Welcome back to the final part of this deep dive series into Evolution Gaming AB.

In this series, I have set out to ask 5 questions that all long-term investors should know before investing in any company, these are:

Is the business understandable?

Is it a good business?

Are management capable and trustworthy?

Does the business have a long re-investment opportunity, and what are the risks associated?

Is it available at a fair price?

In part 1, I covered questions 1, 2 & 3, to gain a deeper understanding of the business and the drivers associated, along with a review of the competitive analysis.

In part 2, I took a slight detour to discuss the recent developments of the business in detail.

In part 3, I will be addressing questions 4 & 5, by looking at the opportunities, risks and valuation. I will close out this deep dive by sharing how I view Evolution, with respect to my portfolio allocation.

If you missed, part 1 or 2, check them out using the links below, and don’t forget to subscribe to ensure you don’t miss out on my future deep dives!

4. Does the business have a long re-investment opportunity, and what are the risks associated?

Understanding the opportunities that lie ahead is a crucial aspect of any investment. It helps investors understand where a business is with respect to its lifecycle.

Evolution potentially has a long runway of growth ahead.

Thesis: Evolution’s commitment to game innovation, along with the company’s market dominance, positions the company well for future growth. The continued increase in popularity of online casinos from continued gaming innovation, mobile adoption and the regulation of new International markets marks a significant opportunity to attract new players.

The company’s highly scalable business model & opportunistic buybacks should allow Evolution to grow earnings per share at least as fast as revenue growth, potentially even faster!

Finally, Evolution’s commitment to paying out at least 50% of net profits as a dividend, allows investors to receive a current 3.7% dividend yield that will likely continue to grow along with the company.

The Goal

Evolution has a clear goal: grow the business at a faster rate than the overall online casino market. This outperformance will be driven by the live industry.

I have discussed previously that live revenue makes up 83% of company revenue. Within the online casino industry, live casino makes up only 5% of the industry but it is growing at a faster rate. This outperformance from Evolution’s key segment should allow the company to achieve its goal of growing at above market rate.

Market Growth

While Evolution hopes to grow faster than the industry, we must first understand how fast the industry can grow.

The online casino market likely has a long runway of potential future growth ahead, Grand View Research is expecting the global online casino market to grow by 12.4% per year through 2030.

This growth is due to;

Technological innovations making games better and more enjoyable to end-users.

Rising adoption of mobile, making online casinos more accessible.

New market regulation, opens the industry up to a new pool of players.

Online Casino growth has powered the growth of the total industry. Over the past 4 years, the total gambling market grew by 4.6% annually, reaching a current market value of €489B.

The strong growth demonstrated above of Live & RNG casino is causing the market share of online casinos to increase. In 2020, online casinos made up 20% of the total industry, increasing to 25% today.

While Grand View Research is expecting the online casino industry to grow by 12.4% in the future, this growth expectation incorporates all of the different segments of online casinos, such as; Live, RNG, Poker, Sports Betting, Bingo and Lottery. It is clear to see from the growth rates above, that the segments Evolution competes within are growing significantly faster than the whole. This strong growth means Live & RNG could grow even faster than the industry forecast of 12.4%.

Innovation Driving User Adoption

In this next section, I will dive deep into the different aspects driving the industry's growth.

To do this, first, we must ask why have players adopted live casinos historically.

This backwards-looking question can help us gain a greater insight into what will drive increased popularity in the future.

Accessibility: The first factor in the rise in popularity, is technological advancements making the industry accessible to the mass market. The benefits the industry has felt from the increasing speed of broadband & bandwidth cannot be understated. These improvements have allowed the delivery of live casinos without delay and buffering, letting users play in real-time. This smooth content delivery allows for seamless gameplay where users & dealers can interact, making the experience lifelike from the comfort of a player’s home.

Furthermore, the rise of mobile gaming has opened the industry to a much larger audience, allowing users to play anywhere they have an internet connection. This has lifted the restrictions of needing access to a computer or laptop. Additionally, Evolution’s mobile-first design, implemented in 2016 has allowed for a mobile-friendly interface along with mobile direct deposits and other improvements to the mobile experience making the mobile experience even better.

These improvements have resulted in significant adoption of mobile usage in the industry. In 2016, Evolution generated 41% of revenue from mobile devices, this has increased to 71% in Q3 2024, demonstrating mobile devices are the preferred way to play.

Gaming: While the ever-improving quality & delivery of online casinos has been a key driver in the accessibility of the industry, game innovation, similar to the rise of other forms of gaming, has driven increased consumer popularity & engagement. Evolution has been at the forefront of this innovation.

Live dealer games were the first iteration in driving the increased popularity of online casinos. This segment has long been Evolution’s core competency, with the company solely focusing on this segment in their early years, a decision that benefitted them tremendously. The company became a clear leader by focusing on the user experience; providing high-quality video feed, well-trained dealers in local languages and a high standard of game integrity. These characteristics built trust with end users that blurred the lines between online & land-based casinos. These games continue to be the backbone of the company.

Evolution, then introduced adaptations of live casino games, further attracting end users. Adapting an already well-known live casino game like roulette, to include the opportunity to win 2,000x the traditional amount is a powerful model for attracting new players.

Firstly, it brings well-known content that most people already know to the market, making it easily recognisable & understandable, with the increased lure of even larger payouts.

Secondly, it differentiates online casinos from land-based casinos. These new adaptations cannot be replicated by land-based casinos for two reasons;

The higher return to player (RTP) requirements of these games means land-based casinos cannot afford to adopt them.

physical space; Unlike the internet, land casinos only have the space within their four walls, this means they can’t have every single adaptation of every game as there simply isn’t space.

Finally, the biggest innovation of them all; live game shows. This new game category has been the single biggest driver of attracting new players, especially those who would otherwise not have considered online casinos.

Live game shows are a mix between live casino, TV gameshows and RNG games. These games provide a gateway to the rest of the Evolution gaming portfolio due to their strong entertainment value. In fact, game shows are so entertaining that some people enjoy watching them, not just participating, similar to television.

The first game show, Dream Catcher, was launched in 2017. Since then, Evolution has introduced many game shows that have gone from strength to strength.

