Xpel Deep Dive Part 2

Recent developments, Management, Capital allocation, Destination analysis, risks and valuation

Welcome to part two of this Xpel deep dive.

In Part One, I covered business history, the components of the Xpel business model, competitive advantages, and financial characteristics. If you missed part one, you can check it out using the link below.

In part two, I will cover:

The recent downturn

Management

Capital allocation

Destination analysis

Risks

Valuation

Feel free to subscribe below to not miss my future deep dives.

Recent developments

Following the pandemic, Xpel’s business rebounded rapidly. In 2020, revenue increased by 22% over 2019, despite the impact of the pandemic. Building on this, revenue grew an astounding 63% in 2021. This sustained growth was likely a key contributor to shares increasing over 10x from the COVID low, surpassing $101 per share in July 2021.

Today, shares trade at $35 per share, down 65% since that high (80% at the peak), so why have shares fallen so much?

Revenue Slowdown

Following the summer of 2021, growth began to slow. On a trailing 12-month basis, the growth rate declined from 63% to a trough of 6.1% for the full year 2024. There are several reasons for the slowdown, including:

Consumer Slowdown - Following a strong Covid rebound, semiconductor shortages led to new car inventory bottlenecks. This limited growth, especially in the dealership services business, which operated at 65% capacity through late 2021 and early 2022.

Within the broader economy, supply chain disruption and excessive stimulus (among other items) led to inflation and rising interest rates, beginning in March 2022. As a result of the dealership service business ramping up to full capacity again, Xpel initially accelerated growth for a short period.

However, starting in the summer of 2023, the company began to see a slowdown in the aftermarket channel, affecting independent installers, company-owned facilities and the dealership channel. This slowdown coincides with other discretionary businesses, all of which have been impacted by rising inflation and interest rates.

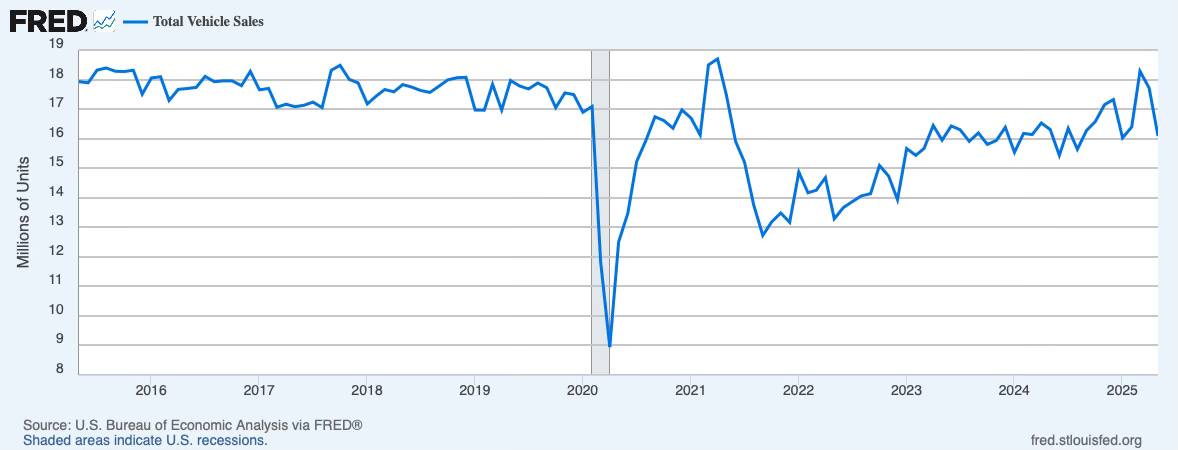

The weakening consumer financial position led to the delay or complete avoidance of major discretionary purchases, such as cars (see the chart below between 2021 and 2023).

As in any free market, when demand drops, supply (dealerships & OEMs) are forced to discount and increase incentives in response. The secondary effect of these promotions is the attraction of a different kind of buyer: those who are price sensitive. These discount-driven purchases are likely from the 25% of owners who have no pride of ownership, making them unlikely to be prospective Xpel customers, amplifying the impact on Xpel. While Xpel is indexed primarily to the luxury car segment, EVs also represent a meaningful portion, which has been especially prone to discounting.

Finally, the impact of slowing consumer demand has affected the installer base that Xpel relies on. These installers are themselves likely to delay investments that would grow the aftermarket channel. Types of investments include local advertising and capacity expansion.

These impacts naturally affect the most penetrated markets, such as the US, Canada, and some parts of Europe, the most.

China - China has also been a significant headwind for the past 5 years. Before the pandemic, China accounted for 23% of revenue. Today, this figure stands at 7.8%. I have already covered the country-specific issues Xpel has faced in China in part one, including a shift from European to domestic manufacturing, and the product portfolio being too expensive for a lower-cost labour market.

Additionally, China remains the only one of the top 20 automotive markets that is still indirect. This distributor reliance has led to revenue experiencing large swings as a result of the sell-in/sell-through dynamic. Until recently, Xpel’s lack of people on the ground in China has also resulted in somewhat poor execution concerning marketing and distribution channel expansion. All of this has led to poor performance in the most competitive market in which Xpel operates.

Acquisition valuations: The final factor contributing to the revenue slowdown is the lack of acquisition activity. Acquisitions have been a significant driver of growth, especially within the service segment. However, management currently views valuations to be too high, stating "unrealistic expectations around purchase price".

While this leads to slower growth in the near term, shareholders should be happy that management is being good stewards of shareholder capital, more on this below.

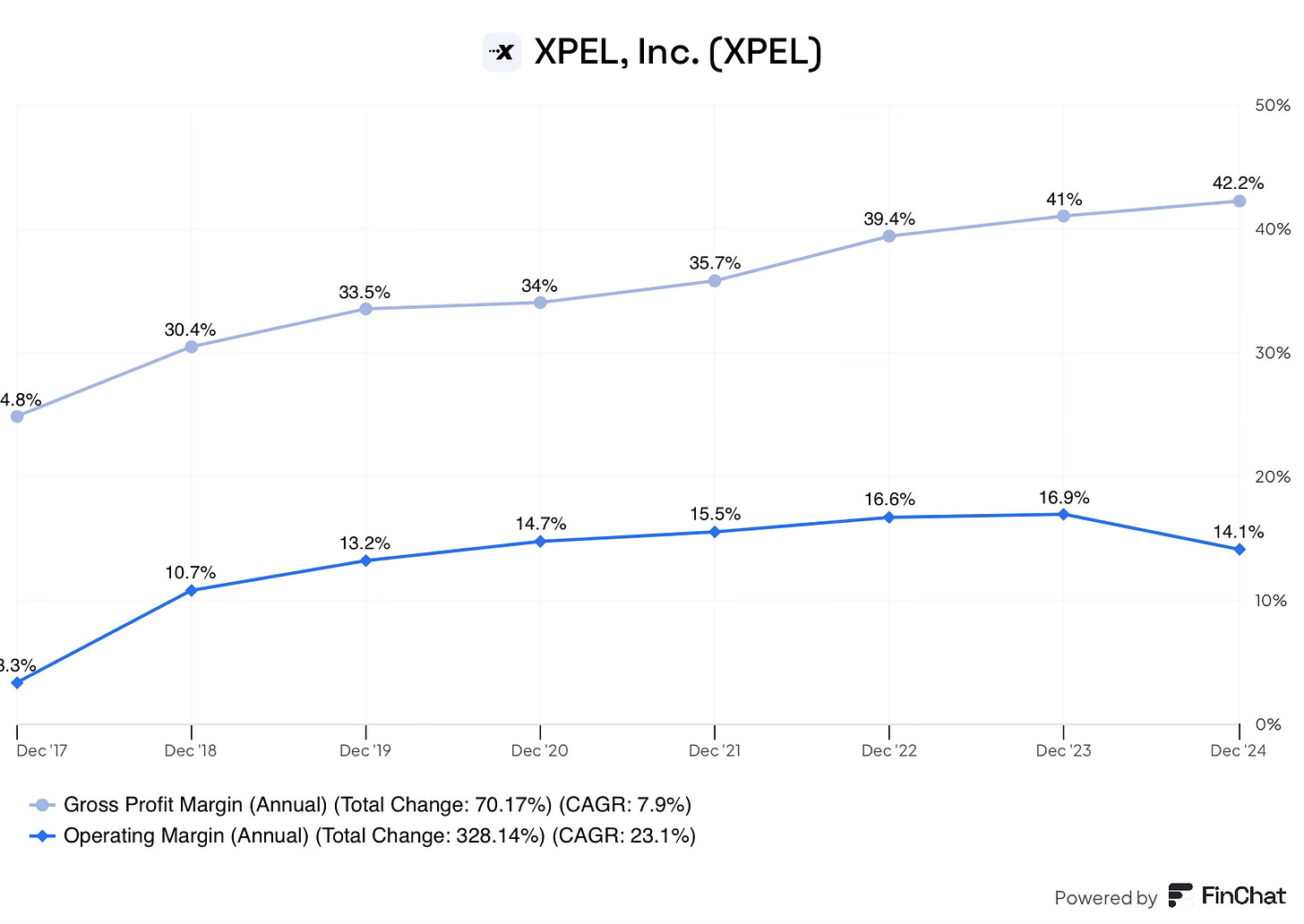

Margin Contraction

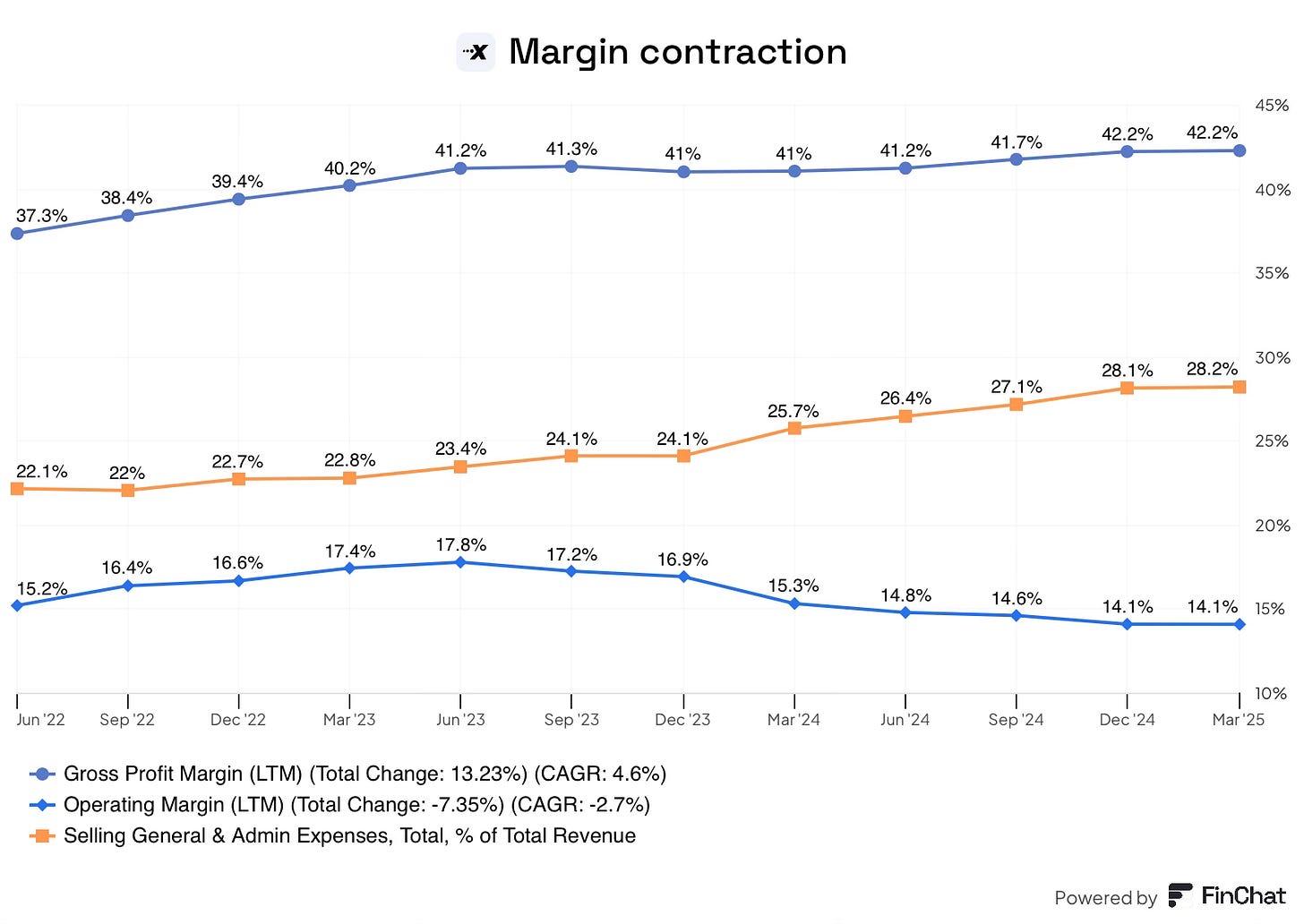

As the above factors have impacted Xpel’s growth rates, SG&A expense growth has remained elevated, leading to operating margins declining from a peak of 17.8% to 14.1% on a LTM basis. This margin contraction has resulted in net income staying relatively flat despite the top line expanding 30% since 2022.

