Evolution Gaming AB Deep Dive Part 2

Recent developments & why the stock has performed poorly over the past 4 years.

Welcome back to part 2 of this deep dive on Evolution Gaming. If you missed part 1, check out the link below. If you have enjoyed this series, please help out the substack and subscribe to not miss out on future deep dives.

Contents:

Introduction

Recent performance

Share price

Capacity constraints

Geographic analysis

Game rounds index vs revenue

Increased risk awareness

Introduction

In this deep dive series of Evolution Gaming AB, I am covering 5 questions long-term investors should be asking before investing:

Is the business understandable?

Is it a good business?

Are management capable and trustworthy?

Does the business have a long re-investment opportunity, and what are the risks associated?

Is it available at a fair price?

In part 1 I covered questions 1 to 3.

In this article (part 2), I will be taking a slight detour to take an in-depth view of the recent developments in Evolution and the industry to help you get up to speed, before I lay out the investment case in part 3 (covering questions 4 and 5):

Recent developments

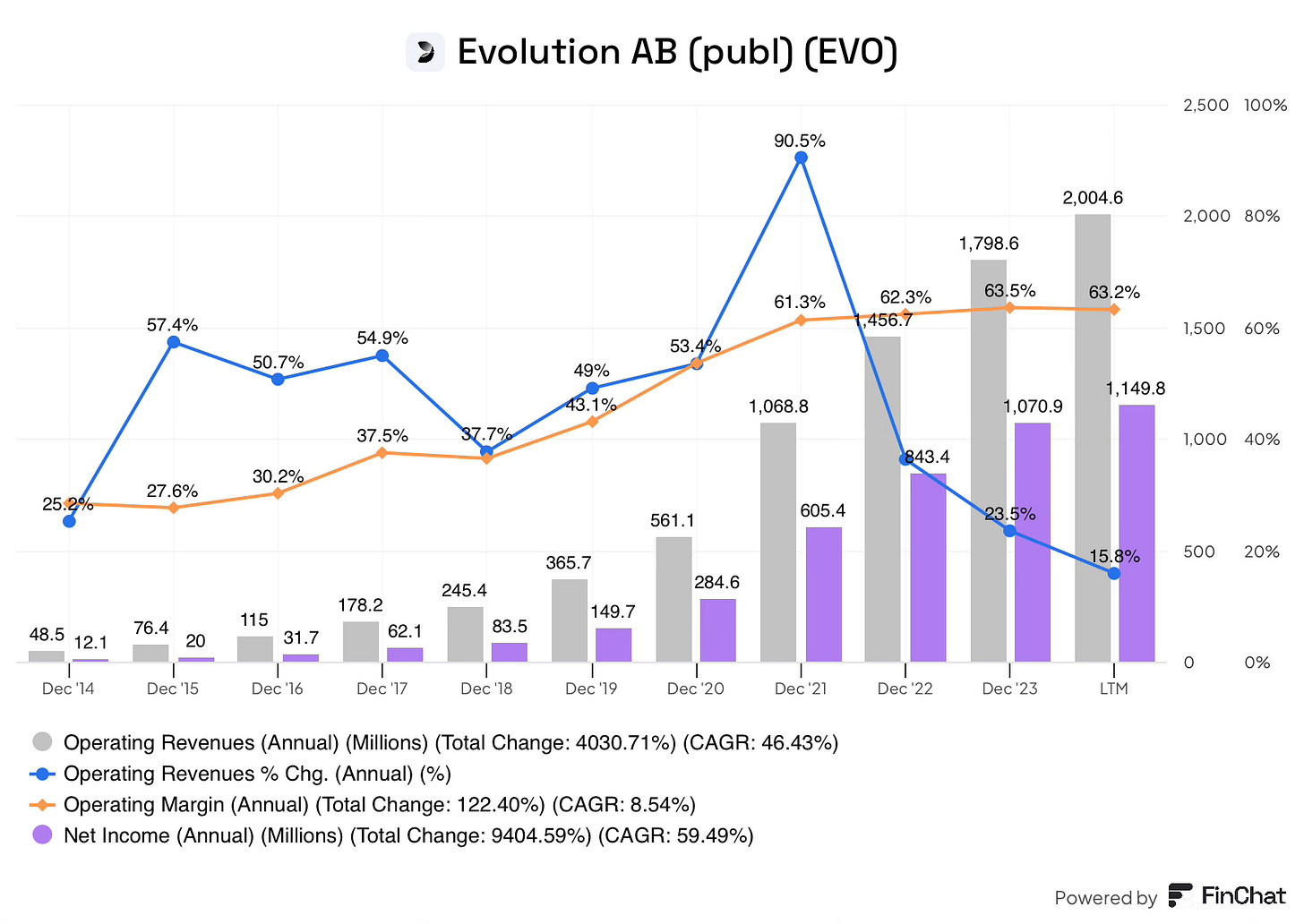

While the financial picture seems rosy with strong revenue growth and extremely high profitability driven by growth in studio capacity, game innovation and regulation of new markets, it is important to understand what has been happening below the headline numbers that has shaped these results.