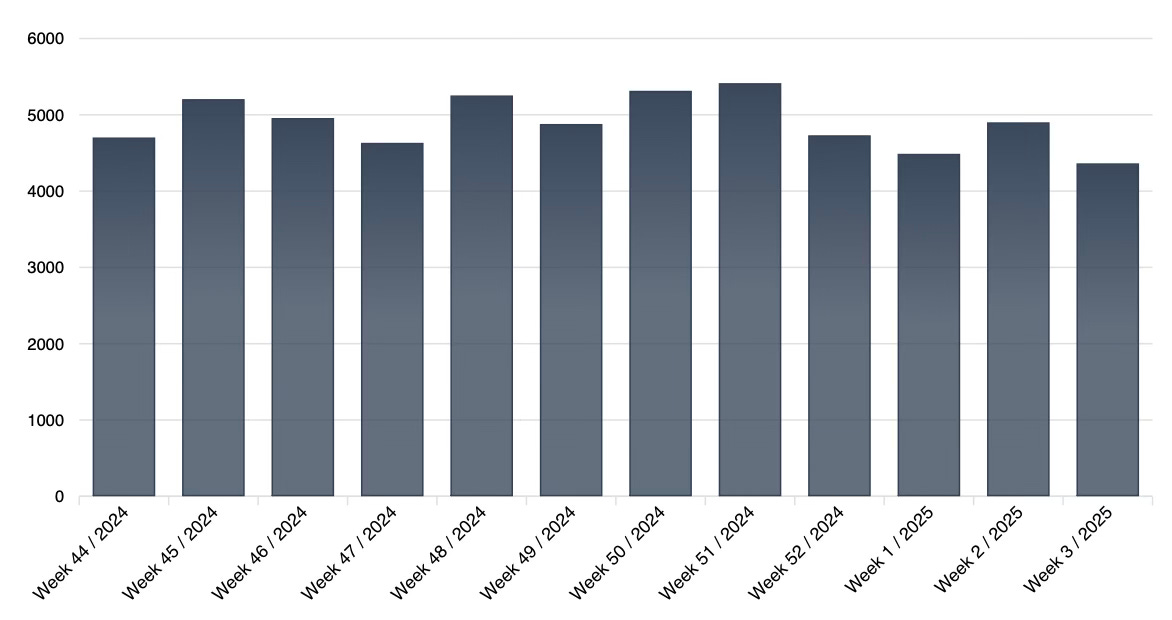

Crazy Time (launched in 2020) remains the most popular game show in history, with player growth of 50% in 2023, 5 years after its initial launch, demonstrating the quality of the game. The result of this rise in game show popularity is that it has become the most popular category by player count, overtaking traditional live casinos.

The story doesn't end there, in fact, Evolution would argue that it is only just beginning. Evolution is extremely focused on continuing to push the boundaries of what is possible online. Evolution will continue to innovate in every format of games, continuing the compani’s strong track record of innovation, attracting users and providing the best portfolio of games in the industry.

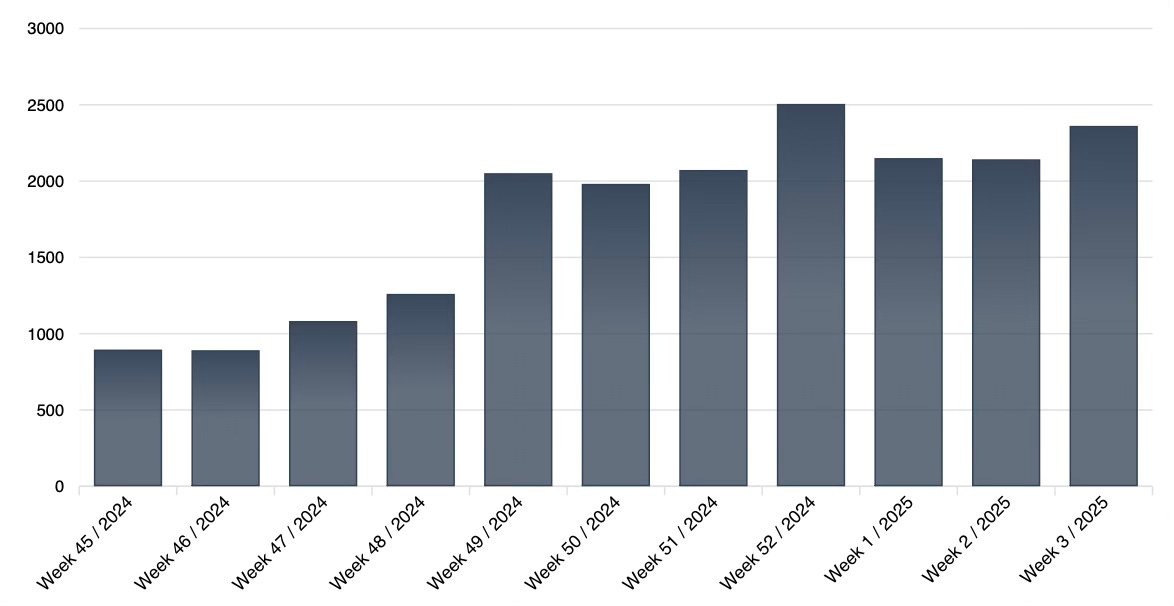

This innovation is demonstrated by their recent launch of Crazy Balls in November 2024. This game is now demonstrating strong user growth and will likely become another big hit for the company.

Evolution continues to invest significant resources in developing new state-of-the-art games that will further extend its lead over the competition. Looking forward, there are several spaces where Evolution will likely push into, and given the company’s track record, likely succeed.

Social: Social gaming represents a large opportunity to further attract new players & increase engagement. Evolution entered this space with the acquisition of Livespins, a B2B social streaming game provider. This technical acquisition opens the possibility for Evolution to integrate a social element into their games. What this means in practice is end users will be able to “bet behind their favourite streamers, brand ambassadors and influencers” - Q3 2024. This could create some kind of network effect, further attracting new users.

By incorporating a social element, even users who have no intention of gambling will sign up to be able to interact with friends & influencers who are using the site, exposing new users to what is possible, with some likely converting over time. Furthermore, incorporating influencers into the ecosystem, acts as a form of advertising, further spreading the word. With Evolution acquiring the leading company in this space, they are well positioned to expand their lead when they incorporate more social aspects into future games.

AR/VR: The rise of AR/VR represents a potential future platform shift in the industry as it gains popularity. Evolution is once again well-positioned to capture any future growth that may come from this area.

Evolution has already been experimenting with AR/VR capabilities. In 2021, Evolution launched Gonzo’s treasure hunt which included a VR mode. While this is not meaningful to the business, it demonstrates Evolution’s forward-thinking nature to be ready when/if future adoption takes place.

To conclude this section, Evolution’s core focus on innovation has been instrumental in attracting new users. The company continues to invest significantly into this innovation engine, positioning the company to continue extending its lead over competitors.

Continued industry market share gains

As I outlined earlier, online casinos have become an increasingly important part of the overall gambling market, with online gambling currently accounting for 25% of the total industry. While online casinos aren’t taking share directly away from land-based casinos yet, they are capturing nearly all of the growth within the industry, this could be through attracting different users or increasing the total spend of traditional gamblers.

So the second question to ask is why are players choosing Online casinos over land-based casinos.

Higher RTP: RTP or return to player indicates how much money a game pays out to players over time. For example, a game with 99% RTP returns €99 out of €100, with the game operator only taking €1. Online casinos can achieve a much higher RTP, often in the range of 95-99%, while land-based casinos could be as low as 75%. This difference is due to the higher operational costs of running a physical building with rent, maintenance and utilities to pay for, along with the free drinks of course! This higher win rate makes end users far more likely to win money online, keeping them more engaged with the platform.

Convenience: playing online is far more convenient for the end user. Instead of having to dress up, and travel to & from a casino, an end user can play on their mobile at any time of day 24/7 from the comfort of their own home, this lowers the barriers to play, attracting more users to online platforms.

Games: Historically, the game quality of land-based casinos could not be replicated over the Internet, this has changed. Today, online casinos offer a wider variety of games, including modern twists on classic games with large multipliers and popular game shows that Evolution invented. Furthermore, Live casino games have become extremely popular through technological advances, with the ability to interact with dealers & even tip their favourites, online casinos are reducing the deficit to the in-person experience, with future game innovations of social aspects and AR/VR iterations set to further improve the online casino offering.

These three factors make online casinos a better option for the majority of end users, which should sustain the adoption of online casinos over the long-term, allowing for continued market share gains, this could be at the expense of land-based casinos in the future.

How much market share could online casinos get? In a more mature market, like the UK, online gambling generated £4B in gross gambling yield, compared to land-based casinos, which generated £2.5B, achieving a market share of over 60%. This means as the overall market matures, the market share of online casinos could have significant upside from the current 25% share today. This assumption also excludes any future innovation within the online casino space, which could further increase the popularity of the industry.