The majority of these increased SG&A costs have been intentional. Over the previous few years, Xpel has invested in several key areas:

Verticalisation: Xpel has expanded the size of functions such as R&D, quality control, and product teams, while also investing in manufacturing capabilities.

Services: To accompany the expansion in functionality that DAP provides, so have the costs associated with it.

Marketing: Historically, marketing has represented only 3% of revenue. In 2024, Xpel intentionally increased its marketing spend to expand beyond the enthusiast buyer and help grow the dealership business.

Beyond these intentional investments, the company has also experienced higher costs associated with the acquisition and integration of International distributors; these costs are at the corporate level.

In late 2024, Xpel initiated a comprehensive review of its cost structure, which has resulted in the company making several corrective measures. In February 2025, Xpel implemented a workforce reduction that will save approximately $2m in annual costs. These job cuts were primarily at the corporate level, in areas such as remote work and duplicate positions, inherited through previous acquisitions.

Additionally, the company will continue to reduce numbers at the corporate level by not replacing certain roles that become vacant through attrition, making Xpel a leaner organisation.

Importantly, the company is seeking to cut areas of expenses that are not revenue-generating. However, management will continue to invest in areas that will drive long-term growth.

“I will justify investments in SG&A that drive revenue growth in the field all day long. These are truly investments in the future. But investments in our true corporate overhead have to be scrutinised and ultimately reduced where possible.” - Ryan Pape, Q4 2024.

These comments demonstrate that Pape understands the importance of a lean organisation, while also not sacrificing the long-term prospects of the business, to boost short-term earnings.

Signs of a turnaround?

Xpel recently announced its Q1 2025 results, the company reported significant improvements on both the top and bottom line, potentially signalling the first steps towards a turnaround.

In Q1, revenue accelerated from +1.9% in Q4 to +15.2%. This growth was driven by strong performance in both the US and China.

In the US, growth accelerated from 6.2% to 11.6%, potentially due to some pull forward from the threat of looming tariffs, along with strong growth in the window film segment, likely due to the new windshield protection film product, which continues to grow rapidly.

In China, revenue increased 459% as a result of timing issues. Xpel’s on-the-ground team seems to be making inroads into the sell-in/sell-through dynamic that is unique to China. This will lead to a more reflective representation of the underlying demand in China.

On margins, both gross and operating margins improved 0.6% and 4.6%, respectively, likely as a result of some of the cost-cutting actions Xpel has taken. As a result, net income grew 28% to $8.6m, while EPS came in at $0.31/share.

It is too early to tell whether Xpel is turning a corner or whether tariffs have created some near-term demand pull forward.

Bad news and a short report

While the slowing growth, margin pressure and high starting valuation have all played a role in the significant stock drawdown, there have also been 2 key external news items, which caused the stock to drop dramatically:

Tesla insourcing PPF installation

Entrotech and PPG joint venture announcement

To amplify investor concerns, Culper Research released a short report centred around the existential threat that these two news items pose to Xpel’s business. Below, I will outline each item before analysis.

Tesla is taking PPF in-house.

Tesla vehicles have been a meaningful part of Xpel’s business despite costing significantly less than the other types of cars with high PPF attachment rates, Porsche, Ferrari, McLaren, etc.

The reason Tesla has such high attach rates despite the lower average value is due to the poor paint quality that Tesla has. Elon Musk has confirmed that at the Fremont facility (Tesla’s first high-volume factory), cars are often removed from the paint booth before the paint has fully set, which could lead to quality issues over time. To protect this soft paint, owners turn to PPF, more often than not from Xpel.

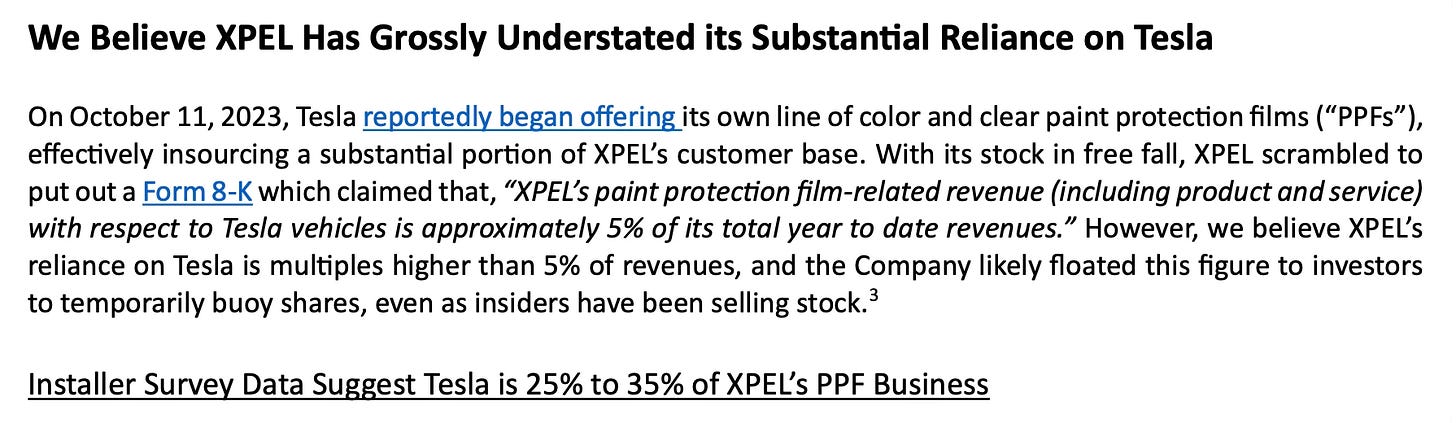

On October 11th 2023, Tesla reportedly began offering PPF installation as a factory option for consumers. This film is supplied by PPG and Aero films (owned by Entrotech, more on this later) and installed by Tesla-employed installers. In response, Xpel shares fell from $75 to $45. To stop the free fall, Xpel released a Form 8-K, stating that Tesla vehicles make up only 5% of total revenue.

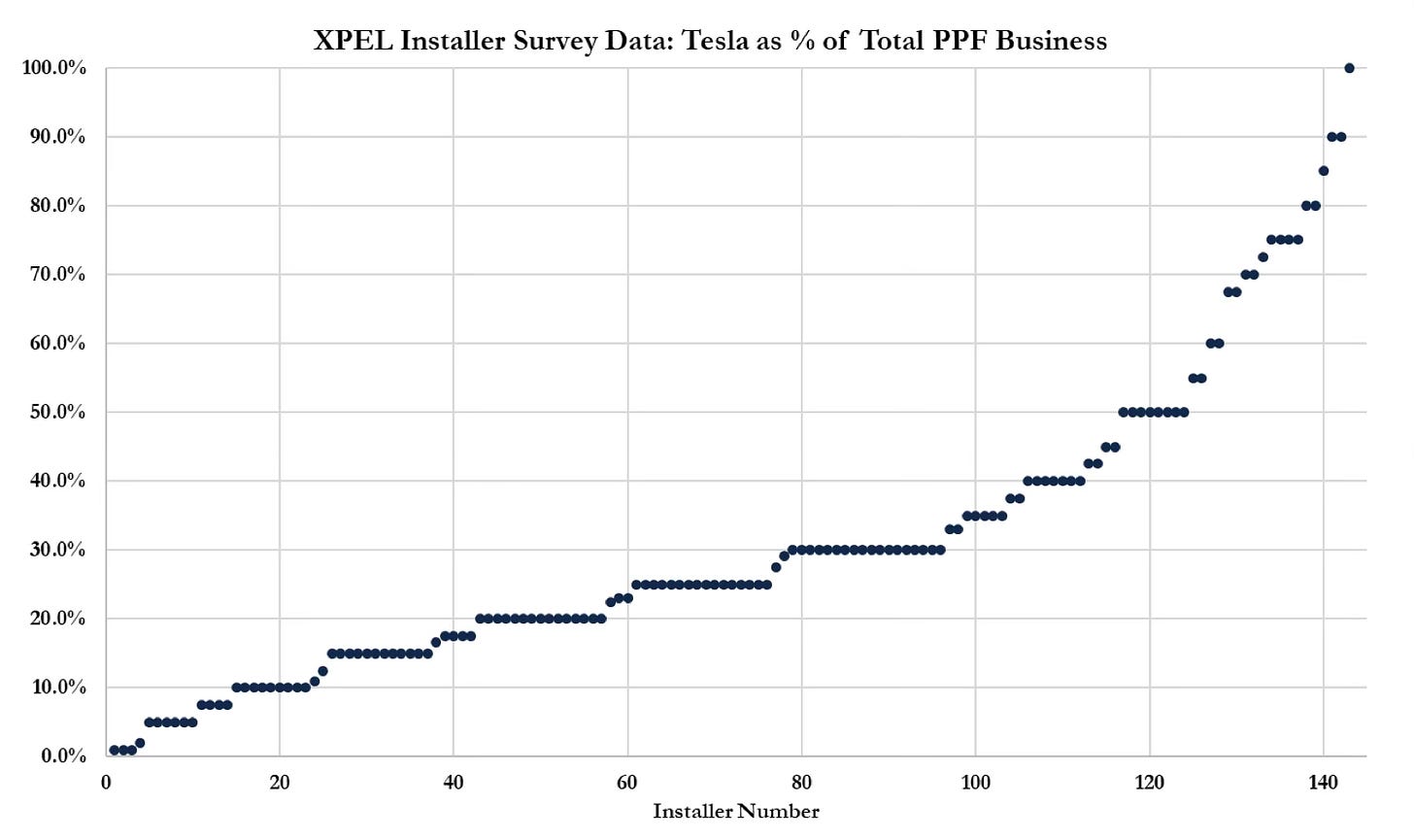

In the short report, Culper disagrees, claiming Xpel has understated its reliance on Tesla by as much as 5-6x, claiming Tesla is 25-35% of PPF revenue.

While these claims happened over a year ago, in that time, revenue growth as described above has continued to slow; it is therefore important to make sure this is not a contributing factor. Let’s unpack the claim:

Firstly, management. I find it very hard to believe that morally, Ryan Pape, CEO of 15+ years, who used his credit card to bail the company out, who also holds the vast majority of his net worth in Xpel, would suddenly risk securities fraud when Xpel’s DAP software will provide the company with a high degree of certainty about the exact car models that are being protected.

Onto the numbers, there are several key facts that Culper has missed when extrapolating the survey results of the 143 US-based installers:

Xpel has 6,000+ independent installer locations globally. Culper’s survey was equivalent to 2.5% of the total. On top of this small sample size, Culper did not survey any of the large multi-location installers, such as Tint World or Sunstoppers, which have a greater impact on revenue.

Xpel generates 42.8% of revenue internationally, none of which was surveyed.

The Fremont factory is the primary location for the majority of paint quality issues. Alternatively, the Berlin Gigafactory reportedly has the most high-tech paint shop in the world; therefore, extrapolating the Fremont issues globally is likely inaccurate.

The survey only considers the volume of Teslas through the door; it does not consider the protection coverage. It is highly unlikely that Tesla vehicles, on average, receive the same coverage as exotic cars, resulting in less per-vehicle revenue.

Ignoring the above points, let’s consider the numbers assuming Culpers’ 31% Tesla contribution is correct.

In 2023, Xpel generated $396m in revenue. From this figure, $230m (58%) came from PPF-related services.

Looking at the channels, independent installers contributed 63.2% of revenue, roughly $145.3m. We can exclude the remaining channels because Xpel did not do PPF work for Tesla in the dealership or OEM channels at the time.

Finally, geographically, the US accounts for 56.7%, applying a still above claimed 10% contribution figure to the international portion, the total Tesla revenue contribution figure comes to $31.8m, or 8% of total revenue as a worst-case scenario. When considering the above points, the 5% figure is likely accurate.

