Xpel Deep Dive Part 1

History, Understanding the business, Economics and Competitive advantages

Welcome to this deep dive on Xpel XPEL 0.00%↑

Disclosure: I own shares in Xpel

Xpel is a leading supplier of films and services, primarily serving the automotive industry, along with adjacent sectors such as architecture, marine, electronics, and aviation. Founded in 1997 and headquartered in San Antonio, Texas, Xpel has been one of the best-performing stocks since the 2008-09 financial crisis. Shares have risen from $0.05, briefly touching $100 in the summer of 2021, a 200,000% increase!

Driving this astronomical stock performance is strong fundamental growth. In 2009, Xpel had annualised revenue of $3m, was losing money and faced a lawsuit that should have sent the company into bankruptcy. Fast forward to today, the company reported full year 2024 revenue of $420m and operating income of $59m!

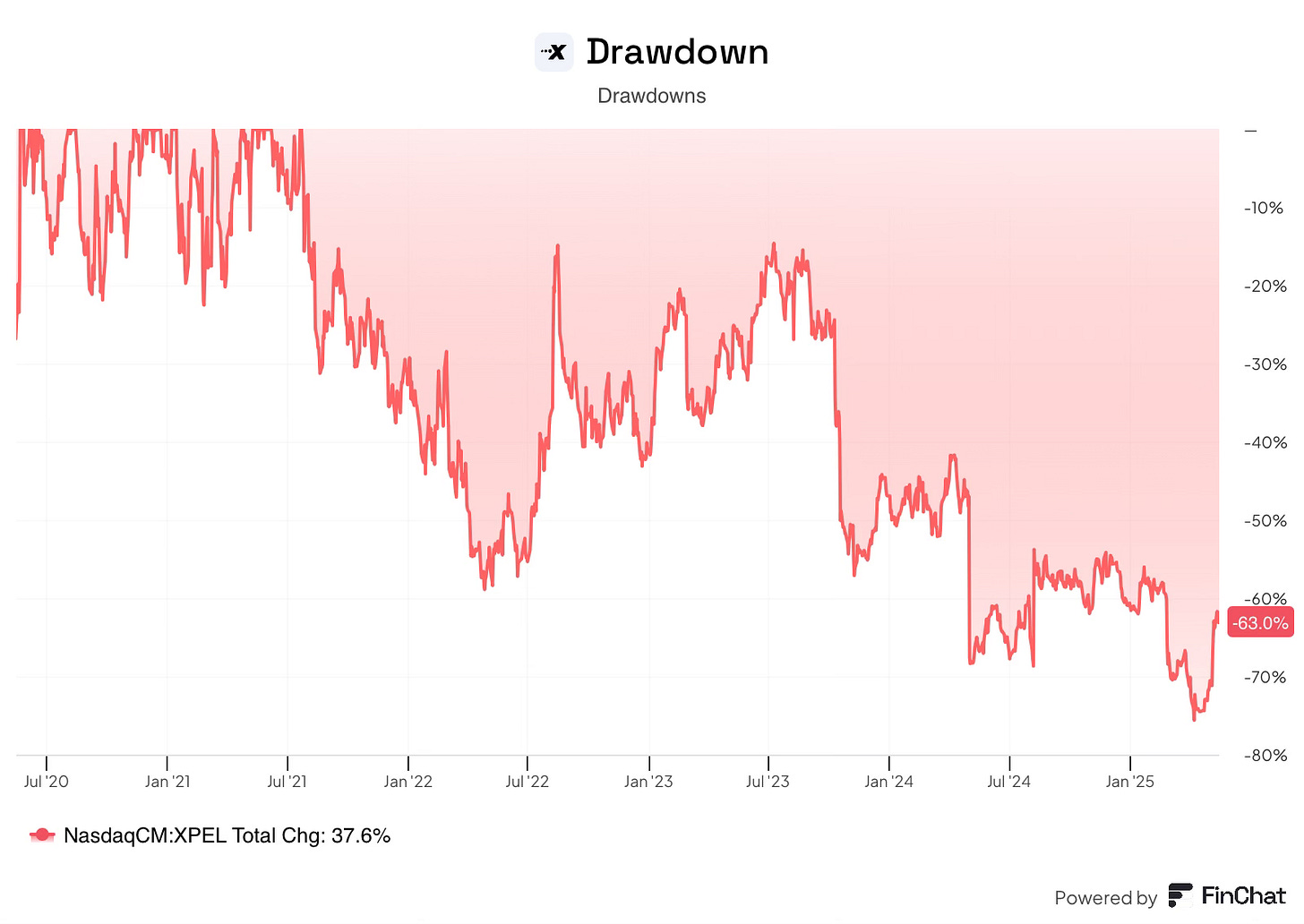

Shares peaked in 2021; since then, they have crashed by over 75%. This contrast between strong fundamental growth and a crashing stock makes Xpel an interesting opportunity to dig deeper.

In this deep dive, I will dive into the major topics relevant for the long-term investor to learn about Xpel. In this 2-part deep dive, I will cover:

Part 1: Everything required to understand the business.

Business history

Understanding Xpel

Product segment

PPF (installation, pricing, attachment rates)

Window Film (Window tint, window protection film)

Non automotive (Architecture, marine, Other)

Go to market (Independent installers, New car dealerships, OEMs, international)

Film Economics

Service segment

Installation services

DAP software

Training

Service economics

Competitive advantages

Financial profile

Part 2: Will focus on the investment case, including: the drawdown, management, capital allocation, opportunities, risks and valuation.

Business History

Creation of PPF

Paint Protection Film (PPF or Clear Bra) is a Thermoplastic Urethane (TPU) based film that is used to cover and protect painted surfaces from damage. Today, the automotive industry is the largest use case; however, its original purpose was for military helicopters.

PPF was invented during the Vietnam War when the US military tasked 3M to find a solution that protects helicopter blades and other sensitive areas from flying debris, a common cause of damage. Not only did the solution have to provide sufficient protection, but it also had to be discreet and lightweight so as not to affect performance.

Despite successful adoption by the military, PPF took significantly longer to gain acceptance into commercial use due to the difficulty of installation (too thick) and durability concerns (turning yellow and cracking). Over time, improvements were made, and PPF slowly began to be adopted by the automotive enthusiast community. Today, the product still has penetration rates of 8-9% in the automotive industry and is gaining adoption in marine, aviation, cycling and medical industries.

Xpel founding

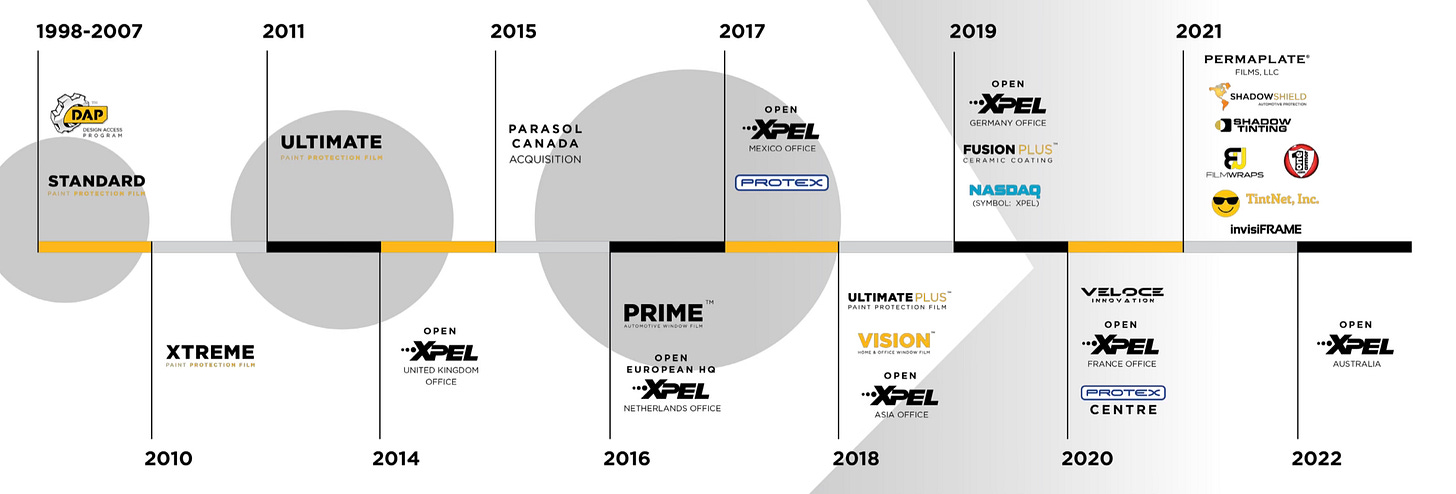

Xpel was founded in 1997 in San Antonio, Texas, under the name Reflex. The company originally sold 40mm PVC headlamp covers online and through catalogues, such as Autosport.

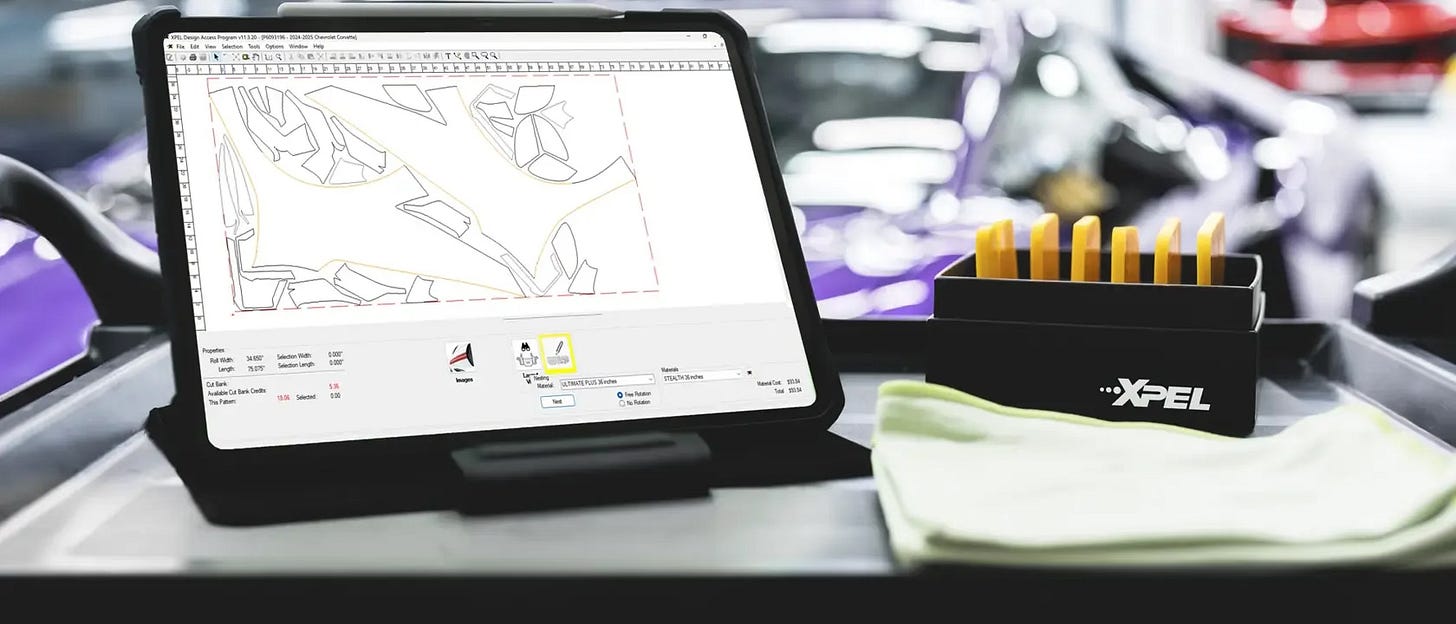

It was through this business, founders Tim Hart and Reggie Brunner realised software patterns would be required for PPF to cover larger, more nuanced panels of a car, essential for the growth of the industry. This insight led to the company's pivot towards being a software company, where Design Access Platform (DAP) was born.

By possessing the exact dimensions of every panel of every car within a database, an installer eliminates the risk of damaging a car during installation from cutting the film directly on the panel, while simultaneously accelerating the installation process and minimising waste.

Ryan Pape

At this time in the early 2000s (2004), Ryan Pape, the current CEO, joined the company. Initially, Pape was hired as employee no.12 through a consulting company to lead the software development.

Despite the successful development of the DAP software, a lack of consumer awareness and supporting infrastructure (installers, training and marketing) surrounding the PPF industry meant the business perpetually struggled. Ryan Pape later said that the software “was a good solution to a product that didn’t exist”. To be able to survive, the company realised it would need to create a market for this product.

While this shift ultimately ended up being the right move, before and during the financial crisis (08-09), the company was in poor financial shape. The company stayed alive through capital raises and a public listing on the TSX Venture Exchange in July 2007. In the summer of 2008, with future capital raises unattainable for Xpel, Ryan Pape left, returning to his previous consulting business, while he believed in its potential, the poor financial shape left the future of the business doubtful.

Survival

In a strange turn of events, a few months after leaving, the board of directors called Pape, offering him the CEO role. Pape later joked that everyone else had said no. Unlike others, Ryan Pape took the role because he believed in the company’s potential. At the time, Xpel had a revenue run rate of $6 million and a share price of 4-5 cents.

Pape described his first day as CEO as filled with “a lot of oh s**t” after realising the magnitude of the obstacle they would face. The company was managing cash flow daily, just to stay alive and make payroll. On his fifth day, Xpel was sued for a $250,000 unpaid racing sponsorship agreement, a sum that would seal the company’s fate into bankruptcy. In an unconventional response, Pape offered the company a take-it-or-leave-it offer to charge his $25,000 Continental Airlines credit card as full repayment, a deal that was eventually accepted after initial resistance.

Beyond the legal challenge, the company still had to be turned around, a difficult challenge with no money. Pape understood the importance of building a business around PPF and took several immediate actions to focus on this. Firstly, the company sold its Canadian distribution business, cutting revenue in half (-50%) to just $3 million, re-focusing on the core US business. Secondly, he began hiring sales personnel when they could afford to; at the time, the company had no salesforce. Pape described the department in charge of sales as a business prevention department. Since their first hire, Xpel has continually expanded revenue and the number of sales personnel they employ.

After surviving this near-death experience, the company began its long run of expansion, building strong installer partnerships through its expanding salesforce and expanding distribution internationally.

Xpel Ultimate

Progress was boosted in 2011 by the introduction of Xpel Ultimate PPF. This self-healing, non-yellowing film represented a significant quality improvement, providing Xpel with a product advantage that enabled the company to offer a 10-year warranty, thereby positioning it to gain market share. Coupled with this, Xpel began marketing to the end user, car enthusiasts, through various media channels and events, rather than solely marketing to installers. This minor yet profound change allowed the company to build consumer awareness and a strong brand that would expand the market dramatically.