At some point in the future, I believe it is likely that the advantages of online casinos will take direct market share from land-based casinos, driving continued growth of the industry.

New markets

New market regulations present significant upside opportunities for both Evolution & the industry.

Evolution has yet to establish a presence in all of the major markets due to local regulations, examples of untapped markets include:

United States (in 43 states it remains illegal)

Latin American - Brazil (until recently), Peru, Chile

European - France, parts of Eastern Europe

Asia - India, Southeast Asia (Thailand, Philippines)

South Africa

Over time, the industry has been trending towards regulation with more countries laying out regulations, and facilitating online casinos. This provides a significant tailwind to Evolution.

The first question I need to answer is why are we seeing more & more countries move to regulate the industry over time?

There are several reasons why a country would choose to regulate a market rather than ban online gambling; these include Economic benefits and improved player protections:

Tax benefits: when a government regulates online gambling, it provides the country with a new tax stream that can be invested into new roads, schools, and hospitals. In 2023, the UK generated £1.3 billion in tax revenue from online gambling, providing a significant revenue stream to the country. Furthermore, it creates jobs and increases investment in the country, further enhancing its attractiveness.

It is reported that in France, where online gambling is illegal. Black market gambling providers are making between €748M - €1.5B per year, this is lost tax revenue that the country could have earned if they had regulated.

protecting the consumer: While this may sound strange initially, consider the alternative: An unregulated market where consumers use a VPN to access a black market provider with no consumer protections. This ease of black market access creates the potential for users to lose significant amounts of money, creating hardship for users, along with billions in lost tax receipts.

Regulating the online market;

Gets rid of bad actors.

Requires operators to be licensed.

Allows a greater oversight of the industry.

When the Netherlands regulated their market in 2021, they set a goal to have 80% of consumers playing on regulated sites within 3 years. It seems the country has achieved this, with 90% of players using regulated sites. This demonstrates that regulating the market has almost eradicated black market gambling in the country, protecting consumers.

Furthermore, it allows governments to impose restrictions, such as bet size, loss limits and deposit restrictions, allowing consumers to enjoy the thrill of gambling without getting into significant financial difficulties.

To conclude, these crucial factors not only create financial incentives for governments but also protect end users, making a strong case for more countries to regulate in the future.

Market analysis

In this section, I will analyse some of the markets that have the biggest potential for regulation in the future.

United States

The United States is likely the biggest long-term opportunity for the company. Grand View Research forecasts the market is expected to grow 12% annually through 2030, while Zion market research expects the industry to increase from a value of $11.92B in 2023 to $36.52B by 2032.

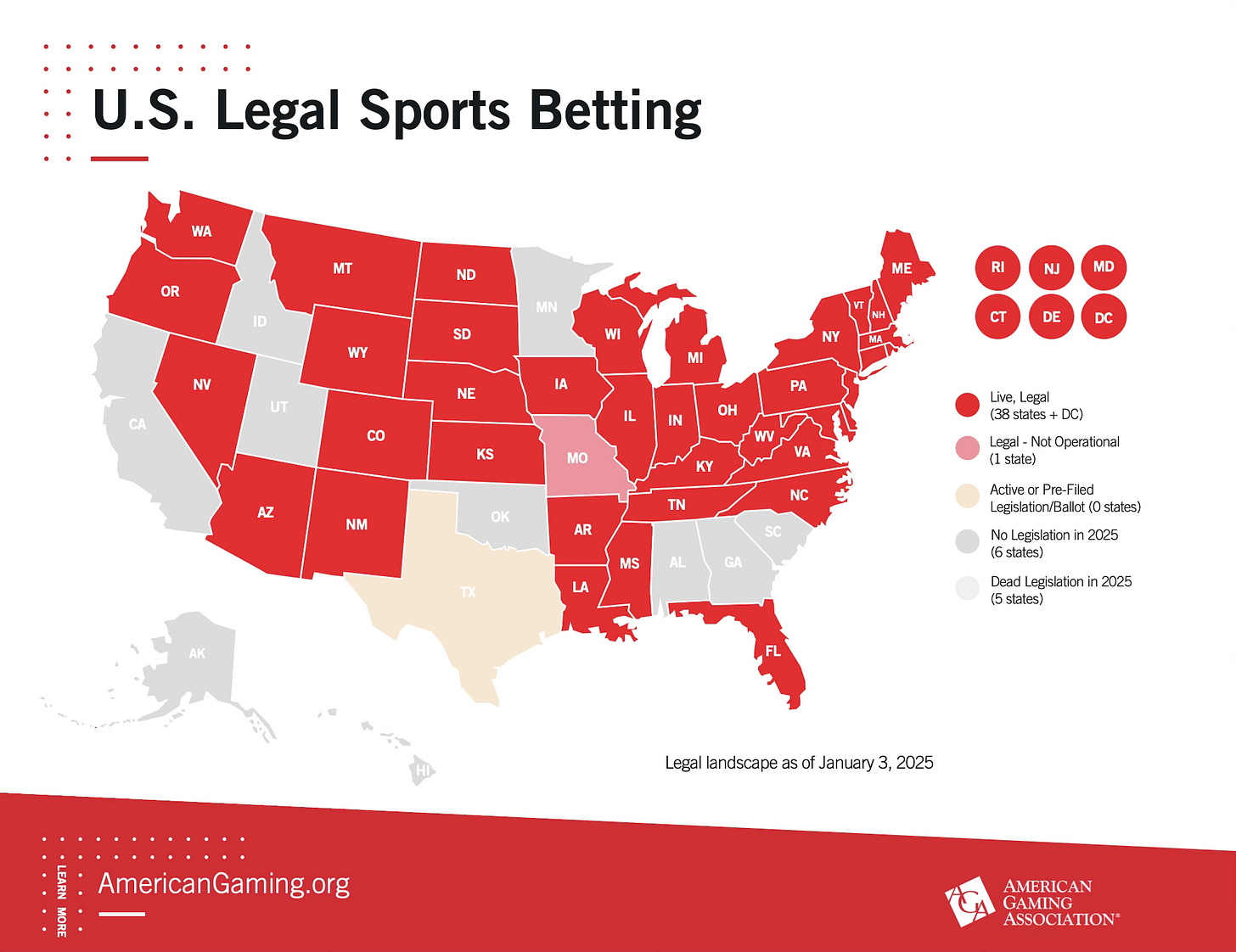

Like earlier, this doesn’t represent the future growth of the segments Evolution competes in. The estimates above account for the entire online betting industry, this includes lottery, sports betting, bingo, poker and casino. Most of these segments are significantly more penetrated across the nation when compared to online casinos, for example, Lottery is legal in 45 states, while sports betting is legal in 38 states.

This compares to 7 states that have legalised online casinos so far. This underpenetration suggests that Online casino has significantly more growth ahead versus the more penetrated online gambling industry segments.

Furthermore, live dealer games are significantly underpenetrated in these 7 states with users only now experiencing the segment for the first time. Over time as players learn to trust & adopt it, like they have in the rest of the world, this normalised penetration will provide additional growth for Evolution.

These two key factors mean, that what looked like an already strong outlook for the company, is actually significantly underestimating Evolution’s potential in North America.

How many states could introduce regulation?

This is the most important question in accessing the potential of the market. Unlike other countries, the US regulates at a state-by-state level, which means each of the 50 states would need to regulate the industry for it to be legal nationwide. However, this is unlikely to happen with states like Texas unwilling to regulate currently.

There are two benchmarks that I have used to assess online casinos future potential.

First, sports betting has been legalised in soon-to-be 39 states.