The downside scenario was/is that Xpel would lose 5% of its revenue from Tesla (or from any other OEM who insources). However, reports suggest that independent installers have not seen any kind of impact from these actions, likely because end users trust the Xpel brand name and therefore they would rather take their car into the aftermarket. Additionally, in 2024, Xpel and Tesla created a referral program for window tint and another partnership for Xpel to provide the exclusive wrapping of the Cybertruck. These two new partnerships likely mean Xpel generates more revenue from Tesla today than prior to the short report.

Entrotech & PPG joint venture

On 23rd May 2023, Entrotech (Xpel’s primary supplier) and PPG announced a joint venture to deliver a new solution, Paint Film. Culper claimed;

Entrotech and PPG have developed a way to integrate Entrotech’s paint protection technology directly into PPG’s paints. Given that PPG has the vast majority of market share of OEM paint coatings (independent estimates suggest 85%), the JV will set out to integrate this technology directly with OEMs, straight from the production line, hence virtually eliminating the need for XPEL’s clunky aftermarket wraps.

The launch of this new film highlights two risks:

Xpel’s. perceived reliance on Entrotech

Disruption risk

On the manufacturing risk, Entrotech used to account for over 75% of Xpel’s film supply through an exclusive supply agreement. However, in January 2022, Xpel ended the exclusive agreement and began to diversify its manufacturing base, over a year before this announcement. Today, Xpel has no single supplier risk, and as mentioned in part 1, the company is beginning to vertically integrate the entire process.

On disruption, Ryan Pape said,

I can tell you that there's no known technology that puts film inside paint that we're aware of, and this is not something that our partners at PPG are doing. And so I think that what you're seeing on a broader basis is can you use films to augment or replace paint in limited circumstances. - Q3 2023 earnings call

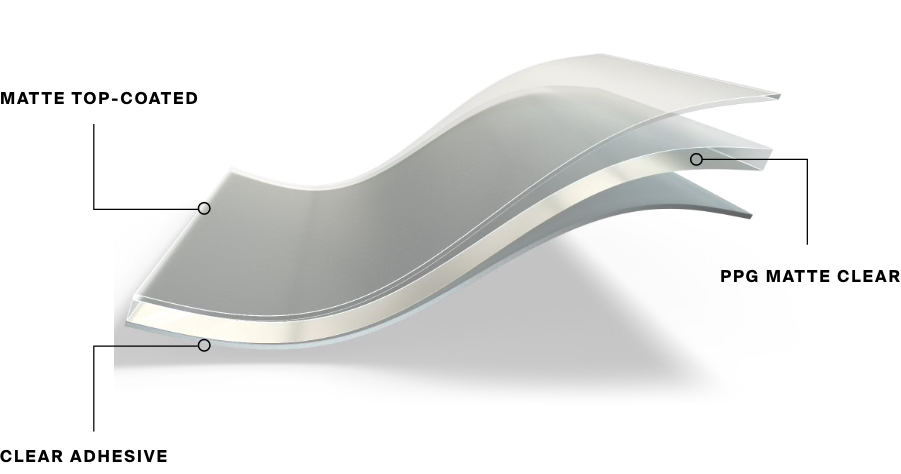

The joint venture brings together Aero films from Entrotech (PPF) and Wörwag films from PPG, a coatings supplier that PPG acquired in 2021. From the publicly available information (website and interview), it appears the claim that PPF has been integrated into paint is false, as confirmed by Ryan Pape above. Rather, it appears that Paint film is coloured PPF, which can be used to replace paint in certain circumstances.

The JV initially signed a contract to cover the 2024 Mustang line (seen below); beyond this, there have been no other announcements of contract wins.

While positive that Xpel hasn’t been made obsolete. The JV of these two companies marks the entry of a new competitor; the combination of Entrotech’s manufacturing capabilities, PPG’s OEM relationships and deep pockets could result in a formidable competitor in the future.

I hope it is clear to see that these events, while not positive for Xpel, do not materially impact Xpel’s business. Despite this, Xpel’s stock still has not recovered to the levels seen before these news articles.

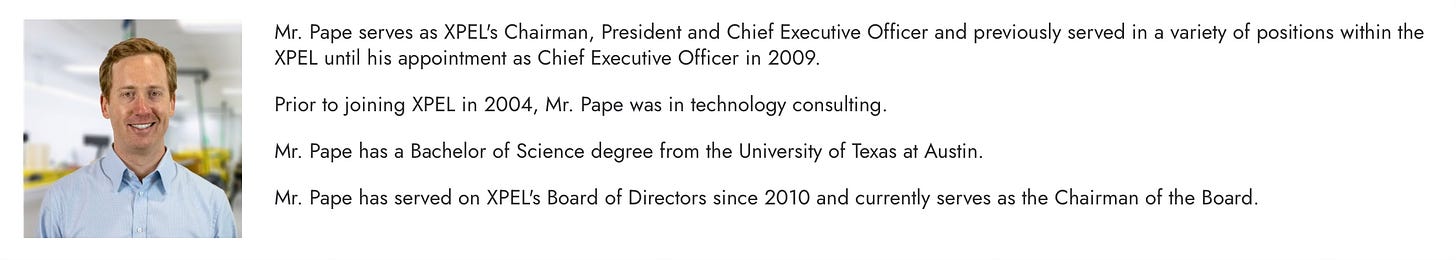

Management

Ryan Pape (43) has been CEO of Xpel since 2009. During his tenure, Pape has taken the business from the brink of bankruptcy to a highly profitable industry leader, in an industry Xpel helped to create, at a time when no one else could see its potential. There is little doubt in my mind that Pape and management as a whole are highly capable and arguably visionary.

Beyond the vision to sell PPF, management has demonstrated the ability to manage during a crisis, build a premium brand and expand distribution channels beyond the aftermarket. A notable attribute that Pape has ingrained into the culture to achieve this strong execution is speed.

Xpel’s culture can be summarised through the phrase “no tomorrow”, a precursor for speed. This emanates through the entire company, from management making quick decisions to service reps helping a dealer promptly. Pape is often the driving force behind this, personally pushing all teams to move faster.

This focus on speed is in contrast to other large competitors, many of which are owned by large conglomerates, likely with layers of bureaucracy. Chris Hardy describes the difference in speed between organisations as “not even apples to watermelon”.

Pape has also created a customer-obsessed organisation, whether that is setting high installation standards to ensure that no end user leaves unsatisfied, or by stocking up on inventory during the supply chain shortages (2021-2022) to make sure that no installer would run out of film, at great expense to the company. As previously mentioned, this has led to an extremely loyal installer base, as demonstrated by the consistently strong turnout at the annual Xpel dealer conference.

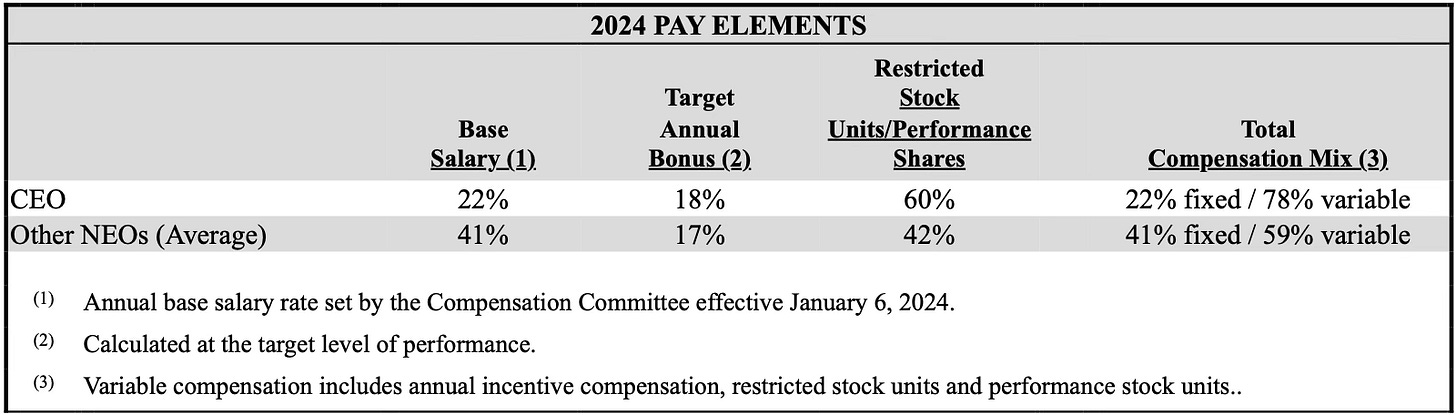

Compensation

Management is compensated in three ways:

Annual salary - 22%

Annual bonus - 18%

Long-term stock awards (RSUs) - 60%

Importantly, 78% of management’s compensation is tied to business performance. Annual incentives are based on revenue and EPS hurdles, weighted equally between the two, incentivising profitable growth. In 2024, following a slow year, management only received 34% of this award, highlighting the fact that management doesn’t receive bonuses for mediocre performance.

Long-term stock awards are also based equally on two variables: 3-year average revenue growth (with a hurdle) and 3-year average return on invested capital (ROIC). The target revenue growth and ROIC are 12.6% and 22.3%, respectively. These incentives incentivise management to allocate capital in a shareholder-friendly fashion, not just for growth’s sake.