Following the product launch, Xpel faced a significant lawsuit from 3M that alleged Xpel’s ultimate PPF was infringing on a patent held by 3M. In late 2016, the two companies settled after several years and significant costs. Importantly, Xpel, today, possesses a perpetual license to United States Patent No. 8,765,263 “Multilayer Polyurethane Protective Films” - Xpel 10k, while I can’t confirm, this likely came as a result of the settlement.

Today, Xpel holds approximately 35-40% of the market in the US. Considering Xpel only began to sell PPF around the financial crisis, this dramatic growth has led to Xpel being deemed responsible for bringing the category to prominence. Currently, roughly 8% of new cars in the US have some amount of protective film, an increase from 1-2% in 2013, which is not bad for a company fighting for survival just 15 years prior.

Investing for growth

During the following decade-plus of strong growth, the business grew in 2 key ways:

Acquisitions

Since Xpel became cash flow positive, the company has used a significant portion of this on acquisitions. To date, the company has made over 30 tuck-in acquisitions and a few larger ones. These acquisitions have been focused on several key areas aimed at getting closer to the customer:

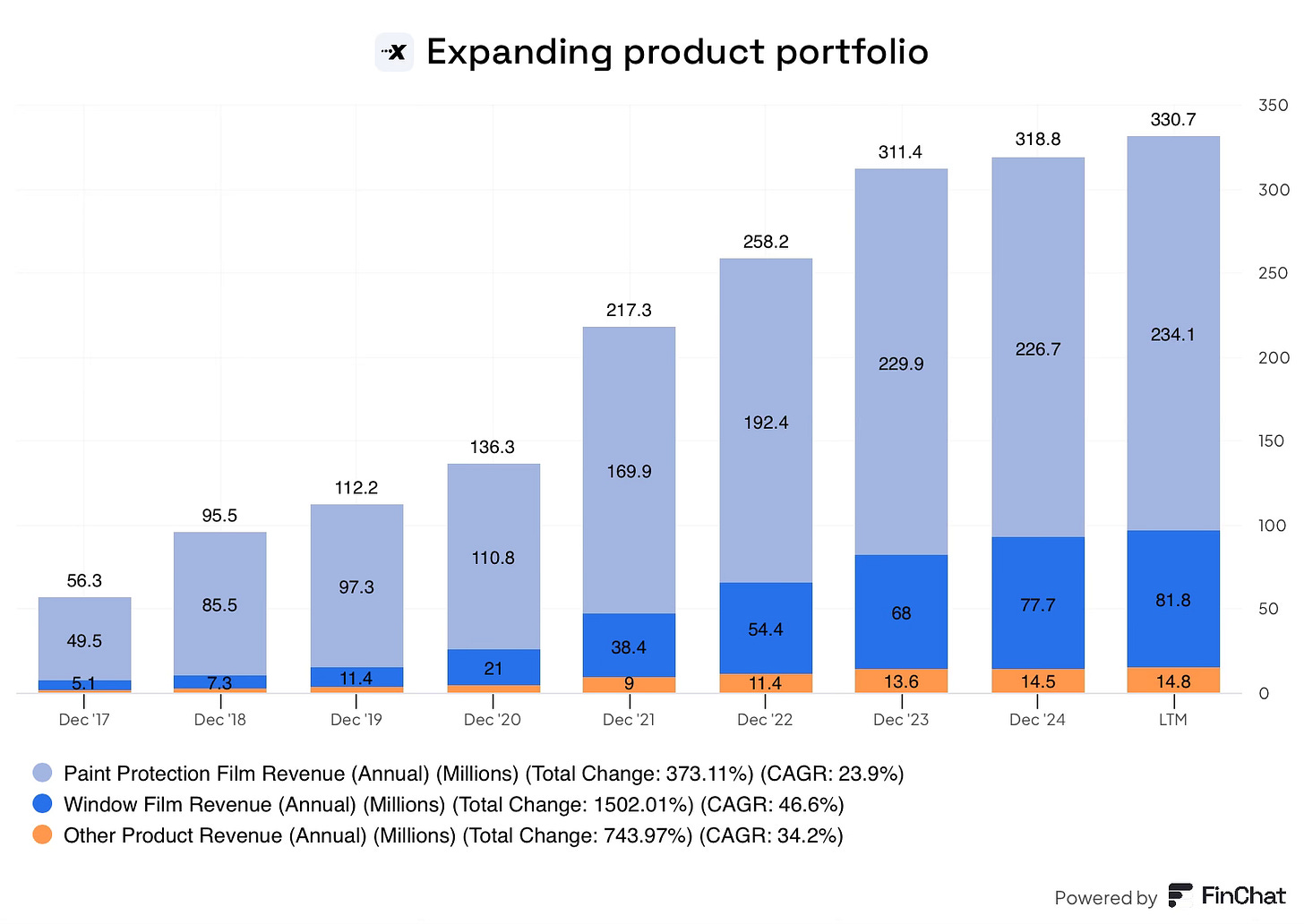

Product Line Expansion: Beginning in 2015, the company expanded beyond PPF into window tint. The company later expanded into architectural film (2017-2018), ceramic coatings (2019), antimicrobial film, interior protection, and marine. This has resulted in PPF concentration dropping from 100% of product revenue to two-thirds, despite growing healthily.

These efforts have also expanded the company’s TAM into adjacent industries such as architecture, marine and aviation while also increasing total dollars spent per car.

International and distributor acquisitions: Xpel has been a truly international company from a young age, with over 50% of sales being made up of international markets for many years. The intention behind this early expansion was to become the premium global brand, which they have achieved.

Initially, international expansion was through local distribution partnerships. Over time, as Xpel’s financial position has improved, the company began to acquire these distributors in a bid to control the channel and brand messaging.

Channel expansion: Xpel originated in the aftermarket, working with a growing number of independent dealers globally, which today number in the thousands. Xpel supports these dealers with software, training, marketing and lead generation.

Throughout this period, the company has expanded its go-to-market strategy through acquisitions into new car dealerships, original equipment manufacturers and even into company-owned installation facilities.

Brand building

When Ryan Pape took over, there was no sales or marketing department at the company. Subsequently, the company began to employ a growing sales force to create relationships with dealers to sell Xpel (B2B).

Following the launch of Xpel Ultimate, the company recognised the need to talk to the end user directly. To do this, the company became an early adopter of social media advertising, particularly Facebook, while also targeting car enthusiasts through events such as car clubs, auctions and events like the Goodwood Festival of Speed. At one point, the company was attending over 100 events per year.

This advertising drove strong consumer awareness for PPF and Xpel, driving market share gains and rising PPF attachment rates, particularly in key markets, such as the US and Canada.

Today, Xpel has created the premium brand in the industry, its marketing engine has become a significant competitive advantage that allows it to create partnerships that drive business for the company and installers, more on this later.

Listing change

In 2019, Xpel shifted its public listing from the TSX Venture Exchange onto the Nasdaq, adding significant credibility to both investors, customers and end users.

The drawdown

In 2021, following multiple years of rapid growth, Xpel’s stock briefly touched the $100/share mark. In valuation terms, this equalled a 100X P/E ratio or almost 14X sales! Undeniably, investors had gotten ahead of themselves.

Following this, the stock crashed 75% to the trough. While some of the drawdown is due to multiple compression, now trading at a 20X P/E ratio, slowing business growth, margin compression, and a well-distributed short report have also contributed to investor concerns.

I will discuss these factors in greater detail in part 2 of the deep dive, but now let us dive into understanding the business!

Understanding Xpel

In this segment, I will dive into the key aspects of Xpel’s business.

Business model overview

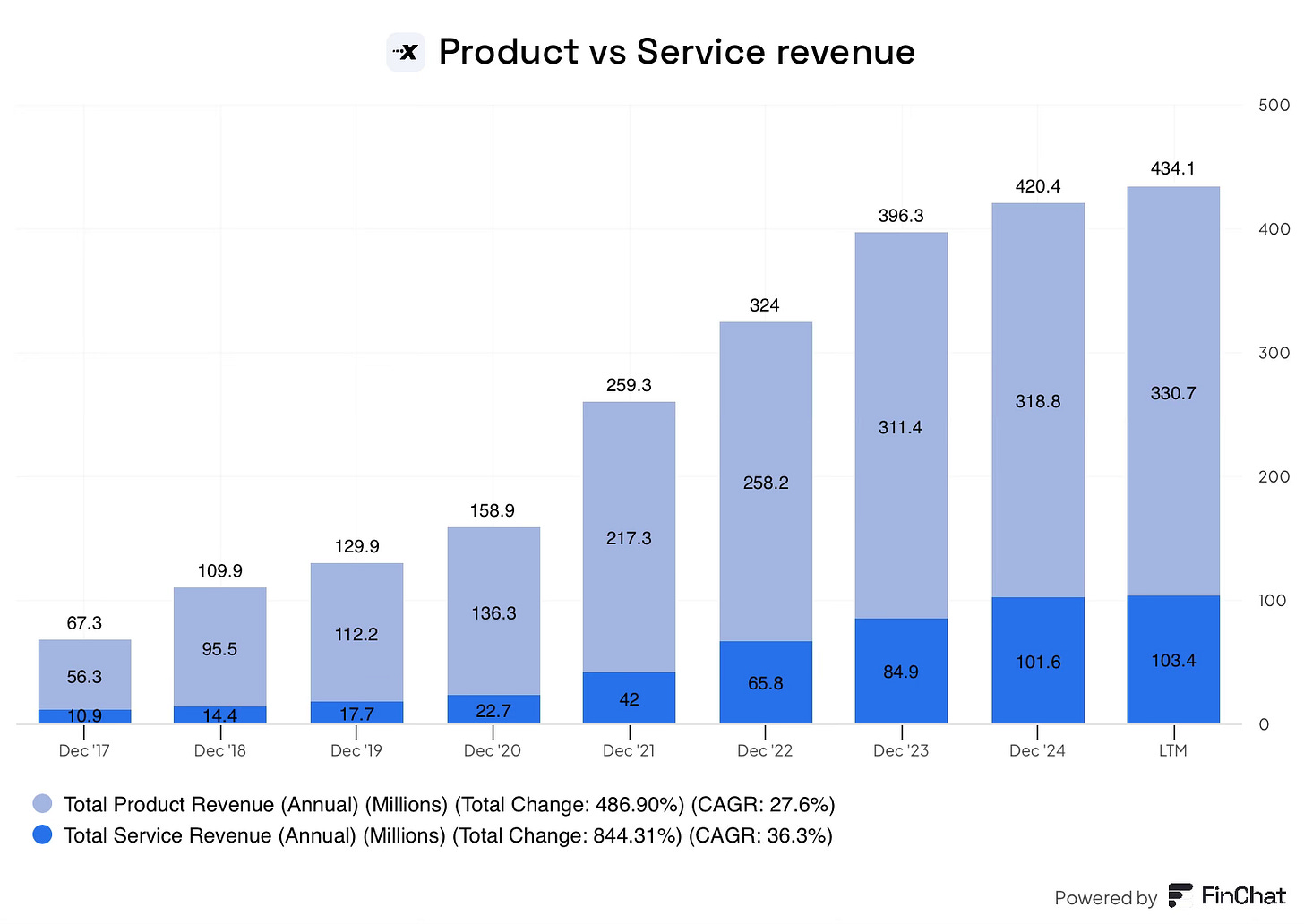

Xpel has two business segments: Product and Services, of which product revenue accounts for 76% of sales and service revenue for the remaining 24%. Essentially, through these two segments, Xpel supplies film and supporting tools to installers (B2B) with a north star of getting as much film on as many cars as possible.

Breaking down the business within industries, automotive revenue accounts for over 90% of the company's total, with the remaining amount coming from architectural (2.5%) and other revenue (3.4%), which includes ceramic coatings, plotters, chemicals, and other installation tools. Additionally, the company supplies film to industries such as marine, electronics and healthcare, which are not disclosed but likely make up the remainder.

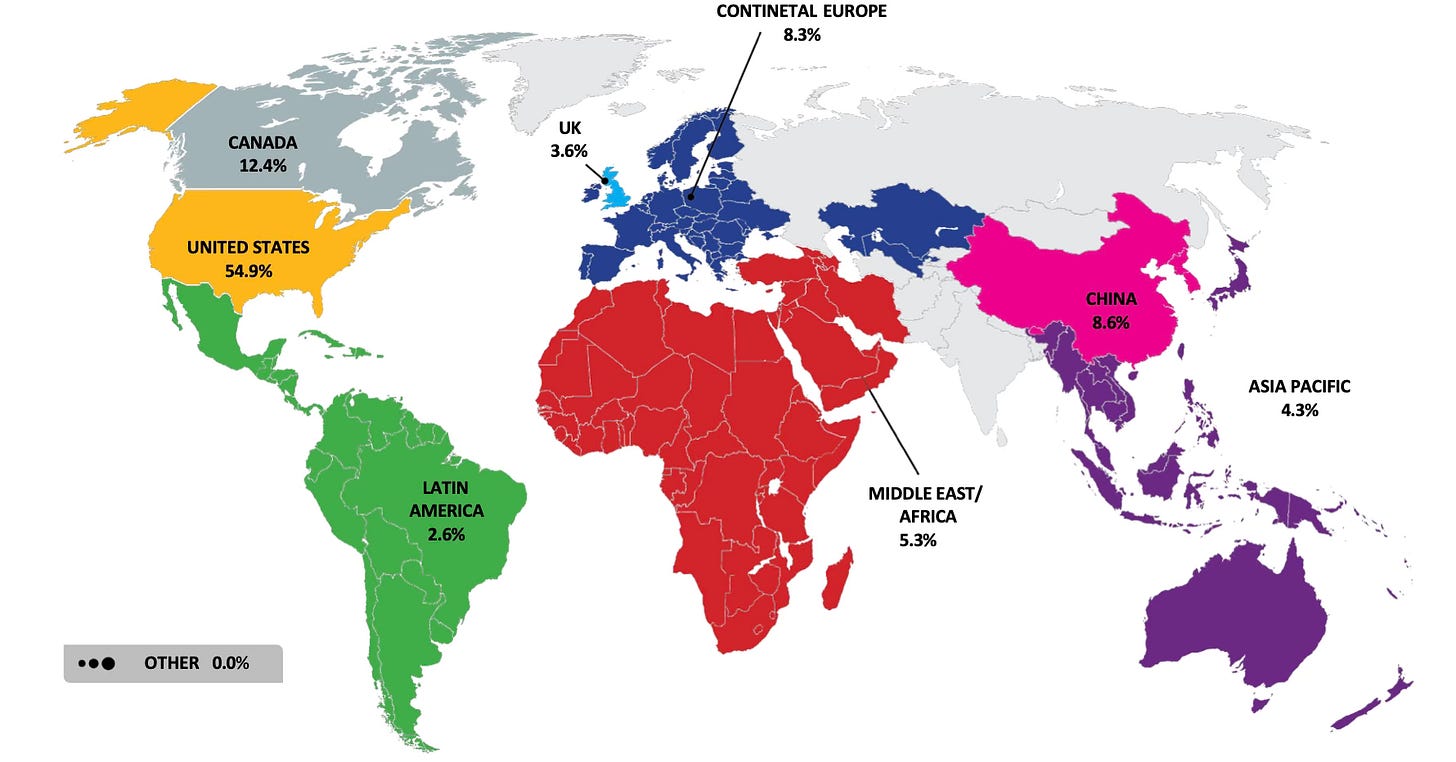

Geographically, North America accounts for almost 70% of the revenue, with Europe (13%), China (5.7%), the Middle East (5%), and Asia (4%) accounting for the rest.