Second, land-based casinos are legal in 27 states.

I expect online casinos will likely end up somewhere in the middle of the two. Suggesting a best-case upside of 32 states, with 11 on the downside.

There are several reasons I have come to this conclusion:

Sports betting has paved the way for online casinos. Now 39 states across the US are feeling the economic benefit of the tax dollars from sports betting. This tangible economic benefit will create a pro-bias for regulating online casinos when further tax dollars are there for the taking.

Furthermore, some states are likely against regulating online casinos. The ease for users to use a VPN to move their IP address across state borders to access online casino games will likely force regulators to legalise online casinos, to capture lost tax revenue.

On the other hand, the biggest opposition in some of the states is land-based casinos themselves, as they fear online casino will cannibalise their business. However, this fear seems to be misguided, in New Jersey where online casinos have been regulated for many years, land-based operators have not seen any canalisation of revenue.

One potential workaround in these resistant states is collaboration, in this scenario land-based casinos would be able to provide an omnichannel experience that would likely grow their business rather than cannibalise it.

Which states will likely regulate next?

In the near term, there are four states that are the front runners to regulate; Maryland, Virginia, Wyoming and Virginia.

In Maryland, the general assembly has restarted discussions to regulate online gambling. In Virginia, the state senate has introduced a bill that would allow existing licensed casinos (land-based casinos) to offer online gambling. This bill has a deadline of the 30th of September 2025, providing the potential to move fast. In Wyoming, Robert Davis has proposed a bill to allow online casinos in the state. In Virginia, a bill has been introduced to allow online casino and live dealer games in the state.

These developments represent a strong interest in online casinos that would increase the total addressable population from just under 40 million people to roughly 63 million, a 50%+ increase. Additionally, other states such as New York, Ohio and Indiana have been identified as promising for future regulation.

Implications for Evolution

With a population of 335 million, and only 40 million people currently served, the US is the largest opportunity for Evolution over the next decade or two.

Evolutions North America segment generated $246M in revenue over the last year, accounting for just over 12% of company revenue. With the huge runway for growth through; regulation and increased Live penetration, it would not be surprising if this becomes the largest segment for the company at some point in the distant future.

Brazil

The recent regulation (1st January 2025) of the Brazilian market has set the stage for Brazil to become the largest market in Latin America & one of the biggest in the world.

Evolution expects Brazil to make up 60% of the LATAM market. Given the infancy of the LATAM market with countries like Peru & Chile set to regulate in the future, the opening of Brazil presents a significant upside that should drive growth of the LATAM market over the next decade.

To facilitate this growth, Evolution is planning to build a studio in Brazil to accompany the three studios already in the region. Brazil will likely generate significant revenue in 2025, inflecting growth of the LATAM segment positively.

France

While Europe may be the most mature segment for Evolution, there are still markets that haven’t been regulated providing further upside, these markets include France and Cyprus.

Currently, online casinos are prohibited in France, this has led to a black market that is making between €750M-€1.5B annually. France is reportedly going to make a decision on regulation by the end of 2025.

If they decide to regulate, France could become the third largest market in Europe, driving growth in the European segment.

Other markets

In this segment, I have outlined some of the most significant markets that are set to be regulated in the future. However, there are many markets around the world that I have not included such as; Thailand, Philippines, Cyprus, Peru, Chile, Paraguay, and Uruguay.

Brazil 216m

France 68M

Thailand 72M

US 335M

Peru 34M

Chile 19.6M

Philippines 115M

Cyprus 1.2M

Paraguay 7.5M

Uruguay 3.3M

If the markets I have mentioned above decide to regulate, this would increase the addressable market by 750M+ people! A huge opportunity ahead.

These tailwinds will drive growth across all regions. However, due to the uncertainty of timings of regulation, this growth will almost certainly be lumpy, as it has been in the past.

Investors should have confidence that Evolution will be able to capitalise on this global expansion. Historically, Evolution has been the first to market in all major markets, while competitors have taken their time, likely due to the lack of resources. This first-to-market approach cements the company as the partner of choice.

RNG turnaround

Since Evolution entered the RNG space with the acquisition of NetEnt in 2020, the segment has failed to deliver the double-digit organic growth target that management laid out. RNG remains a small part of revenue today and makes little difference to the growth rate from quarter to quarter.

However it is strategically important for Evolution to turn around this business, the RNG segment is the largest contributor to the online casino industry, therefore for the company to reach its full potential it is important to improve RNG performance. Additionally, having a leading RNG game portfolio helps to drive additional growth in the Live segment by making Evolution a more attractive partner as a full solution provider.

What went wrong in RNG?

While I have covered this in part 1&2, I will outline the key points here. The first issue was game quality, this mainly stems from the NetEnt acquisition. Secondly, the company did not have a fast enough game release cadence. The RNG business is a volume-based business so a lack of fresh games can reduce demand. Finally, the integration of the different brands into the One-stop shop caused some temporary loss of players.

Can they turn around the business?

The company has made significant efforts to turn around the business. Firstly, they reworked the product roadmap & have increased the cadence of game releases. Secondly, they have gone through the pain of integrating all of the brands into OSS, providing a single touchpoint for operators to access the whole portfolio.

While it is too early to tell, the initial results look good. In Q3 2024, the RNG segment grew 8.5%, while this was against weak comparisons from the prior year, this still demonstrated a meaningful increase in the growth rate. Furthermore, according to Phil Pearson, CEO of White Lable Casino and a well-respected industry insider, NoLimit City and Big Time Gaming have both significantly improved the quality of their games in 2024, while NetEnt continues to struggle. Suggesting half of the portfolio at least is heading in the right direction. This improvement gives investors hope that Evolution has potentially turned the corner with the segment, only time will tell!