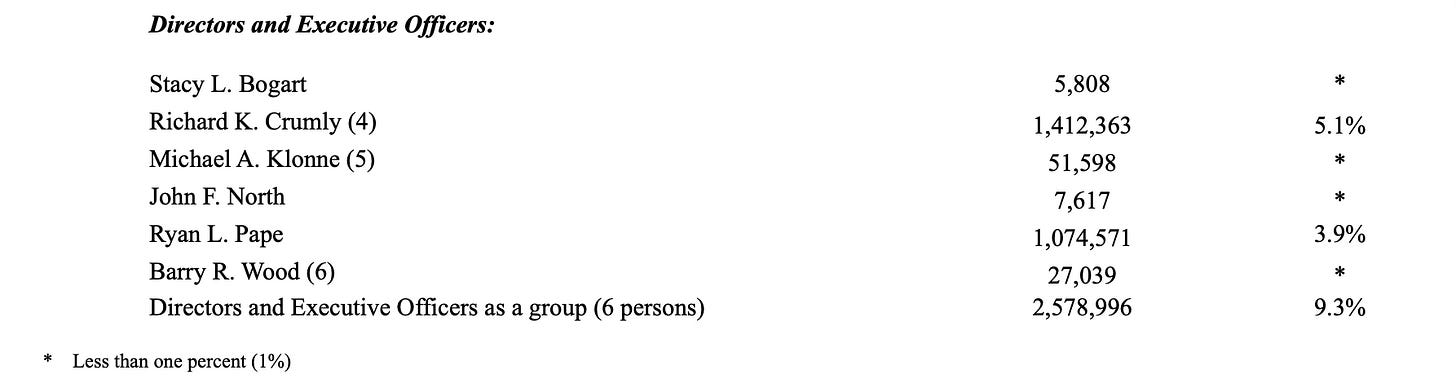

Insider ownership

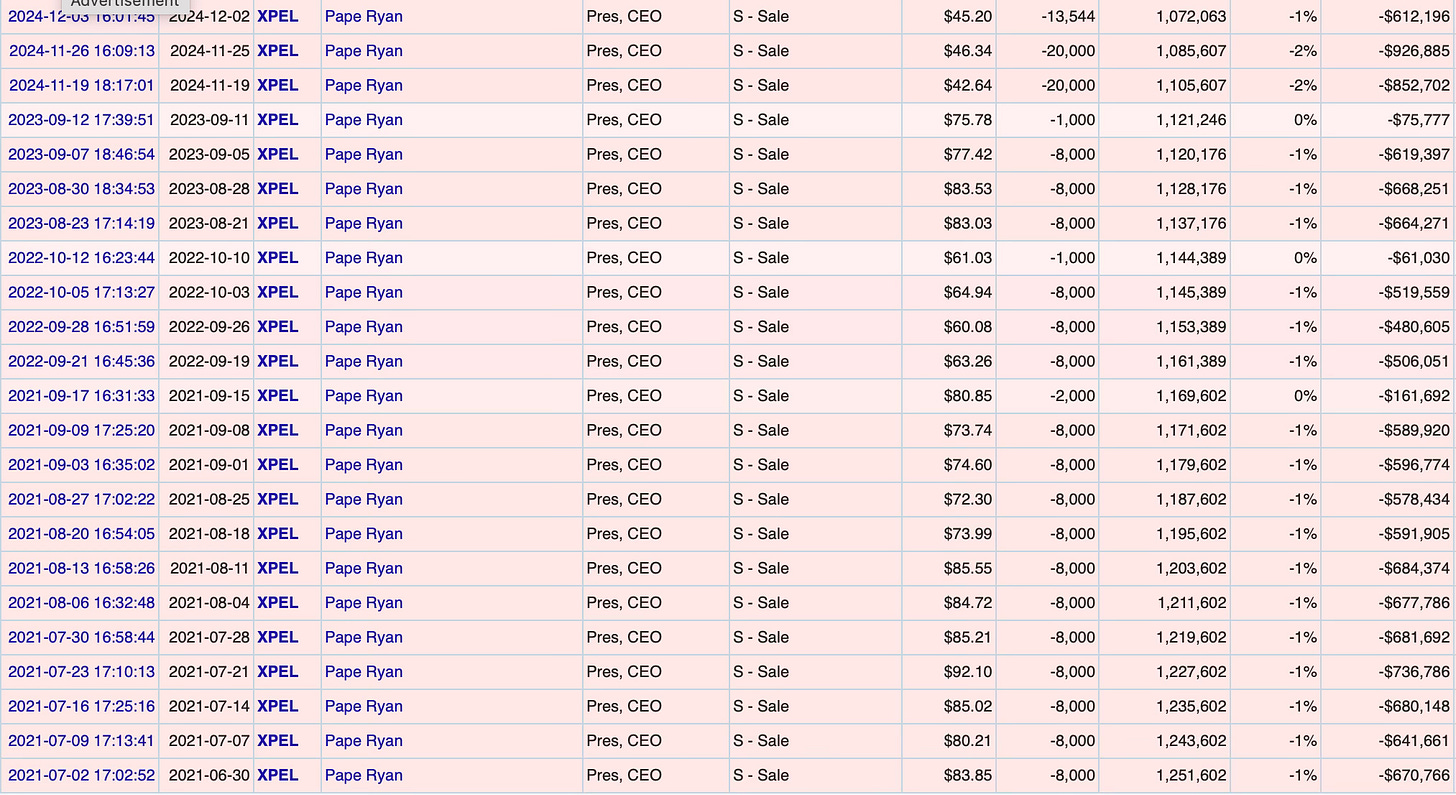

Insiders own a meaningful amount of shares, 9.3% of shares outstanding. However, this figure is down from 40% 5 years ago! While this may seem alarming, the majority of the change is due to director churn. Richard Crumly, who has remained on the board, has also reduced his stake from 17.7% to 5.1% over this period.

It is important to consider the timing of all of these sales, which primarily took place when Xpel’s stock traded at nose-bleed valuations.

Today, Ryan Pape owns 1.1 million shares, equivalent to 3.9% of the company. This ownership stake is down from 4.8% in 2020. While this ownership stake may not seem as high as hoped, the vast majority of Pape’s net worth is tied up in Xpel. Another point to consider is, Pape is not the founder; he bought these shares out of his pocket as a young man (28), likely with minimal financial resources at the time, essentially going all in on Xpel.

SBC

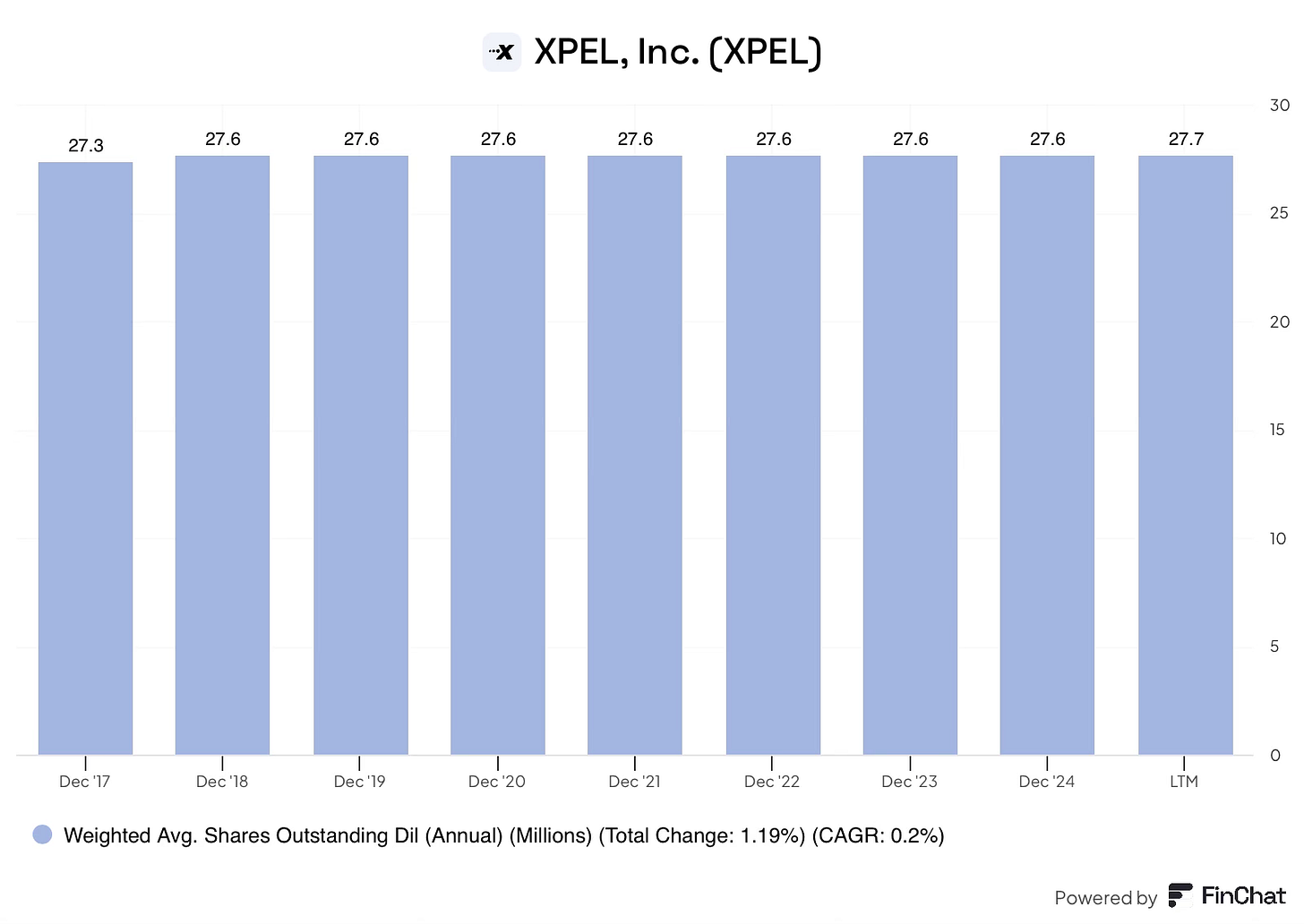

Shares outstanding have remained virtually flat since Xpel went public on the Nasdaq. This highlights management’s propensity to think like owners.

Combined, Xpel’s strong incentive structure, minimal SBC, and Pape’s considerable insider ownership align management’s interests with those of the long-term shareholder. Furthermore, at only 43 years old, Pape likely has many years left at the helm.

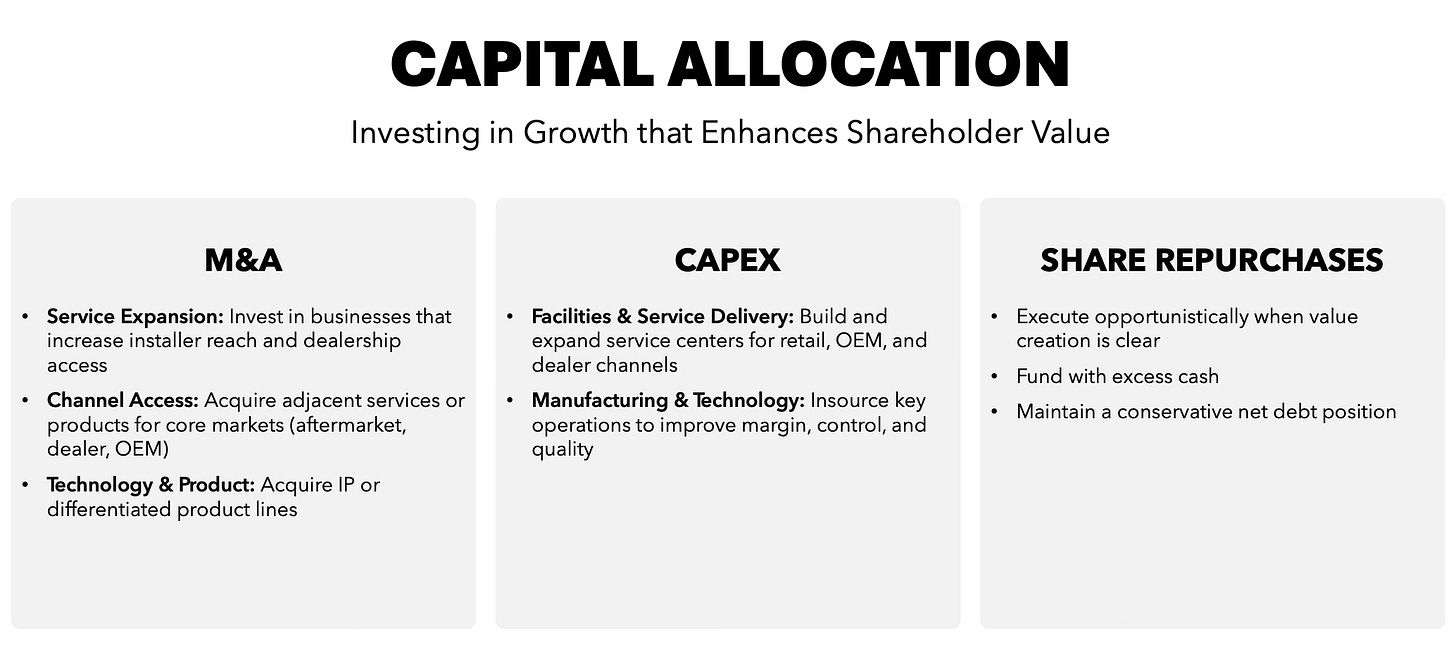

Capital Allocation

Historically, Xpel has retained all earnings, redeploying them into future growth. Beyond the income statement investments of R&D and marketing, Xpel has primarily allocated capital through acquisitions, with capex also steadily increasing as Xpel moves towards vertical integration.

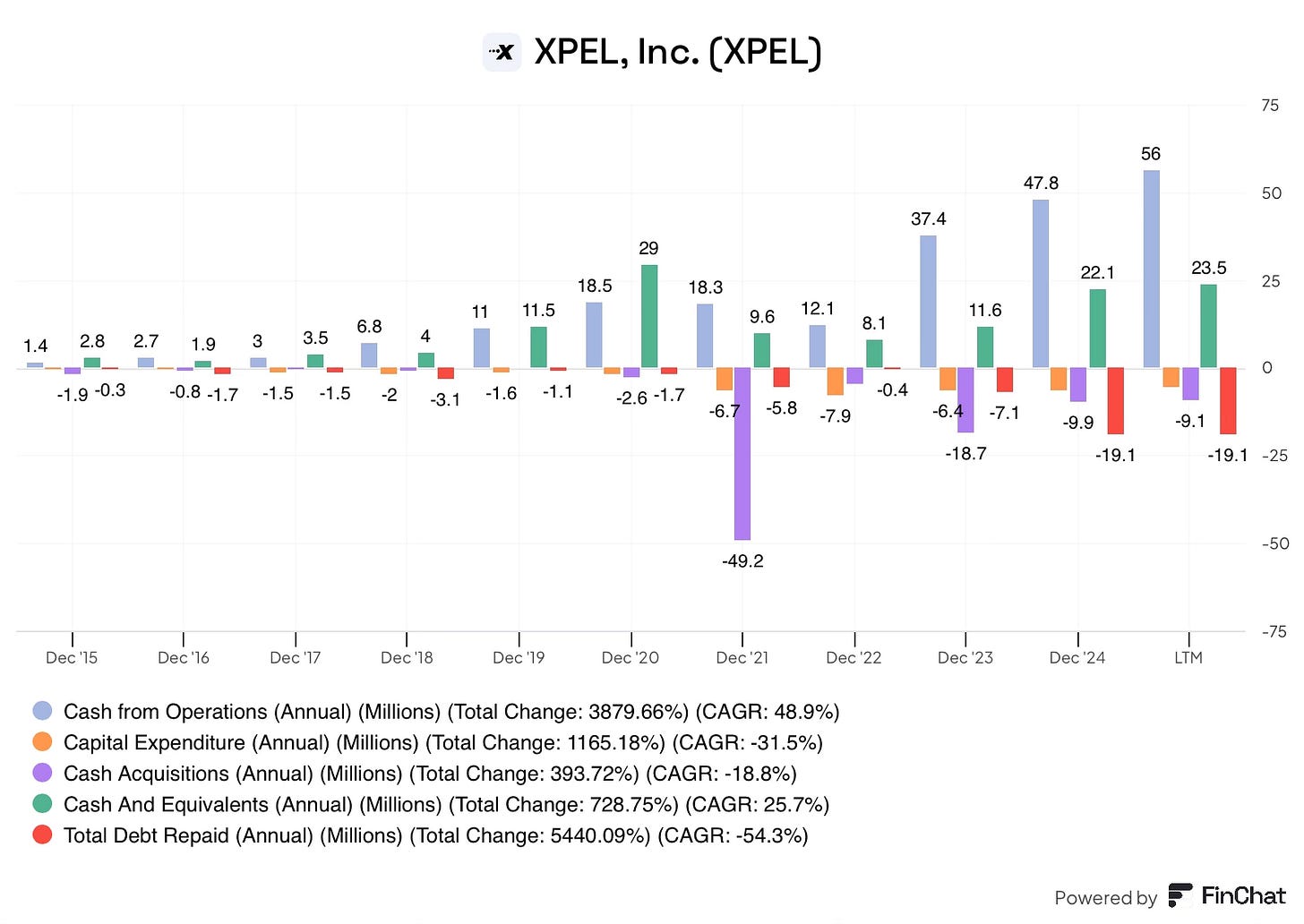

Of the cumulative $159m in cash from operations since 2015, Xpel has allocated $35m to capital expenditures, $90m to acquisitions, and the remainder has gone towards cash on the balance sheet. Below, I will discuss Xpel’s capital allocation strategy.