In the most recent quarter Q3 2024, the company reported operating revenue growth of 14.7%. This continues the trend of slowing growth from its historical track record. The company did experience 4 percentage points of headwind from FX. Excluding this, growth would have been around 19%. In comparison to most companies, this growth rate is still incredibly impressive, however, by Evolution’s standards it represents a slowdown.

So, what has driven revenue growth over the past several years?

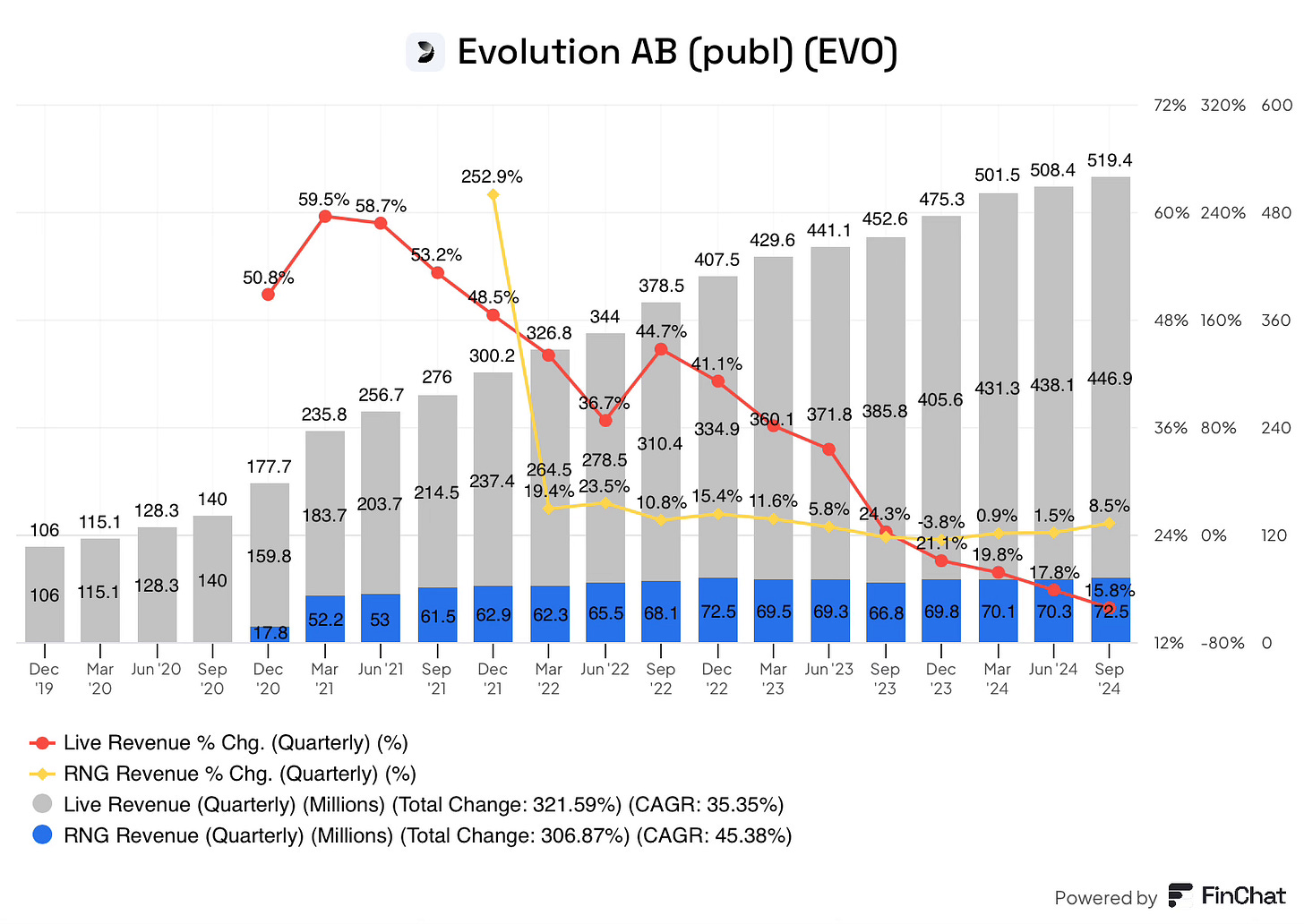

Live Revenue: While Live revenue has historically been 100% of Evolution’s revenue, an acquisition spree beginning in 2020 of NetEnt, Big-Time Gaming and many more meant RNG revenue soon accounted for 22% of revenue. Despite this, strong growth from the live segment has accounted for the vast majority of organic revenue growth, even in recent years. This growth has been driven by strong growth in Asia, Latam and, increasingly, North America. Capacity constraints have created mild headwinds to growth, predominantly in the more mature Europe region. The company has significantly increased the number of studios and tables to accommodate the segment’s strong growth.

RNG Revenue: As mentioned above, RNG revenue growth has been through inorganic methods. The segment has continued to disappoint on the organic side with management unable to hit or even come close to their own double-digit growth targets. To address this, the company first restructured NetEnt to improve the quality of games. More recently, the company has worked on increasing the number of games they produce, while also making some small technical acquisitions to further enhance game quality. While it’s too early to tell whether this has worked, the segment’s 8.5% growth in Q3 2024 gives investors some encouraging signs.

While it is only natural for Evolution’s growth to slow over time, there are several factors that I will dive into below that have caused Evolution’s growth to slow down more than it would have otherwise.

Share Price

In response to the company's strong financial results since the company went public, the share price has been on a meteoric rise, with an almost 10x increase between 2019 & 2021. Since that high in 2021, the stock has remained in a significant drawdown. At the time of writing the company is experiencing a 50% drawdown almost 4 years after it’s all-time high.

There are several likely reasons as to why the company is experiencing this prolonged drawdown, including; multiple compression, revenue growth slowdown & a greater awareness to the risks of the business.

Valuation Compression

While I will cover valuation & outlook in more detail in part 3. It is clear to see on the chart above, the price to earnings multiple has compressed significantly during recent years. The stock hit a P/E of 90x in 2021, before decreasing significantly. Currently, the valuation is sitting at an all-time low of just under 14x. The causes likely include, revenue slowdown and decreased risk appetite from the market after several events likely spooking investors.