Margins

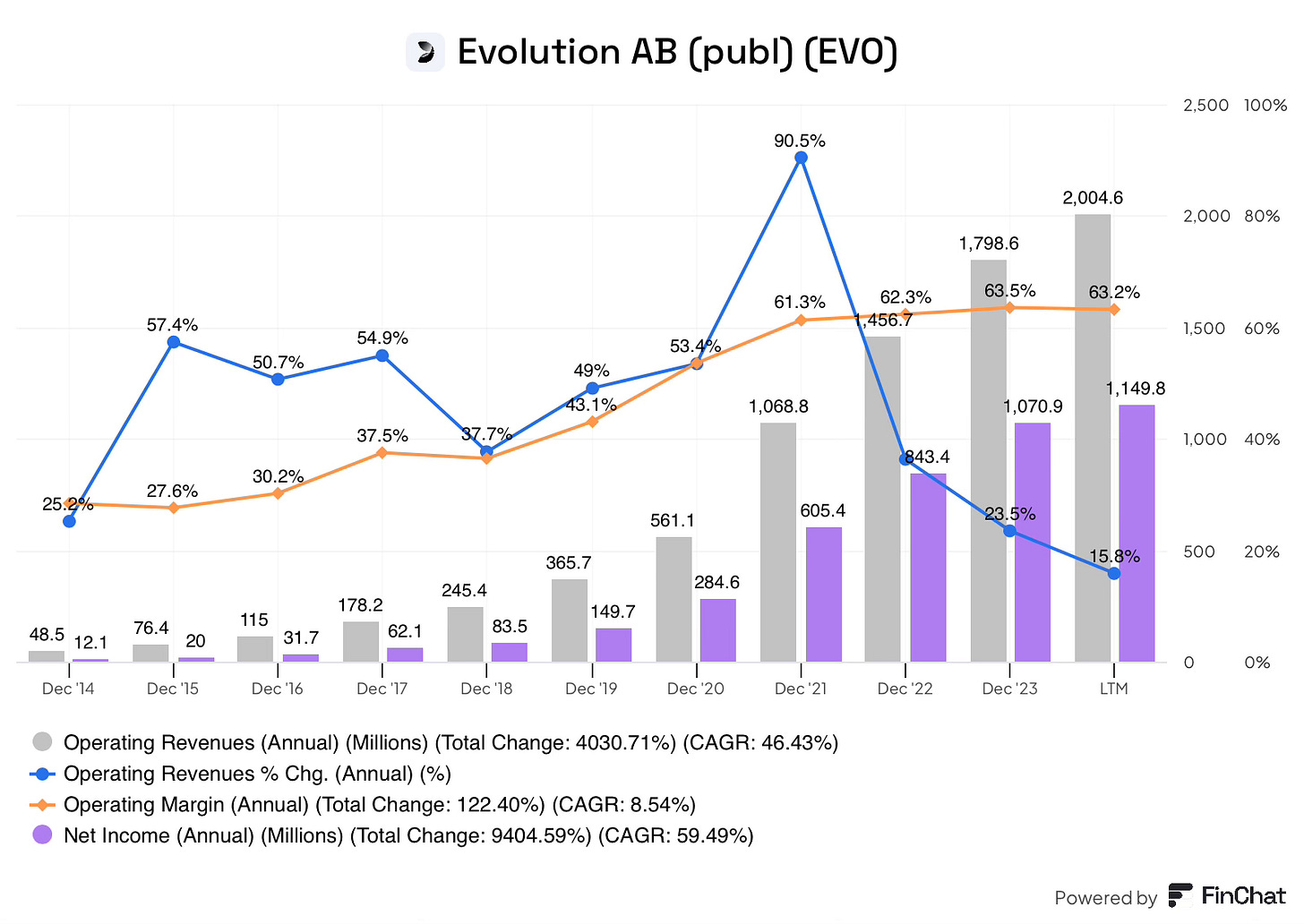

In Part 1, I outlined that one of the highlights of Evolution’s business model is the fact it is highly scalable. This is because, unlike a land-based casino, Evolution can theoretically cater to a far higher number of players per game, spreading the cost of game development over an increasingly large base of players, leading to higher margins.

Items like game development, technology infrastructure (One-stop shop, cyber defences, streaming capabilities), and dealer costs all experience significant leverage.

This would likely be offset by increased studio costs from global expansion.

While there are puts and takes to the margin expansion story, over time the company will likely continue to scale, expanding margins, and driving earnings growth faster than revenue.