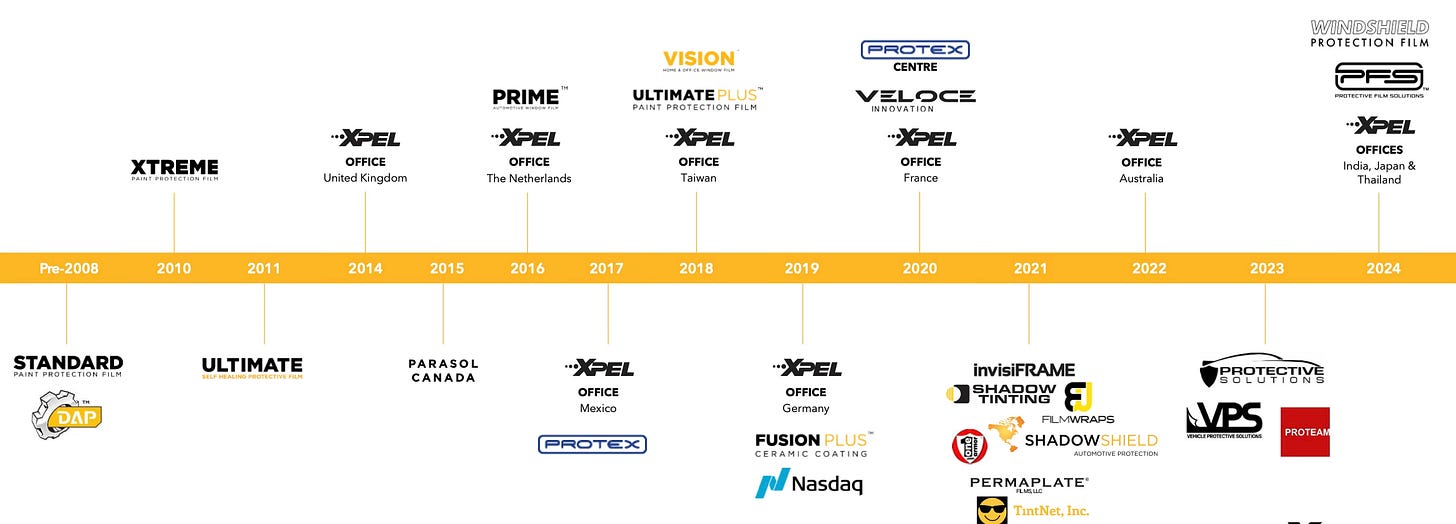

Acquisitions

Acquisitions have been a significant source of capital allocation over the last decade. In 2024 alone, the company acquired five businesses for a total of $12.5 million. These have typically been funded by cash on hand and modest debt, which has been repaid rapidly.

Acquired businesses range from:

International distributors - Australia, Japan, Thailand and Taiwan.

Dealership services businesses - Permaplate

New product verticals - Veloce (architectural film)

DAP bolt on - Autonovo

Installer businesses - Parasol and Protective film solutions.

Local distributors: Historically, this has been the primary source of capital. As mentioned previously, the financial improvements Xpel can generate in these markets post-acquisition result in strong ROI. Over the last few years, Xpel has rolled up the distributors of the top 20 automotive markets (excluding China). Due to the slow macro environment, the company likely hasn’t experienced the benefit of these quite yet.

While Xpel can invest organically into these distributors, future distributor acquisitions (other than the possibility of China) are highly unlikely. Instead, future acquisitions will be focused on two key areas.

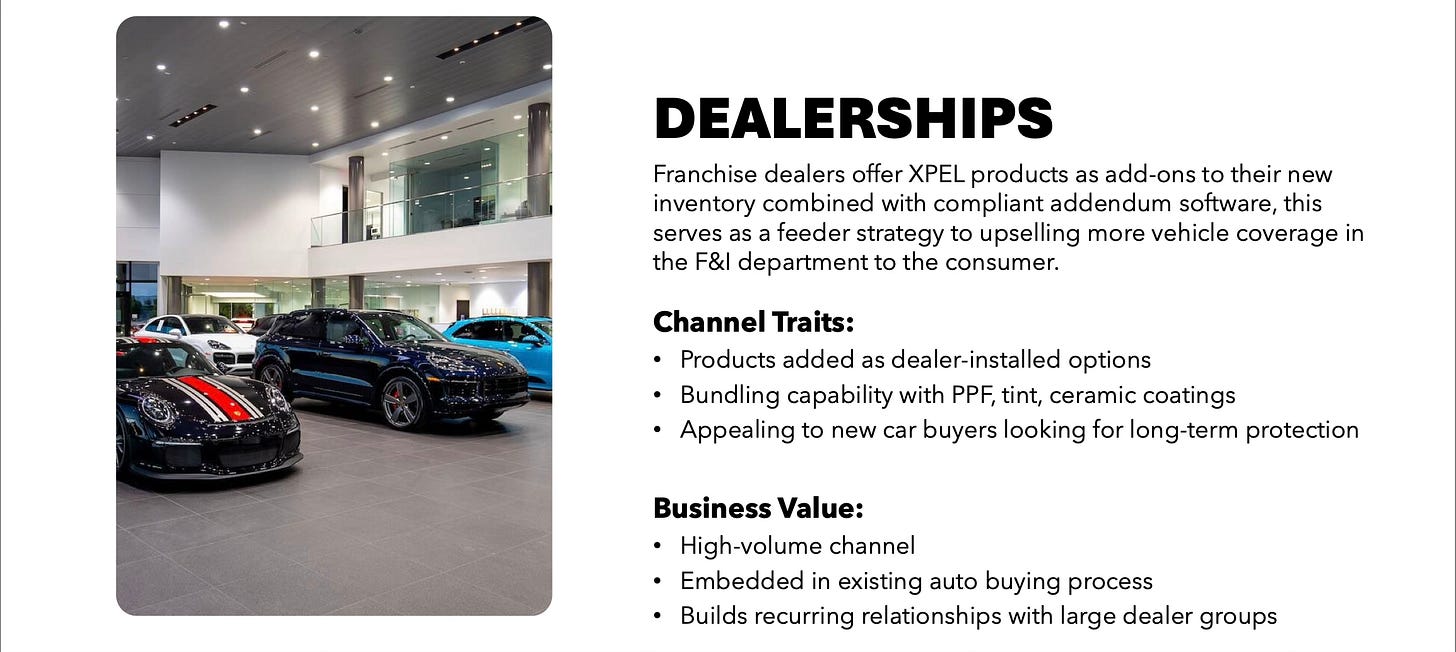

Dealership services: A relatively new source of capital (beginning in 2021 with Permaplate), this channel is becoming the preferred source of capital. Xpel believes that currently, dealerships are not well served, presenting an opportunity for Xpel to win in this channel. To expand beyond the car enthusiast market, this channel will be crucial.

To better serve dealerships, Xpel will continue to acquire high-volume installation businesses and other dealer-related services. These acquisitions have been and will likely continue to be high ROI acquisitions due to the superior economics these businesses demonstrate.

Product line expansion: Xpel has historically acquired its way into new product lines, including window tint, architectural film and antimicrobial film.

Recently, there have been several major products developed in-house: Windshield protection film and Coloured PPF (releasing in Q2 2025). This marks a more balanced approach going forward to both acquisition and in-house development.

Either way, new products likely demonstrate high ROI, which is due to the scale Xpel can achieve by leveraging that product across 6,000+ installer locations, OEM relationships and dealership partnerships.

Valuations for these acquired businesses have historically ranged between 3-5x EBITDA, representing attractive valuations. To date, Xpel has completed over 30 acquisitions, typically small tuck-in businesses, with the largest being Permaplate for $30m. Over time, the size of acquisitions will increase into the $25-50m range, which is only natural as the business gets larger.

All in all, the dealership channel is the primary focus for new acquisitions. Given the fragmented nature of this end market, it likely provides a long runway for future acquisitions. However, these acquisitions will not be for growth’s sake; management is willing to be “flexible and patient” to make sure they get “the right deals at the right price”. Currently, Xpel views valuations as unrealistic, demonstrating discipline and a keen focus on ROI rather than a growth-at-any-cost mentality.

Increasing organic investment

Historically, Xpel was solely a distributor of film, which meant the business was extremely capital-light; this was out of necessity due to the poor financial position they found themselves in. This is beginning to change as the company increasingly invests in vertical integration.

As mentioned previously, Xpel has invested heavily in recent years to insource key manufacturing operations. Xpel should see the benefit of this through higher gross margins and greater operational control.

Additionally, the push to expand the OEM and dealership channels requires Xpel to build installation centres close to OEMs and dealerships, while also increasing marketing spend to support this expansion.

These increased investments will likely generate strong ROIs; however, they will make the business (relatively) more capital-intensive.

Share repurchases

The final part of Xpel’s capital allocation strategy is share repurchases. This is the most recent aspect; in fact, no meaningful amount of shares have been repurchased yet.

In Q1 2025, Xpel announced that the board of directors authorised $50m of share repurchases, at a time when shares were trading 80% below their all-time high (16x PE ratio), suggesting management is not only valuation conscious in everything they do, but they also truly understand share repurchases. This is further confirmed by this quote from Ryan Pape:

“We still view the number one priority for capital allocation is investing in the business via M&A primarily, and then, secondarily possibility of more CapEx to drive our costs lower. Having said that, there’s always a price where buying yourself is obvious”. - Ryan Pape, Q1 2025.

This capital allocation strategy is sound, management is valuation-focused and incentivised to allocate capital in a way that achieves a 22% ROIC. The only arguable negative is the highly conservative balance sheet.

On the one hand, by maintaining little to no debt, the business increases its margin of safety against events outside of its control, making it highly durable, likely a wise decision when selling an expensive discretionary product that is tied to the automotive sector.

On the other hand, by utilising a modest amount of debt, the business could achieve high returns on equity, optimising the capital structure.

Recently, Xpel has acknowledged this fact, suggesting openness to adding leverage if the right opportunities present themselves.