Through these 2 business lines, Xpel aims to drive and capture adoption of its film and services by increasing global brand awareness.

Product Segment - 76% of sales

Xpel sells a range of films under the Xpel brand name. Initially, the company solely sold PPF to automotive enthusiasts. Over time, the product range and use cases have expanded to cover PPF (multiple variants), Window protection film, Window Tint and ceramic coatings to the automotive, architectural, marine, aviation and cycling industries.

Paint Protection Film (PPF)

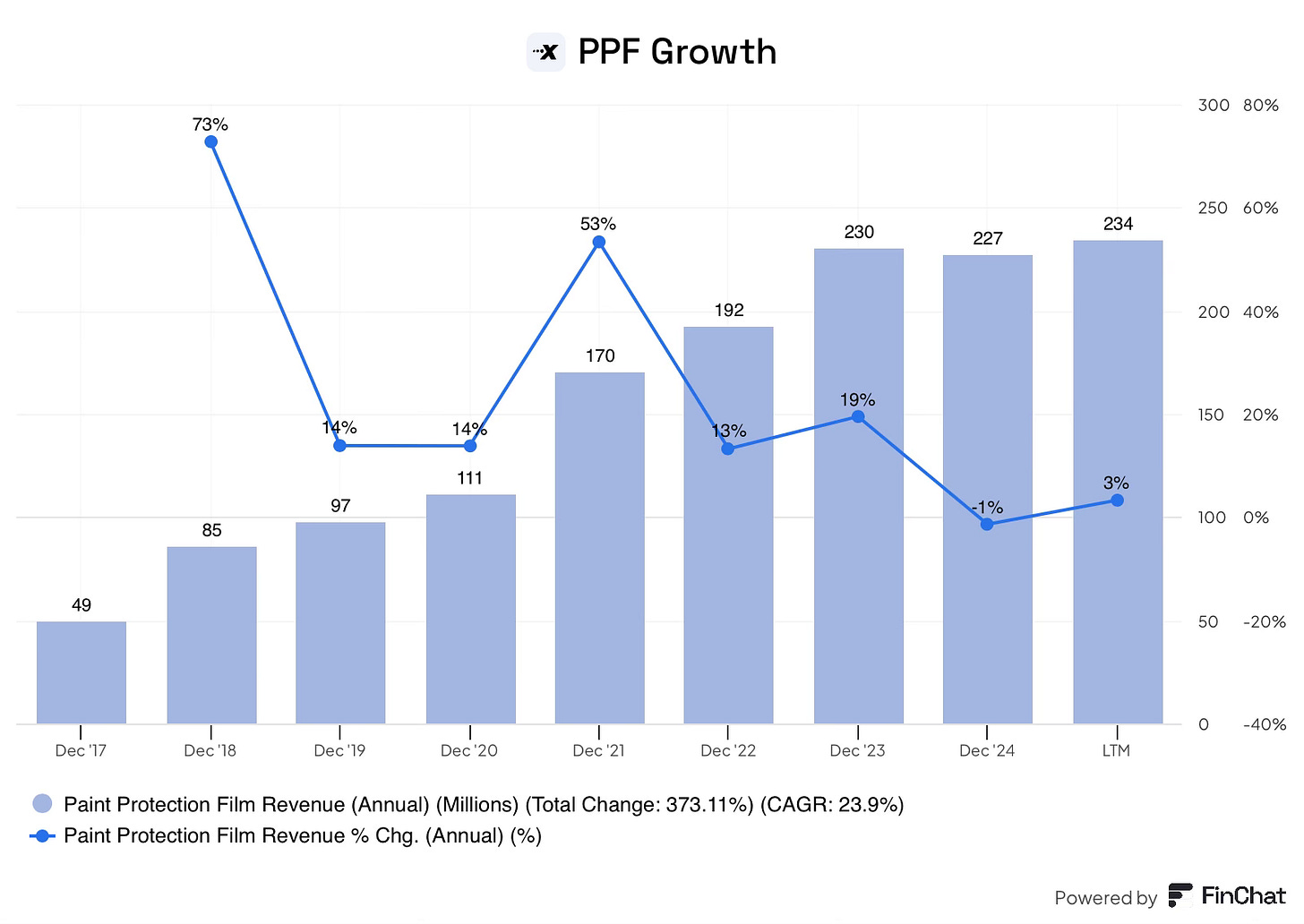

PPF revenue (including cutbank) accounts for 58% of sales. While this weighting has come down over time as new product lines and installation revenue have grown at a faster rate, PPF sales achieved a 24% annualised growth since 2017, demonstrating impressive growth as the company continues to increase penetration of new car sales.

So, what is Paint protection film? PPF is a TPU-based invisible film that is applied to painted surfaces to protect them from damage. The primary use case has been to protect cars from damage caused by rock chips, bug acid, road debris and other items. The film can withstand harsh weather conditions, which makes it long-lasting. Usually sold with a warranty lasting for 10 years.

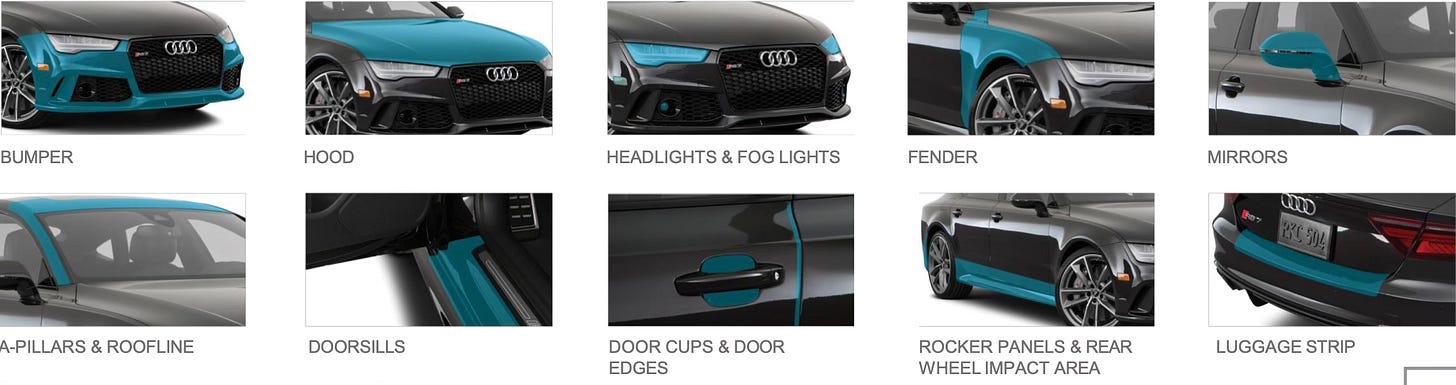

Installation process

PPF is a product that should be installed by professionals, making Xpel a B2B business at the core. To these professionals, Xpel supplies large rolls of film to installers, who will install it in the following steps.

1 - Cleaning: The first step of installation is cleaning. The intended surfaces must be spotless, free from all dust and contaminants that may not even be visible until film is applied. This stage can involve several cleaning steps.

2 - Pattern: Once clean, the bodywork patterns can be cut using DAP software and a cutting machine. This process increases installation efficiency and reduces waste.

3 - Installation: Once cut, a slip solution will be applied to both the car and the film, allowing the film to be positioned correctly while on the car. When in position, the slip solution is squeegeed out, locking the film onto the car.

4 - Tuck and wrap: To finish the look, the edges of the film are wrapped behind the panel, leaving no trace of any PPF on the car.

For a more in-depth look at the process, the video above provides a great look at the process.

The installation process is no easy feat, a full car wrap can take multiple days to complete, and to do it well, not only do installers need the right equipment (clean, good lighting, DAP software, installation tools), but it can also takes years to be able to leave a near invisible finish on every shape and size panel out there.

The PPF value proposition

There are several key factors a consumer cares about when choosing PPF, underpinned by a desire to protect their car from damage. According to surveys, the number 1 complaint with new car ownership is damage caused by rock chips. PPF protects against this damage, keeping a car looking brand new while maintaining its value. When choosing a brand, consumers look for:

Product quality: Firstly, how will it look on the car? Is it visible? Secondly, how well and how long will it protect the car, and does it come with a warranty?

Price: Does it provide a strong value proposition?

However, given the current skew towards higher-priced cars and automotive enthusiasts, price becomes a distant second consideration, with brand name and installer reputation as the primary.

Xpel’s strong brand positioning and best-in-class film properties have resulted in a subset of end users requesting Xpel PPF specifically. However, the reality is that the remaining end users who have either not experienced PPF or do not have as much brand loyalty to Xpel are heavily influenced by the installer, car dealership or OEM that is selling the PPF. This means that winning the business of the installer (B2B) is even more important than the end user because they are the best distribution for the product.

To satisfy installers, Xpel has focused on developing a product that not only has strong optics and protection but is also the easiest to install. Additionally, the company’s DAP software, distribution reliability, and revenue generation opportunities and brand lead installers to choose Xpel.

Pricing

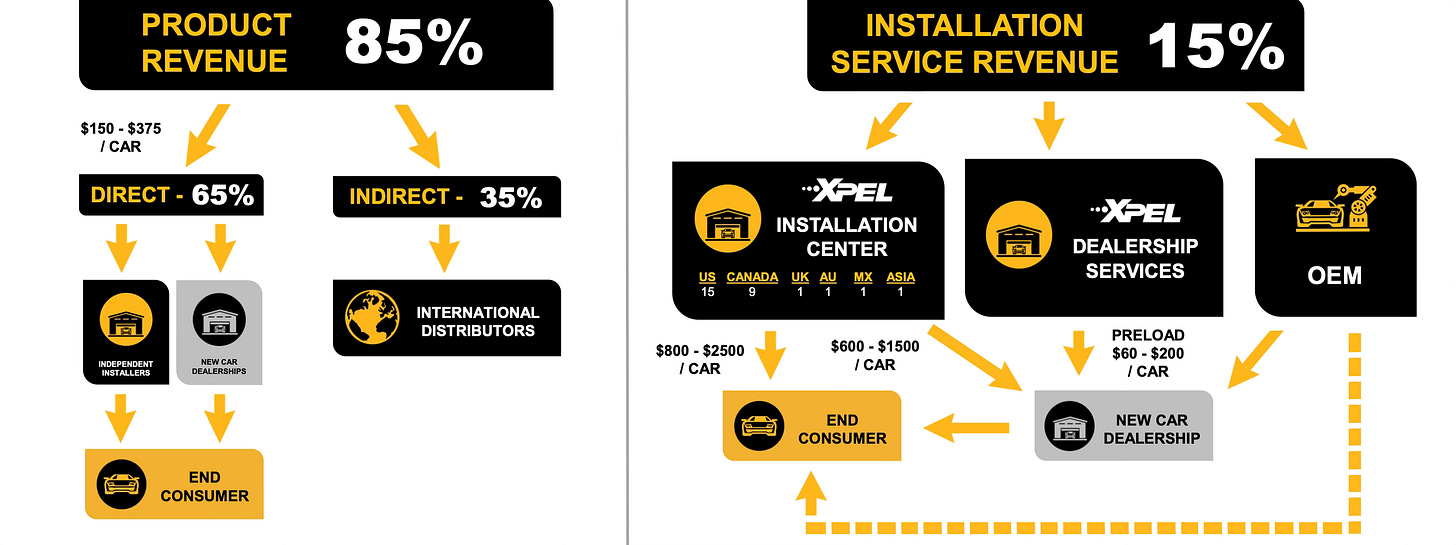

Xpel does not control the price an installer charges the end user, although they are looking for more standardisation across the board. Pricing can vary depending on coverage amount, distribution channel, regional variations, along with installer reputation, etc. Typical pricing can be seen below.

At the core, Xpel sells rolls of film through a tiered pricing system for exclusive dealers, which depends on volume hurdles. A typical role of Xpel Ultimate PPF is priced between $1,200-$1,400, which will cover between 1-2 cars. These prices are 10-15% higher than the competitive set, and in some cases above the next best competitor.

To put the price into perspective, PPF equates to roughly 20% of a $6,000-$7,000 full car protection package, meaning installers can earn a significant markup for their work.

Attachment rates

Another way to look at pricing is revenue per car. When sold to the independent installer base, Xpel typically generates $150-$375 per car in revenue, suggesting the average finish is between a full front and partial hood. This is confirmed by Xpel’s owned installation centres, which generate $800-$2500 per car in revenue, remember this includes installation.

For wholesale agreements to new car dealerships, Xpel generates $600-$1500 per car (includes installation), as high-volume work typically generates discount agreements.

Finally, dealership services generate $60-$200 per car, the lowest of any channel. This segment primarily installs pre-loaded window tint and small amounts of PPF on a large number of cars; this segment presents the largest opportunity to increase content (revenue) per car.

Expanding product portfolio

Following the success of Xpel Ultimate (2011), the company has since diversified into complementary product lines through acquisitions and some internal development, beginning with window film in Q1 2015, with the acquisition of Parasol Canada, a distributor of PPF and window tint products.

The expansion of the product offering enables Xpel to fulfil its mandate of “getting more products on more cars” in a manner that allows the company to enhance its competitive position in a margin-accretive manner.

Additionally, Xpel’s independent installer base offers a wide variety of products beyond PPF; the most common adjacencies include window tint, ceramic coatings, vinyl wrap, etc. Depending on location, installers may also do work in adjacent industries such as Marine, Architecture and cycling, to name a few.

Xpel is able to leverage its product quality, DAP software, and marketing capabilities to expand the number of Xpel products used within the installer base.