Revenue Slowdown

The slowdown of growth from a high-growth company is always going to affect the share price negatively, and Evolution is no exception. Below, I will outline some of the challenges Evolution has faced over the past several years that have created headwinds for the business. While the RNG business has of course been a headwind, I have documented the struggles of that multiple times now, so I will refrain from repeating it here, but bear it in mind.

Studio Capacity Constraints

Over the past several years, Evolution has faced one of the best problems you can have in business, struggling to keep up with growing demand for your product.

These struggles began during the pandemic when the company had to limit its capacity to comply with local restrictions, while demand for online casinos kept growing. Since that time, the company has continued to experience strong demand, whilst also experiencing delays in building and hiring employees to expand capacity.

The company reacted by embarking on a global expansion through 2 avenues;

New studios, which take 12-24 months to build from initial plans.

Existing studio capacity growth.

From 2020 to today, the Evolution employee account grew from 8,700 to 20,000. This large-scale recruitment effort is extremely difficult; the company first has to make sure they are hiring the right people, and then employees have to be trained, all while maintaining the company culture. Ramping up hiring and training beyond the natural churn of the business is a big task to implement the programs required, but Evolution seems to have navigated this potential hurdle successfully.

Q3 2024 Results: Undersupply of the industry seems to be improving. In Q3 2024, CEO Martin Carlesund said, “They are still a little behind”, however, this is a big improvement from this time last year. This situation is set to improve further with the Czech Republic & Colombia studios recently opening, with studios in Brazil and the Philippines pencilled in for future openings 12-24 months down the road.

Potential Implications of this Undersupply

Revenue: The most obvious implication is revenue lost during this period. While this is a negative for the financial side, Evolution was able to mitigate this revenue impact through the prioritisation of higher-value tables.

Game Round Index: The game round index is affected more significantly than revenue. The prioritisation of higher-value tables has the negative effect of reducing supply to lower-value tables. These lower stakes tables will likely include a disproportionate amount of new players who are trying out Evolution’s games. This could have caused a worse playing experience for these players, who might end up moving away from Evolution games, negatively affecting the company’s long-term potential.