Destination analysis

Excluding valuation, investors can boil down future returns to two key variables:

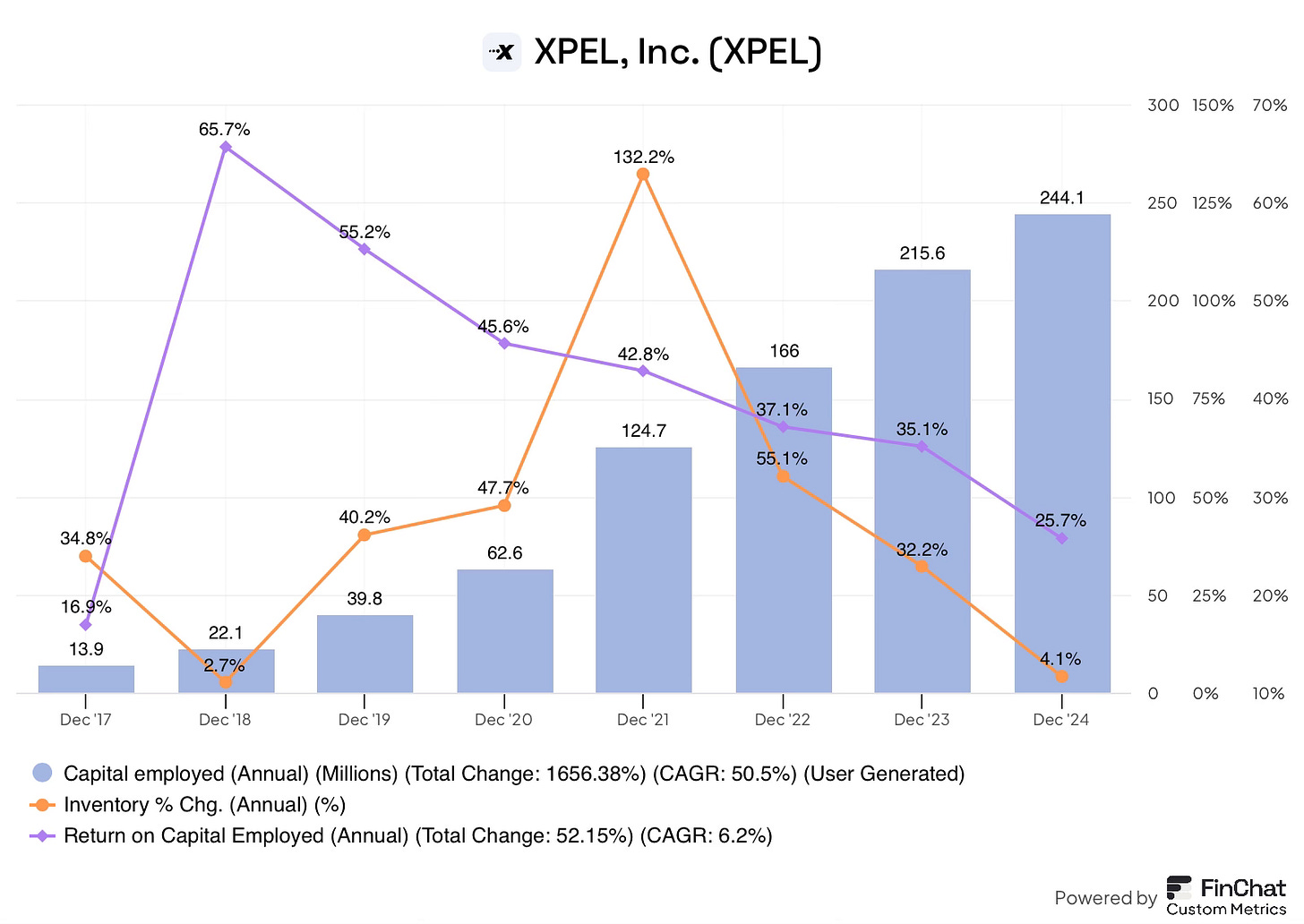

Expected growth rate = Capital employed x Return on capital employed (ROCE)

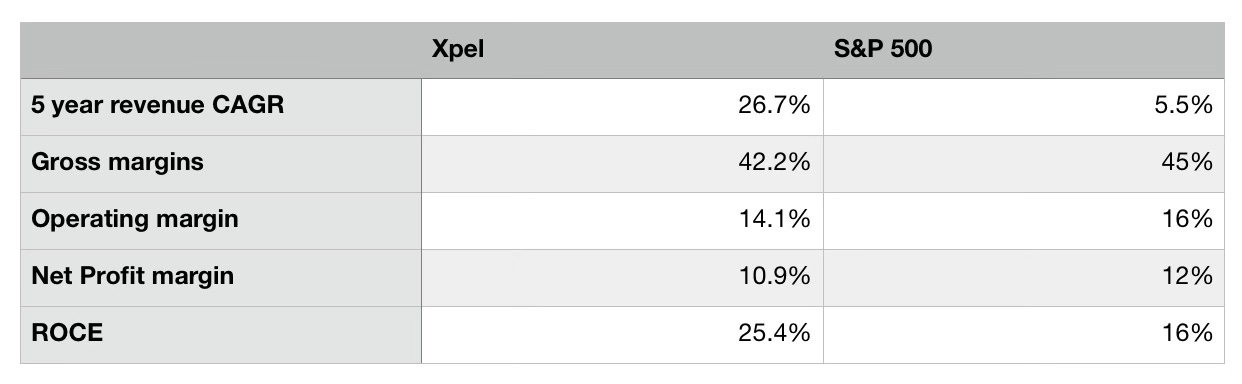

Xpel has historically grown capital employed by 49% annually since 2015, while returns have come down gradually over time, they remain above the average S&P 500 business of 16%, and significantly above the cost of capital despite being depressed from the rapid growth in inventory over the past few years, amplified by the current business slowdown. At some point, I expect both the slowdown and inventory position to reverse, normalising ROCE.

In the previous section (capital allocation), I concluded that Xpel’s management is both value-oriented and incentivised to achieve high ROI. In this section, I will therefore focus on how much capital can be redeployed into future opportunities.

Historically, Xpel has executed a strategy to drive and capture the adoption of films and services in a few key ways:

Expand the affiliated installer base.

Partner with new car dealerships and OEMs to drive growth beyond the car enthusiasts, acquiring dealership-focused installers where appropriate.

Create and nurture a premium brand through brand marketing.

Launch Adjacent products to act as a gateway.

In the future, a few key variables will determine the outcome for Xpel, including PPF penetration rates (both in North America and internationally), Product line expansion, Growth beyond Automotive, and Acquisition cadence & valuations (touched on previously).

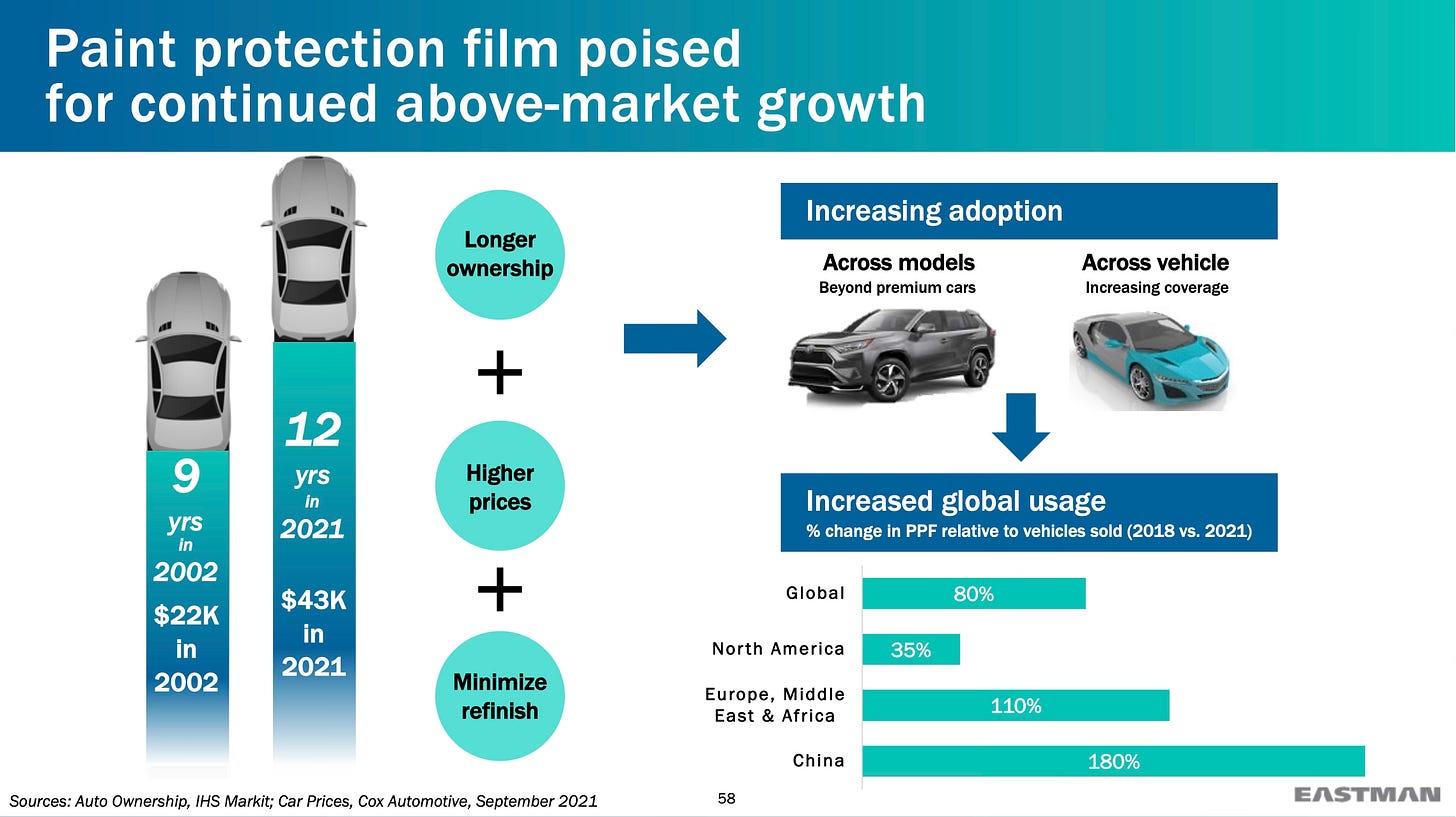

PPF vehicle attach rates

Over the last decade, PPF attachment rates have grown from 1-2% of new vehicle sales to 8-9% in North America. To contextualise the potential opportunity, consider these data points:

15% of new car buyers are enthusiasts.

19.6% of new cars sold in the US are luxury.

60% of new car buyers are reportedly open to PPF.

At the low end, PPF has penetrated just over half of the car enthusiast segment. On the higher end, PPF is only a fraction of where it could end up. However, it is unlikely that PPF will reach these higher penetration rates, similar to window tint (which has much higher adoption) given the significantly higher price point of PPF. Roughly speaking, the theoretical mature PPF attach rates is therefore between 15-60% depending on how well Xpel (and the broader industry) can execute in growing the PPF market through channel expansion, growing consumer awareness and rising personalisation trends. Additionally, coverage amounts has significant room to increase, with the average coverage currently between partial and full front.

Beyond the US, penetration rates are even lower, likely between 1-3% in most regions as markets remain in their infancy, in some places Pape views this as a 20 year lag!

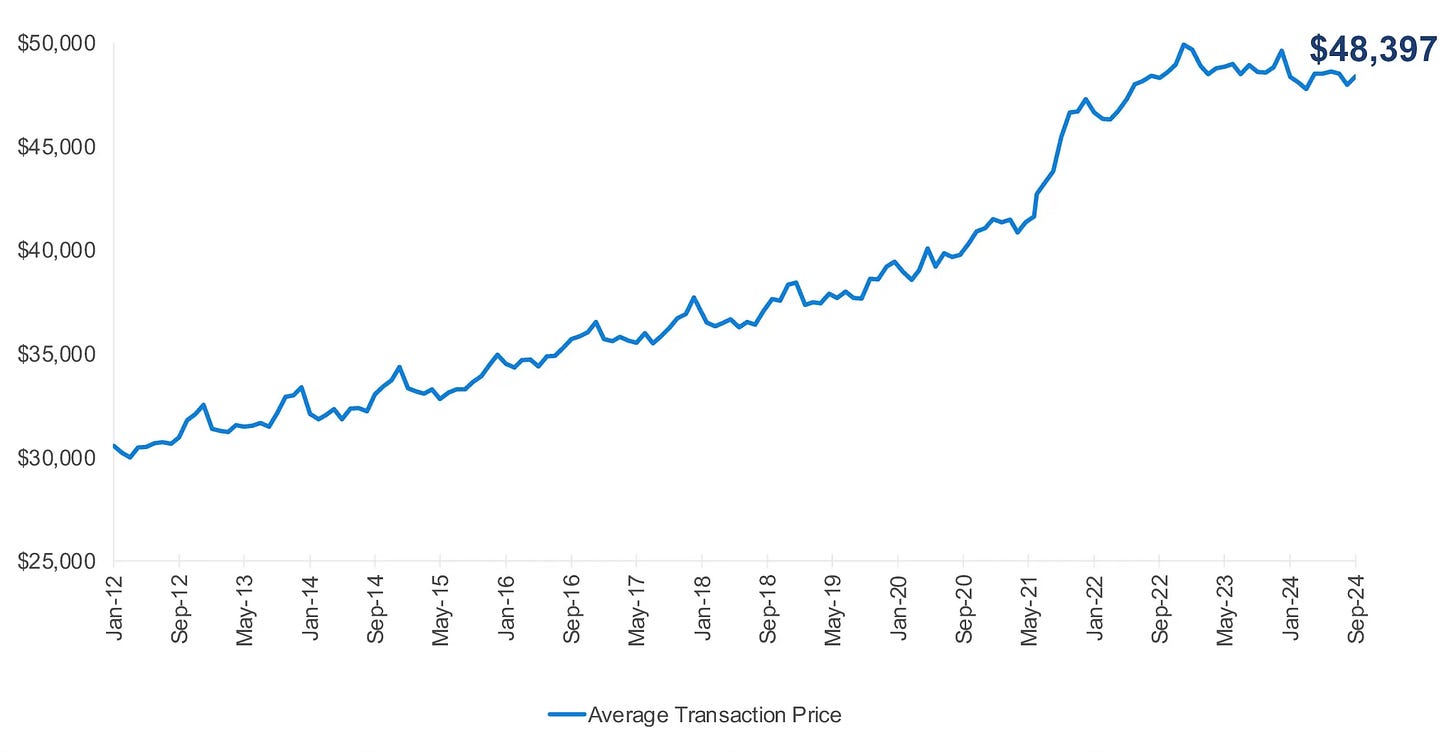

There are several tailwinds that are driving, and should continue to drive greater adoption of PPF. The first tailwind is average new vehicle value, over the past 12 years, the average transaction price of a new vehicle has increased by 50%. As vehicles become increasingly expensive through material inflation, incorporation of technology (sensors), and the shift to electric and autonomous vehicles etc. These higher prices create a greater incentive to protect these higher priced assets, furthermore, the cost of protection becomes a smaller percentage of the vehicles cost, making it more justifiable.