By consolidating an installer’s purchases to Xpel, it becomes harder to switch to competing brands. For Xpel, adding additional products to a customer’s order incurs minimal SG&A costs, making incremental products margin accretive. This may sound only beneficial to Xpel, but the installers benefit in multiple ways, including access to best-in-class products, DAP software and marketing and lead generation, which drive additional business, more on these later.

Window Film Segment

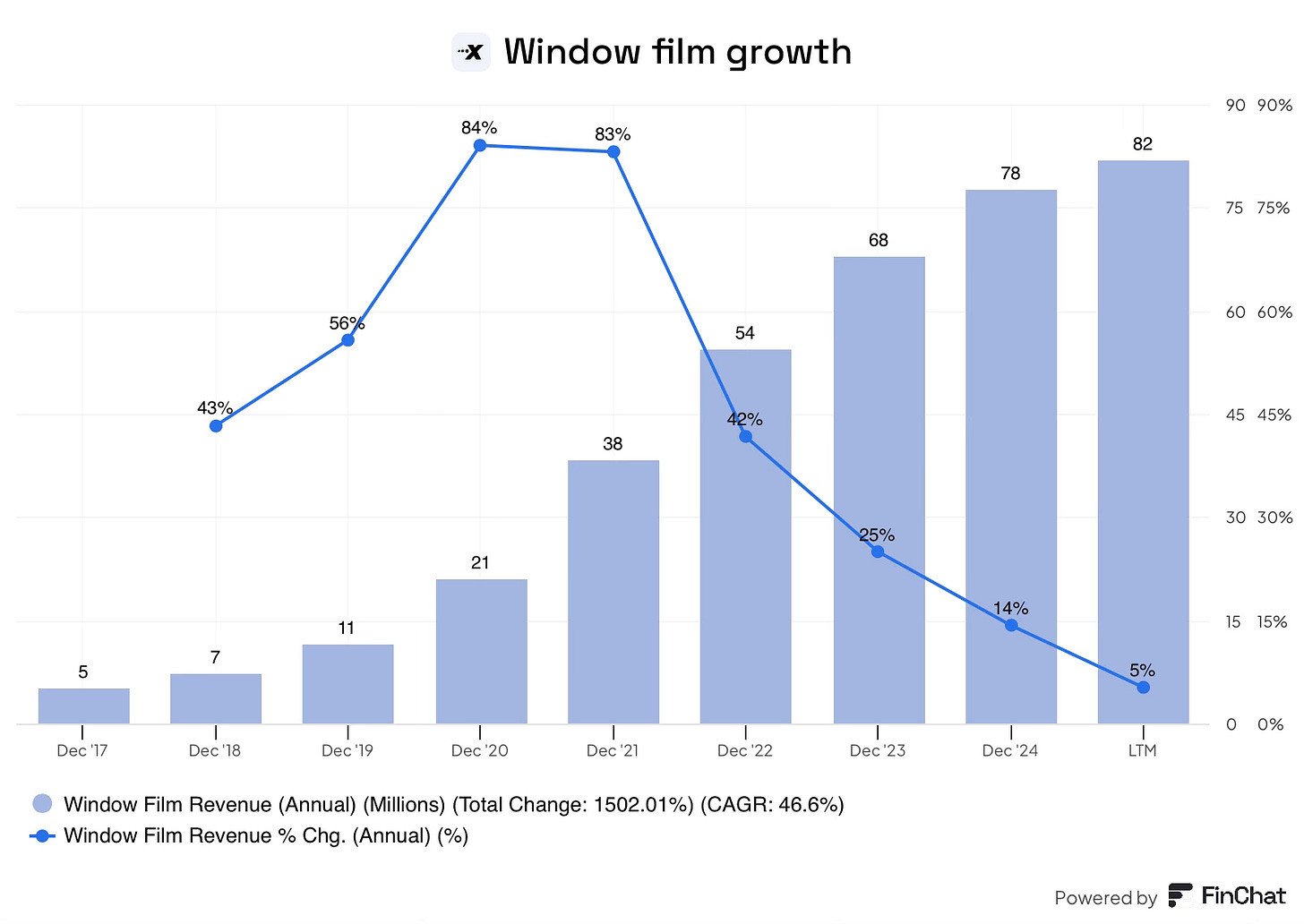

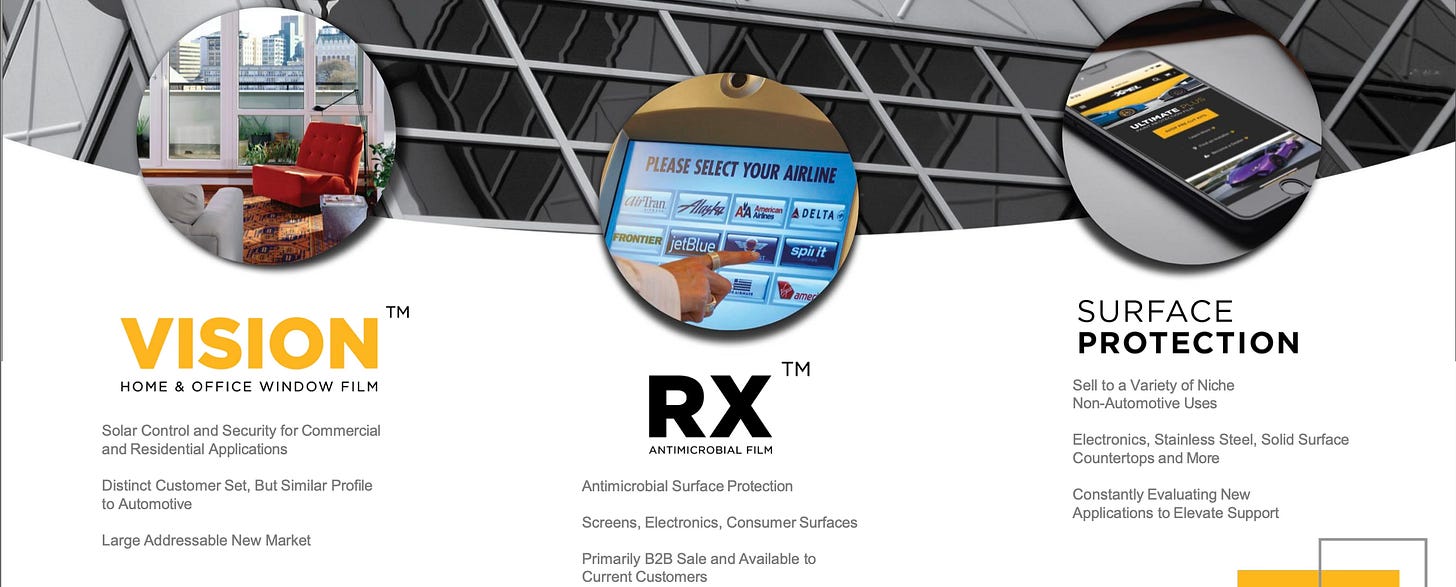

Window film accounts for 19% of the company's revenue and is sold under Xpel Prime (Window Tint), Xpel Vision (Architectural film), Xpel RX (Antimicrobial film) and Xpel Windshield protection film lines.

Xpel’s strong brand recognition, cross-sell opportunities and large addressable market have allowed this segment to grow at a compound annual rate of 46% since 2017.

Window Tint

Window Tint is the natural adjacency to PPF and today makes up the majority of the window film segment (85%). The business has grown rapidly, outgrowing several distribution facilities in the already highly penetrated market. Today, window tint has much higher attach rates in comparison to PPF, meaning Xpel’s growth in this segment is more tied to market share gains (although the industry is still growing).

Window tint can be used for various applications including: aesthetics, privacy, heat rejection and UV protection.

While revenue is lower when compared to PPF (lower price tag), window tint is now the highest volume business, overtaking PPF.

Windshield protection film

In late 2024, Xpel launched windshield protection film, a highly requested product that shields the front windscreen from chips and cracks caused by rocks and other flying debris. This product is not a new invention in the industry; in fact, many competitors have competing products in the market, that reportedly “have a number of trade-offs”. Instead, Xpel has spent years developing this product to avoid these trade-offs.

Despite only being launched in late 2024, Xpel recorded $1.5m in sales for its first month in Q4 2024. On an annualised basis, this works out to roughly $18m, or just over 20% of the window film segment.

This new product is potentially a gateway product for new consumers who haven’t been exposed to PPF before. Windscreen chips and cracks are a common frustration for every car owner, regardless of whether they are an enthusiast or not. Furthermore, with windscreens becoming increasingly expensive as electronics are integrated within, the value proposition becomes more attractive. These two factors could see adoption closer to window tint (~60%) versus PPF (~8-9%).

Non-Automotive films

Architectural Film

Architectural film, under the vision line, makes up 13.4% of window film sales. Initially started in 2014, the segment became established following the acquisition of Pro-Tect Film in late 2016.

Under the Vision brand, Xpel sells architectural glass solutions for commercial and residential buildings. Products include:

Solar: Similar to window tint, Solar provides solar energy rejection.

Safety & security: film to secure glass in the event of breakage.

Other: includes anti-graffiti & decorative films.

Despite being in the market for some time, Xpel was still late to the game with 3M in particular (followed by Eastman Chemical) holding a strong position in the market, leading to weaker-than-hoped performance.

To counteract this, Xpel acquired Veloce in 2021, bringing veteran leader Harry Rahmen to the company. He has a strong track record, growing both Veloce and Huper Optik (Eastman subsidiary) into industry leaders. While it is too early to tell, this segment has shown signs of promise, winning some large accounts and introducing technology and warranty features to the offering.

Marine

The marine vertical is the latest product expansion, established from the acquisition of Protective Film Solutions (PFS) in June 2024, bringing Ryan Townsey onboard as the director of Marine.

PFS, primarily an automotive installer, has established a “Substantial marine model”. Since its acquisition, Xpel has standardised this model and is rolling it out to viable installers. Despite minimal investment in the vertical, the company has seen good traction in a market that remains in its infancy.

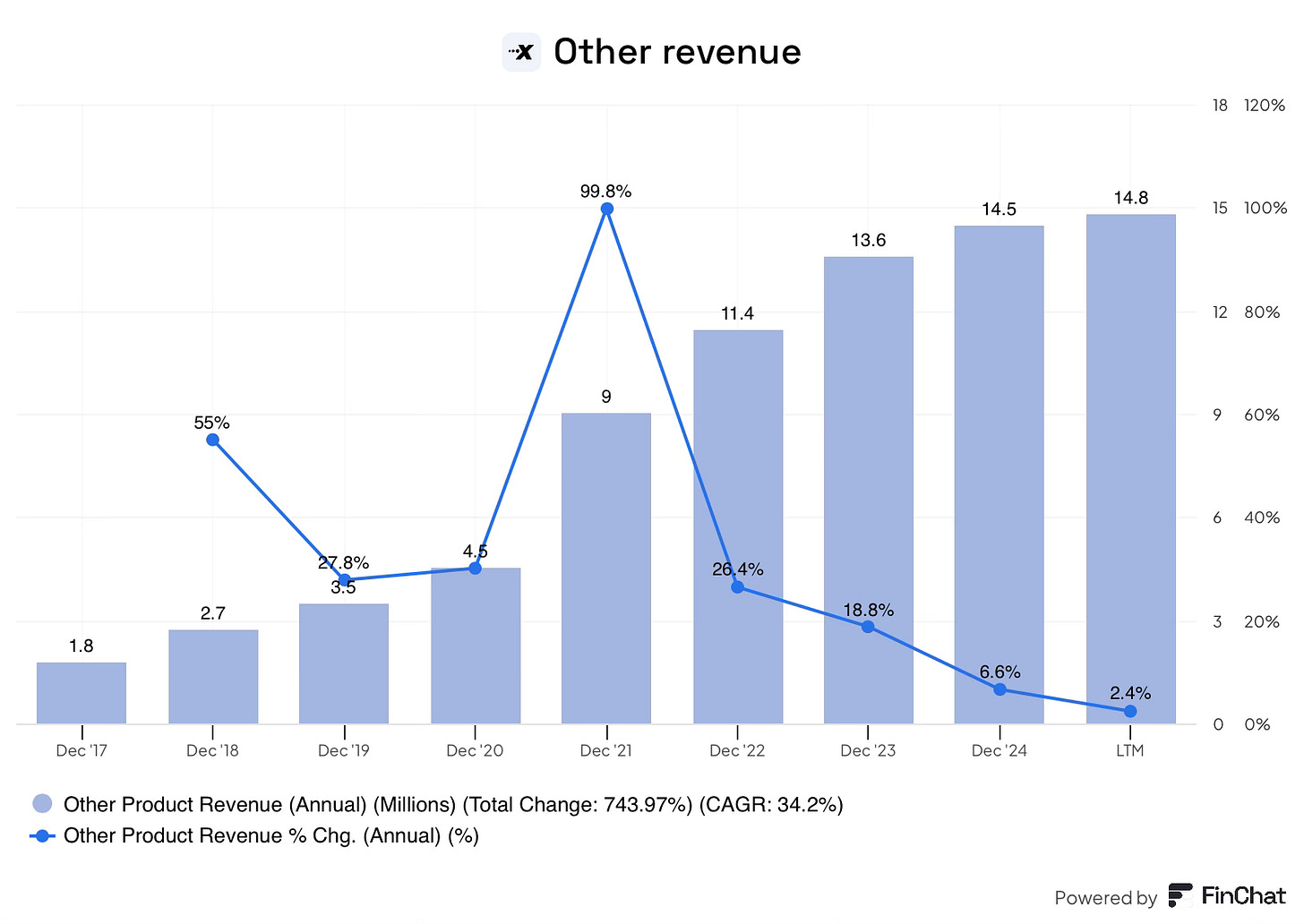

Other Revenue

The other revenue segment has $14.8m in sales, representing 3.4% of total revenue. The category includes miscellaneous items, including plotters, chemicals, and other film installation tools and accessories. Many of the installation tools are commodity items, and the chemicals are available to both the installer and end users through the Xpel website.

The other product in this segment is ceramic coatings, accounting for $6.4 of the $15m in revenue. Ceramic coatings were launched in 2018 under the Fusion brand name. Ceramic coating is a liquid polymer solution that can be applied to pretty much any part of the bodywork of a car, even on top of PPF. Although only Xpel fusion can be applied on top of Xpel PPF to preserve the warranty of the product.

Ceramic coating provides hydrophobic properties, UV protection and minor resistance against scratches, etc. Essentially, the coating keeps a car looking new while preserving the paint from fading.

While still small in size, this line of coatings has been “smoking the market” since its launch, according to Chris Hardy, leading to the strong growth in Other revenue.

Asset-light business model

Xpel has historically not manufactured any of the films in-house. Instead, the company utilises third-party and contract manufacturers. This approach was taken out of necessity; recall, Xpel began to sell film in 2007 at a time when the business was in poor financial shape, and the company did not have the resources to build out its own facilities.