Market Share: I mentioned in part 1 that scale is a key benefit in the industry. This undersupply could have gifted competitors the key scale they needed as Evolution couldn’t fulfil all of their demand. This could be the reason Pragmatic has reportedly gained share in the industry. While not nice to see, investors should take comfort from the fact it isn’t a competitive takeaway. Furthermore, Evolution has still grown faster than the market during this time, suggesting Evolution wasn’t giving up market share, rather, they were not able to gain further market share.

Margins: This high cadence of investments & hiring has likely caused costs to grow at a faster rate than otherwise, leading to margin pressures, likely demonstrated in the flattening of the margin expansion chart.

The company remains in an expansion phase which will likely keep the cadence of capacity growth high over the coming years. Studio growth will likely be seen in many of the fast growing regions; Asia, LATAM & North America.

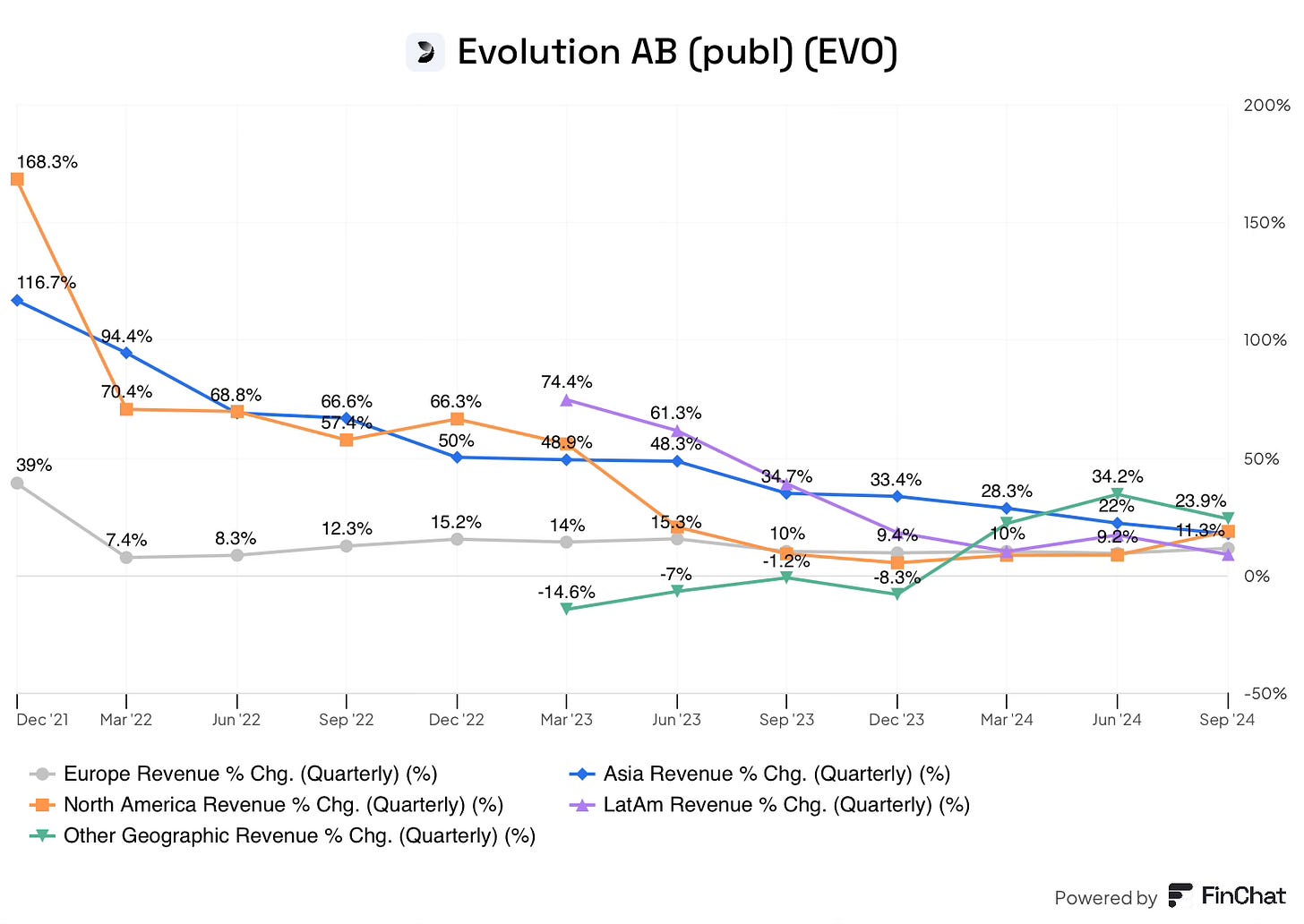

Geographic Analysis

Inevitably, revenue growth cannot be sustained at the rates they have been historically. Otherwise, the business would become extremely large very quickly! However, the recent slowdown in revenue growth over the past few years likely indicates a temporary slowdown rather than the new normal. In this section I will dive into each of the significant regions to provide an update on what has been happening.

