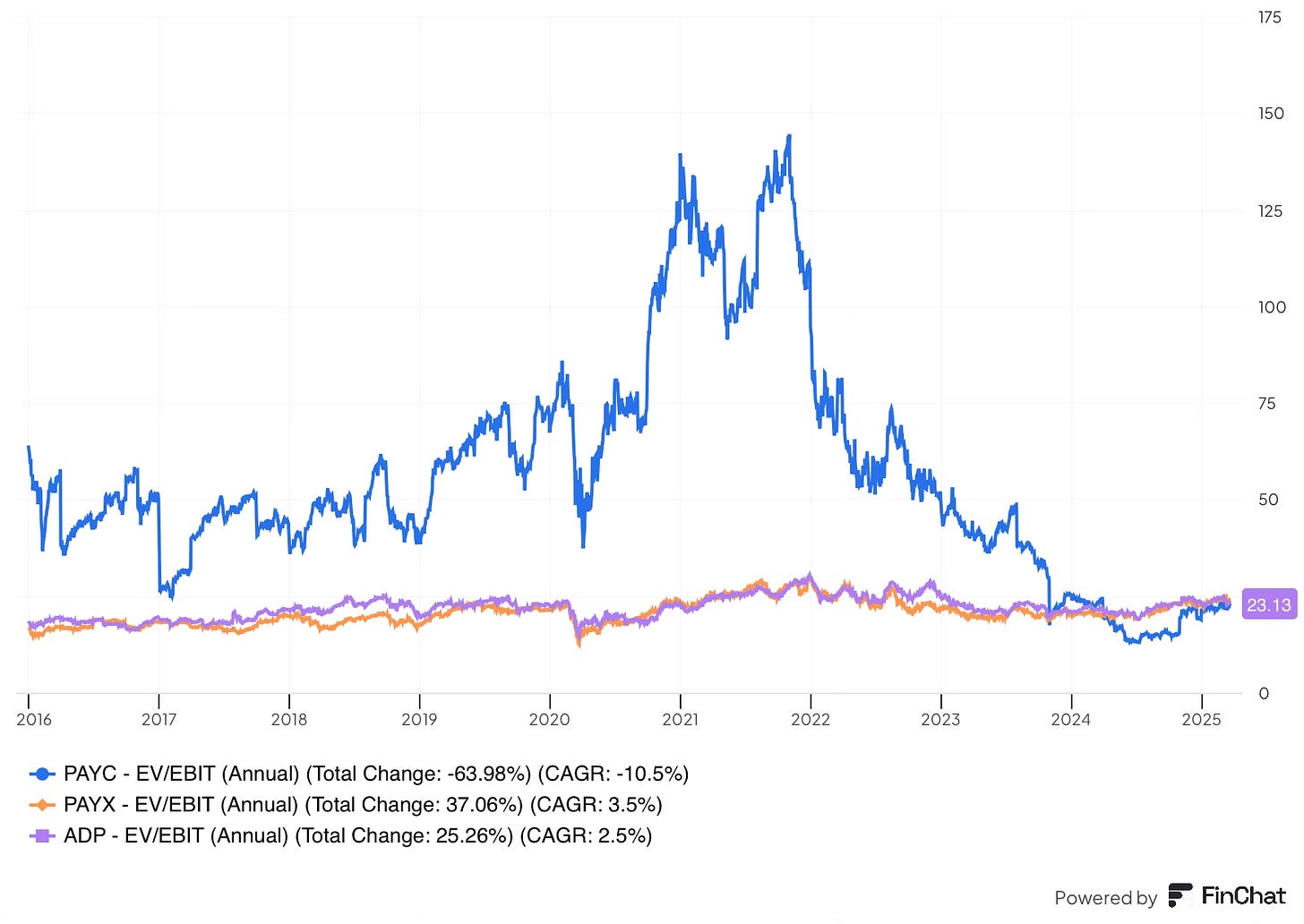

Paycom has consistently traded at a higher valuation than larger peers Paychex and ADP, for the first time since inception, Paycom is trading at a discount.

When comparing the companies, Paycom achieves margins lower than Paychex but higher than ADP. However, Paycom has achieved revenue growth double that of Paychex and ADP in every year the company has been public.

This comparable margin profile, significantly faster revenue growth and superior product that I have argued throughout, leads me to believe that Paycom is deserving of a premium to ADP and Paychex.