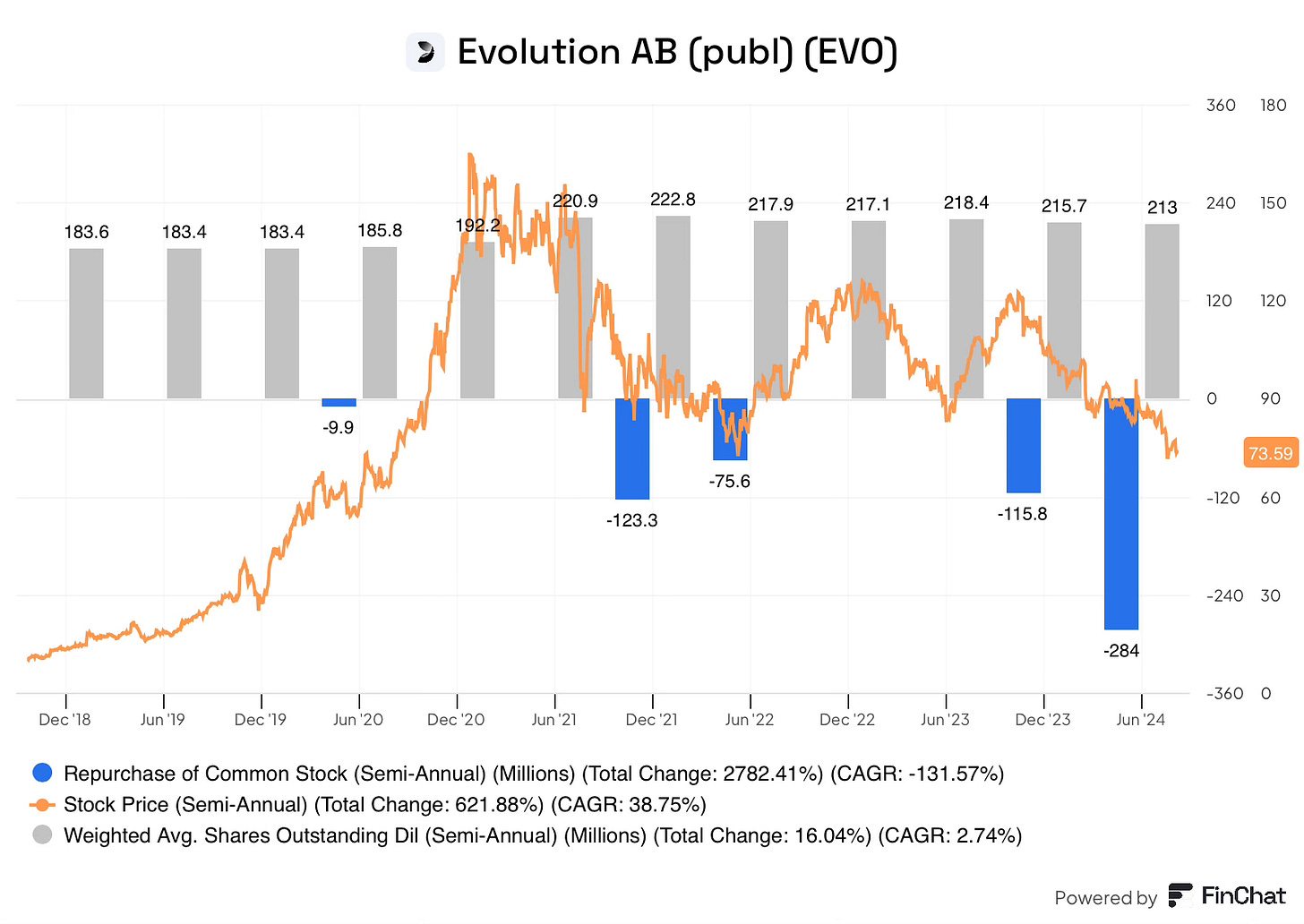

capital returns

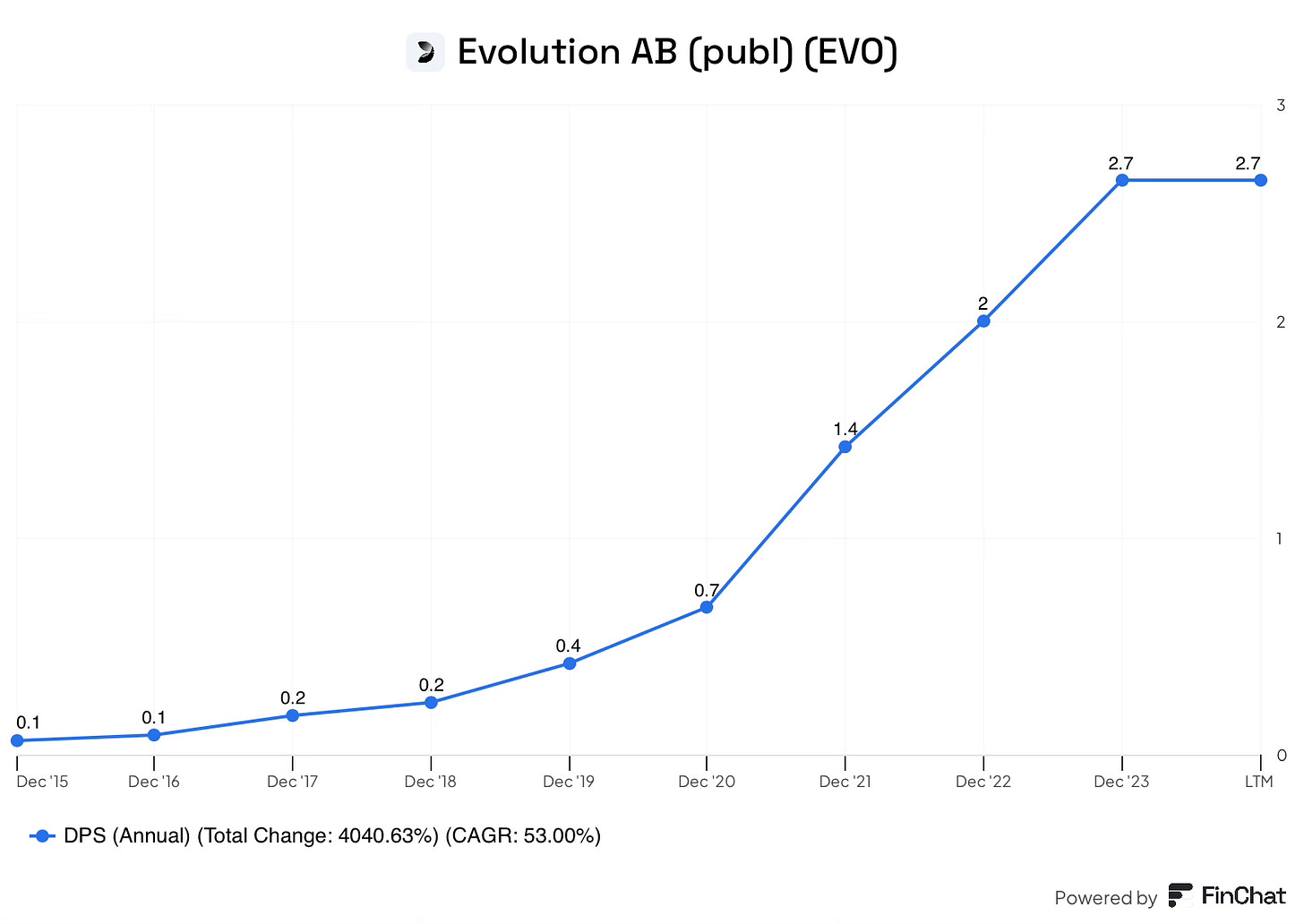

Evolution has historically paid out 50%+ of net profit in the form of a dividend. This dividend has grown substantially over time as the amount of profit the company generates has also increased.

With the company set to continue growing, the dividend will likely follow suit, rewarding long-term shareholders.

Evolution has also been utilising share buybacks over the past few years. These buybacks are controlled by the board of directors. The best time to buyback shares is when shares are undervalued, Judging by the above graph, the company has demonstrated they know how to do this. It is refreshing to see a buyback executed correctly, this approach is very value accretive to shareholders.

While these buybacks have been relatively modest so far, I expect them to become an increasingly important method of capital allocation in the future. The company indicated this through their capital allocation framework, outlined in a recent press release.

Reducing the share count opportunistically over time provides a tailwind to earnings per share, further increasing the growth rate.

Conclusion

To conclude, the business has significant opportunities to grow ahead. Evolution has a strong innovation engine which brings new exciting games to market, attracting new players. Furthermore, this innovative portfolio makes Evolution an irreplaceable partner for the majority of the industry.

The global trend of new regulated markets opening up provides Evolution with an untapped pool of potential players that haven’t been introduced to online casinos, giving Evolution a long runway of growth ahead.

For long-term investors, this huge runway for growth likely creates an asymmetric opportunity.

Bear Case

In this risk section, I will cover all the potential risks that would jeopardise the bull case above.

Regulation: Regulation is the single biggest opportunity & risk for the business. While the historical trend has been to regulate new markets as governments seek to increase tax revenue and gain greater oversight of the industry to prevent bad actors, there are several risks that arise from regulation:

Timing risk: this refers mainly to the US where timelines for new regulated markets are unknown, this therefore creates significant swings in growth rates that can make it unpredictable for investors. While I sympathise with this view, I’d rather have a lumpy 15% versus a steady 12%.

Regulated markets imposing increased restrictions: This risk has been felt in markets such as the UK & Germany over the past few years. Increased restrictions can take many forms, for example; game licencing requirements, bet size limits and any kind of restriction that makes a platform more complex to operate. The increased regulations of already regulated markets can have negative effects, as demonstrated in the European markets mentioned above. When new regulations are imposed, operators tend to take a step back, and act more cautiously, slowing growth so as to not be hit with a fine or have licences revoked due to noncompliance. This risk factor is unpredictable and is likely to happen in some markets at any point. This is likely to become an increasing problem for the industry. However the impact depends on where you sit in the industry, Evolution is the largest B2B supplier, with the most operational licences and the largest legal & compliance budget. Any kind of increased operational requirements likely favour Evolution over the long term due to its scale. This scale gives Evolution the ability to manage through any headwinds, widening the gap to competitors who do not have the same firepower.

Unregulated markets: 60% of Evolution’s revenue comes from unregulated markets. An unregulated market is one that doesn’t have any rules for or against online casinos. As I mentioned at the start of this segment, the trend is for increased regulation over time as governments seek greater control, this means that over time this revenue will likely shift to regulated markets, Evolution shares this view. However, on the downside, countries could outright ban online casinos, which would create a hit to revenue. This heavy reliance on unregulated markets may seem risky to investors, however, within the industry, this is completely normal.

Higher tax: Higher taxes are also a risk to profitability, this increased tax rate risk is due to governments taxing “sin” companies due to their potential harm to society. This higher tax is likely to happen over time. While this may reduce Evolution’s profitability in the short term, this will likely have a more significant impact on smaller less profitable companies, potentially forcing them out of business, and potentially enhancing Evolution’s competitive position.

Cyber attacks: Cyber attacks like the one in Asia during Q3 2024 will likely become an increasingly common trend as bad actors try to gain access to Evolutions & other game provider’s portfolios. By being the largest player, Evolution has the largest R&D budget to defend itself.

Acquisitions: Historically, the company has predominantly made two types of acquisition: Technology & RNG games.

On the technology acquisitions, these have been small purchases to obtain a certain technology, such as DigiWheel. It is difficult to determine the ROI of these. However, due to the small monetary value, even if the acquisition only helps create 1 live game show (unlikely to be just 1), they are likely a good use of capital.

RNG has been a different story. While the businesses are highly profitable (less profitable than live), the low growth these brands have demonstrated since purchase has caused a significant drop in the ROIC of the overall business. While ROIC is recovering, it is taking longer than expected.

It is however still early days, these businesses could turn around and turn out to be solid acquisitions.

Acquisitions will likely continue in the future due to two reasons.

To bolster the RNG game portfolio

Acquire any business that could potentially pose a threat to Evolution’s competitive position.

I will be watching these capital allocation decisions closely.