Before getting started, it is important to note Evolution operates a global business, which means the company sees lumpiness from year to year due to local market conditions & regulatory landscapes. This is just a natural course of business & part of the complexity of running a global operation.

Europe

Europe is the company’s original market and likely the most mature online casino market globally. It is therefore rational to expect that this will be the slowest growing region of the business. Beyond this the region also experienced the largest effects of the undersupply, while also facing regulatory headwinds.

I covered undersupply above, so I won’t repeat that here.

On the regulatory side, multiple markets have been negatively affected over the past couple of years, mainly; the UK & Germany. It’s not all bad however, with the Netherlands regulation spurring growth in that region.

UK: The UK has been a laggard for some time, potentially due to it’s early success in the market, achieving the largest market size and highest penetration rates across Europe. In Q1 2021, the UK accounted for 9% of total revenue. As of today, this has decreased to 3% of revenue. This underperformance is likely due to a number of reasons, including the UK gambling comissions increased efforts to enforce strict regulations on operators, increasing operational costs to comply. Furthermore, the delay of a government white paper led to uncertainties, causing operators to act with caution, for fear of fines. Additionally, reports suggest that younger consumers are more cautious around gambling, finding alternative entertainment through console gaming and streaming. Despite these headwinds, the company remains optomistic regarding the future potential of the UK market.

Recently, the UK gambling comission announced it is reviewing Evolution’s operating licence in the UK. This was after regulators found Evolution’s games accessible through operators who did not have a licence. While this may sound bad, the worst case scenario is Evolution losing access to the UK, resulting in a one-time 3% decrease in revenue. In the current quarter FX headwinds had a greater impact to revenue. However, on the upside and the more likely outcome would be for Evolution to receive a fine. This is in line with sanctions UK regulators have taken over the past years since stepping up their scrutiny of the market.

Germany: Similar to the UK, Germany has been struggling for some time. In Q3 2020, Evolution earned 5-10% of revenue from Germany. Since that time, revenue has taken a hit, with the region likely making up low single digits of revenue today.

The challenges of the German market are similar to that of the UK. Regulators “still have not reached a clear decision on how to offer regulated online casino gaming”. This indecision is leading to hesitancy among operators.

Adding to the troubles is the gaming approval system. In Germany each game needs to be apporved to operate on a specific platform, this means if a game is on 10 operators platforms, it would have needed individual approval 10 times. This is a costly and time consuming process, leading to less games in the market overall.

This difficult and unclear regulatory environment has caused the German market to become a hotspot for black market operators, with 47% of the market made up of illegal operators.

This has led to the German market falling behind similar countries. For example, in 2023 the German market reported €4.8B in revenue, compared to the UK’s €12B, despite having a population advantage of 84 million versus 64 million for the UK.

Tailwinds: While the mature European market has seen some increased regulatory pressure since the pandemic, the region has also had some tailwinds, including increased adoption and new countries regulating.

While not entirely up to date, the European market has demonstrated steady growth over the past several years, with Evolution’s growth beyond 2022 staying fairly consistent, similar to that of the chart. This growth is driven by increased player adoption, larger bet sizes and the opening up of new regulated markets such as the Netherlands & Czech Republic.

Netherlands: In 2021, the Netherlands regulated it’s online gambling markets, paving the way for greater growth in the future. Evolution went live with all 10 operators (100% market share) following the new rules, with strong intial growth. Growth has continued with 2023 gross gaming revenue growing 28% over 2022 to €1.39B, this strong growth has made it the 10th largest online gambling market globally.

Czech Republic: In 2024, the Czech Republic ammended it’s regulations to allow for online casinos, due to the deman for live casino games. While Evolution was already present in the country with it’s RNG games, the company now has the ability to capture the Live Casino market. In Q3 2024, Evolution opened it’s first studio in the Czech Republic to capture this new growth along with providing extra capacity to the Euopean market.

Looking forward, there has been talk of the potential for France to regulate their market, this would likely be become the largest market in Europe. Furthermore, many Eastern European countries are also looking to regulate.