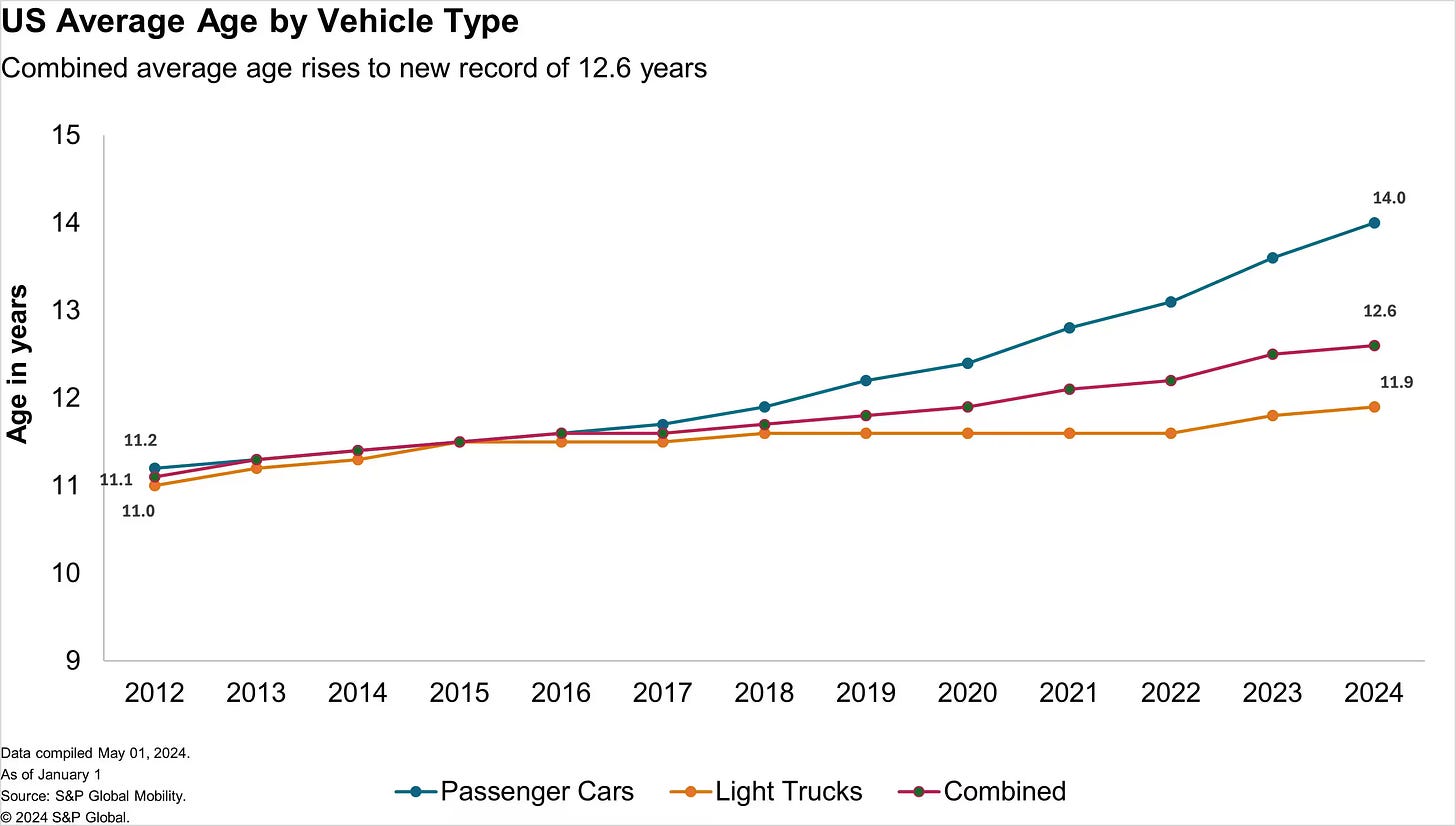

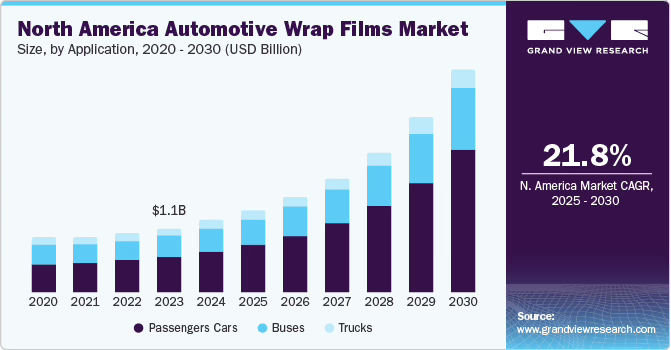

Secondly, the average owneship period in the US is increasing, in the US, the average age of a passenger car is now 14 years, up from 11 years in 2012. If cars are owned for a longer period of time, there is a greater need to protect them, increasing its useful life and resale value. As a result of these tailwinds and greater consumer awareness from industry investments, Grand View research predicts that the Automotive wrap films market is going to grow at a 21.8% annual growth rate over the next 5 years.

To capture this trend of higher value vehicles and longer ownership periods in both North America and Internationally, Xpel simply needs to execute on the current strategy (mentioned above), but on a larger scale.

New car dealerships opportunity

Xpel has a significant opportunity within the dealership channel to gain market share.

Previously I discussed this area as a primary opportunity for acquisition, beyond that, the company has significant opportunity to expand its penetration and reach within exisiting dealerships.

Dealerships often incentivice prospective buyers with add-ons, known as F&I (finance and insurance) products to get a purchase over the line, typical products include; extended warranty, guaranteed asset protection, tire and wheel protection and many more financial instruments. These are typically high gross profit products for the dealership.

In 2023, the FTC announced the CARS rule to fight against “bait and switch tactics and hidden junk fees” amongst car dealerships, this prevents dealerships from charging for add-ons that do not provide a real benefit to the consumer, like some of the above mentioned.

On the 27th of January 2025, the Fifth circuit court of appeal vacated the CARS rule after procedural deficiencies, allowing dealerships to still sell questionable products. Despite this, there is growing scrutiny of these products with legislation at the state level filling in for the CARS rule, states such as California and Massachusetts are leading the way.

So what does this have to do with Xpel? Well as these F&I products are potentially outlawed over time, dealerships will have to incentivise consumers with more tangible and beneficial products as replacement. PPF, Window tint, and windshield protection film are in a prime position to be replacement products, especially as an owners affinity to protect their new car is greatest at this point. For the dealership, these product will also provide high gross margins, incentivising dealers to partner with Xpel.

Xpel is acting agressively by expanding their sales organisation, while also making it easier for independent installers to do dealership work through Xpel. There are over 18,000 new car dealerhsips in the US alone, to put this opportunity into perspective, Xpel has 6,000 independent installer relationships that make up c.63% of revenue. Additionally, while Xpel has given no specific information, it is likely that at the store level, a new car dealership will generate more revenue for Xpel than an independent installer, this is because of the high volume nature of the work. This makes each incremental new car dealership extremely valubale, explaining why Xpel is investing aggressively to win in this area.

International opportunity

Xpel’s international revenue accounts for roughly 43% of the business, despite 81% of all vehicles sold in 2024 being outside the US. This large discrepancy is down to low penetration (1-3%).

These largely untapped markets provide plenty of investment opportunity in the future now that Xpel has a direct presence in the top 20 markets. I would expect the company to follow a similar playbook to what made them so succesful in the US, with local nuances.

China is arguable the largest opportunity internationally. In 2024, China consumed almost double the amount of cars as the US (26 million vesus 15 million). Xpel already has a leading premium brand in the country, and now with Xpel teams on the ground (for marketing and distribution expansion support) and a more appropriate product portfolio, the company and distributor alike can expand distribution into the aftermarket, new car dealerships and OEM partnerships with greater success.

Despite the large opportunity outside the US, the more penetrated US segment has grown at a faster rate over previous years, due to the combination of both organic and acquisitions fuelling the growth rate. It is likely that Xpel will begin acquiring businesses internationally (beyond distributors) at some point, when the opportunity presents itself, allowing growth to accelerate.

Additionally, as the Xpel brand gains a larger presence internationally, Xpel will be able to leverage OEM partnerships globally, further strengthening the brand.

New product lines

Within the automototive segment, Xpel is releasing (or has just released) several new products, a trend that will likely continue over time. The expanding product line has multiple benefits including:

Gaining share, and providing a greater product portfolio to their installer base

Attracting new customers to the brand (gateway products)

Increasing content (revenue) per car

Windshield protection film

Technically already released, windshield protection film potentially has a long runway for growth, especially as a gateway product within the dealership segment.

Launched in late 2024, after several years of development, Xpel’s windshield protection film is completley clear, has self healing technology and comes with a 12-month/12,000 mile warranty. This film applied to the outside of the windscreen protects against chips and cracks, a common pain point for all road users, not just car enthusiasts. In the US alone, 14 million windscreens get replaced every year (substantially more get chipped and cracked), this is roughly 5% of all registered cars.

The value proposition for this product continues to increase as more and more electronics get integrated into the windshield, such as heaters, rain sensors, cameras and sensors for ADAS (advanced driver assistance system). Additionally, calibration of these further increases the cost to replace a windscreen. Today, windscreens can cost upto $1500-$3000 to replace, and even more for luxury vehicles. While it varys from dealer to dealer, Xpel windshield protection film and installtion costs $450-500, an attractive price to save time and money.

Prior to release, this was the most requested product, and since launch, the product has gained strong traction in the aftermarket. Strong growth could be maintained by succesful introduction into the dealership channel. The product has a tangible benefit and strong value proposition to new buyers, which could help it replace F&I products (described earlier).

Xpel plans to begin marketing the product later this year to unlock its potential as a gateway product. Looking to its potential, I see no reason why it couldn’t reach parity with window tint at some point.

Colour PPF

Coloured PPF is set to launch in Q2 2025.

Coloured PPF is not new, it has been in the market for some time through various forms, such as laminating vinyl to PPF etc. Xpel has taken a wait and see approach to this product, primarily due to the installation technique, which resembles that of applying vinyl wrap (applied using heat). This technique would have made it difficult for Xpel to expect the same high quality finish from its installer base who are used to the TPU based installation process (wet installation).

Now, Xpel has developed and is launching a TPU-based colour PPF with the same characteristics as its traditional PPF range.

Colour PPF demonstrates premium properties over the incumbent vinyl wrap, including better optical appearance, more protection and self-healing capabilities. This should allow the product to gain some market share away from vinyl, expanding the TAM for Xpel by allowing it to fully participate in all TPU based wrap options. While management is optimistic about the product, they have tempered expectations, stating that it will not change the number of people who want to change the colour of their car. On the other hand, colour PPF has recieved a lot of attention at SEMA 2024 conference by being able to provide “the best of both worlds in one film”, suggesting others parties are more optimistic.

Similar to windshield protection film, colour PPF allows Xpel to gain further traction in the OEM and dealership channels by providing affordable factory customisation. Similar to the PPG & Entrotech JV (mentioned earlier), Xpel will be able to provide customisation options, for example, a contrast roof, which would have typically been a multi-layer paint process can now be offered by a simple wrap, providing a quicker, cost effective solution, with similar appearance.