The benefits of this approach include: lower capital intensity, lower business complexity, and scalability. On the other hand, it also introduces some risks.

Reliance on third-party manufacturers: Historically, Xpel relied on a single supplier, Entrotech. However, over the last few years, the company has mitigated this risk by diversifying its production base.

Quality issues: Given Xpel’s positioning as the “gold standard” in the industry, quality control is crucial. By outsourcing production, Xpel runs the risk of poor production quality or consistency. This became true in late 2015/ early 2016 when the company ran into quality issues. Xpel has since established in-house conversion operations at global facilities, including: quality assurance, inspection, rewinding, boxing and packaging. These measures have led to a greater focus on quality and have prevented a repeat of these issues.

In Q4 2024, Xpel brought a new manufacturing location up to scale in what appears to be the company’s first owned manufacturing facility, potentially marking a gradual shift towards vertical integration.

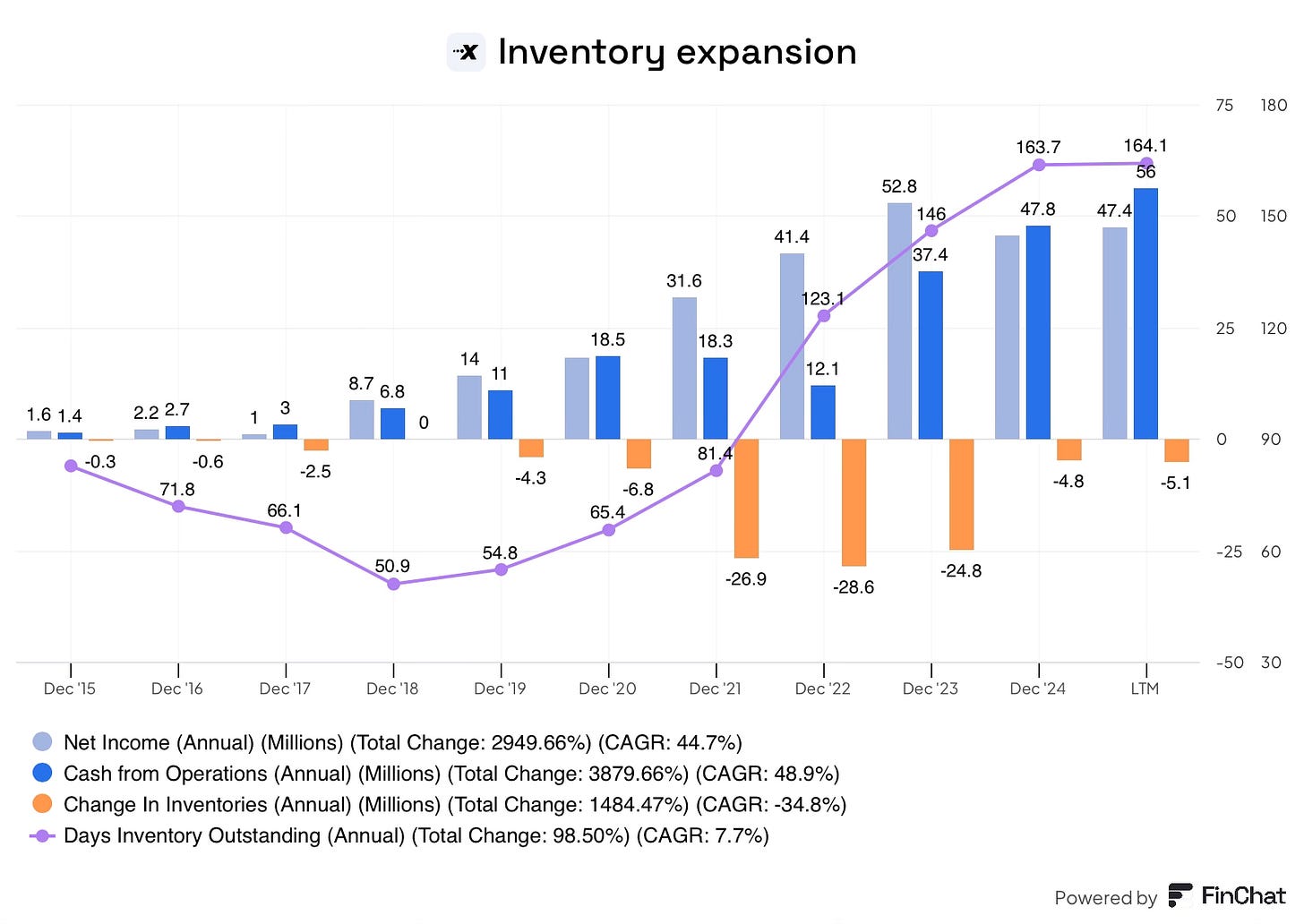

Inventory

Being a supplier requires disciplined inventory management. Currently, Xpel holds almost double its historical inventory levels, which has caused cash from operations to be lumpy in comparison to Net income. This trend is particularly evident from 2021 to 2023, when inventory days increased from 80 to 146.

During this period, many industries were facing significant supply chain issues due to local lockdowns and shortages. Xpel foresaw these issues, placing large orders of film to make sure they never ran out of stock, which otherwise could have had a significant impact on dealerships, negatively impacting customer loyalty and brand image. Instead, Xpel took the short-term financial hit to ensure dealership success, something other brands fell short of at the time. This situation likely allowed the company to gain market share and earn the company significant goodwill from customers.

Go to market

Xpel’s north star and measure of success is content per car; the company is therefore agnostic as to which channel the end users decide to buy through.

Currently, there are 3 channels through which end users can find Xpel’s products in developed markets such as the US, Canada and parts of Europe:

Independent Installers (Aftermarket)

New car dealerships (Dealership services)

OEM partnerships

Beyond these developed markets, the company has been transitioning from local distributor partnerships to a direct model through acquisitions.

I will discuss each of these strategies below.

Independent installers

Xpel’s products are for professional installation, and the independent installers are the professionals who apply PPF, Window tint and Ceramic coatings onto customers’ Cars, Windows, Boats and more.

While the exact number is unknown, Xpel has relationships numbering in the thousands globally. In recent years, Xpel has won over some large multi-location installers, such as Tint World and Sunstoppers, from competitive brands. This base is responsible for 63.8% of total revenue, making it a crucial aspect of the business. In turn, Xpel provides a comprehensive turn-key solution including: comprehensive best-in-class selection of films, installation training, access to DAP, marketing support and lead generation.

Arguably, even more important than the financial returns this channel generates is the influence these installers have on the end users’ perception of the Xpel brand.

While the quality of film matters greatly, it is only half of the story; the years of practice mastering the art of installation are just as important in preserving Xpel’s status as the gold standard in the eyes of the end user. Xpel emphasises that every end user must leave happy. If installation quality issues become persistent, Xpel may discontinue an account, indicating the company is acutely aware of the importance of maintaining its brand long term over short-term financial gains.

Following some 2020 policy changes, there are two types of installer supply agreements:

New Accounts (Post January 2020): Following changes to supply agreements, all new installers after this date must be exclusive, offering solely Xpel products in product categories where Xpel has an offering.

Grandfathered accounts: For all installers that Xpel supplied before the 2020 changes have been honoured and are not required to exclusively install Xpel for the time being. However, as installer demand heats up in certain geographical locations, exclusivity will likely be required from grandfathered installers to prevent additional Xpel-approved suppliers from being approved.

This move towards exclusivity is the next step in Xpel’s drive towards being the gold standard in the industry. By being exclusive, the installer will appear as a franchise, maintaining a consistent brand image, eliminating competitors’ products from the shelves, while better aligning the interests of the installer and brand.

On the flip side, by making the installer exclusive, Xpel must manage the density of installer locations, striking the right balance between full geographic coverage, internal competition and maintaining quality.

In return for exclusivity, Xpel provides a comprehensive turn-key solution including: comprehensive best-in-class selection of films, 24/7 dedicated support, installation training, access to DAP, marketing support and lead generation.

Addressable market

Independent installers have been a great place for the enthusiast buyer to get PPF. However, with the company setting its sights on increasing adoption beyond just the enthusiast, Xpel must meet these consumers where they shop.

Xpel estimates the car buyer market in the US is made up of 15% car enthusiasts, 50-60% buyers with varying levels of pride of ownership and the remaining 25% or so having no pride of ownership and will therefore not be Xpel customers.

Furthermore, Xpel believes that 60% of new car buyers would be open to PPF if presented with the opportunity at the purchase stage.

In Xpel’s view, this means they can target up to 75% of the market. To get beyond the 8-9% penetration today (in the US, even less internationally), Xpel is investing heavily in New car dealership & OEM channels.

New car dealerships

Xpel products are primarily utilised on new cars; the longer a car is on the road unprotected, the less effective PPF will be. Covering a car before sale is, therefore, the most logical channel for both Xpel and the end user.

Following the acquisition of Permaplate in 2021, Xpel began to invest significantly in expanding its dealership capabilities. Today, this channel is the second largest for Xpel.

There are several different ways new car dealerships can partner with Xpel:

Developing an in-house program with internally hired staff who install film directly purchased from Xpel.

Xpel onsite installation services.

Third-party (independent installers) onsite installation.

Partner referral to an independent installer nearby.

Xpel, consistent with its strategy of getting more film onto more cars, is agnostic to which channel a dealership prefers.

Currently, this channel is primarily pre-load window film. The currently minimal penetration of PPF in this channel presents future opportunities to cross-sell to customers who would not typically take their car into the aftermarket, opening up a broader segment of the market for Xpel to attract.

The pre-load nature of this channel ties the business to dealership inventory levels.

For the independent installer, Xpel offers wholesale programs. This allows them to perform work for dealerships, invoice it through the DAP platform and get paid within 24 hours, solving one of the biggest issues for wholesale work, payment terms and the subsequent cash flow challenge.

Investors should expect Xpel to invest significantly in this channel going forward.

OEM’s

Xpel has roughly 10 partnerships with Original equipment manufacturers (OEMs) where Xpel, through installation services or independent installers, install film (mainly PPF) directly for vehicle manufacturers. This normally occurs at a dedicated facility near the point of production.

The primary target for this partnership would be EV manufacturers who directly sell to the end user, the prime example of this is Rivian, who offer a full stealth wrap promotion.

It is worth noting that these contracts are typically for a single model for a certain amount of time.

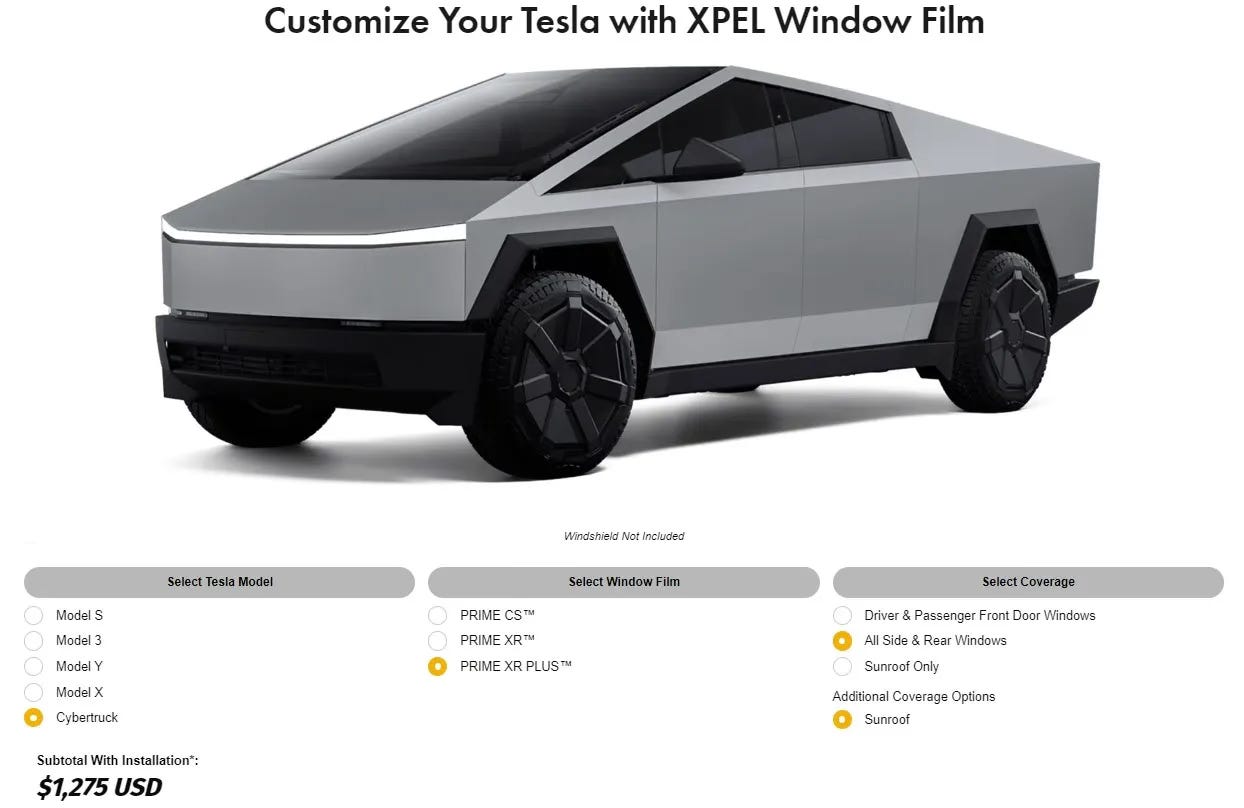

Beyond direct installation, Xpel has recently announced (2024) a pilot referral program with Tesla. In this scenario, Tesla would refer a new car buyer to Xpel’s website, where they can purchase film coverage. Xpel will collect payment and route the job to a nearby approved independent installer, who will then be remunerated.

The company also has several exclusive partnerships with high-end brands. Xpel installation is offered at both The BMW Driving Experience and The Porsche Experience in Europe.

Over the past 4 years, this segment has grown rapidly, yet still only accounts for less than 5% of revenue. While likely that Xpel will continue to expand the number of partnerships they have. The OEM segment will remain the smallest of the 3 channels for several key reasons:

Scaling issues: Given the manual and time-consuming installation process, it requires significant human capital, putting a limit on how big it can be.

Dealership internalisation: Dealerships would likely prefer to internalise these customisation offerings as a way to maximise gross profit generation at the dealership level.

International: Direct vs Indirect

Xpel generates 31% of revenue outside of North America (US & Canada).

Internationally, the company operates in a mix of direct (typically large auto markets) and indirect markets, through established relationships with local distributors. These indirect markets have 15-25% lower margins than those where Xpel has a direct presence.