Q3 2024 Results: In Q3, Europe revenue actually accelerated slightly to 11.3% revenue growth, up from 9.2% in Q2. This slight acceleration is likely due to Evolution finally being able to match supply with demand, after years of undersupply. This increased supply is due to 2 new studios coming online over the past year. First, in Q4 2023, the Bulgaria studio launched, and in Q3 2024 the Czech Republic studio launched, as mentioned above. Furthermore, the RNG business seems to be improving in Europe, with 2 quarters of above 10% growth in the region also contributing to growth.

Asia

Asia has consistently been the fastest growing market for Evolution over the past years. As mentioned in part 1, this has resulted in Asia becoming the largest region for the company in Q1 2024. While growth has naturally slowed over the period. This is only natural with growth rates of 50%, being unsustainable as the company garners a larger presence.

Evolution’s growth in Asia has been mainly driven by market share gains, while more recently the company has experienced some headwinds surrounding cyber attacks in the region, temporarily slowing growth.

Market Share Gains: management has called out repeatedly that the growth in Asia is due to market share gains in the region This is because unlike Europe & North America, Evolution is a relatively small player there. In fact, the company doesn’t even have a studio in Asia yet. The driver of market share gains is due to their superior product, in particular their Bacarrat product and local variations they have released, which is the most popular game in Asia. With Evolution planning on launching their first Asia studio in the Philippines, this product will likely continue to improve over time.

Cyber Attacks: In Q3 2024, Evolution was the target of cyber attacks These attacks come in the form of people/organisations who “use advanced technology to intercept our video feed, manipulate it and redistribute it without authorisation”. While this type of activity has likely always taken place, the effectiveness of this particular attack was significant. These attacks negatively impacted revenue in Q3. In response, Evolution has “deployed several measures” which have been successful. The company will have to improve it’s defence mechanisms for these types of incident, as they will likely only get more common.

Q3 2024: The result of the above cyber attack resulted in a larges sequential slowdown in growth to 17.5% in Q3, down from 22% in the previous quarter. Furthermore, the cyber attacks will likely cause an overhang to Asia revenue growth over the next year before they roll off.

North America

It’s widely accepted that the North American market has huge potnetial. Unlike other markets, North America is regulated at the state level, which means individual states choose whether or not ot legalise online casinos. The opening up of states is a huge opportunity for Evolution.

Since the pandemic, the North American market has faced some challenges that I will address, inlcuding; slower state regulation, RNG market share losses, slow Live adoption & game licence wait times.

These challenges have caused North American growth to slow considerably.

Slower State Regulation: Online casinos are currently legal in 7 US states. New Jersey was the first state to regulate in 2015, this has been followed by; Pennsylvania in 2019, Michigan, Conneticut, West Virginia, Oklahoma and Delaware all opening since 2021. While this is great news for the industry, many were expecting a faster cadence of regulation, ultimately leading to some what dissapointing growth.

While many states; including Georgia, Minnesota & Missouri have all shown promising signs of regulation, the timings of when this may happen is uncertain. This state by state regulation has & will continue to result in lumpy growth over time. Furthermore, as some of the regulated states continue to grow, their growth rate has matured, resulting in slower overall growth for the region.

Beyond the United States, Canada has also seen some states regulate, with Ontario becoming the first market to open. While Canada is nowhere near the size of the US market, growth in the region will still benefit the company. Evolution partnered with Ontario lottery and gaming corporation (OLG) & all of the commercial operators to provide live casino in Ontario, which has seen good traction since launch. Furthermore, in Q3 2024, Evolution signed with Atlantic Lottery to provide live casino to the rest of Canada, opening access to another 40 million people. This expansion should help grow the segment in the future.

RNG Market Share Losses: While market share losses are never a good thing to see, it is important to take into consideration where the business started. Evolution acquired NetEnt in 2020. This put the company in an extremely dominant position within the slots segment, when at the time only 2 states had regulated online gambling. Naturally as the market grows, competition is inevitable, especially when the business in question has such great economics. Evolution has seen increases in competition as suppliers have & continue to join the market. This increase in competition was amplified by the companies poor performance in RNG. Unlike Live casino, RNG is a volume based business, meaning to stay competitive & maintain market share, a company needs to provide a constant stream of new games to the market. During 2022, Evolution did not release enough new games to the market, resulting in stagnant & at some points slight declines in revenue. While Evolution has subsequently increased it’s game release cadence to better compete in RNG, the company was seeing some delays to new game licence approvals, which further delayed the recovery.

Live Casino Adoption: Another difference to the North American market is the relatively low penetration of live casino, with end users initially favouring the more familiar RNG slot games. This further impacts Evolution due to the companies core competency in live games versus the struggling RNG business which is the larger part of the North american segment. However, this dynamic is beginning to change gradually as end users are beginning to learn and trust the live casino experience. This is leading to the live casino segment growing faster than the overall market, making up for some of the share losses within the RNG segment.