Dilution: One of the biggest negatives I found while researching Evolution was the dilution of shareholders to buy NetEnt, resulting in a 16% increase in shares outstanding. This raised several concerns. First, using shares to buy a business, potentially demonstrates that the company isn’t focused on delivering shareholder value. Secondly, using stock to acquire a significantly worse business than the current one, dilutes the overall quality, and this has a huge impact on shareholders over the long-term.

While Evolution did use shares in the subsequent purchase of Big Time Gaming. The company has since changed the way it makes acquisitions, primarily using cash, with an earnout bonus if the company performs well. This earnout has been historically structured as roughly 70% cash and 30% shares. This is a more shareholder-friendly acquisition structure with less dilution for existing shareholders, I hope this continues.

Diversification: I have previously questioned whether venturing into the RNG business was a good move, due to the risk of diluting the high-quality live business with something not quite as good.

However, with all competitors now trying to provide a full game portfolio, the strategic nature of having both Live & RNG does make sense.

Management has previously been asked whether they will venture into the adjacent online sports betting arena. While you’ll be pleased to know they have no intention to in the near future, management also did not rule it out completely.

This could further dilute the excellent live business and potentially take management outside of their circle of competence, taking up significant time away from the core.

Increased Capital Intensity: I explained in the bull case that the US market is different to other countries by regulating on a state-by-state basis. This state regulation also requires Evolution to have a local presence in each market, meaning Evolution has to have a physical studio in each regulated state, this is different to the rest of the world, where Evolution can cover capacity from any global studio.

The risk here is that as the US becomes a larger part of revenue, the business will also become more capital-intensive, reducing margins.

I disagree with this argument, while Evolution will require a studio in each state, these studios can be scaled to the demand required. Furthermore, the US likely has a larger bet size compared to other regions, counteracting the higher investment with more revenue per table.

Additionally, as more states regulate, the increased investment required to have a presence in each state, along with the increased complexity due to compliance, once again favours the scaled player who can make the necessary investments, positioning Evolution well in a capital-intensive environment.

Competition: Evolutions is seeing increased competition in both live and RNG as B2B suppliers focus on providing a complete game solution to operators. It is highly likely competition will continue to increase in the future. I covered Evolution’s moat analysis in part 1 of this deep dive series, I will therefore not repeat that here. However, I expect Evolution’s competitive advantages to protect it from competitors.

According to a recent industry interview with a seasoned industry insider. There have been 17 new live businesses showing up this year, suggesting a new wave of competition. While this may sound worrisome, the difficulty of providing a live dealer product that is comparable to Evolution’s makes it very unlikely these businesses will succeed. Furthermore, even if they could provide a similar product, Evolution’s reputation for having best-in-class live dealer games & unmatched live game shows makes Evolution’s portfolio a must-have for operators.

On the other hand, the RNG business is more susceptible to competition, with providers like Pragmatic Play taking slight market share from Evolution. Despite this, Evolution will likely be able to maintain its dominance by simply acquiring any competitor that is able to reach scale, as they have in the past. Evolution has also taken the necessary steps to turn around the RNG business, which will likely result in better performance going forward.

Additionally, the regulatory environment favours Evolution. In a world that will likely see increased capital intensity through; regulations requiring a greater local presence, increased compliance costs and investments to prevent further cyber attacks. The scaled player with the most resources stands to benefit the most, with smaller companies unable to invest the necessary capital to compete effectively.

Player trackers are a great way to get an idea of the popularity trends of certain games. However, it must be noted that these are not fully accurate, so all trends should be taken with a pinch of salt.

Diving into the data, it is clear to see that the closest competitor Pragmatic Play, has been experiencing a steady decline in users on its most popular games; Mega Wheel & Sweet Bonanza Candyland, going against the narrative that Pragmatic is gaining share.

Las Vegas Sands: One of the new competitors that has investors concerned is Las Vegas Sands, the largest gambling company in the world. While it is too early to tell whether the company will succeed or not, I am doubtful.

The online casino industry is vastly different to operating a land-based casino where Las Vegas Sands's core competency lies, with far more technology involved, these hurdles will likely take time, effort and significant resources to overcome or to even have a remotely competitive product to Evolution.

Furthermore, the company will not have the scale of Evolution or other industry players, which will result in worse economics, making the venture far less valuable for Las Vegas Sands. These facts leave me doubtful about LV Sands being successful, I expect after a couple of years they will likely partner with Evolution in a similar fashion to Caesar’s Entertainment.

Management & Compliance: In a recent news article it was revealed that Swedish regulators were investigating Evolution for delaying the press release of the news that the UK Gambling Commission was reviewing the company.

Jacob Kaplan, CFO, seems to be responsible for this. Furthermore, it was recently announced Joakim Andersson would replace him as CFO. While it is possible this is a coincidence, it is also plausible they are linked.

The 2 recent events of failing to comply with regulations are potentially a warning sign of an underlying systemic issue in the company.

If these issues were to be real, Joakim Andersson might be the right person for the CFO role, previously he has worked in senior roles across many financial institutions. It is well documented that financial institutions are highly complex regulated businesses, Joakim is therefore likely well versed in compliance.

Class Action lawsuit: Currently there is a shareholder class action lawsuit against Evolution. The lawsuit claims that Evolution has misled investors about its business prospects due to a significant portion of revenue supposedly being at risk due to “potential regulatory clampdowns”, this is referring to the 60% of revenue from unregulated markets.

I believe this lawsuit will ultimately amount to nothing.

Evolution clearly states in their annual and quarterly reports, that 60% of revenue is from unregulated markets. The company has not experienced any loss of revenue from these markets, in fact, the biggest regulatory headwinds the company has experienced in recent times have been from regulated markets (UK & Germany) cracking down further, creating uncertainty.

Conclusion

This business has more risks than most, given its “sin stock” status. However, the risks investors are focusing on the most such as increasing competition and unregulated market exposure are likely not the most important risks.

I have previously outlined Evolution’s moat and player data demonstrating competition is actually not eating away at Evolution.

Furthermore, investors’ natural bias to punish uncertainty comes into play with the unregulated market exposure, However, this exposure is completely normal within the industry with no industry insiders considering it a risk.

The biggest risks in my opinion are increased regulations leading to higher capital intensity & the complexity of compliance in regulated markets. With the potential to receive heavy fines or worse licence withdrawals.

Furthermore, Evolution’s strong cash generation highlights the significant importance of strong capital allocation. There are 3 options of where to allocate this capital; re-investment, acquisitions and returns to shareholders. My preference would be to reinvest as much as possible while returning the rest to shareholders. Management’s track record of acquisitions hasn’t been awful, but also hasn’t been spectacular. I am therefore hesitant to see continued large acquisitions that would further dilute the core outstanding live business.

Recent compliance events & the subsequent CFO transition have further raised eyebrows, while I don’t believe there to be any underlying systemic issues, the situation is developing and I will be keeping a close eye on the outcome.

5. Is it available at a fair price?

Evolution is currently trading at its lowest-ever valuation, potentially providing the opportunity to buy a business with a strong business model, wide moat, and aligned management team with a large opportunity for future growth at an attractive price.

In part 2, I outlined that slowing growth & greater risk awareness among investors had led to the valuation compressing.

There are several ways to look at valuation, I will cover these below.

P/E ratio

Evolution has a historical P/E ratio of 37x, this may seem quite extreme. Today, the business is trading at a P/E of 13.6X, less than half of its historical average, this large swing in valuation multiple could have swung from overvalued to now undervalued, with a reversion to the mean due in the future.

Peer comparison

To gain a better understanding of Evolution’s valuation, I will compare the company with some publicly listed peers & the valuations Evolution paid to acquire some of the biggest businesses, below is a list of the valuations of these comparisons.