Over time, Xpel has increasingly established a direct presence in top markets. In Europe and Mexico, the company has organically established its own operations, distribution and local sales teams. In other markets such as Canada, Taiwan, the Middle East, Australia and India, the company has acquired local distributors, typically at valuations of 3-5X EBITDA, generating strong IRRs for Xpel. These acquisitions lay the foundations for future organic investment in each market.

When Xpel acquires a distributor, the company has consistently accelerated growth while simultaneously expanding margins. The acquisition of the distributor in Australia is a prime recent example of this, closed in late 2022, revenue increased by 2-3 times over the next year, and margins also expanded to the highest level of any market. To achieve this, Xpel ensures the full product line is available, prices products correctly (typically lowering prices), establishes a proper go-to-market strategy and develops deep relationships with dealers.

Following recent acquisitions in Japan, Thailand, and India in 2024, the company has established a direct presence in the top 20 automotive markets, excluding China.

Now that distributor consolidation has for the most part been completed, the company will follow its proven playbook in these markets (outlined above), which should result in accelerated growth and higher margins over time.

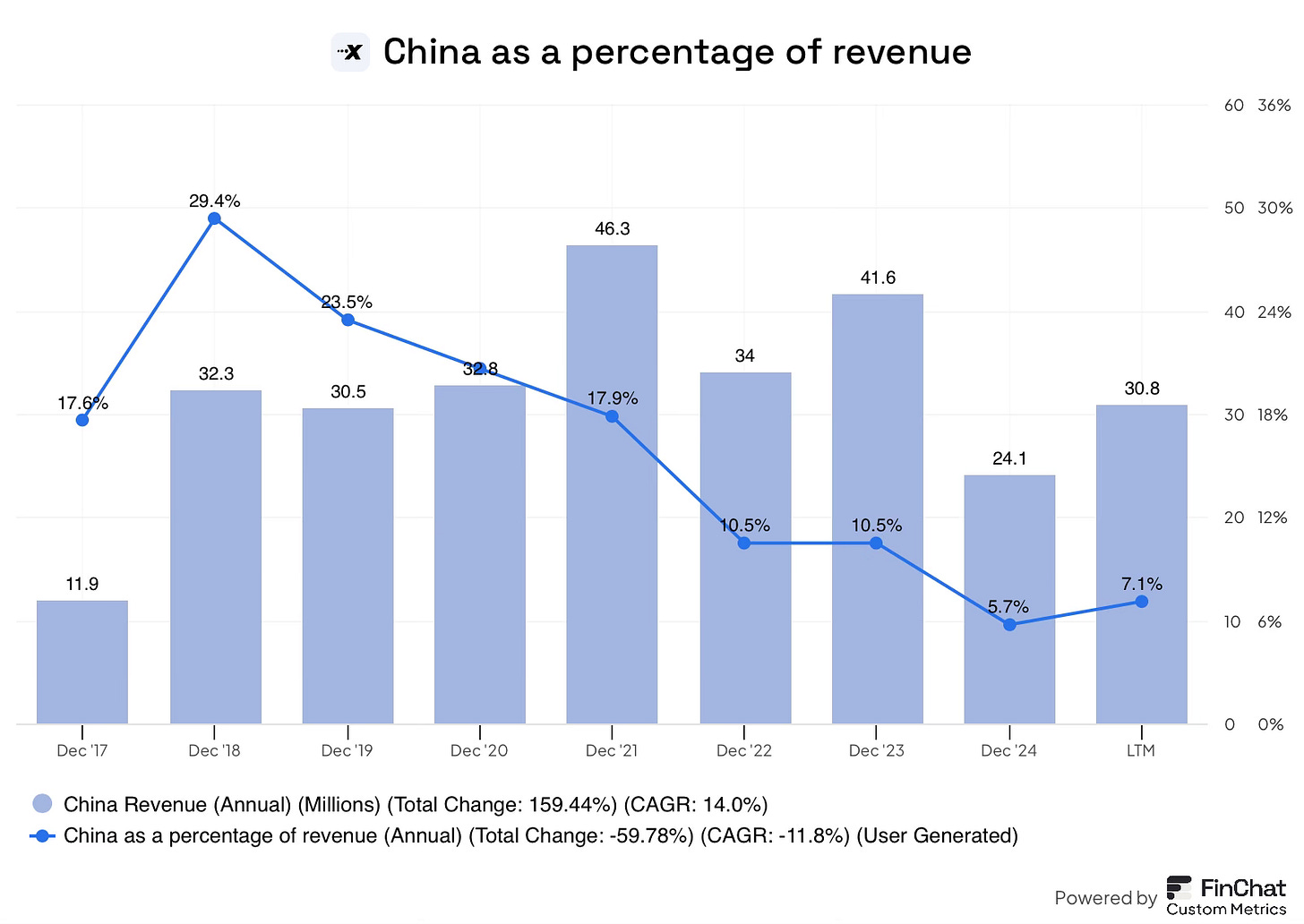

China

China has been a large part of Xpel’s business; in 2018, China accounted for almost 30% of revenue. Since then, sales have stagnated, causing China’s concentration to shrink to just 5.7% of the business for the full year 2024.

The struggle in this region is due to multiple factors:

Rising domestic production: The domestic car market in China has changed dramatically. In 2018, Xpel’s products were predominantly used to protect European car brands. However, as domestic EV brands have taken share, this has resulted in a transitional period. As this transition has taken place, Xpel has pursued partnerships with domestic brands to counteract declining European presence.

Product portfolio: While Xpel has a premium proposition in every market, in China, this proposition skews to the very top end of the market. This almost luxury proposition has resulted in the company limiting the size of its TAM to Supercars, etc. The company has recognised this and is rolling out a lower-priced product portfolio that should allow for broader market adoption, while maintaining its premium brand. This is a common theme across many of Xpels’ lower labour cost markets.

For many years, the company remained adamant that it had no intention to have a direct presence in China. However, a change in tone, potentially due to the prolonged weak performance of late, has led the company into advanced talks about a direct presence in the market. Given the size of this market and only a single master distributor present, an acquisition here could be the largest in the company’s history. However, an acquisition is not the only solution; Xpel has several teams on the ground in China working with the distributor on marketing, channel expansion and product portfolio changes. These actions suggest the company may choose a hybrid solution instead of outright acquisition.

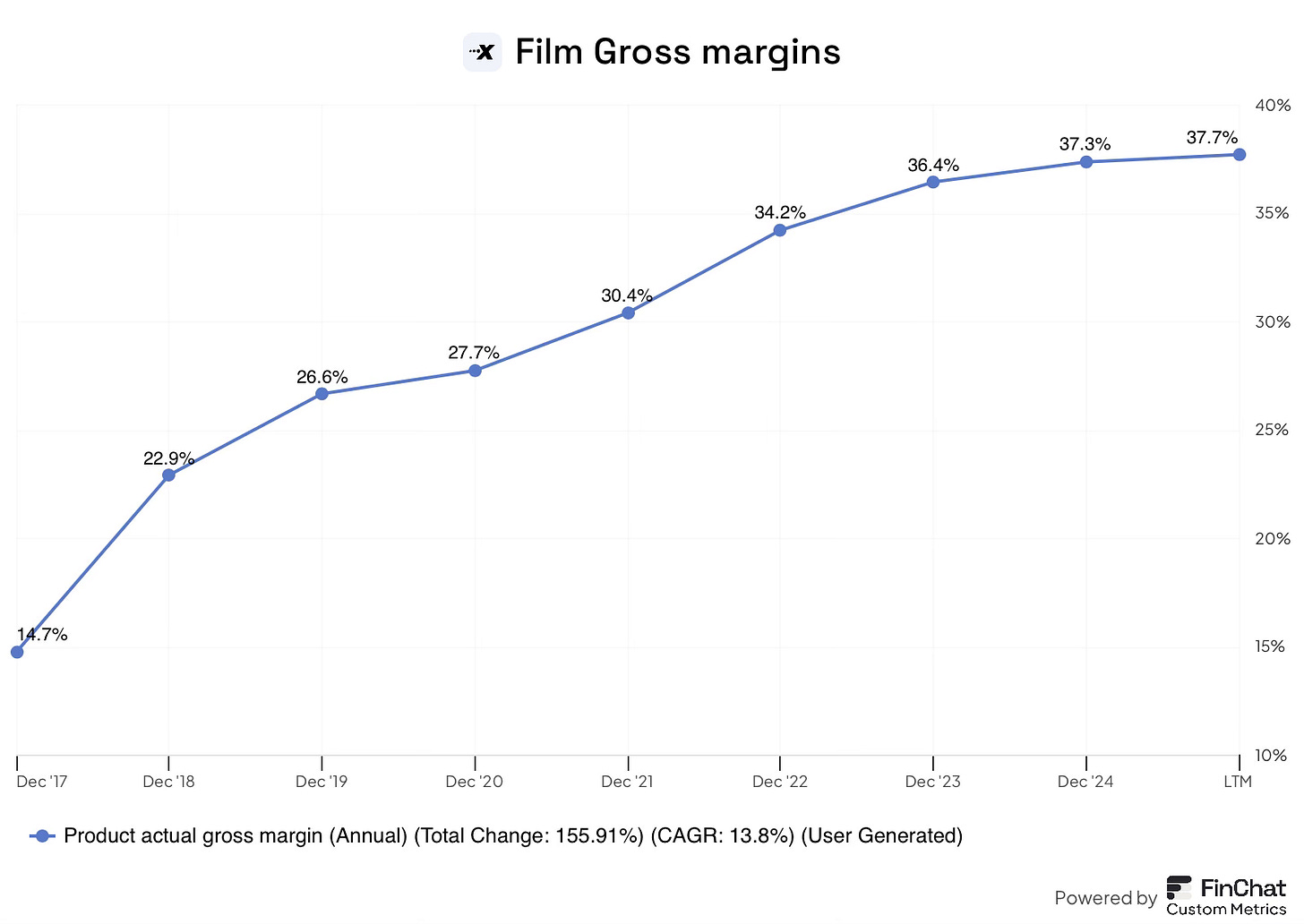

Film Economics

So, where does all of this shake out?

Xpel’s product margins have expanded dramatically over time from 15% to 37% in 7 years. Several factors have driven this substantial improvement:

Cost leverage: Xpel’s costs of goods sold include multiple items, including material costs, shipping costs, warranty costs, labour and overhead costs. Over time, through reducing the bill of materials, supply chain optimisation and leveraging fixed costs, the company has driven significant margin improvements in this area.

Product mix: Xpel’s product has become best in class, and the brand has grown in strength, allowing Xpel to introduce price increases and the launch of additional products with accretive gross margins. As these products have become a larger part of the overall pie, margins have increased.

Geographic mix: Markets where Xpel acts directly have 10-15% higher gross margins than distributor margins. Over time, Xpel has generated an increasing portion of revenue from North America and less from China; this has had the effect of trading a low-margin business for high margins. Additionally, the transition from indirect to direct distribution in many of Xpel’s largest markets has allowed the company to achieve margin parity with markets like the US.

While the magnitude of margin increase will be less going forward, the company still believes they have the opportunity to increase margins gradually over time. The company will continue to be a good partner to suppliers, allowing them to negotiate discounts, introduce accretive gross margin products and further transition towards direct distribution markets.

Additionally, the potential for future vertical integration of manufacturing facilities presents future upside optionallity.

Service revenue

Beyond selling film, Xpel provides a range of services to installers which help run their business. The company also has in-house installation centres catering to the aftermarket, new car dealerships and OEMs.