Q3 2024: In the most recent quarter, growth accelerated considerably to 18.5%, up from 9.2% in Q2. There were several factors casuing the acceleration in revenue:

As I mentioned above, the market in Canada opened up significantly from just Ontario to the rest of the population.

After several quarter of market share losses and revenue declines, the RNG business turned positive (but still grew slower than the market), a good sign on the road to turning that segment around.

The live casino segment continues to gain momentum. This growth is also likely becoming more pronounced as the segment contributes an increasing share of the overall market.

Looking forward, North America remains the largest opportunity for Evolution. It is rare to find a global company that doesn’t derive most of it’s revenue from North America!

LATAM

LATAM is a relatively new segment for the company, after being broken out in Q1 2023 from other revenue after demonstrating strong growth and a huge potential.

Studio Expansion: Evolution was the first gaming provider present in this market & likely has the local expertise. Over the past decade, LATAM market has shown significant growth as markets like Colombia, Argentina & Mexico have regulated, paving the way for the regions growth. This has translated into strong revenue growth, with revenue of the “other” segment consitnetly posting high growth rates before the segment was split. To cater to this significant growth, Evolution has built 3 studios. The first studio was a smaller studio in Argentina, followed by a small Colombian studio. In Q3 2024, Evolution added a state of the art studio to Colombia to capitalise on the regions growth. These new studios demonstrate the commitment the company has to the region.

Market Regulation: While the region has experienced lumpy revenue over the past, delays in regulation of the Brazil market, has created further headwinds to growth. With Brazil finally regulating what will likely be the largest LATAM market on january 1st 2025, these headwinds will likely abate.

Q3 2024: In the most recent quarter, revenue continued to slow, growing only 8.7%. The slowdown is likely due to the delays in the Brazilian markets regulation, casuing uncertainty amongst operators.

With the Brazilian market finally opening on January 1st 2025, it is likely that the region will experience strong growth this year.

Game Rounds Index VS Revenue Growth

Over the last several years, Evolution’s revenue growth has been slower than the growth in game rounds index. The game rounds index has grown 357% since Q1 2021, while revenue has grown 120% in the same period. Simply put, this means, Evolution hasn’t been able to monetize the growth of new game rounds as effectively as they have previously.

There are several reasons this has happened. Firstly, growth of new markets with lower bet sizes, inlcuding Asia & LATAM. With the company expanding into new markets, this has attracted new players to the game. Initially these players place lower bet sizes compared to tenured players, lowering the monetisation. Furthermore, in these new markets, bet sizing is smaller overall. This means the expansion into new markets is causing substantial game growth, the financial benefit of these is far less.

Additionally, the type of game matters a lot. Evolution is able to generate far higher revenue off a game like Roulette vs Baccarat, due to the number of people who are able to play it at once. With the strong recent growth in Asia, games like Bacarrat (& local adaptations) have lowered bets per game, while increasing demand.

With significant future growth expected from lower monetising regions, this could be a trend that continues into the future, along with the currency fluctuations detailed prior.