DCF - Discount cash flow

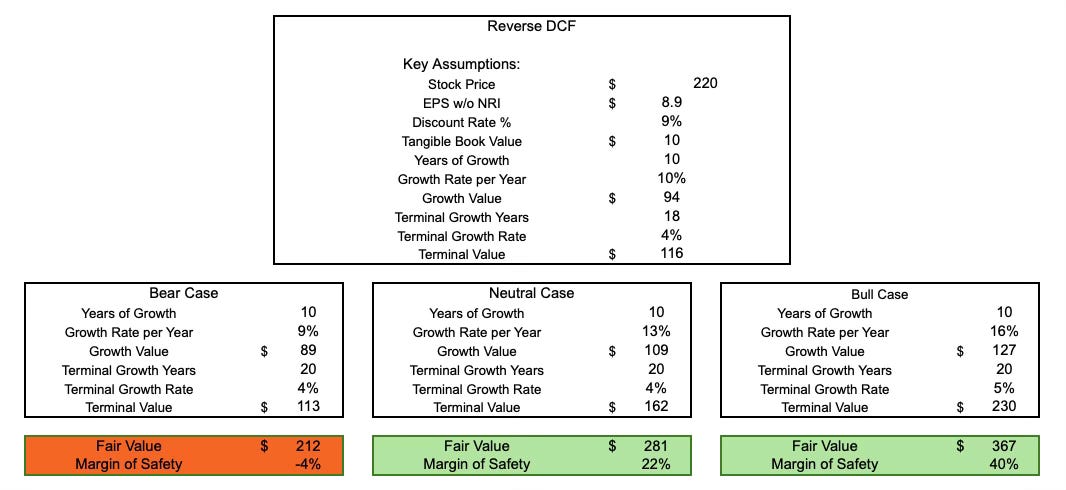

By using the following key assumptions:

Stock price of $220

EPS of $8.90

Discount rate of 9%

We can assume that the market is currently expecting the business to achieve a growth rate of 9% over the next decade. Considering the business is facing multiple headwinds at current and is still growing at 13%, this seems to be undervaluing the potential re-acceleration in the business.

Secondly, by running several DCF scenarios of how the business could perform, the business is likely undervalued if the company can sustain or re-accelerate revenue as I have argued.

Bear case: In this scenario, I have assumed that the business will achieve industry growth (9%), considering the business has historically doubled industry growth, this scenario seems undemanding. In this case, the business is roughly fair value.

Neutral case: In this scenario, I have assumed that the business maintains its current growth rate rather than accelerating. In this case, the business is worth somewhere in the region of $280, likely providing a 20% margin of safety.

Bull case: In this scenario, I have assumed that the business can re-accelerate revenue from current rates to 16%, an undemanding re-acceleration given the large growth opportunity ahead to capture. In this case, the business is worth in the region of $365, providing a 40% margin of safety from current levels.

“Over the long term, its hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return” - Charlie Munger.

Given the potential margin of safety, strong returns on capital employed (28%+) and a long runway for re-investment (capital employed growth of 32%), Paycom could see shares compound at a very healthy rate for a long time, providing they execute.

Risks

Beyond the risks that I have already covered in this deep dive, such as slowing growth, executive turnover and key man risk. There are some additional risk factors investors should consider:

Compliance: The HCM industry is subject to a wide array of laws and regulations at the local, state, and federal levels. These regulations cover everything from labour laws, tax codes and industry-specific requirements, these regulations are ever-evolving. While this increasingly complex regulatory environment has been a catalyst for increased demand for HCM platforms, Paycom and other industry peers must be able to evolve quickly, the downside for failing to comply ranges from fines, client losses and reputational risk. In an industry that is high risk - low reward, any loss of trust could result in significant client losses.

Data security: Data security is imperative in this industry due to the sensitive nature of the information these companies possess, such as employee information, social security information, salaries and health records. In 2021, UKG was hacked, exposing the data of over 2,000 individuals from companies such as PepsiCo and Tesla, among others. As a result, not only did the company face lawsuits, but its reputation was severely impacted, resulting in client losses and likely significant headwinds to growth.

SBC: Stock-based compensation has historically been in the region of 6-7% of revenue. This level is not a deal breaker, however I would like to see this figure come down over time.

Conclusion

If you have made it this far, Thank you!

I hope from this deep dive you can see that Paycom is a very high quality business, with industry leading growth and margin profiles thanks to its product advantage, that is currently facing some temporary self inflicted headwinds.

Despite this, managements capacity to suffer and long term track record should allow the business to come out the other side a stronger business. Looking out, the business has ample opportunity to continue to grow market share through product innovation and expansion of sales capacity.

Finally, the business offers a compelling entry point with the market currently doubting that Paycom can re-accelerate revenue growth.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Very informative post. Thank you. I had my eyes on it as a research candidate when it was trading around 160ish recently. Then once it went over 200 I kind of lost interest, probably due to anchoring bias.

Thanks for the great analysis. I digged into PAYC last summer when the stock traded around 140$.

However, I lost track on it when it popped up over 200$ last fall