NetEnt (2020 acquisition) - 35X EBIT

Big Time Gaming (2021 acquisition) - 20X P/E

NoLimit City (2022 acquisition) - 15X EBITDA

Galaxy Gaming (2024 acquisition) - 6.5X EBITDA

PlayTech (public listing) - 23.9X P/E

Light & Wonder (public listing) - 27.7X P/E

Excluding the NetEnt acquisition, which was likely overvalued, Evolution has typically managed to buy businesses for less than publicly listed peers. Furthermore, I’d argue Evolution deserves a premium valuation versus all of these players (excluding the overpriced NetEnt deal) due to its dominant market position (especially in the highly profitable live segment), strong fundamentals, and capable management team.

Evolution’s current valuation is half of the publicly listed peers, further indicating it is undervalued. While some may argue this is because the company primarily trades in Europe, I’d disagree with this argument for two reasons:

Playtech is listed in Europe and still has a 20+ P/E ratio

Evolution has historically traded much higher, suggesting it is not a structural issue, but rather a temporary phenomenon.

This argument would be far more plausible if publicly traded peers had also seen a significant drop in valuation.

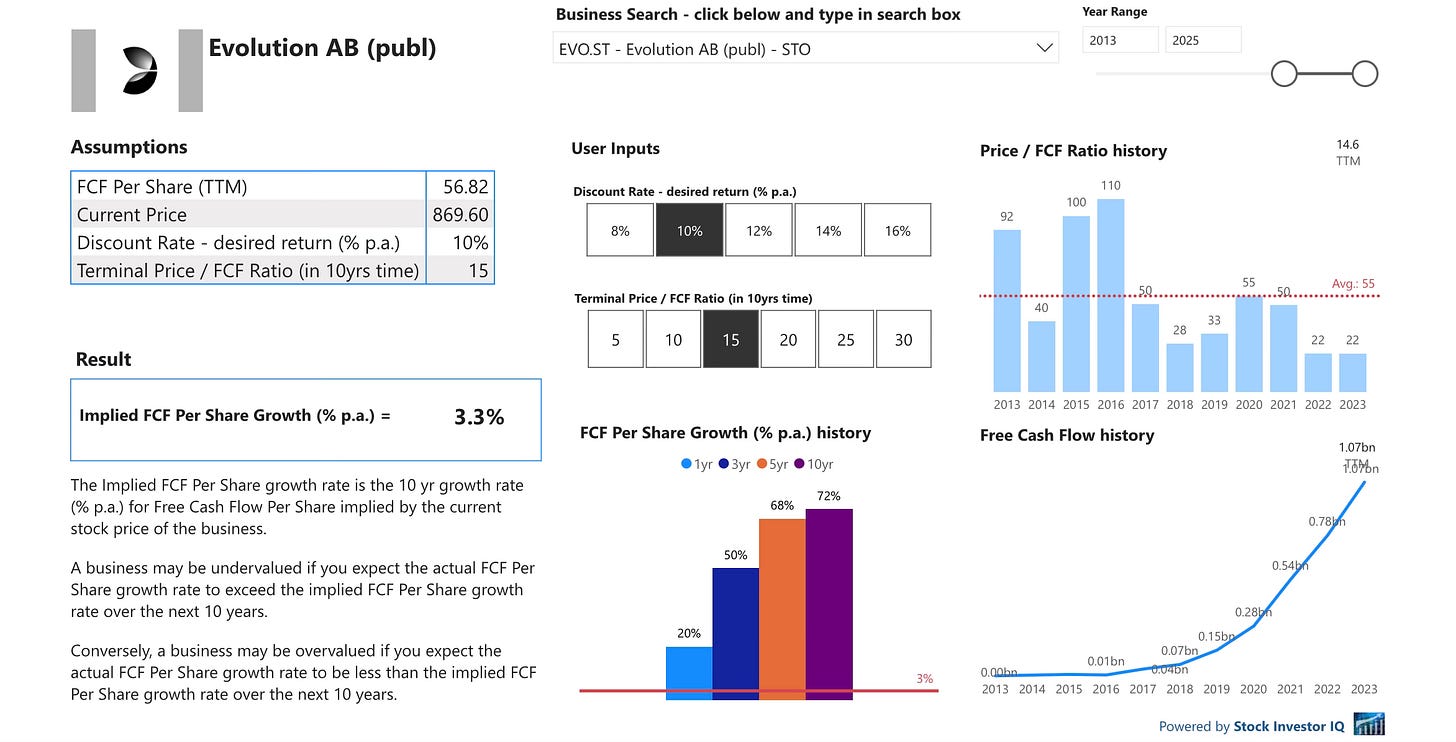

Reverse DCF

A reverse discount cash flow model is a great way to understand how the stock market is pricing a particular stock, by reversing the model, we are taking the current share prices and making an estimate of the assumptions the market is expecting. In a traditional discount cash flow model, I would be assuming particular growth rates and the duration of these, this model relies on multiple assumptions being correct to get a reasonable valuation.

By assuming a 10% discount rate and a terminal P/FCF multiple of 15X, both of which are conservative given the historical growth and valuation of the company. The reverse DCF tells me the market is assuming 3.3% annual FCF per share growth over the next 10 years. I believe at the current valuation, the market is mispricing the business for multiple reasons:

Strong track record: Evolution has a very strong track record of growth, growing FCF/ share by 72% annually over the past decade.

Significant growth opportunities ahead, as I outlined in the bull case.

Management team with a strong track record.

Defensible moat.

Now we know what the market is assuming, we can look at what the company would be worth assuming different growth rates in a traditional discount cashflow model.

5% annual growth = €983 (16.9% upside from today)

10% annual growth = €1,426 (69.5% upside from today)

15% annual growth = €2,069 (146% upside from today)

Conclusion

I hope that it is now clear to see that the market currently has very low expectations for the future of this company. If Evolution is able to achieve a growth rate similar to what it has been/is currently doing, the stock likely has significant upside potential from current levels.

Evolution has a long history of trading at a premium valuation, rightfully so given its impressive growth rates, scalability and competitive advantages. This current share price weakness has Evolution trading at lower valuation multiples of less competitive & profitable peers.

The current all-time low valuation potentially provides an interesting entry point if Investors believe Evolutjon can execute on the growth opportunities ahead while avoiding the risks outlined.

Closing Thoughts

Through this deep dive, it has become clear that Evolution is a great business, the company possesses;

A simple and understandable business model

A wide moat to defend itself from competition

Significant opportunities to keep growing

A cheap valuation

While the business has a lot to like, it does come with greater risk than most. I believe this is where bet sizing comes in useful.

Over the past month, I have been adding to Evolution as it trades down, currently, the position makes up 4.0% of my portfolio. Due to the increased risks associated with it, I am only willing to go to 6-8% of the portfolio at cost versus a full 10% position that I would be willing to make otherwise.

I will continue to track the progress of this business and document all that I learn.

Thank you for joining me on this deep dive into Evolution Gaming AB, I hope you have enjoyed learning about it as much as I have!

Your support is greatly appreciated, a like, comment, and subscription goes a long way!

I hope you join me for my next deep dive on AirBnB.

Sources: Company filings & transcripts unless otherwise linked.

Disclosure: I/we may or may not have a beneficial long position in any of the securities discussed in this post, either through stock ownership, options, or other derivatives. This article expresses our own opinions. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Incredible 3-part writeup! Best I've read in a long time. /bow

Glad to see EVO is being proactive in developing for the AR/VR platform. Staying ahead is key! Nice write-up!