Risk Awareness

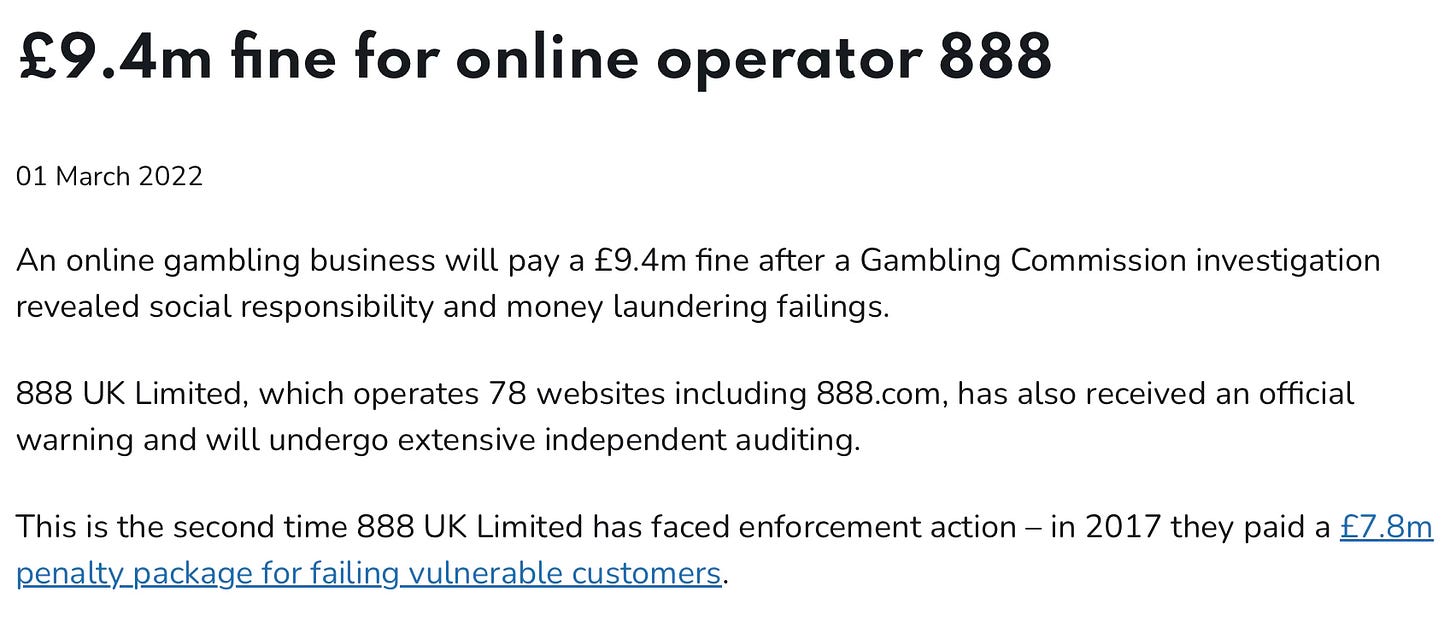

The final factor for a laclustre stock performance over the past 4 years is greater risk awareness. Over the past several year, have been several events that have likely caused investors to percieve Evolution to be riskier than they did historically. These include;

regulatory pressures (including the recent UK review)

Cyber security attacks in Asia

2022 anonymous short report

Union strike in Georgia

I have covered the first 2 points above, therefore, I will not repeat those here, instead I will focus on the later events.

Short Report: In 2022, an anonymous entity released a short report on Evolution, with some people speculating it was a US based competitor While I do not have any idea, the fact the New Jersey regulators recieved a copy makes it a credible argument.

The short report alleged that Evolution was allowing it’s games to be accessible from black-listed countries such as Iran & Syria. This caused shares to drop by 25% in the week following the report.

While the accusations in the report have been denied & no subsequent action has been taken on the company. The short report risked reputational damage towards Evolution that could of caused strain with regulators & operators. To prevent this, Evolution was in constant dialogue with regulators around the world.

Despite no apparent effects on the business, it likely caused greater awareness of the fact Evolution only generates 40% of revenue from regulated markets. While this is extremely common in the industry, it likely creates uncertainty to investors, weighing on the stocks valuation. Over time, it is likely that regulated markets will make up an increasing part of Evolutions revenue as countries move towards regulation over time.

Georgia Strike: In the summer of 2024, a union in Georgia voted to go on strike after two years of negotiations broke down as management claimed the requests were unreasonable. The strike involved roughly 550 employees, and had little impact on capacity. In august, a small number of the 550 employees turned violent, blocking entrances, vandalising buildings, violent behaviour and harassing working employees. This caused Evolution to downsize capacity of the hub in Georgia to around 60% of capacity.

While the likelihood of this affecting the business long-term is minimal, it does present some risks to the business. First is the disruption this causes the business, Evolution had just got out of a period of undersupply, losing 40% of the capacity from one of the companies biggest studios has caused some further loss of revenue and a hit to the games round index, which will take time to recover.

Furthermore, the unions have spread lots of false information on Evolution, which could impact the companies hiring efforts while also attracting unwanted attention from regulators, which could cause further distraction for the company.

Closing thoughts

To conclude, Evolution has strong fundamental performance over the past 5 years, with strong revenue and earnings growth. However, this has not translated into share gains due to a combination of; slowing growth & increased risk awareness leading to valuation compression.

In part 3 I will analyse the bull & bear case for evolution, including an in depth look at the significant opportunity for growth ahead, along with the risks associated with that. Finally, I will look at Evolutions valuation, finishing off with my thoughts on whether or not Evolution has made it into the portfolio.

Sources: Company filings & transcripts unless otherwise linked.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Nice write-up on Part 1 and 2. Any thoughts on the class action lawsuits and their effects on the price performance. I know there are plenty of other factors which you covered.

I own shares and believe there is great margin of safety in these price levels despite the latest news on the CFO and also the Swedish FSA.