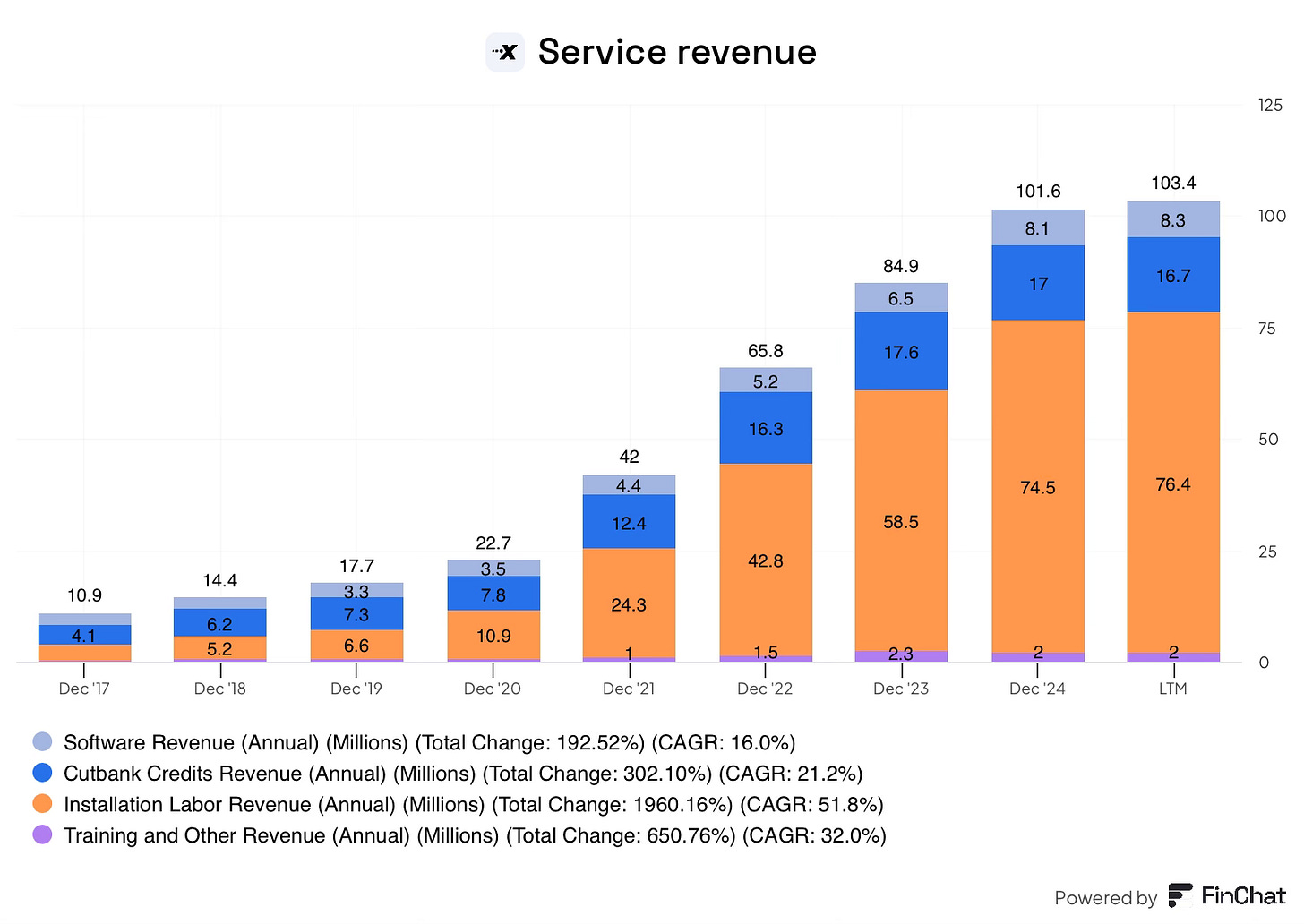

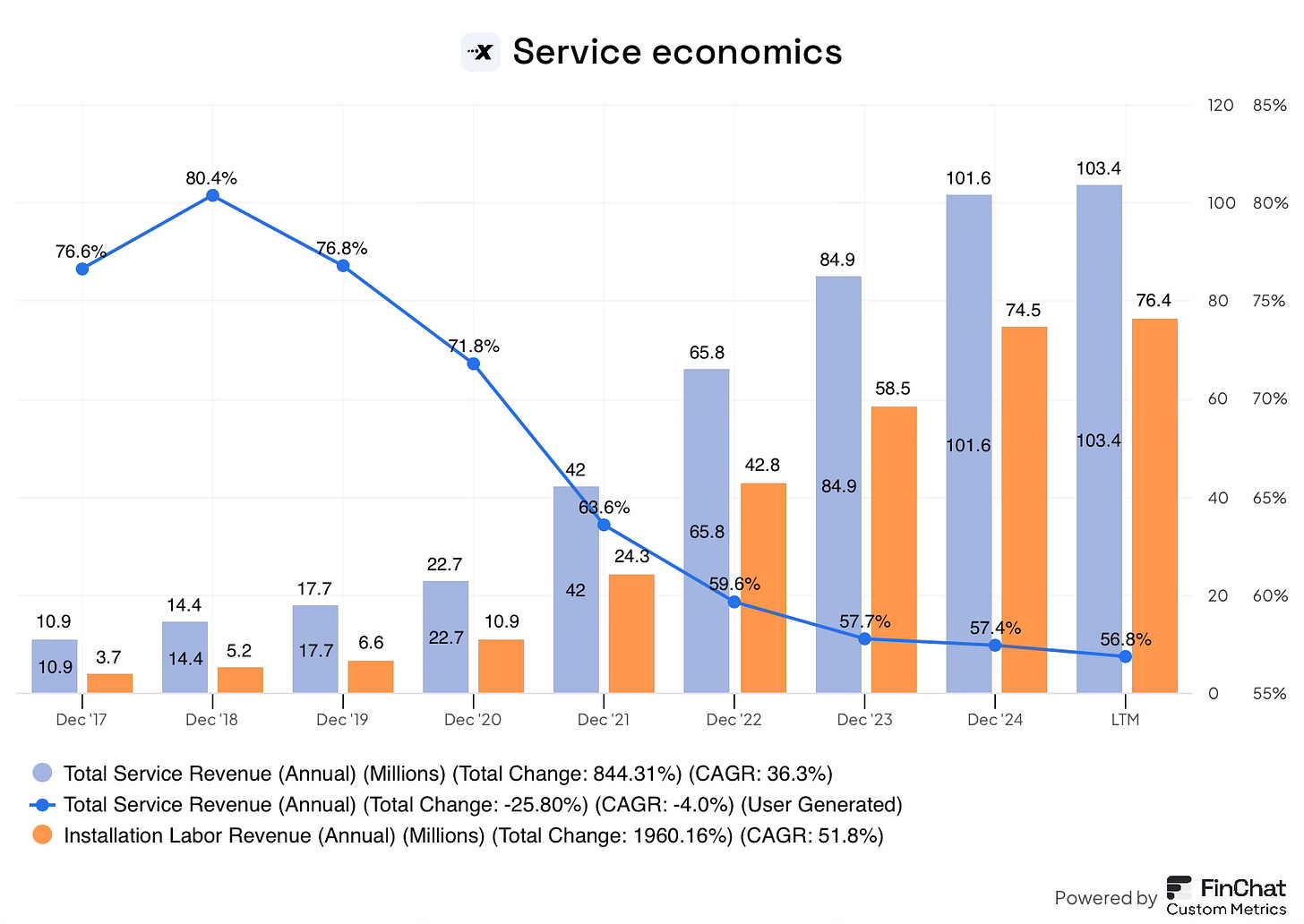

Service revenue accounts for roughly 24% of total revenue and has grown at a CAGR of 36% since 2017, driven by significant growth of the installation business ($3.7m to $76.4m!)

There are several components to this segment, which I will discuss below.

Installation services

Installation revenue accounts for 17.7% of total sales and 75% of the service segment. Through acquisition, this segment has been the fastest-growing part of the business since 2017, achieving a compound growth rate of 55%. Strong growth is set to continue with the company identifying new car dealership services as the primary target for future acquisitions.

Xpel installs film through three primary channels:

Installation facilities: Xpel operates several installation centres in the US and Canada. These centres serve the aftermarket and allow the company to keep its “pulse” on market and customer trends.

Dealership services business: Through acquisitions such as PermaPlate, Tint Net and One Armor, the company has established a significant presence among dealerships. These relationships typically involve high-volume installation, primarily of window film and small amounts of PPF.

OEM partnerships: As mentioned previously, Xpel has partnerships with manufacturers to install film shortly after manufacture. This typically takes place on-site or in an Xpel facility nearby.

While disclosure makes it unclear as to how resources are split across these three segments, the company has a total of 32 company-owned facilities, primarily in the US and Canada, with over 400 installation technicians. I estimate that the dealership business represents over 50% of this.

The economics of installing PPF are accretive to Xpel’s film business despite having higher fixed costs from the facilities and labour costs associated, and lower ASPs from wholesale agreements. Additionally, these costs are fixed during downturns, resulting in a cyclical element. I estimate that for the same amount of film sold, Xpel likely records 3-4X more revenue versus solely selling the film to installers. Gross margins are likely anywhere from 45-60%, depending on the channel, significantly higher than the 37.7% film margins generated.

Software

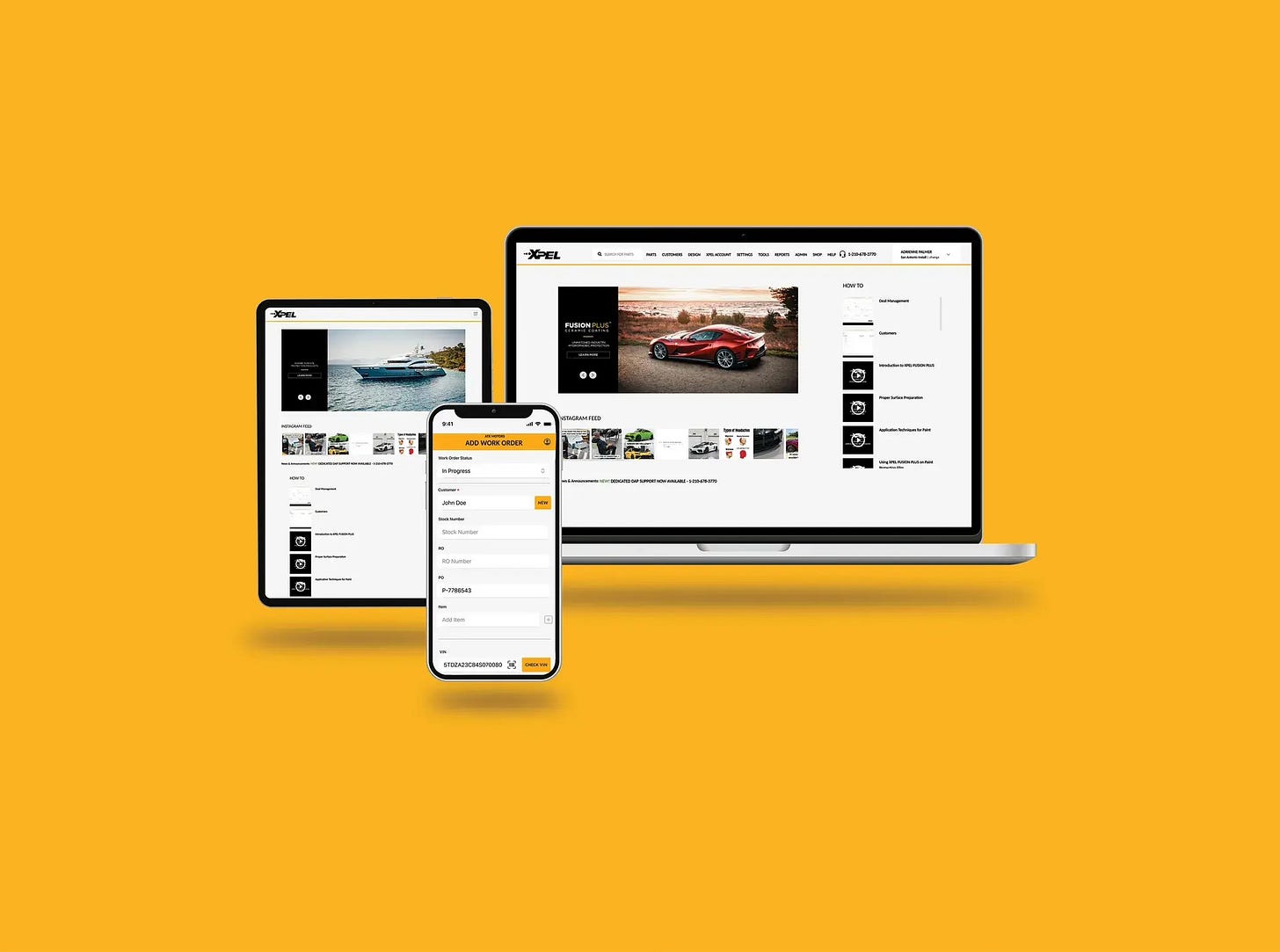

Software revenue accounts for 4% of total sales, while Cutbank revenue accounts for an additional 6%. Despite being a relatively insignificant portion of the overall pie, the software segment has a far greater impact on the overall business when considered through the value proposition Xpel offers to installers.

A key reason independent installers choose Xpel is for the proprietary Design Access platform (DAP). This SaaS business contains over 80,000 vehicle applications that are updated daily. This database has expanded dramatically from the 10,000 patterns in 2013 and aims to cover every panel of every car.

As previously discussed in the installation process, installers use this software to cut out the exact shape of each panel they are installing, reducing installation time, the risk of damage from cutting directly onto a car, and simultaneously reducing waste by maximising the patterns fit on the film. The company spends significant resources on keeping these patterns up to date for any new car launches.

As the platform has evolved, Xpel has integrated features such as warranty submission, scheduling, quotes and launched a companion mobile app. These integrations embed DAP further into the dealership workflow, making it harder for users to switch while also making it more attractive for prospective dealers as the company expands their software advantage. These new features have received strong feedback.

There are two types of pricing for the DAP platform:

Xpel film + Software: Exclusive installers are charged an ongoing access fee for the database (Software revenue), and any Xpel film purchased is then credited with the same volume purchased into their software account (Cutbank revenue) to cut patterns.

Software only: Dealers who are not exclusive to Xpel, such as Grandfathered accounts and installers in low penetration areas who can use different branded films, are charged both an ongoing access fee and a per pattern fee for every use.

This structure incentivises dealers to use both film and DAP software from Xpel.

Training services

The final part of the service segment is training, which accounts for less than 2% of segment revenue.

Despite the minimal financial impact this segment provides, there is a broader, tangible benefit that this segment provides to both its customers and the industry as a whole.

Brand: As I am sure it is clear by now, Xpel is meticulously focused on preserving its brand image as the premium provider. Controlling the quality of training that installers get goes a long way to ensuring customers receive the quality installation that the Xpel brand promises.

Expanding the installer base: Training new technicians is critical to expanding the overall industry into locations that are either underpenetrated or completely untouched (International), allowing Xpel to fill in gaps in their installer network.

Standardising Xpel and DAP: Installers often choose PPF based on film characteristics (thickness, stretch, etc.) By training installers with Xpel film and software from the start, it creates a habit that will be difficult to change away from, increasing switching costs down the line.

Service segment economics

Over time, gross margins within the service segment have dropped from a peak of 80% to 57% today. This drop coincides with the explosive growth of the installation segment. In 2018, installation revenue accounted for one-third; today, 75%.

This means that software likely achieves gross margins of 80-90%, while installation, as previously mentioned, is somewhere between 45-60%. Due to the already significant contribution installation revenue makes to this segment, gross margins will likely stabilise going forward.

Competitive Advantage

Xpel’s competitive advantage has evolved. Initially, Xpel predominantly had a product advantage following the 2011 launch of Ultimate. Over time, competitors Eastman Chemical (through brands Suntek & Lumar) and 3M have narrowed this gap with their own “self-healing” films. Today, Xpel is still considered the gold standard, but individual installers may have their favourite film based on installation characteristics.

Secondly, Installer chose Xpel because of the DAP software. While the software has a more challenging user interface than Eastman’s Core software, which Xpel is working to improve, the database has the most patterns and is regarded as the most accurate.

While both the product and software products remain best in class today, the advantage over competitors has narrowed over the last few years. Despite this, incremental improvements of PPF are unlikely due to the already strong protective qualities and 10-year protection warranty.

On the software side, Xpel’s efforts to improve the user interface and enhance functionality with CRM, inventory tracking and other features could reinforce their software advantage.

Today, Xpel’s moat is based on the interplay between Xpel’s premium brand to end users and the switching costs of Xpel’s captive independent installer base.

Brand

Xpel’s product advantage (Film + DAP), marketing engine and commitment to customer satisfaction have led to Xpel being the premium brand in PPF and increasingly across the industry as the portfolio of products expands. This brand advantage has given Xpel and its installers several advantages:

Premium pricing: Xpel prices its products 10-15% above the market, allowing Xpel and installers alike to capture more value.

Increased volume: Xpel’s consumer-facing brand creates a layer of trust amongst the end user, leading to a subset of end users requesting/seeking Xpel specifically in an otherwise installer-led market.

Switching costs

Xpel has a captive installer base that is deeply ingrained into the Xpel ecosystem, creating significant switching costs.

Brand: As highlighted above, the Xpel brand name drives higher revenue and profits to the installer. Anecdotally, on a forum, two brothers ran independent installer shops. After one switched to Xpel, the business outgrew the other despite starting from equal places.

Distribution: Xpel’s aggressive push into new car dealerships has been enabled by Xpel’s brand, but more importantly, has provided Xpel another opportunity to drive more business to its installers through referral programs and the installer locator. Again, these opportunities for an installer to grow are only available to Xpel installers.