Beyond Automotive

Automotive currently makes up 94% of the business, continued investments into adjacent sectors could lead to the formation of adjacent markets, leading to long term growth. There are several key but not exclusive areas that have high potential for future growth.

Architecture

Architecture was Xpel’s first adjacent market and today represents 4% of the business. Xpel was somewhat late to this segment, this established market already has an estimated size of $3-4B, and is expected to grow 5% annually (PPF segment likely faster), driven by tailwinds such as energy efficiency, aestheitcs and privacy.

This long term tailwind and already sizeable market, could lead to future market share gains.

As mentioned in part 1, to bolster the product portfolio, Xpel acquired Veloce in 2021, bringing veteran leader Harry Rahmen to the company, who has a strong track record in the flat glass segment, growing both Veloce and Huper Optik (Eastman subsidiary) into industry leaders, he has also been credited with the largest single flat glass deal ever (2m SqFt)

This acquisition and new leadership have shown positive results so far with multiple large accounts that were previously hesitant in joining Xpel, subsequently joining. This has resulted in revenue growing roughly 60% in 2023, despite these tough comparisons, revenue grew another 14% in 2024, representing an annual growth of 35% across the two years (despite the weak housing market). These strong results demonstrate strong market share growth that are set to continue.

Marine

At less than 1% of the business today, marine is a natural extension to the automotive business. Boats are subject to even harsher conditions, such as UV, rain, salt spray, rope wear, barnacles, algae and marina docking, making maintenance and protection a crucial part of boat ownership.

The marine coatings business is already well established, particularly for larger vessels. However, PPF has an opportunity to penetrate the leisure market. The Smooth hydrophobic surface and self-healing properties would make it easier to clean, reduce wear on high touch areas, and reduce damage above the water line, preserving the boats aesthetics. The benefits of PPF can also be used in other demanding industries such as aviation and cycling.

Xpel’s full suite of products is transferrable to marine, with window tint and ceramic coatings complementing PPF. Additionally, Xpel can leverage its DAP software to adjacent industries to help installers with installation.

Margin expansion

Discussed in depth in part 1, Xpel has and will likely continue to expand margins long term, allowing earnings to grow faster than revenue. This margin expansion will come from 2 areas:

Improving film economics: Xpel has increased product gross margins from 15% to 37%, this increase was driven by supply chain optimisation, channel mix (indirect to direct markets), and the contribution from margin accretive films. These improvements will likely continue, albeit it, not at the magnitude historically. Additionally, the current investments to in-source increasing amounts of the manufacturing process, should allow for future margin expansion as they cut out the middle man.

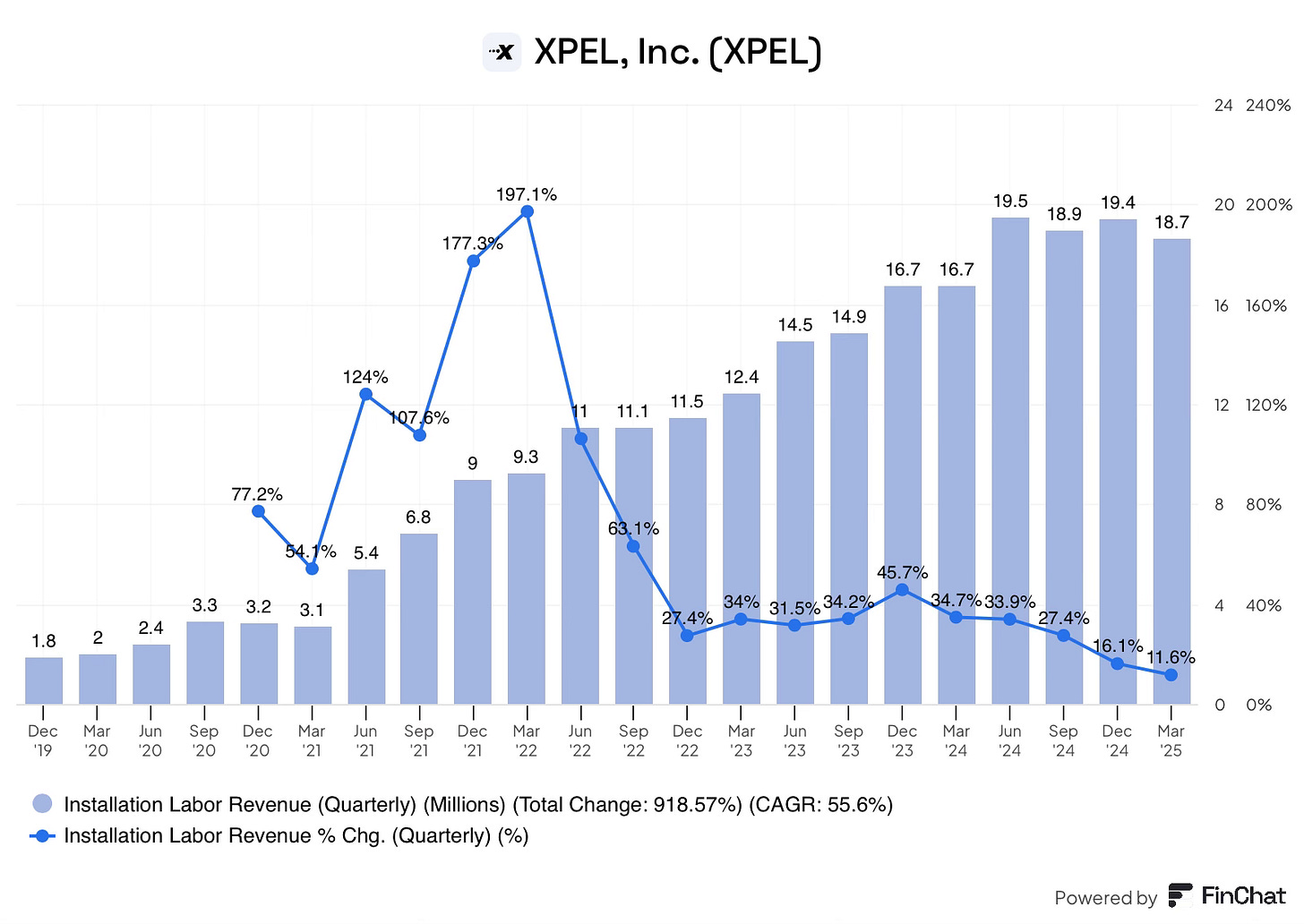

Increasing contribution from the service segment: The service segment (software and installation) has significantly higher gross margins when compared to the film business, LTM gross margins of 57% vs 38%. Over the past 7-8 years, the services segment has grown significantly faster, 36% vs 28% Cagr, contributing significantly to overall margin expansion.

With Xpel investing heavily in growing both the installation and software business, it is highly likely that this segment will continue to grow faster than the film business, driving further margin expansion.

Currently, LTM gross margin are just north of 42%, management believes they have a long runway for growth. Barry Wood, CFO stated they “certaintly don’t think that 43% is the cap by any stretch”.

To conclude this section, Xpel has multiple growth opportunities, these growth avenues, coupled with margin expansion and a flat to slightly shrinking diluted share count (from opportunistic repurchases), could result in EPS growing at a strong rate for the forseeable future.

Risks

Now I have outlined the bull case for Xpel, what could de-rail the business?

Macro and consumer preferences: Xpel sells an expensive consumer discretionary product that is not only reliant on the automotive cycle, but also on consumers going out of their way to protect their car.

Xpel has and will likely continue to benefit from 2 key trends:

New car values increasing over time

Ownership length increasing

However, these trends can also work to the detimant of Xpel, during tough economic times, a consumer could postpone or fully put off buying a new car, or if time critical, buy a used car. This factor will likely lead to the industry becoming more cyclical over time. While Xpel is protected financially through its healthy balance sheet, prolonged downturns could significantly impact the dealer base who are more economically sensitive. Additionally, downturns could lead to discounting and other brand destructive activities, which could be detremental to its long term prospects.

Autonomous vehicles

The future of car ownership is a long tail risk for Xpel. Autonomous vehicles are highly likely at some point to become the industry standard, raising two key questions for Xpel; When? and how will that affect PPF penetration rates?

When: Your guess is as good as mine (1-100 years take your guess).

PPF penetration: The days of owning a car may soon be over, fleets of autonomous vehicles could soon provide mobility as a service like offerings. While this statement is extreme, car ownership rates, especially within large metropolitan areas, could decrease as autonomous vehicles make the value proposition of owning a vehicle less attractive.

As large fleets of vehicles become wider spread, there is no guarantee that these companies will protect their vehicles with PPF, although window tint and windshield protection film are still likely to be adopted. However, I do believe there is a strong value proposition to protect these expensive cars, including; maintaining vehicle value and maintaining brand image and professionalism through a uniform fleet.

Disruption: As I touched on earlier, there is currently no paint that can incorporate the protective characteristics of PPF today. However, that doesn’t mean that it couldn’t be developed in the future.

Additionally, Xpel could also face disruption if OEM’s decided to in-house the PPF installation (hiring their own installation technicians). While not imporssible, this would require significant amounts of space and trained labour to mass install PPF, making it unlikely to replace partnerhsip models.

Competition: Xpel faces many competing film brands, most notably, 3M (scotchguard) and Eastman Chemical (LLumar and Suntek). These competitors have typically introduced new types of film before Xpel, in some instances years before.

Despite this, Xpel has gained market share against these competitors. Between 2018 and 2021, Eastman grew its PPF business by 84%, while Xpel grew by 135%. Beyond the structural advantages that I discussed in part 1, Xpel has one strucutral advantage, speed.

Both Scotchguard and Suntek &LLumar are part of larger conglomerates with sprawling interests, internal battles for invesments, and layers of middle management. In comparison, Xpel has a singular focus and a culture of speed (no tomorrow).

This structural advantage has likely been a key reason for Xpel’s success.

Despite this, competition will likely increase with the joint venture between PPG and Entrotech entering the picture.

Valuation

Following a period post-pandemic of inflated valuation multiples, Xpel is now trading at a level that is below historical averages, even when excluding the previous few years of bubble-like valuations.

The multiple becomes even more attractive (relative to historical trends) when adjusting for the currently inflated expense base that is compressing earnings. Today, Xpel trades at a P/E ratio of 21X (2015-2019 avg of 24.5X), or 18X when normalising margins.

Comparisons

While Eastman Chemical and 3M both compete with Xpel, the respective performance film segments are only small parts of large conglomerates. Unsurprisingly, Xpel trades at a premium to these large, slow growing businesses.

However, there is one data point that is available, Eastman Chemical acquired Suntek for $438m, which based on current revenue at the time, represented a 4.4X price to sales multiple. Xpel is currently valued at 2.4X sales, representing a significant discount to that transaction.

Is Xpel worthy of a premium valuation?

Ultimately this is up to the reader, but Xpel demonstrates significantly faster growth and capital efficiency, but a slightly lower margin profile than the S&P 500. Furthermore, Xpel arguably has several qualitative advantages over the S&P 500: management quality and capital allocation.

Reverse DCF

Using a reverse DCF with the following assumptions:

8% discount rate

Book value of $8.5 / share

share price $36.2

FCF / share of $1.8

The market is pricing in growth of 6% for the next 10 years, followed by 3% growth for a further 10 years (terminal rate).

Assuming Xpel a longer terminal period, the market is pricing in 3-4% growth for 10 years, followed by a 2% terminal growth rate for 20 years.

In both scenarios, the market does not expect Xpel to grow anywhere near its historical growth rate, potentially providing a margin of safety for anyone who disagrees with Xpel’s future earnings potential on a per share basis.

Assuming different growth rates in a traditional discount cashflow model, we can look at what the company could be worth in various scenarios, using a 15 year, 4% growth terminal rate (as an in-between).

5% annual growth = $39.20 (7.67% upside from today)

10% annual growth = $52.74 (31.3% upside from today)

15% annual growth = $72.25 (49.87% upside from today)

20% annual growth = $100.14 (63.83% upside from today)

Instead of presenting my own valuation, which may or may not be accurate, this deep dive provides you with a comprehensive context of Xpel’s business model, competitive advantages, financial profile, management, capital allocation, growth opportunites, risks and valuation, which I hope should allow you to come to your own thesis on what Xpel is worth.

Closing thoughts

If you have made it this far, thank you!

Xpel is a fascinating company, the company has a capital light business model, a nuanced but powerful competitive advantage, strong and trustworthy management team that understands capital allocation with the opportunity to allocate capital to plenty of growth drivers.

For me, Xpel has become a meaningful part of the portfolio, circa 8% of the total.

Your support is greatly appreciated, a like, comment, and subscription goes a long way!

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.