DAP: DAP software has long been regarded the best pattern database, improving installer efficiency while reducing material waste, given that time and materials constitute the majority of an installers costs (rouhgly 80%), any reduction in costs here go straight to the bottom line, while also allowing more cars to be completed.

Increasingly, Xpel is rolling out more mission-critical features within the software offering. As adoption of these features increases, the stickier the software becomes. Following the 2020 policy changes, an installer must be exclusive with Xpel to have access to this software.

Expanding product line: With the company’s continual push into new verticals and adjacent products, such as windshield protection film, architecture and marine products, etc. These new lines provide installers the opportunity to grow their business beyond the automotive space, driving more business and reducing reliance on a particular customer set.

The result is a virtuous cycle: the best brand (Xpel) attracts the best installers, given the importance of installation quality, the best installers end up enhancing the brand value by providing the best product and service, this allows Xpel to further expand its distribution footprint, resulting in more end users, further strengthening the brand, and so on.

Conversely, for an installer to leave (reversing the flywheel), they would need to be willing to give up the organic business from the brand, extra business opportunities from referral programs, dealership &OEM partnerships, and expanding product lines. The installer must also be willing to endure the disruption and higher costs associated with giving up access to DAP software.

Given that these independent installers are typically small businesses that rely on the profits generated from their business, it makes very little sense for an installer to give up these profits.

The Xpel dealership conference (XDC) demonstrates the captivity of Xpel’s installer base. Hosted every year, the XDC brings installers and employees together to learn, network, launch new products and train. The event has grown every year (bar some disrupted years during COVID), with over 700 attendees at the most recent 2025 event. Most strikingly is the appetite of the attendees to get their hands on Xpel-branded merchandise. In a brilliant Substack post by Chris Waller he showed photos of the queue weaving around the building to enter the shop, demonstrating the power of the Xpel brand and what it can do for an installer’s business.

Financial profile

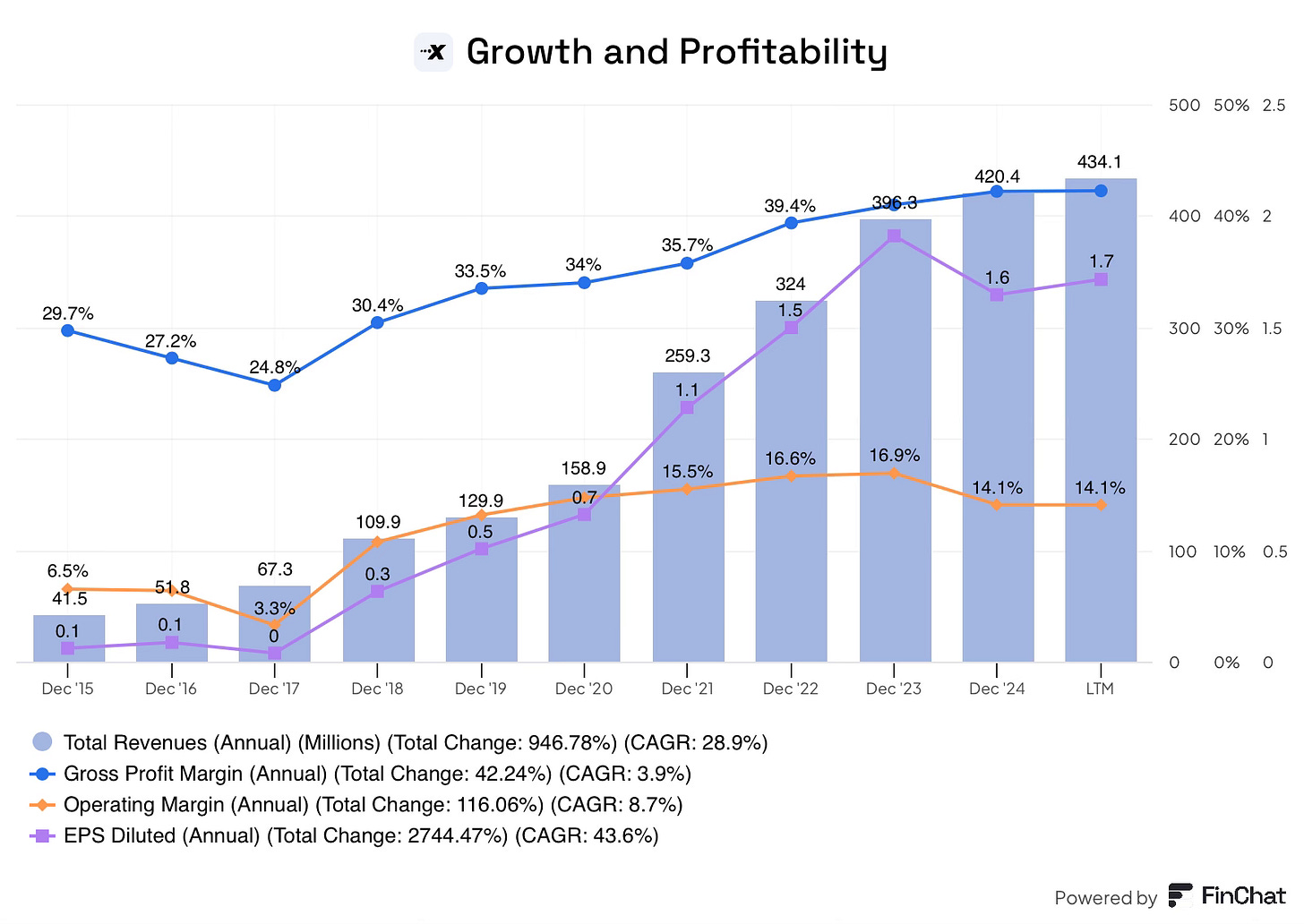

Growth and Profitability

Combined, Xpel’s operating segments have achieved a CAGR of 29% since 2015, driven by increased PPF adoption and multiple acquisitions, which have expanded distribution channels and product lines.

On the margin side, gross margins have expanded from 30% to 42%, driven by expanding film margins (discussed above) and increased contribution from the higher margin service segment. Operating margins have followed suit, expanding from 6.5% to 14%.

The combination of strong top-line growth and margin expansion, coupled with a share count that has remained flat at 27.6 million since 2018, has resulted in diluted earnings per share growing at 43.5% per year since 2015!

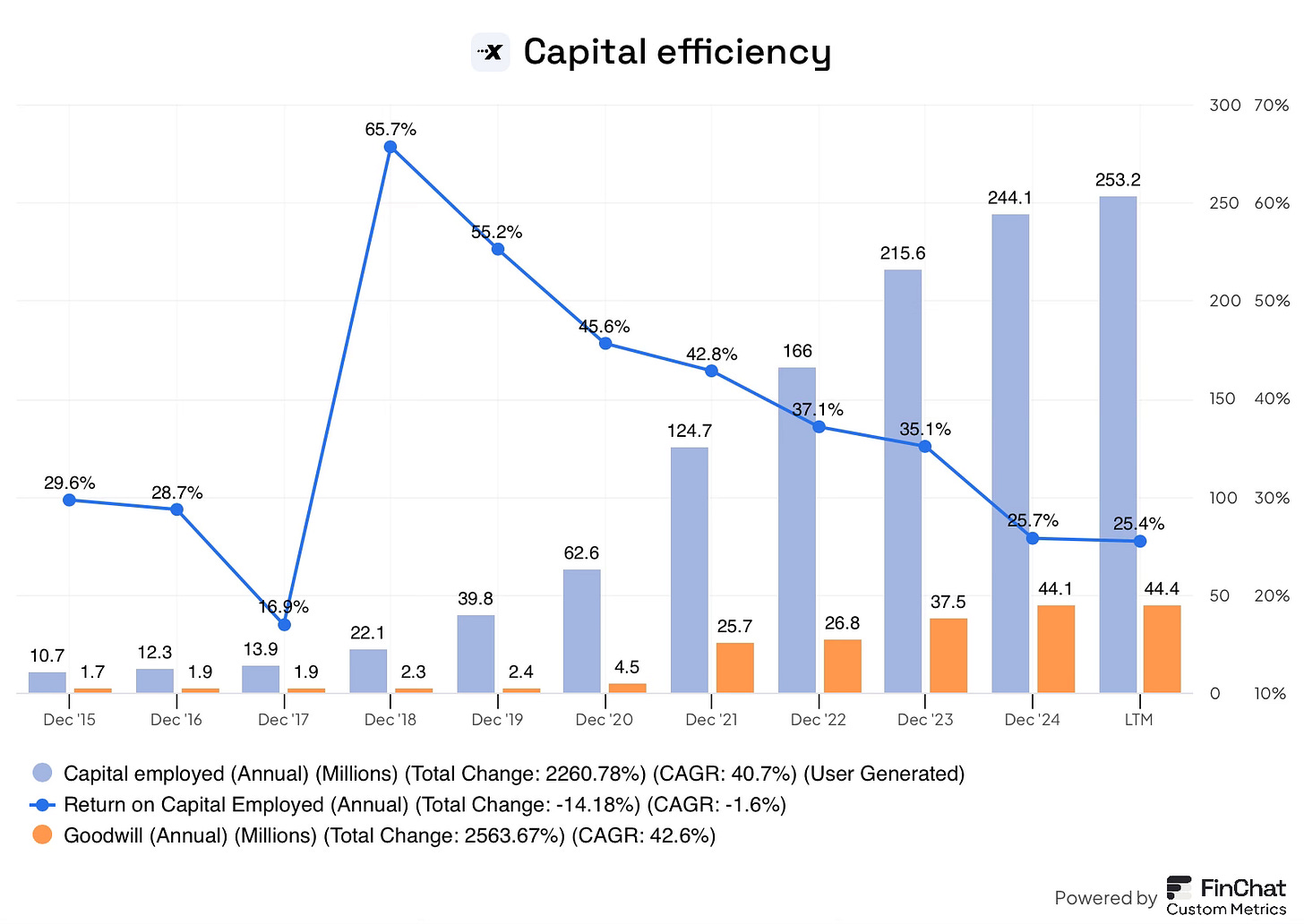

To achieve this strong growth, Xpel has similarly grown capital employed by 40% annually. The company achieves a strong 25% return on capital employed; this figure has decreased over time, partially attributable to the growth in goodwill from multiple acquisitions. Beyond the goodwill, a recent slowdown in the company’s growth rate, coupled with a continued strong investment cadence, has impacted near-term margins and ROCE.

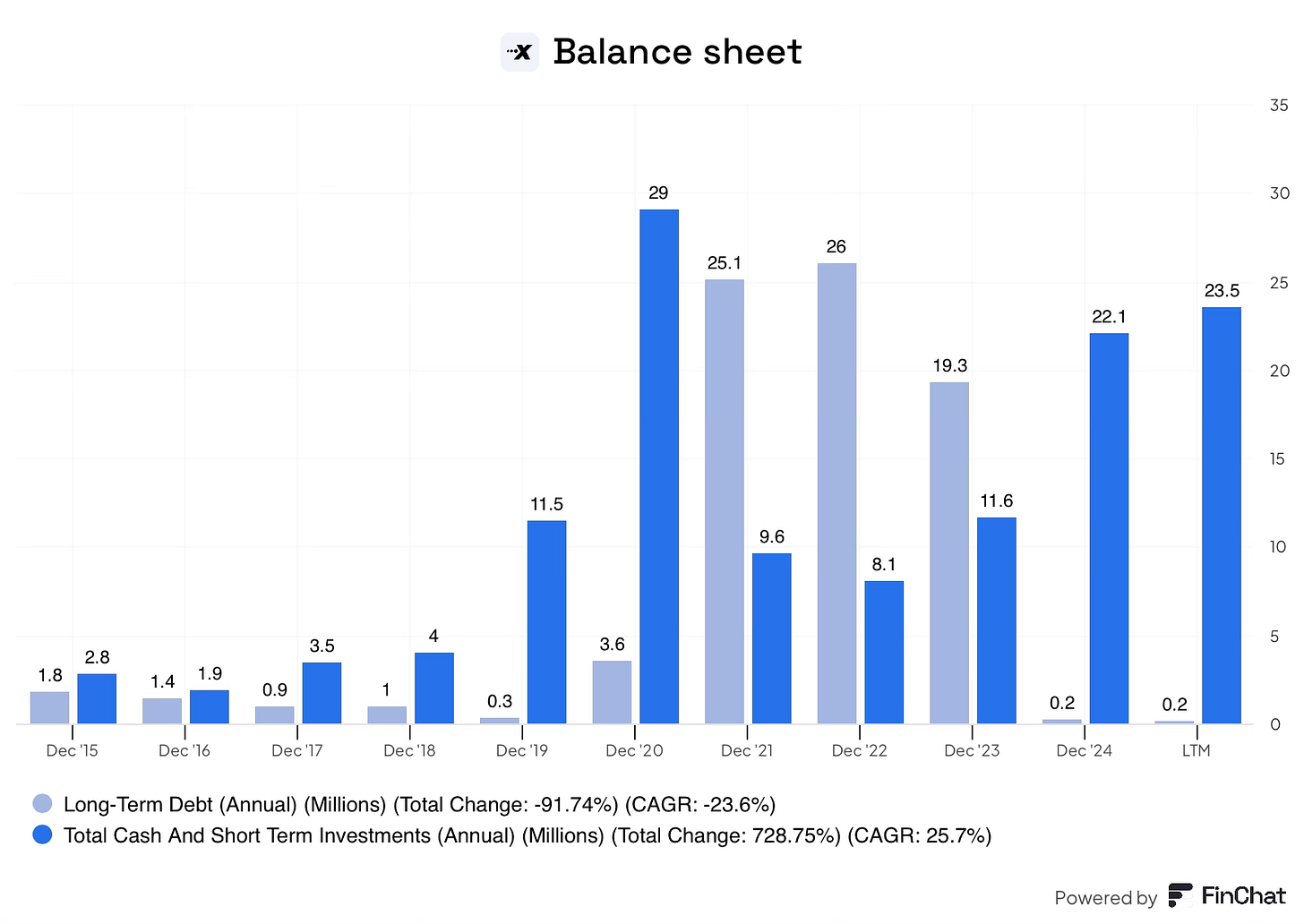

On the balance sheet side, Xpel has used debt opportunistically to fund acquisitions; however, they have paid this down quickly. Today, the company has virtually no debt and $23.5m of cash on hand. This conservative financial position provides the company with plenty of optionality.

Conclusion

Now that we fully understand Xpel’s business model, the history of where it has come from and the economics of the business. It is clear to me that Xpel demonstrates many of the characteristics of a great business.

In part 2 of the Deep dive, I will discuss the recent downturn, management, capital allocation, opportunities, risks and valuation.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Sources: